Carbon Accounting Software Market Size, Share, Trends, Industry Analysis Report: By Deployment (Cloud-Based and On-Premise), End–Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 116

- Format: PDF

- Report ID: PM5085

- Base Year: 2023

- Historical Data: 2019-2022

Carbon Accounting Software Market Overview

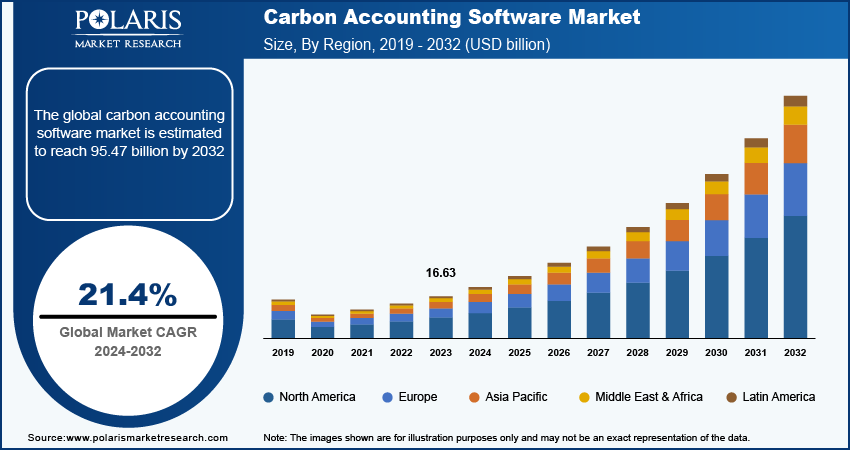

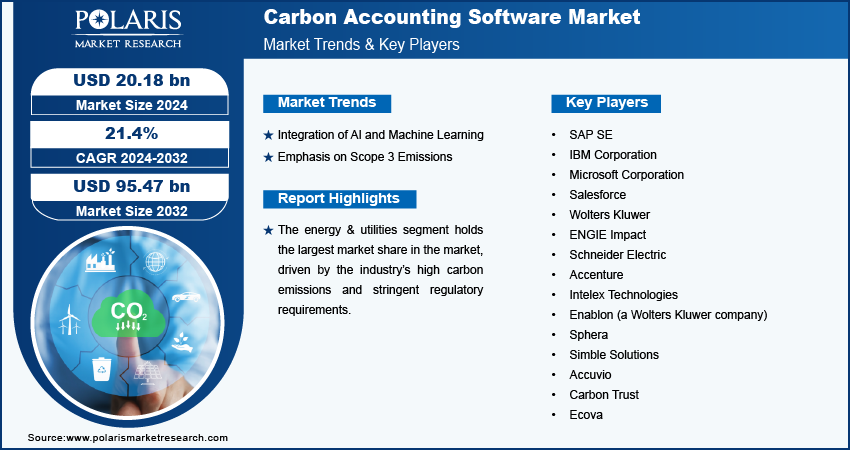

The carbon accounting software market size was valued at USD 16.63 billion in 2023. The market is projected to grow from USD 20.18 billion in 2024 to USD 95.47 billion by 2032, exhibiting a CAGR of 21.4% during 2024–2032.

Carbon accounting software is a digital platform that helps organizations measure, track, and manage their greenhouse gas (GHG) emissions. These tools are essential for compliance with regulatory requirements, sustainability reporting, and the implementation of corporate environmental strategies. The adoption of carbon accounting software is rising due to increasing regulatory pressure, growing importance of corporate social responsibility, and the need for transparent sustainability reporting.

To Understand More About this Research: Request a Free Sample Report

Carbon Accounting Software Market Trends

Integration of AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies enhances the accuracy and efficiency of carbon accounting by automating data collection, analysis, and reporting processes. For instance, AI-driven platforms can process vast amounts of data from various sources, such as energy consumption and supply chain activities, to provide real-time insights into an organization's carbon footprint. The use of these technologies is expected to continue as organizations seek sophisticated tools to comply with increasingly stringent environmental regulations. Thus, the integration of AI and ML with carbon accounting software is expected to emerge as a key trend in the coming years.

