Cannabis Testing Services Market Size, Share, Trends, Industry Analysis Report: By Type (Potency Testing, Terpene Profiling, Heavy Metal Testing, Pesticide Screening, Microscopy Testing, Residual Solvent Screening, and Others), End Use (Cannabis Drug Manufacturers, Cannabis Cultivators/Growers, and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 115

- Format: PDF

- Report ID: PM1771

- Base Year: 2024

- Historical Data: 2020-2023

Cannabis Testing Services Market Overview

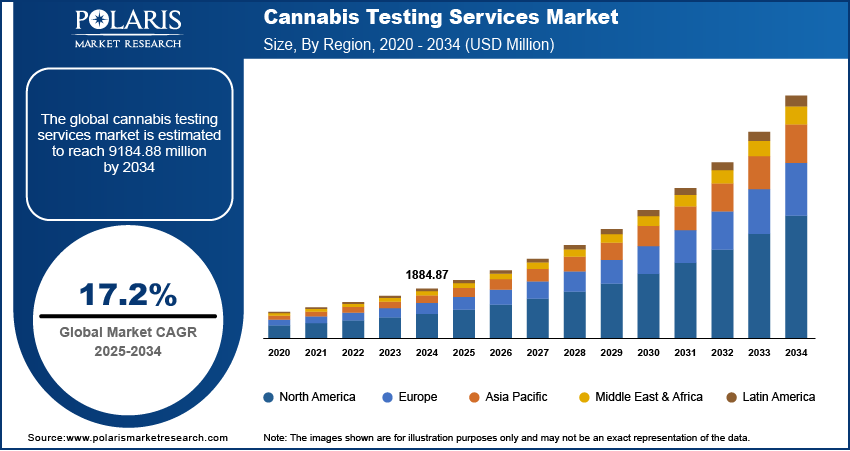

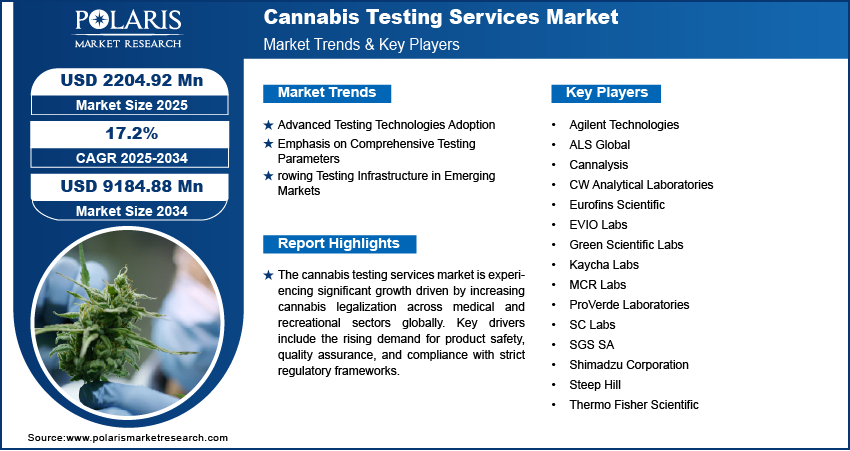

The global cannabis testing services market size was valued at USD 1884.87 million in 2024. The market is projected to grow from USD 2204.92 million in 2025 to USD 9184.88 million by 2034, exhibiting a CAGR of 17.2% during 2025–2034.

The global cannabis testing services market involves the provision of analytical testing services to ensure the safety, potency, and regulatory compliance of cannabis and its derivatives. A few key factors driving the market growth are the increasing legalization of cannabis for medical and recreational use, the rising demand for quality assurance and safety among consumers, and stringent regulatory frameworks mandating product testing. Prominent cannabis testing services market trends shaping the market include advancements in testing technologies, a growing focus on terpene profiling and pesticide testing, and the expansion of testing service providers in emerging cannabis markets.

To Understand More About this Research: Request a Free Sample Report

Cannabis Testing Services Market Dynamics

Adoption of Advanced Testing Technologies

The cannabis testing services market is experiencing a rapid shift toward advanced analytical techniques such as high-performance liquid chromatography (HPLC), gas chromatography-mass spectrometry (GC-MS), and tandem mass spectrometry (LC-MS/MS). These technologies enhance the precision of cannabinoid and contaminant analysis, meeting increasingly stringent regulatory requirements. For instance, a study published in Analytical Chemistry reported that LC-MS/MS could detect trace pesticides in cannabis products with higher accuracy compared to traditional methods. The adoption of advanced cannabis testing technologies supports in complying with regulatory compliance and building consumer trust in cannabis products, which boosts the cannabis testing services market development.

