Carbapenem Market Share, Size, Trends, Industry Analysis Report

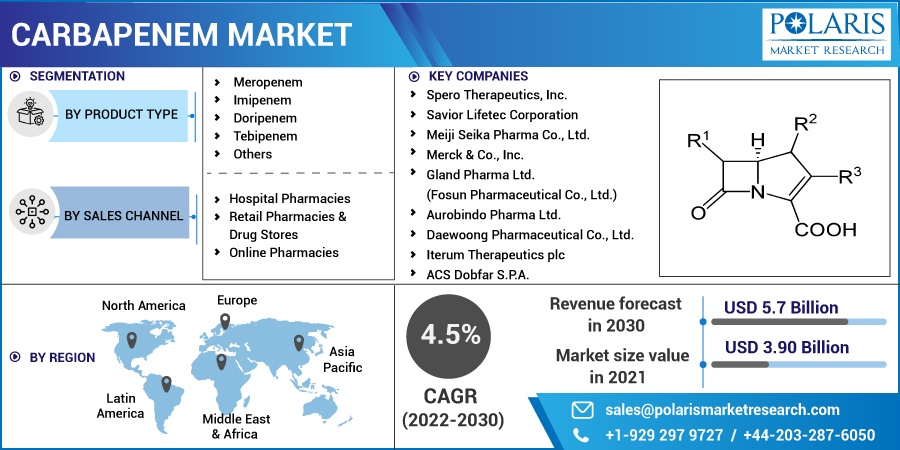

By Product Type (Meropenem, Doripenem, Imipenem, Tebipenem, And Others); By Sales Channel; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 115

- Format: PDF

- Report ID: PM2729

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

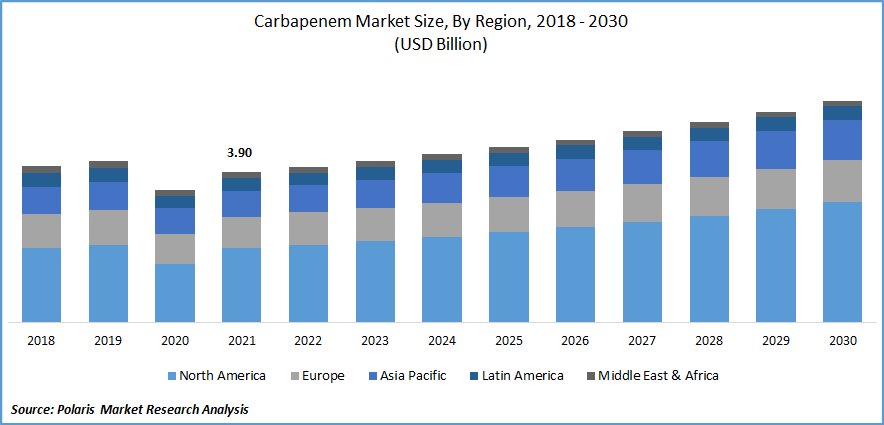

The global carbapenem market was valued at USD 3.90 billion in 2021 and is expected to grow at a CAGR of 4.5% during the forecast period. A group of extremely powerful antibiotics known as carbapenems is frequently suggested for treating serious or dangerous bacterial infections. Carbapenems are extremely important in treating infectious disorders because of their antibacterial capabilities.

Know more about this report: Request for sample pages

The rise in infectious disorders such as urinary tract infections (UTIs), intra-abdominal infections, and bacterial meningitis, as well as the growing popularity of generic product firms, are the main drivers of the carbapenem market.

The community's extensive infections with these organisms are probably going to cause a sharp rise in the usage of empiric carbapenem. In clinical studies, more recent oral carbapenems such as tebipenem have also demonstrated efficacy against the cUTI. Tebipenem further benefits from being helpful in lower cUTIs. Additionally, it lowers the likelihood of problems and hospitalization expenses, giving carbapenems an edge over other antibiotic groups.

The pharmaceutical sector underwent a radical transformation because of technological advancements, which improved treatments. To create new antibiotics, the pharmaceutical sector has combined cognitive technologies such as deep learning, machine learning, and artificial intelligence (AI). Tools and platforms for finding novel antibiotics are currently being developed by researchers. The total antibiotics industry is projected to shift due to the cutting-edge technology found in recent antibiotic discoveries. As a result of ongoing medication development, creating antibiotics for gram-negative bacteria is difficult.

The COVID-19 pandemic outbreak has brought about a number of unexpected changes in the world economy, and its repercussions have been felt across all industries. The COVID-19 pandemic is expected to have a negative impact on the worldwide carbapenem market. Post-COVID-19 era, considering the full economic impact of this health catastrophe. At the same time, the sector for intravenous injections changed throughout this prediction period.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Generic medicine producers now have more possibilities to join the market with their affordable medications because of the patent expiration of carbapenem-based antibiotics. The goal of generic medicine manufacturers is to expand the market for their products.

