Carbon Credit Validation Verification and Certification Market Size, Share, Trends, Industry Analysis Report: By Service (Validation, Verification, and Certification), Type, Sector, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 123

- Format: PDF

- Report ID: PM5189

- Base Year: 2024

- Historical Data: 2020-2023

Carbon Credit Validation Verification and Certification Market Overview

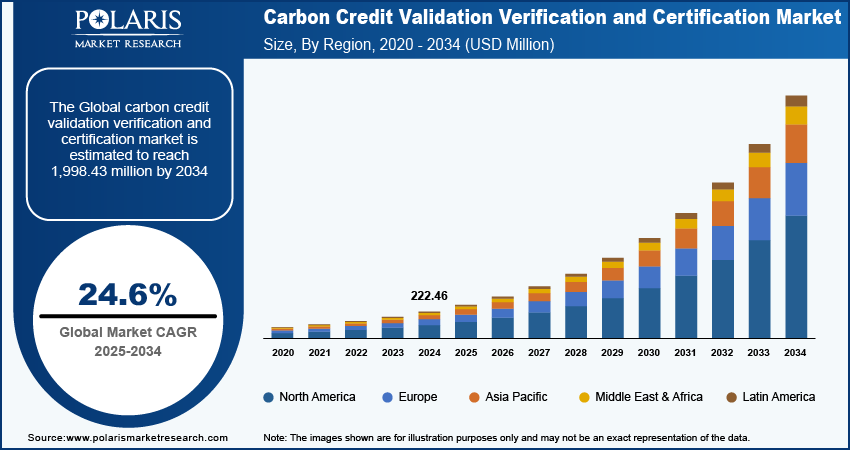

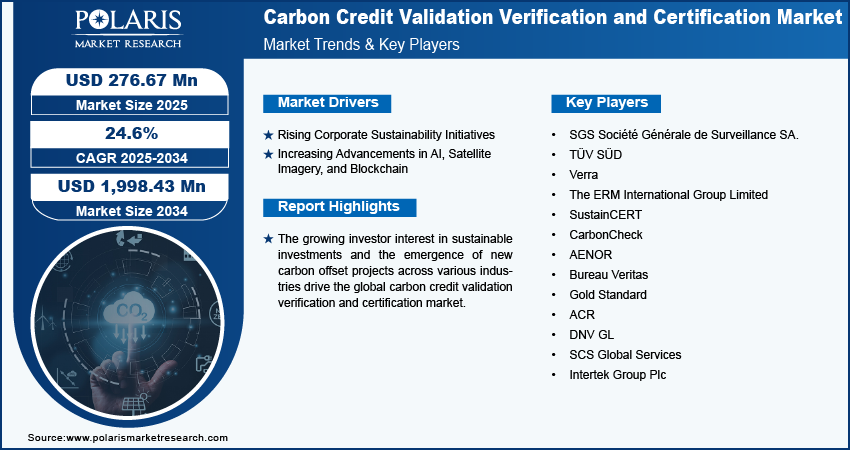

The global carbon credit validation verification and certification market size was valued at USD 222.46 million in 2024. The market is projected to grow from USD 276.67 million in 2025 to USD 1,998.43 million by 2034, exhibiting a CAGR of 24.6% during 2025–2034.

Validation, verification, and certification processes are critical components of the carbon credit system, ensuring that projects aimed at reducing greenhouse gas (GHG) emissions are credible and effective. The processes help maintain the integrity of carbon markets by confirming that the carbon credits generated represent real, measurable, and additional reductions in emissions.

The stringent climate policies and emission norms are driving the global carbon credit validation verification and certification market growth. India aims to reduce emissions intensity by 45% by 2030 compared to 2005. Businesses need to demonstrate compliance as governments implement stricter emission norms and climate policies. This drives the need for validated carbon credits to offset emissions legally.

The growing investor interest in sustainable investments is propelling the global carbon credit validation verification and certification market growth. Companies with validated carbon credits easily access capital from sustainable-focused investors and green bond markets, as these entities often prefer investments with proven sustainability credentials. This encourages other companies to validate themselves on carbon credits to attract potential investors.