Emphasis on Comprehensive Testing Parameters

As cannabis use becomes more widespread, the demand for comprehensive testing that extends beyond potency to include contaminants such as pesticides, heavy metals, residual solvents, and microbial impurities is rising. Terpene profiling has also gained traction, as terpenes contribute significantly to cannabis’s therapeutic properties. A report by the Journal of Cannabis Research indicates that terpene testing requests increased by over 25% between 2020 and 2023, reflecting consumer interest in product differentiation and safety. Testing labs are increasingly offering bundled testing packages to address this expanded scope. Such emphasis on comprehensive cannabis testing parameters is expected to drive the cannabis testing services market growth in the coming years.

Growing Testing Infrastructure in Emerging Markets

The expansion of cannabis legalization globally has led to a surge in testing infrastructure in emerging markets such as Asia Pacific and Latin America. These regions are witnessing investments in laboratory facilities and training programs to meet regulatory standards. For instance, a 2023 study by the Asia Cannabis Report highlighted that the number of licensed testing laboratories in Thailand grew by 40% within a year of legalization. This growth facilitates compliance and supports market entry for cannabis producers seeking to meet export standards. Hence, the growing testing infrastructure in emerging markets across the world is projected to fuel the cannabis testing services market expansion during the forecast period.

Cannabis Testing Services Market Segment Insights

Cannabis Testing Services Market Outlook – Type-Based Insights

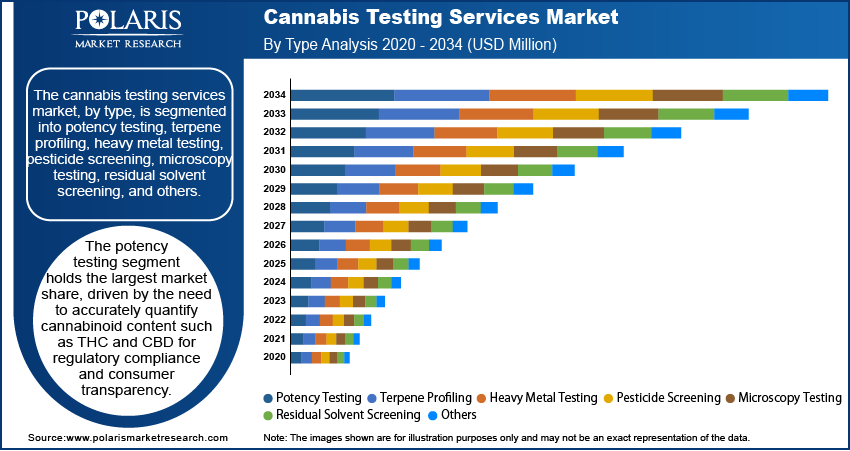

By type, the cannabis testing services market is segmented into potency testing, terpene profiling, heavy metal testing, pesticide screening, microscopy testing, residual solvent screening, and others. The potency testing segment holds the largest market share, driven by the need to accurately quantify cannabinoid content such as THC and CBD for regulatory compliance and consumer transparency. This segment's prominence is further supported by the widespread use of potency data in product labeling, enabling manufacturers to meet varying legal requirements across regions. Additionally, potency testing is essential for medical cannabis products, where precise dosing plays a critical role in therapeutic efficacy.

The pesticide screening segment is experiencing the highest growth rate, fueled by stringent regulatory frameworks targeting the safe consumption of cannabis products. Increasing awareness of the health risks associated with pesticide residues has compelled producers to prioritize this testing. A report by Frontiers in Chemistry indicates a marked rise in demand for pesticide screening protocols, particularly in North America and Europe, where consumer safety regulations are stringent. The growing prevalence of organic and sustainable cannabis cultivation practices also aligns with the need for comprehensive pesticide testing to validate claims of purity and quality.

Cannabis Testing Services Market Assessment – End Use-Based Insights

The cannabis testing services market, by end use, is segmented into cannabis drug manufacturers, cannabis cultivators/growers, and Others. The cannabis drug manufacturers segment accounts for the largest market share due to the stringent testing requirements imposed on medical and pharmaceutical cannabis products. These manufacturers rely heavily on testing services to ensure product safety, efficacy, and regulatory compliance, particularly in highly regulated markets such as North America and Europe. The increasing focus on precision medicine and the development of cannabinoid-based drugs further amplify the demand for robust testing protocols in this segment.

The cannabis cultivators/growers segment represents the fastest-growing segment, driven by the rising adoption of quality assurance practices at the cultivation stage. Regulatory mandates for testing raw cannabis materials before sale or processing have propelled cultivators to invest in testing services to validate their products' purity and potency. Furthermore, the shift toward organic and sustainable cultivation methods has heightened the need for specialized testing, such as pesticide screening and terpene profiling, to meet market and consumer expectations for clean-label products. This trend is particularly evident in emerging markets with expanding cannabis cultivation activities.

