Car Care Products Market Share, Size, Trends, Industry Analysis Report, By Product (Car Cleaning Products, Car Polish, Car Wax, Wheel & Tire Care Products, Glass Cleaners, Interior Care Products, Others); By Packaging, By Application, By Distribution Channel, By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 110

- Format: PDF

- Report ID: PM2197

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

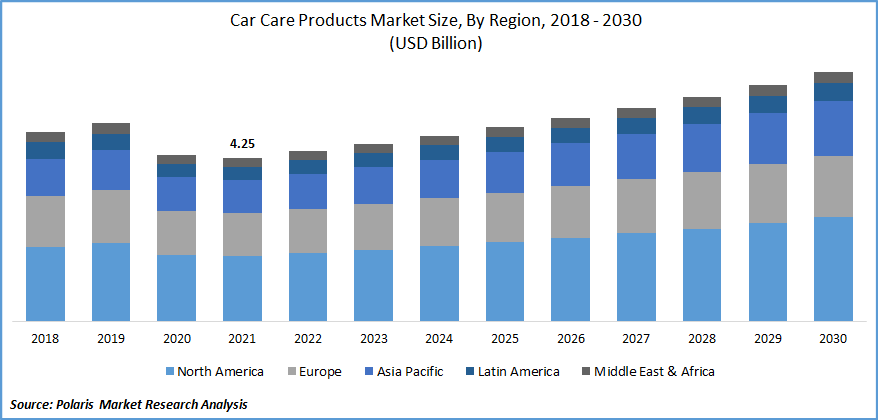

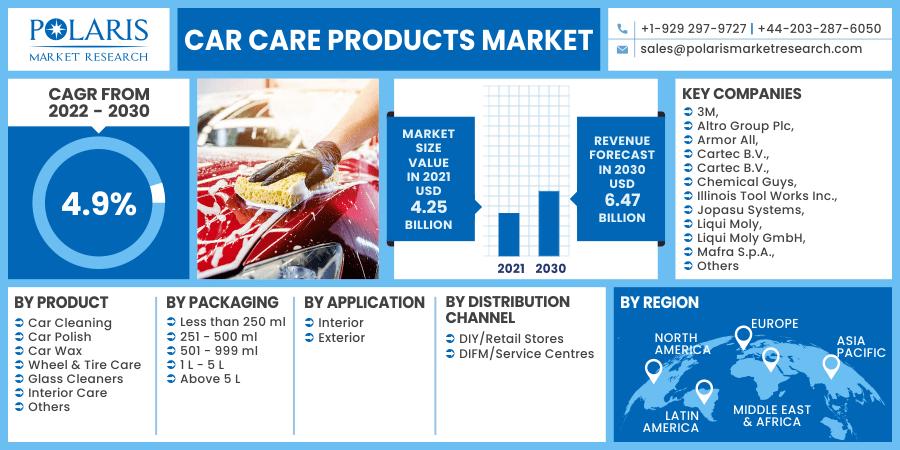

The global car care products market was valued at USD 4.25 billion in 2021 and is expected to grow at a CAGR of 4.9% during the forecast period. Car care products are high-quality chemicals that help autos shine, gloss, and last longer. Car maintenance products protect and heal damages such as scratches, assuring that each part of the vehicle receives the best maintenance and the vehicle's visual appeal is preserved. Many automotive cosmetic chemicals are available on the market, including waxes, polishes, paint protection treatments, tire cleaners, rim protectors, and glass cleaners. In addition, COVID-19 also raised a demand for interior car care products, as automobile owners became more concerned about the importance of maintaining a vehicle inside hygiene for all passengers. Antimicrobial and disinfection goods that assist keep the interiors of vehicles free of germs and viruses are also in more demand due to the pandemic.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The growth in the car care products market is being driven by the rising launches of automobile maintenance products by the major players and their other strategies. For instance, in January 2021, with the launch of its new Car Care line, Motul is expanding its product portfolio in the automotive sector. The one-of-a-kind cleaning and accessory products were created using Motul's extensive experience and knowledge to provide effective and long-lasting care for the vehicle's interior and exterior. The new Car Care product line, which includes eleven different cleaning and care solutions and six accessories, is currently available at select retail partners.

Motul is adding a new line of special care solutions to its product line for the automobile sector. The careline comprises not only cleaning supplies but also accessories like microfiber towels, bodywork sponges, rim brushes, and wash mitts. It also created solutions for in-between repairs, such as a puncture spray and scratch remover. Thus, the major players' focus on broadening the launches of automobile maintenance products is to boost the car care products market growth during the forecast period.