Emphasis on Scope 3 Emissions

Another key trend in the carbon accounting software market is the growing emphasis on tracking and managing Scope 3 emissions. Scope 3 emissions, which encompass all indirect emissions that occur throughout a company’s value chain, often represent the largest portion of an organization’s carbon footprint. According to the World Resources Institute, more than 75% of a company’s carbon footprint typically comes from Scope 3 emissions. Traditionally, these emissions have been challenging to measure due to their complex and fragmented nature. However, companies are better equipped to monitor and report on these emissions with advancements in carbon accounting software. The increased focus on these indirect emissions is driven by rising stakeholder expectations and the need for comprehensive sustainability reporting, pushing organizations to adopt more robust carbon accounting solutions.

Rise of Cloud-Based Solutions

Cloud-based platforms offer greater scalability, flexibility, and accessibility compared to traditional on-premise solutions, making them particularly appealing to organizations with diverse operations spread across multiple locations. Cloud-based solutions also facilitate real-time data sharing and collaboration across teams, enhancing the overall efficiency of carbon management processes. As more companies recognize the benefits of cloud technology, its adoption in carbon accounting is expected to grow, further driving innovation in the market.

Carbon Accounting Software Market – Segment Insights

Carbon Accounting Software Market Breakdown – Deployment-Based Insights

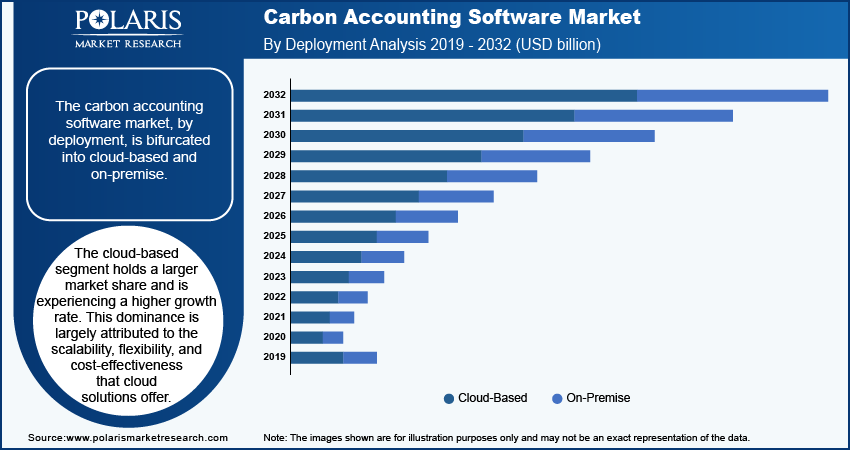

The carbon accounting software market, by deployment, is bifurcated into cloud-based and on-premise. The cloud-based segment holds a larger market share and is experiencing a higher growth rate. This dominance is largely attributed to the scalability, flexibility, and cost-effectiveness that cloud solutions offer. Organizations across various industries are increasingly opting for cloud-based platforms as they enable real-time data access and seamless integration with other digital tools, making it easier to manage and report carbon emissions across multiple locations. Additionally, the lower upfront costs associated with cloud solutions, combined with their ease of implementation, make them an attractive option for companies looking to streamline their sustainability efforts without significant capital investment. The preference for cloud-based platforms is also driven by their ability to support remote work environments, which have become more prevalent in recent years. As companies continue to prioritize flexibility and operational efficiency, the demand for cloud-based carbon accounting software is expected to accelerate, reinforcing its position as the dominant deployment model in the market.

The adoption rate of on-premise carbon accounting software, while still relevant for certain organizations, particularly those with stringent data security requirements, is slower than cloud-based solutions.

