Cannabis Pharmaceuticals Market Size, Share, Trends, Industry Analysis Report: By Brand Type (Sativex, Epidiolex, and Other Brands), Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 116

- Format: PDF

- Report ID: PM1773

- Base Year: 2024

- Historical Data: 2020-2023

Cannabis Pharmaceuticals Market Overview

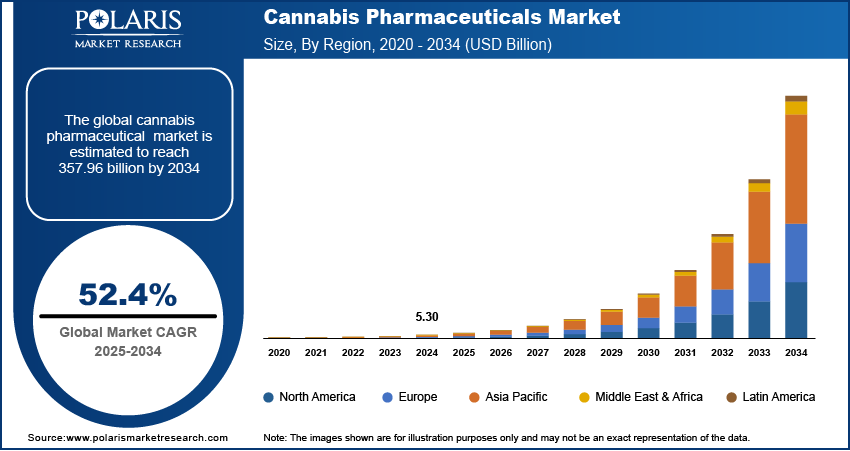

The global cannabis pharmaceuticals market size was valued at USD 5.30 billion in 2024. The market is projected to grow from USD 8.07 billion in 2025 to USD 357.96 billion by 2034, exhibiting a CAGR of 52.4% during 2025–2034.

The global cannabis pharmaceuticals market refers to the segment of the pharmaceutical industry focused on the development, manufacturing, and distribution of cannabis-based products for medical use. This market includes products derived from cannabis plants, such as cannabidiol (CBD) and tetrahydrocannabinol (THC). The products are used for treating various medical conditions, including chronic pain, epilepsy, and anxiety. Key market drivers include the increasing acceptance of cannabis for medical purposes, advancements in research and clinical studies, and regulatory changes that facilitate cannabis use in healthcare. Cannabis pharmaceuticals market trends such as the rising demand for non-psychoactive CBD products and the growing focus on personalized medicine are further shaping the market growth. Additionally, the ongoing legalization of cannabis in many regions is expected to create lucrative market opportunities during the forecast period.

To Understand More About this Research: Request a Free Sample Report

Cannabis Pharmaceuticals Market Dynamics

Growing Adoption of Medical Cannabis

The adoption of medical cannabis has been expanding significantly in various regions, driven by increasing evidence of its therapeutic benefits. Cannabis-based treatments, particularly those containing CBD, have gained popularity for managing chronic pain, neurological disorders, and anxiety. In countries such as the US, Canada, and several European nations, the legalization of medical cannabis has boosted access to these products. According to a 2023 study by the National Institute on Drug Abuse, approximately 60% of medical cannabis users in the US report using it for pain management, a clear indication of the growing reliance on cannabis-based therapies. This trend is expected to continue as more clinical trials validate the medical benefits of cannabis, expanding its use across various therapeutic areas. Hence, the growing adoption of medical cannabis is expected to boost the cannabis pharmaceuticals market development in the coming years.

Expansion of Non-Psychoactive Cannabis Products

Non-psychoactive cannabis products, particularly those derived from CBD, are becoming increasingly popular in the pharmaceutical market. CBD products, which do not produce the "high" associated with THC, have gained traction due to their perceived safety and effectiveness in treating a range of conditions, including epilepsy, insomnia, and anxiety. A significant milestone was the US FDA's approval of Epidiolex in 2018, the first cannabis-derived medication to be approved for use in treating certain types of epilepsy. The global demand for CBD-based medications is growing rapidly as consumers and healthcare providers seek alternatives to traditional pharmaceuticals. Thus, the expansion of non-psychoactive cannabis products drives cannabis pharmaceuticals market growth.