However, the automobile wash and maintenance services regulations are hindering the industry growth during the forecast period. Carwash rules are largely in place to preserve the environment and ensure worker safety. The Environmental Protection Agency (EPA) is in charge of all environmental issues. Workplace safety requirements are overseen by numerous occupational safety legislation, such as the Occupational Safety and Health Administration (OSHA). The Environmental Protection Agency (EPA) wants automobile owners to employ professional detailing services rather than do-it-yourself (DIY) cleaning at home. This rule directly impacts demand for DIY automobile maintenance products. Thus, the regulations for automobile wash and fine for that is restraining the market growth during the forecast period.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The market has observed extensive developments in the last few decades supported by various factors such as the rise in automotive sales and used automobile sales across the globe. The rise in passenger vehicles has led to increased demand for these maintenance goods, driving the market growth. Also, the sales of used automobiles have risen in emerging countries due to their low disposable incomes, which has boosted market growth during the forecast period.

Further, according to the International Organization of Motor Vehicle Manufacturers, around 63.7 million passenger automobiles were sold during 2019, and it gets reduced to 53.5 million in 2020 around the globe. In addition, according to the IBEF, around 3.49 million units were sold in the passenger and commercial vehicle categories combined in 2020, and India was the fifth-largest automobile market. In 2019, it was the seventh-largest commercial vehicle manufacturer.

The total production volume of passenger vehicles, three-wheelers, two-wheelers, and quadricycles reached 1,984,676 units in August 2021 (excluding BMW, Mercedes, Tata Motors, and Volvo Auto). Small and mid-sized vehicles account for the vast bulk of passenger vehicle sales. With nearly 20.1 million vehicles sold in FY20, two-wheelers and passenger automobiles accounted for 80.8 % and 12.9 % of the market share, respectively.

In August 2021, a total of 232,224 passenger automobiles were sold. In FY20, automobile exports totaled 4.77 million vehicles. Two-wheelers accounted for 73.9% of all vehicles shipped, with passenger vehicles accounting for 14.2%, three-wheelers accounting for 10.5%, and commercial vehicles accounting for 1.3%. Thus, the rise in the demand for cars across the globe has increased the demand for automobile maintenance goods, which is propelling the car care products market growth during the forecast period.

Report Segmentation

The market is primarily segmented based on product, application, packaging, distribution channel, and region.

|

By Product |

By Packaging |

By Application |

By Distribution Channel |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Application

Based on the application segment, the interior segment is expected to be the most significant revenue contributor in the global market in 2020 and is expected to retain its dominance in the foreseen period. The interior segment includes automotive maintenance products used to keep a vehicle's inside in good working order. Furthermore, current breakthroughs in antimicrobial automobile care products will encourage the use of interior vehicle care solutions to maintain the aesthetics of an automobile interior while also keeping it free of germs and viruses.

Geographic Overview

In terms of geography, North America had the highest share in 2020. The market for the North American region is anticipated to grow significantly as a result of the rising sales of automobiles in the region and the rising awareness among people for the maintenance of vehicles. The people in the region are more concerned about luxury things such as automobiles, which has increased the demand for these maintenance products, boosting the market's growth during the forecasts period. Furthermore, the rising use of compact trucks as family automobiles and the rising demand for luxury vehicles is expected to expand the market for these goods.

Moreover, APAC is projected to witness a high CAGR in the global market in 2020. This increase can be attributed to the rising demand for automobile maintenance products from countries such as India and China. Furthermore, factors such as rising disposable income and population growth in developing countries such as India and South Korea are predicted to boost the automobile industry, resulting in increased product demand. According to the United Nations, China (1.44 billion) and India (1.39 billion) continue to be the world's two most populated countries, each with more than 1 billion people, accounting for 19 and 18 percent of the global population, respectively.

Between 2019 and 2050, India is expected to replace China as the world's most populated country around 2027, while China's population is expected to decline by 31.4 million, or roughly 2.2%. Thus, the rising population has increased the demand for automobiles in the region, increasing the demand for these maintenance products.

Competitive Insight

Some of the major players operating in the global market include 3M, Altro Group Plc, Armor All, Cartec B.V., Cartec B.V., Chemical Guys, Illinois Tool Works Inc., Jopasu Systems, Liqui Moly, Liqui Moly GmbH, Mafra S.p.A., Simoniz USA, Soft99 Corporation, Sonax GmbH, Tetrosyl Ltd., Turtle Wax, Wurth Group.

Car Care Products Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 4.25 billion |

|

Revenue forecast in 2030 |

USD 6.47 billion |

|

CAGR |

4.9% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Application, By Packaging, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

3M, Altro Group Plc, Armor All, Cartec B.V., Cartec B.V., Chemical Guys, Illinois Tool Works Inc., Jopasu Systems, Liqui Moly, Liqui Moly GmbH, Mafra S.p.A., Simoniz USA, Soft99 Corporation, Sonax GmbH, Tetrosyl Ltd., Turtle Wax, Wurth Group. |