Carbon Accounting Software Market Breakdown – End Use-Based Insights

The carbon accounting software market, in terms of end use, is segmented into energy & utilities, IT & telecom, healthcare, transportation & logistics, retail, construction & infrastructure, food & beverages, chemicals, and others. The energy & utilities segment holds the largest market share in the market, driven by the industry’s high carbon emissions and stringent regulatory requirements. Organizations in this sector face significant pressure to reduce their environmental impact, making accurate carbon accounting a critical component of their operations. The complexity of tracking emissions from multiple sources, including power generation, distribution, and consumption, has led to the widespread adoption of advanced carbon accounting solutions. Additionally, the sector's focus on transitioning to renewable energy sources and improving energy efficiency fuels the demand for these tools.

The transportation & logistics segment is registering the highest growth rate in the market. This rapid expansion is attributed to the sector's substantial contribution to global carbon emissions and the increasing regulatory and consumer pressure to reduce its environmental footprint. The rise of e-commerce and global supply chains has intensified the need for comprehensive carbon tracking across various modes of transportation and logistics activities. As a result, companies in this sector are increasingly investing in carbon accounting software to monitor and report emissions, optimize operations, and meet sustainability goals. The growing emphasis on sustainable logistics practices, including the adoption of electric vehicles and fuel-efficient technologies, further drives the demand for carbon accounting solutions in this segment.

Carbon Accounting Software Market – Regional Insights

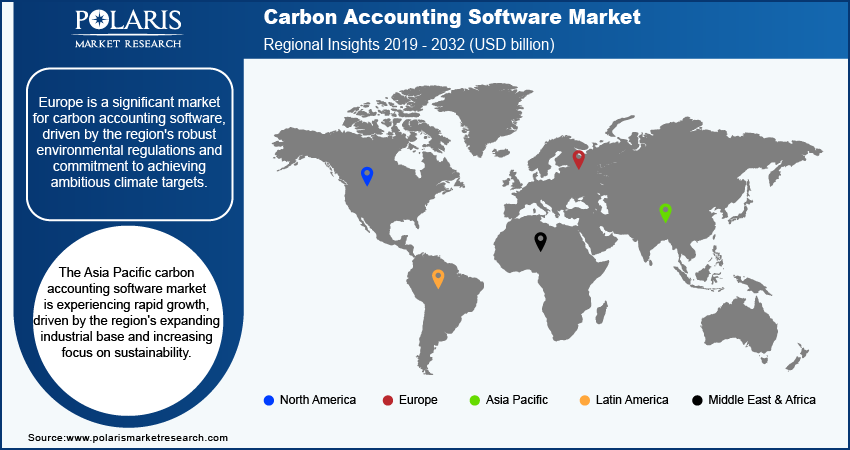

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the carbon accounting software market, primarily due to the stringent environmental regulations across the region and the strong emphasis on corporate sustainability practices. The US, in particular, has seen significant adoption of carbon accounting tools across various industries, driven by federal and state-level policies aimed at reducing greenhouse gas emissions. Additionally, the presence of major tech companies and innovators in the region has accelerated the development and implementation of advanced carbon accounting solutions. Europe closely follows, with the European Union's ambitious climate goals and regulatory frameworks further driving the adoption of these tools. Other regions, such as Asia Pacific, are experiencing growing demand, particularly in countries such as China and Japan, where industrial growth and increasing environmental awareness are leading to greater focus on carbon management.

Europe is a significant market for carbon accounting software, driven by the region's robust environmental regulations and commitment to achieving ambitious climate targets. The European Union's Green Deal and the legally binding goal to become climate-neutral by 2050 have accelerated the adoption of carbon management tools across various industries. Countries such as Germany, France, and the UK are leading in the implementation of carbon accounting software, particularly in sectors such as energy, manufacturing, and transportation. The strong emphasis on sustainability reporting and compliance with the EU Emissions Trading System (ETS) has fueled demand for advanced carbon accounting solutions. Additionally, Europe's focus on innovation and digital transformation is supporting the growth of cloud-based platforms in the market.