Cannabis Testing Services Market Regional Insights

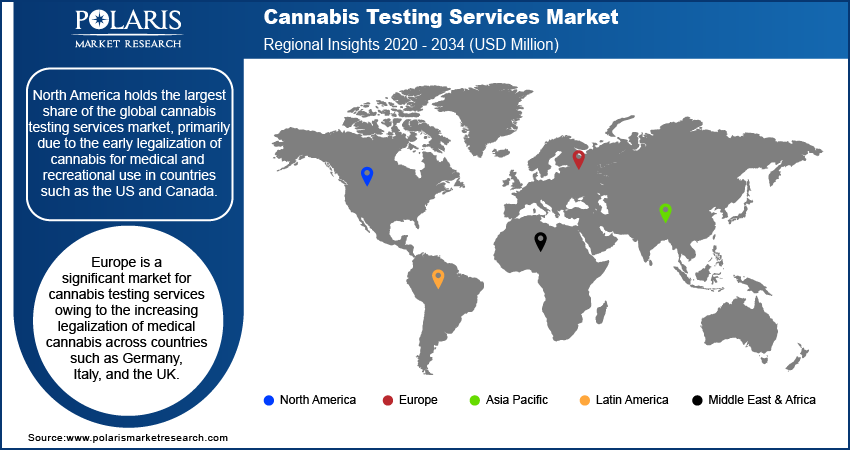

By region, the study provides cannabis testing services market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the global cannabis testing services market revenue, primarily due to the early legalization of cannabis for medical and recreational use in countries such as the US and Canada. The region benefits from a well-established regulatory framework that mandates rigorous testing for safety, potency, and contaminants, driving demand for advanced testing services. Additionally, the presence of a large number of testing laboratories and technology providers supports market growth. Rising consumer awareness regarding product quality and safety, coupled with increasing investments in research and development of cannabis-based products, solidifies North America’s dominant position in the market.

Europe is a significant market for cannabis testing services, driven by the increasing legalization of pharmaceutical cannabis across countries such as Germany, Italy, and the UK. Strict regulatory requirements in the region emphasize product safety, particularly in terms of potency and contaminant testing, fostering demand for advanced testing services. Additionally, the European Union's standardized regulations encourage cross-border trade, prompting cannabis manufacturers to comply with stringent quality standards, thereby driving growth in testing services. The expansion of cannabis cultivation facilities in Eastern Europe also contributes to the growing need for local testing infrastructure.

Asia Pacific is an emerging market for cannabis testing services, fueled by the recent legalization of medical cannabis in countries such as Thailand, Australia, and New Zealand. The region's growing interest in therapeutic applications of cannabis has led to investments in testing laboratories and infrastructure to meet regulatory compliance. The increasing focus on establishing stringent testing protocols for contaminants and potency aligns with global quality standards, facilitating market entry for local producers. Additionally, increasing awareness about product quality and safety among consumers is expected to drive the cannabis testing services market expansion in the region.

Cannabis Testing Services Market – Key Players and Competitive Insights

Eurofins Scientific, ALS Global, SGS SA, Agilent Technologies, Shimadzu Corporation, Thermo Fisher Scientific, Steep Hill, CW Analytical Laboratories, ProVerde Laboratories, Cannalysis, EVIO Labs, Green Scientific Labs, SC Labs, MCR Labs, and Kaycha Labs are a few key players in the cannabis testing services market. These companies are actively providing testing solutions tailored to meet regulatory requirements, including potency testing, contaminant screening, and terpene profiling. While some firms operate globally, others focus on regional markets to address local regulatory demands and client needs.

The competitive landscape is characterized by the continuous adoption of advanced analytical technologies and expanded service portfolios. Companies such as Agilent Technologies and Thermo Fisher Scientific leverage their expertise in analytical instrumentation to enhance testing capabilities, providing precise and reliable results. Laboratories such as Steep Hill and Kaycha Labs focus on comprehensive testing packages to support cannabis producers in maintaining product quality and compliance. Additionally, many players are investing in automation and digital reporting to improve efficiency and cater to increasing testing volumes as cannabis production scales globally.

Collaboration and strategic partnerships are significant trends within the market, with testing laboratories working closely with cultivators and manufacturers to streamline the testing process. Regional players often differentiate themselves by offering localized services, which align with specific regulatory guidelines in their markets. The rising focus on expanding laboratory infrastructure in emerging cannabis regions such as Asia Pacific and Latin America highlights the competitive efforts to capture opportunities in these growing markets.

Eurofins Scientific is a prominent provider of laboratory testing services, including cannabis testing, with a global presence. The company offers a wide range of services, such as potency analysis, contaminant screening, and terpene profiling, ensuring compliance with regional regulations.