To Understand More About this Research: Request a Free Sample Report

The carbon credit validation verification and certification market is driven by the emergence of new carbon offset projects across various industries. A growing number of projects necessitates rigorous validation, verification, and certification to ensure that the credits generated are credible and represent real, measurable emissions reductions. This makes projects attractive to investors and buyers.

Carbon Credit Validation Verification and Certification Market Driver Analysis

Rising Corporate Sustainability Initiatives

Corporations are increasingly reporting on their environmental, social, and governance (ESG) performance. Validated carbon credits enhance the credibility of their sustainability claims, making VV&C essential for transparent reporting. Thus, the rising corporate sustainability initiatives contribute to the increasing carbon credit validation verification and certification market size.

Increasing Advancements in AI, Satellite Imagery, and Blockchain

There is an increased demand for carbon credit VV&C as organizations seek to validate and certify their environmental impacts. Artificial intelligence (AI), satellite imagery, and blockchain technologies enhance the reliability, transparency, and efficiency of carbon offset projects by analyzing large datasets. Therefore, increasing advancements in these technologies boost the global carbon credit validation verification and certification market.

Carbon Credit Validation Verification and Certification Market Segment Insights

Carbon Credit Validation Verification and Certification Market Breakdown by Service

Based on service, the global carbon credit validation verification and certification market is segmented into validation, verification, and certification. The verification segment accounted for a major market share in 2024 due to the increasing need for transparency and accountability in carbon offset initiatives. Organizations across various industries recognized that robust verification processes ensure compliance with evolving regulations and enhance credibility with stakeholders, including investors and consumers. Companies prioritize verified credits to demonstrate their genuine commitment to reducing emissions as they strive to meet ambitious sustainability goals. The rise in stringent governmental regulations and the growing emphasis on ESG (environmental, social, and governance) factors further fuel demand for verification services.

The certification segment is expected to grow at a robust pace in the coming years, owing to the rising demand for standardized frameworks that help organizations communicate their sustainability efforts effectively. Companies are increasingly aware that certification enhances their reputational capital and facilitates access to sustainable finance, which encourages them to opt for certification services. Additionally, advancements in blockchain technology and AI streamline the certification process, making it more efficient and reliable.

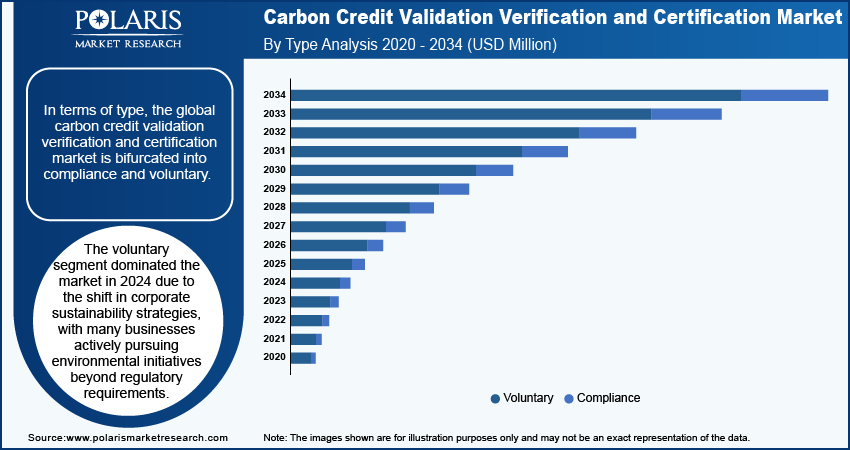

Carbon Credit Validation Verification and Certification Market Breakdown by Type

In terms of type, the global carbon credit validation verification and certification market is bifurcated into compliance and voluntary. The voluntary segment dominated the market in 2024 due to the shift in corporate sustainability strategies, with many businesses actively pursuing environmental initiatives beyond regulatory requirements. Increasing consumer awareness and demand for sustainable practices compel companies to engage in voluntary carbon markets to enhance their brand reputation and showcase their commitment to corporate social responsibility. Additionally, organizations aiming for net-zero emissions targets find voluntary offsets as essential tools to achieve their sustainability goals. These factors support the voluntary segment to achieve the largest market share.