Increasing Investments and Research in Cannabis Medicine

As the legal and regulatory landscape for cannabis continues to evolve, there has been a marked increase in both public and private investments in cannabis pharmaceutical research. This trend is helping to drive innovation in the development of new cannabis-based drugs and therapies. Research institutions and pharmaceutical companies are focusing on clinical trials to explore the efficacy of cannabis in treating conditions such as cancer, multiple sclerosis, and Parkinson's disease. In 2021, the US National Institutes of Health (NIH) allocated approximately USD 20 million in funding for cannabis research. The expanding body of clinical evidence is leading to the development of more targeted and effective cannabis-based treatments, further driving the cannabis pharmaceuticals market expansion.

Cannabis Pharmaceuticals Market – Segment Insights

Cannabis Pharmaceuticals Market Outlook – Brand Type-Based Insights

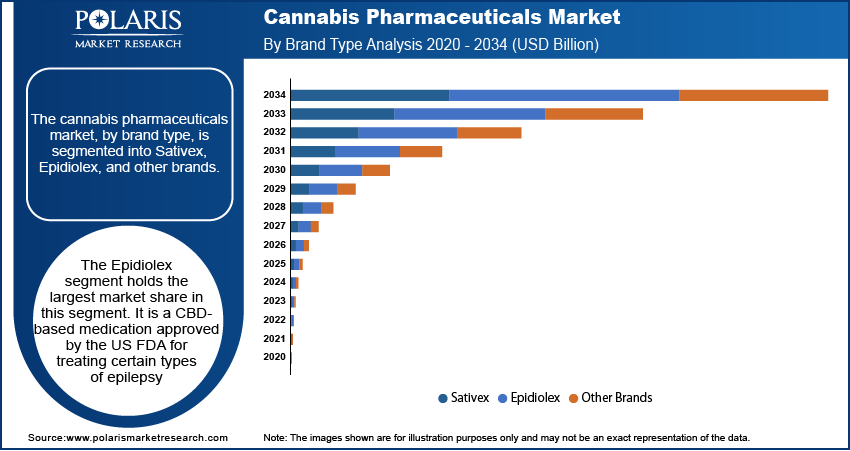

The cannabis pharmaceuticals market, by brand type, is segmented into Sativex, Epidiolex, and other brands. The Epidiolex segment holds the largest market share. Epidiolex is a CBD-based medication approved by the US FDA for treating certain types of epilepsy. Its approval has been a significant milestone in the cannabis pharmaceutical industry, driving both its widespread adoption and substantial revenue generation. Epidiolex's position is further strengthened by its clinical success, regulatory approval in multiple countries, and increasing acceptance among healthcare providers for the treatment of neurological disorders. This brand is expected to continue dominating the market as more research supports its efficacy in treating other conditions, potentially expanding its indication range.

Sativex, a THC and CBD combination product, also maintains a significant presence in the cannabis pharmaceuticals market, particularly for the treatment of multiple sclerosis-related spasticity. However, its growth has been relatively stable compared to Epidiolex, as it faces competition from newer CBD-based treatments and shifting regulatory frameworks. The other brands segment is witnessing the highest growth, driven by the increasing number of cannabis-based pharmaceuticals entering the market. This segment benefits from rising investments in research and development, as pharmaceutical companies explore a wider range of cannabis-derived treatments for various medical conditions. As a result, the other brands segment is poised for strong growth as these new products move through clinical trials and regulatory approval processes.