Furthermore, one of the main factors boosting the market's expansion is the lack of antibiotics to treat bacterial illnesses. Generic carbapenem-based antibiotics are now more widely available in a number of low- and middle-income nations because of increasing manufacture.

Additionally, the market's expanding generic competitors are hastening the development of generic medications. Active pharmaceutical ingredients (API), which are needed to make generic carbapenem-based antibiotics, are being developed by several Asian businesses.

Companies are speeding up the development of generic drugs, fueling the expansion of the worldwide market for carbapenem-based antibiotics.

Report Segmentation

The market is primarily segmented based on product type, sales channel, and region.

|

By Product Type |

By Sales Channel |

By Region |

|

|

|

Know more about this report: Request for sample pages

The Others Segment Held the Largest Market Share in 2021

The market for antibiotics based on carbapenem is divided into categories for meropenem, doripenem, imipenem, tebipenem, and others. In 2021, the others sector accounted for the biggest market share. Drugs from the carbapenem family, including Ertapenem, Vabomere, and Sulopenem (awaiting FDA clearance), are included in the "others" column. The medicines are used to treat a variety of gramme negative bacterial infections. Treatment with carbapenem-based antibiotics is effective against many infections, including cUTIs, bronchopulmonary infections, complex intra-abdominal infections, acute pelvic infections, lower respiratory tract infections, gynecologic infections, and pseudomonas infections.

Due to ongoing advancements in the pharmaceutical sector, an increase in the prevalence of bacterial illnesses, and an increase in the number of regulatory approvals for medications, the segment is anticipated to contribute considerably to the growth of the market for carbapenem-based antibiotics.

The Hospital Pharmacies Segment Held the Largest Share of the Carbapenem-Based Antibiotics Market

Retail pharmacies, internet pharmacies, and hospital pharmacies make up the market segments for antibiotics based on carbapenem. The market for carbapenem-based antibiotics was dominated by the hospital pharmacies sector in 2021, and it is predicted that this segment would see the greatest CAGR during the forecast period.

Asia Pacific is Expected to witness the Fastest Growth

During the predicted period, Asia Pacific is also expected to have high growth momentum. Numerous causes, including the rising elderly population, limited access to healthcare services, and dense urbanization, might be blamed for this development. The high prevalence of community-acquired pneumonia in the Asia-Pacific area has become a financial burden.

Additionally, companies that produce generic carbapenem medications are also growing their product lines. Because of its expanding patient base, better economic climate, and increased disposable income, Asia Pacific is predicted to have the largest proportion of the market. Due to the large population, market players' increased focus on creating novel vaccines and products at reasonable prices, and the high penetration of market players producing generic drugs and exporting them globally, the market size for carbapenem-based antibiotics in India and China is predicted to increase quickly.

The worldwide market share is dominated by North America, which is anticipated to maintain a solid position over the next few years. Due to the growing use of carbapenem-based antibiotics, a high prevalence of antibiotic prescriptions, and developments in research and development that have resulted in the discovery and introduction of new medications, the region is predicted to continue to expand in the future.

Competitive Insight

Some of the major players operating in the global market include Spero Therapeutics, Inc., Savior Lifetec Corporation, Meiji Seika Pharma Co., Ltd., Merck & Co., Inc., Gland Pharma Ltd. (Fosun Pharmaceutical Co., Ltd.), Aurobindo Pharma Ltd., Daewoong Pharmaceutical Co., Ltd., Iterum Therapeutics plc, ACS Dobfar S.p.A.

Recent Developments

- In January 2022, The New Drug Application (NDA) for the approval of tebipenem HBr oral tablets for the treatment of adult patients with complicated urinary tract infections (cUTI), including acute pyelonephritis, caused by susceptible microorganisms, was accepted for substantive review by the U.S. Food and Drug Administration (FDA).

- In September 2022, Except Japan and a few Asian nations, GSK plc. and Spero Therapeutics agreed to an exclusive licensing deal for the commercialization of the late-stage antibiotic Tebipenem HBr. The discovery and marketing of novel carbapenems to treat patients with bacterial infections are therefore predicted to boost the market's expansion.

- In October 2021, Tebipenem HBr (tebipenem pivoxil hydrobromide) was approved by the Food and Drug Administration (FDA) for the treatment of complex urinary tract infections (cUTI), including pyelonephritis, brought on by susceptible bacteria. The business said it would cooperate with the FDA throughout the NDA review procedure in preparation for the planned introduction of tebipenem HBr in the second half of 2022.

Carbapenem Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 4.04 billion |

|

Revenue forecast in 2030 |

USD 5.7 billion |

|

CAGR |

4.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Product Type, By Sales Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Spero Therapeutics, Inc., Savior Lifetec Corporation, Meiji Seika Pharma Co., Ltd., Merck & Co., Inc., Gland Pharma Ltd. (Fosun Pharmaceutical Co., Ltd.), Aurobindo Pharma Ltd., Daewoong Pharmaceutical Co., Ltd., Iterum Therapeutics plc, ACS Dobfar S.P.A. |