The compliance segment is projected to grow at a rapid pace during the forecast period, owing to the increasing number of regulatory frameworks established by governments across the world. Countries implementing cap-and-trade systems and mandatory emissions reduction targets encouraged companies, particularly in high-emission industries, to purchase compliance credits to meet legal obligations. Additionally, the growing focus on climate commitments from international agreements, such as the Paris Agreement, highlighted the pressure on businesses to adhere to strict emissions regulations, contributing to the compliance segment's dominance.

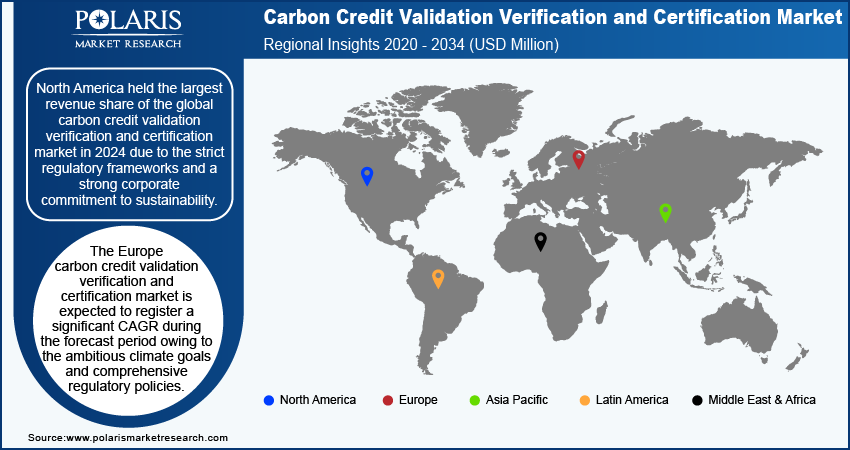

Carbon Credit Validation Verification and Certification Regional Insights

By region, the study provides the carbon credit validation verification and certification market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest revenue share in the global carbon credit validation verification and certification market in 2024 due to the strict regulatory frameworks and a strong corporate commitment to sustainability. The US dominated the regional market, implementing various initiatives aimed at reducing greenhouse gas emissions, such as the Regional Greenhouse Gas Initiative (RGGI) and California's cap-and-trade program. Companies across multiple sectors, including energy and transportation, actively find compliance credits to meet stringent regulations. The increasing pressure from investors and consumers for greater corporate transparency regarding environmental impacts further fueled the market growth in the region.

The Europe carbon credit validation verification and certification market is expected to register a significant CAGR during the forecast period owing to the ambitious climate goals and comprehensive regulatory policies. The European Union's commitment to achieving net-zero emissions by 2050, coupled with initiatives such as the European Green Deal, drives significant investments in carbon offset projects, which necessitates the demand for carbon credit validation verification and certification. Countries such as Germany and the UK are at the forefront of this growth, promoting innovative carbon reduction strategies and sustainability practices. The rising demand for voluntary credits among businesses seeking to enhance their environmental credentials also contributes to Europe’s leadership in the market.

Carbon Credit Validation Verification and Certification Market – Key Players and Competitive Insights

Major market players are investing heavily in research and development to expand their offerings, which will boost the carbon credit validation verification and certification market growth in the coming years. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the carbon credit validation verification and certification industry must offer innovative solutions.

The carbon credit validation verification and certification market is fragmented, with the presence of numerous global and regional market players. Major players in the market are SGS Société Générale de Surveillance SA., TÜV SÜD, Verra, The ERM International Group Limited, SustainCERT, CarbonCheck, AENOR, Bureau Veritas, Gold Standard, ACR, DNV GL, SCS Global Services, and Intertek Group Plc.