The Asia Pacific carbon accounting software market is experiencing rapid growth, driven by the region's expanding industrial base and increasing focus on sustainability. Countries, including China, Japan, and South Korea, are leading this growth, with significant investments in carbon management solutions to address their large carbon footprints. The region's growing awareness of climate change impacts, coupled with government initiatives to reduce emissions, is driving the adoption of carbon accounting tools across various sectors, including manufacturing, energy, and transportation. In particular, China’s commitment to achieving carbon neutrality by 2060 is pushing organizations to adopt rigorous carbon management practices. Additionally, the rise of smart cities and the integration of advanced technologies are contributing to the growth of the carbon accounting software market in Asia Pacific.

Carbon Accounting Software Market – Key Players and Competitive Insights

SAP SE, IBM Corporation, Microsoft Corporation, Salesforce, Wolters Kluwer, ENGIE Impact, Schneider Electric, Accenture, Intelex Technologies, Enablon (a Wolters Kluwer company), Sphera, Simble Solutions, Accuvio, Carbon Trust, and Ecova are among the key players in the carbon accounting software market. These companies are actively developing and providing carbon accounting solutions to meet the growing demand for sustainability reporting and carbon management across various industries.

In terms of competitive dynamics, SAP SE and IBM Corporation have established themselves as significant providers in the market, leveraging their extensive experience in enterprise software and global reach. Microsoft Corporation and Salesforce have gained traction by integrating carbon accounting features into their broader cloud-based offerings, appealing to organizations looking for integrated sustainability solutions. ENGIE Impact and Schneider Electric are distinguishing themselves by offering carbon management services alongside their software solutions, which allows them to provide a comprehensive approach to sustainability. Companies such as Enablon and Intelex Technologies are focusing on delivering specialized environmental, health, and safety (EHS) management platforms that incorporate carbon accounting as a core feature, catering to industries with complex regulatory requirements.

The competitive landscape is characterized by a blend of technology giants and specialized firms, each vying for market share by emphasizing different aspects of their offerings. Some companies focus on the scalability and flexibility of cloud-based solutions, while others emphasize their ability to handle complex, industry-specific carbon accounting needs. Innovation is a key factor, with companies increasingly integrating AI and ML into their platforms to enhance accuracy and provide actionable insights. Additionally, the rising importance of Scope 3 emissions tracking is pushing companies to develop more advanced tools, further intensifying competition in the market. As organizations continue to prioritize sustainability, the demand for robust, user-friendly, and comprehensive carbon accounting solutions is expected to grow, encouraging these key players to continuously evolve their offerings.

SAP SE is a global player in the carbon accounting software market, known for its comprehensive enterprise resource planning (ERP) solutions that include robust carbon management features. SAP’s carbon accounting tools are integrated into its broader sustainability management offerings, which help organizations track, manage, and report their greenhouse gas emissions.

Microsoft Corporation is another key player, leveraging its cloud-based platform, Microsoft Cloud for Sustainability, to provide carbon accounting solutions. Microsoft’s offerings enable organizations to monitor, report, and reduce their carbon emissions through data-driven insights.

Key Companies in Carbon Accounting Software Market

- SAP SE

- IBM Corporation

- Microsoft Corporation

- Salesforce

- Wolters Kluwer

- ENGIE Impact

- Schneider Electric

- Accenture

- Intelex Technologies

- Enablon (a Wolters Kluwer company)

- Sphera

- Simble Solutions

- Accuvio

- Carbon Trust

- Ecova

Carbon Accounting Software Industry Developments

- In May 2023, SAP announced a significant enhancement to its sustainability management suite, focusing on improving the accuracy and transparency of Scope 3 emissions reporting. This update reflects SAP’s commitment to addressing the growing demand for more detailed and actionable environmental data.