Kaycha Labs is a well-established cannabis testing laboratory network in the US, providing services such as pesticide screening, heavy metal testing, and residual solvent analysis. Known for its compliance with state-specific regulations, Kaycha Labs operates multiple accredited laboratories across the country.

List of Key Companies in Cannabis Testing Services Market

- Agilent Technologies

- ALS Global

- Cannalysis

- CW Analytical Laboratories

- Eurofins Scientific

- EVIO Labs

- Green Scientific Labs

- Kaycha Labs

- MCR Labs

- ProVerde Laboratories

- SC Labs

- SGS SA

- Shimadzu Corporation

- Steep Hill

- Thermo Fisher Scientific

Cannabis Testing Services Industry Developments

- In October 2024, Kaycha Labs introduced a new automated data reporting platform to streamline test result delivery for clients, improving operational efficiency.

- In September 2024, Eurofins announced the expansion of its cannabis testing capabilities in Europe, adding new facilities in Germany to meet the rising demand for medical cannabis quality assurance.

Cannabis Testing Services Market Segmentation

By Type Outlook

- Potency Testing

- Terpene Profiling

- Heavy Metal Testing

- Pesticide Screening

- Microscopy Testing

- Residual Solvent Screening

- Others

By End Use Outlook

- Cannabis Drug Manufacturers

- Cannabis Cultivators/Growers

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cannabis Testing Services Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1884.87 million |

|

Market Size Value in 2025 |

USD 2204.92 million |

|

Revenue Forecast by 2034 |

USD 9184.88 million |

|

CAGR |

17.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The cannabis testing services market has been broadly segmented on the basis of type and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at the global and regional levels.

Growth/Marketing Strategy

The cannabis testing services market growth and marketing strategy focuses on expanding service offerings to meet the increasing demand for comprehensive testing, particularly in regions with evolving regulatory frameworks. Companies are investing in advanced testing technologies, such as high-performance liquid chromatography and mass spectrometry, to enhance accuracy and efficiency. Strategic partnerships with cannabis cultivators and manufacturers are crucial to provide tailored solutions that ensure compliance. Additionally, players are focusing on expanding their geographic reach, particularly in emerging markets, while increasing awareness of their services through digital platforms and collaborations with industry associations. These strategies aim to strengthen market presence and meet the rising consumer demand for safe, tested cannabis products.

FAQ's

? The global cannabis testing services market size was valued at USD 1884.87 million in 2024 and is projected to grow to USD 9184.88 million by 2034.

? The global market is projected to register a CAGR of 17.2% during 2025–2034.

? North America held the largest share of the global market in 2024.

? Eurofins Scientific, ALS Global, SGS SA, Agilent Technologies, Shimadzu Corporation, Thermo Fisher Scientific, Steep Hill, CW Analytical Laboratories, ProVerde Laboratories, Cannalysis, EVIO Labs, Green Scientific Labs, SC Labs, MCR Labs, and Kaycha Labs are a few key players in the cannabis testing services market.

? The potency testing segment accounted for the largest share of the global market in 2024.

? The cannabis drug manufacturers segment accounted for the largest share of the global market in 2024.

? Cannabis testing services refer to laboratory-based services that analyze cannabis products to ensure they meet safety, quality, and regulatory standards. These services typically involve testing for various factors, including potency (cannabinoid content such as THC and CBD), contaminants (such as pesticides, heavy metals, and residual solvents), microbial impurities, and terpene profiles. The goal of these services is to provide accurate, reliable data to producers, regulators, and consumers to ensure that cannabis products are safe for use, compliant with local laws, and consistent in quality. These tests are crucial in markets where cannabis is legalized, as they help protect consumer health and maintain product integrity

? A few key trends in the cannabis testing services market are described below: Advancements in Testing Technology: Adoption of precise and efficient analytical techniques such as LC-MS/MS, HPLC, and GC-MS to enhance the accuracy of testing results. Comprehensive Testing Services: Increased demand for full-spectrum testing, including potency, pesticides, heavy metals, residual solvents, and terpene profiling. Regulatory Compliance: Stricter regulatory frameworks drive the need for regular and reliable testing to ensure products meet local laws and safety standards. Expansion in Emerging Markets: Growing cannabis legalization in regions such as Asia Pacific and Latin America leads to increased investments in testing infrastructure.

? A new company entering the cannabis testing services market must focus on specialized testing areas that are gaining prominence, such as pesticide screening and terpene profiling, which are increasingly important for consumer safety and product differentiation. Investing in advanced testing technologies, such as automated systems and more accurate analytical methods, could help improve efficiency and precision. Establishing strong partnerships with local cannabis cultivators and producers to offer tailored testing services could also provide a competitive advantage. Additionally, focusing on emerging markets where cannabis legalization is expanding, such as in parts of Asia Pacific and Latin America, could open new growth opportunities.

? Companies offering cannabis testing services and related products, and other consulting firms must buy the report.