SGS Société Générale de Surveillance SA, established in 1878, is a prominent global inspection, verification, testing, and certification company. SGS operates in various sectors, including agriculture, automotive, consumer goods, and environmental services. The company is recognized for its commitment to quality and integrity, providing services that help organizations manage risk, improve performance, and ensure compliance with regulations. SGS provides validation and verification of carbon credits as independent third-party auditors. In May 2024, SGS was officially approved as a validation and verification body (VVB) under Smart Freight Centre’s Conformity Assessment Scheme to reduce greenhouse gas (GHG) emissions from freight transportation.

TÜV SÜD, founded in 1866, is a global provider of testing, certification, auditing, and advisory services, headquartered in Munich, Germany. The organization has evolved to focus on safety, security, and sustainability across various sectors, including automotive, energy, and healthcare. TÜV SÜD is actively involved in the validation and verification of carbon credit projects to help organizations navigate complex regulatory landscapes and enhance trust among stakeholders. In June 2022, TÜV SÜD South Asia, the wholly-owned subsidiary of TÜV SÜD Group, received approval from the Global Carbon Council (GCC) as a GCC verifier. With this approval, TÜV SÜD South Asia is entitled to provide verification services for Greenhouse Gas (GHG) emission reduction projects.

Major Companies in Carbon Credit Validation Verification and Certification Market

- SGS Société Générale de Surveillance SA.

- TÜV SÜD

- Verra

- The ERM International Group Limited

- SustainCERT

- CarbonCheck

- AENOR

- Bureau Veritas

- Gold Standard

- ACR

- DNV GL

- SCS Global Services

- Intertek Group Plc

Carbon Credit Validation Verification and Certification Industry Developments

September 2024: The ERM International Group Limited, the world's largest advisory firm focused solely on sustainability, launched an end-to-end carbon credit sourcing portal to provide ERM clients with access to carbon credits that complement their greenhouse gas (GHG) emissions reduction strategies and sustainability goals.

May 2024: The ERM International Group Limited announced the launch of ERM Climate Markets, a new business line designed to help companies mitigate unabated greenhouse gas emissions by investing in impactful carbon credits that support their decarbonization and broader sustainability goals.

August 2023: Verra, a global organization that develops and manages standards for sustainable development, climate action, and environmental conservation, released version 4.5 of the Verified Carbon Standard (VCS) Program to strengthen the program’s usability, transparency, and integrity and align it with major global carbon markets initiatives, such as the Integrity Council for the Voluntary Carbon Market (ICVCM) and the Carbon Offsetting Reduction Scheme for International Aviation (CORSIA).

Carbon Credit Validation Verification and Certification Market Segmentation

By Service Outlook (Revenue, USD Million, 2020–2034)

- Validation

- Verification

- Certification

By Type Outlook (Revenue, USD Million, 2020–2034)

- Compliance

- Voluntary

By Sector Outlook (Revenue, USD Million, 2020–2034)

- Agriculture & Forestry

- Energy & Utilities

- Industrial

- Transportation

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Carbon Credit Validation Verification and Certification Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 222.46 Million |

|

Market Size Value in 2025 |

USD 276.67 Million |

|

Revenue Forecast by 2034 |

USD 1,998.43 Million |

|

CAGR |

24.6 % from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global carbon credit validation verification and certification market size was valued at USD 222.46 million in 2024 and is projected to grow to USD 1,998.43 million by 2034.

The global market is projected to register a CAGR of 24.6 % during 2025–2034.

North America held the largest share of the global market in 2024.

A few key players in the market are SGS Société Générale de Surveillance SA., TÜV SÜD, Verra, The ERM International Group Limited, SustainCERT, CarbonCheck, AENOR, Bureau Veritas, Gold Standard, ACR, DNV GL, SCS Global Services, and Intertek Group Plc.

The verification segment is projected for significant growth in the global market during the forecast period.

The voluntary segment dominated the market in 2024.