- In March 2023, Microsoft announced a new feature in its sustainability cloud that allows users to calculate and track the emissions generated by their supply chain activities, further expanding its capabilities in addressing the challenges of Scope 3 emissions. This update underscores Microsoft’s ongoing efforts to support businesses in achieving their sustainability goals through advanced technological solutions.

Carbon Accounting Software Market Segmentation

Carbon Accounting Software Market Breakdown – Deployment Outlook

- Cloud-Based

- On-Premise

Carbon Accounting Software Market Breakdown – End–Use Industry Outlook

- Energy & Utilities

- IT & Telecom

- Healthcare

- Transportation & Logistics

- Retail

- Construction & Infrastructure

- Food & Beverages

- Chemicals

- Others

Carbon Accounting Software Market Breakdown – Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Carbon Accounting Software Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 16.63 billion |

|

Market Size Value in 2024 |

USD 20.18 billion |

|

Revenue Forecast by 2032 |

USD 95.47 billion |

|

CAGR |

21.4% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Deployment By End–Use Industry |

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The carbon accounting software market has been bifurcated on the basis of deployment and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at the global and regional levels.

Growth/Marketing Strategy: The growth and marketing strategy in the carbon accounting software market primarily revolves around expanding product offerings to include advanced features such as AI-driven analytics, real-time data tracking, and comprehensive Scope 3 emissions management. Companies are focusing on cloud-based solutions to attract a broader customer base by offering scalability and ease of integration with existing systems. Strategic partnerships and collaborations with industry leaders are also being leveraged to enhance market presence and reach. Additionally, there is a strong emphasis on aligning product development with emerging regulatory standards and sustainability reporting requirements to meet the growing demand from businesses aiming to enhance their environmental stewardship.

FAQ's

The global carbon accounting software market size was valued at USD 16.63 billion in 2023 and is projected to grow to USD 95.47 billion by 2032.

The global market is projected to register a CAGR of 21.4% during the forecast period.

North America accounted for the largest share of the global market in 2023.

Key players in the carbon accounting software market include notable companies such as SAP SE, IBM Corporation, Microsoft Corporation, Salesforce, Wolters Kluwer, ENGIE Impact, Schneider Electric, Accenture, Intelex Technologies, Enablon (a Wolters Kluwer company), Sphera, Simble Solutions, Accuvio, Carbon Trust, and Ecova.

The cloud-based segment accounted for a larger share of the global market in 2023.

The energy & utilities segment accounted for the largest share of the global market.

Carbon accounting software is a type of digital tool designed to help organizations measure, track, and manage their greenhouse gas (GHG) emissions. These software solutions facilitate the accurate recording of emissions data from various sources, such as energy consumption, transportation, and supply chain activities. They also assist in calculating and reporting emissions in accordance with regulatory requirements and sustainability standards. The software typically offers features such as data integration, real-time monitoring, emissions forecasting, and compliance reporting, enabling organizations to understand their carbon footprint, set reduction targets, and improve their overall environmental performance.

A few key trends in the carbon accounting software market are described below: Integration of AI and Machine Learning: Enhancing accuracy and efficiency in emissions data analysis and reporting through advanced analytics and automation. Focus on Scope 3 Emissions: Increasing emphasis on tracking and managing indirect emissions across the entire value chain, driven by regulatory and stakeholder pressures. Adoption of Cloud-Based Solutions: Growing preference for scalable and flexible cloud platforms that offer real-time data access and integration capabilities. Increased Regulatory Compliance: Enhanced software features to meet evolving regulatory standards and reporting requirements.

A new company entering the carbon accounting software market must focus on integrating advanced AI and ML capabilities to offer enhanced data accuracy and predictive analytics. Emphasizing cloud-based solutions with scalable features and seamless integration with existing enterprise systems can attract a broad customer base. Additionally, addressing the growing need for comprehensive Scope 3 emissions tracking and compliance with evolving regulations will be crucial.

Companies offering carbon accounting software and related solutions and other consulting firms must buy the report.