Cannabis Pharmaceuticals Market Assessment – Distribution Channel-Based Insights

The cannabis pharmaceuticals market segmentation by distribution channel includes online pharmacies, hospitals, and other distribution avenues. The online pharmacies segment holds the largest market share, driven by the convenience they offer to consumers and the increasing demand for cannabis-based medications. The rise in use of digital health platforms and e-commerce has made it easier for patients to access these products, particularly in regions with established medical cannabis programs. Online pharmacies benefit from broader product availability, discreet purchasing options, and the ability to reach patients in remote areas, contributing to their dominant position in the market.

The hospital segment is experiencing the highest growth rate, fueled by the increasing integration of cannabis-based treatments into mainstream medical practices. Hospitals are increasingly adopting cannabis pharmaceuticals for in-patient treatments, especially for chronic pain, cancer-related symptoms, and neurological disorders. The growth is further supported by the expanding clinical research and the inclusion of cannabis medicines in treatment protocols for various conditions. This trend is likely to continue as more healthcare providers become familiar with the benefits of cannabis-based therapies, driving increased adoption within hospital settings.

Cannabis Pharmaceuticals Market Regional Insights

By region, the study provides cannabis pharmaceuticals market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the global cannabis pharmaceuticals market revenue. In the US, the legalization of medical cannabis in several states has spurred significant growth of the market. The approval of cannabis-based drugs such as Epidiolex and Sativex in the country has facilitated broader adoption among healthcare providers and patients. Additionally, ongoing research, expanding healthcare access, and the growing acceptance of cannabis as a medical treatment are propelling the North America cannabis pharmaceuticals market expansion. The supportive regulatory environment and substantial investments in cannabis-related pharmaceutical research are among the key factors that continue to position North America as the dominant market. Europe is also witnessing steady growth, but it lags behind North America in terms of market size and speed of regulatory adoption.

The Europe cannabis pharmaceuticals market is experiencing steady growth, driven by increasing acceptance of medical cannabis and favorable regulatory changes in certain countries. The UK, Germany, and the Netherlands are leading the regional market share. Germany is one of the largest markets in Europe due to its well-established framework for medical cannabis use. The European market is benefiting from the ongoing research into cannabis-based therapies, particularly for conditions such as chronic pain, epilepsy, and multiple sclerosis. While regulatory barriers remain in some countries, the overall trend is toward expanding access to medical cannabis. The region’s growth is also being supported by increasing patient awareness and the growing number of approved cannabis-based medications.

The Asia Pacific cannabis pharmaceuticals market is still in the early stages of developing its cannabis pharmaceuticals market, with significant variation in regulatory approaches across countries. In nations such as Australia and South Korea, medical cannabis is gaining acceptance, and the market is gradually expanding as these countries legalize cannabis for medicinal use. Australia, in particular, has made notable progress, with both medical cannabis production and prescriptions increasing in recent years. However, many other countries in the region, such as China and India, have stringent regulations and limited cannabis use in the medical field. Despite these challenges, the potential for market growth in Asia Pacific remains high as regulatory frameworks evolve and awareness of cannabis-based treatments increases.

Cannabis Pharmaceuticals Market – Key Players and Competitive Insights

Key players in the cannabis pharmaceuticals market include companies that have developed and are actively distributing cannabis-based treatments. A few of the major players include GW Pharmaceuticals (now a part of Jazz Pharmaceuticals), which markets Epidiolex, a CBD-based drug for epilepsy. Another prominent player is Sativex, developed by the company GW Pharmaceuticals and now owned by Jazz Pharmaceuticals. Other key companies in the market are Tilray, which provides a range of cannabis-based treatments and has a strong presence in Canada and the US. Canopy Growth is known for its cannabis medicines and products such as CBG-10; Aurora Cannabis has a focus on medical cannabis treatments; and Organigram is involved in the development of cannabis-based therapies. Other players include Altria Group (parent company of Cronos Group), Zynerba Pharmaceuticals, MedReleaf, and Green Thumb Industries, which are involved in cannabis research and developing therapeutic products. Additionally, companies such as Aphria (now part of Tilray) and Hexo Corporation contribute to the market growth.

The competitive landscape of the cannabis pharmaceuticals market is shaped by the regulatory environment and the clinical efficacy of cannabis-based treatments. The majority of companies are focused on developing pharmaceutical-grade cannabis products with scientific validation and regulatory approvals. Companies that have achieved regulatory approval for their products, such as Epidiolex, have a competitive advantage in terms of market credibility and trust among healthcare professionals. On the other hand, smaller players are attempting to gain market share by focusing on innovative formulations and targeting specific medical conditions, such as chronic pain or neurological disorders, where cannabis-based products have shown promising results in clinical trials. The challenge remains for these companies to gain regulatory approval, as many markets still have strict cannabis regulations in place.

In terms of competitive strategies, companies are focusing on expanding their research and development capabilities to support the growth of cannabis pharmaceuticals use. This includes partnerships with academic institutions, collaborations with research organizations, and clinical trials to establish the safety and efficacy of their products. Many companies are also engaging in mergers and acquisitions to expand their product portfolios and improve their market positioning. The large players in the market, such as GW Pharmaceuticals (now under Jazz Pharmaceuticals) and Tilray, are leveraging their existing infrastructure, while newer players are focusing on regional market expansion and niche product development to establish a foothold. The evolving regulatory landscape will continue to shape the competition, as companies must navigate varying levels of acceptance and approval in different regions.

GW Pharmaceuticals, now a part of Jazz Pharmaceuticals, is known for its development of cannabis-based pharmaceutical products. Its most notable product is Epidiolex, a medication containing cannabidiol (CBD). It is approved by the US FDA for the epilepsy treatment. The company focuses on research and clinical trials to explore the medical uses of cannabis.

Tilray is a Canadian company that is actively involved in the cannabis pharmaceutical market, with a broad range of products across medical and recreational cannabis sectors. Tilray has focused on advancing cannabis-based treatments for conditions like chronic pain, epilepsy, and anxiety. The company has also expanded its product line to include non-psychoactive CBD products.

List of Key Companies in Cannabis Pharmaceuticals Market

- Altria Group (parent company of Cronos Group)

- Aphria (now part of Tilray)

- Aurora Cannabis

- Cannabis Science

- Canopy Growth

- Charlotte's Web

- Cresco Labs

- Green Thumb Industries

- GW Pharmaceuticals (now part of Jazz Pharmaceuticals)

- Hexo Corporation

- MedReleaf

- Organigram

- Tilray

- Tilray Health

- Zynerba Pharmaceuticals

Cannabis Pharmaceuticals Industry Developments

- In September 2023, Tilray announced the acquisition of an advanced manufacturing facility in Germany, aiming to increase its presence in the European cannabis pharmaceutical market and broaden its distribution channels across Europe.

- In March 2023, Jazz Pharmaceuticals, the parent company of GW Pharmaceuticals, announced that the FDA had granted fast track designation for its cannabinoid-based drug for the treatment of certain rare neurological conditions, signaling continued development and focus on expanding its therapeutic offerings.

Cannabis Pharmaceuticals Market Segmentation

By Brand Type Outlook

- Sativex

- Epidiolex

- Other Brands

By Distribution Channel Outlook

- Online Pharmacies

- Hospitals

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cannabis Pharmaceuticals Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.30 billion |

|

Market Size Value in 2025 |

USD 8.07 billion |

|

Revenue Forecast by 2034 |

USD 357.96 billion |

|

CAGR |

52.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The cannabis pharmaceuticals market has been broadly segmented on the basis of brand type and distribution channel. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The growth and marketing strategy in the cannabis pharmaceuticals market largely focuses on expanding product offerings through research and development, clinical trials, and regulatory approvals. Companies are prioritizing partnerships with healthcare institutions and researchers to validate the efficacy of cannabis-based treatments and gain trust in the medical community. Expansion into new markets, especially in regions with evolving cannabis regulations, is also a key strategy. Additionally, companies are investing in educating healthcare professionals and patients about the therapeutic benefits of cannabis. Strategic acquisitions and collaborations with other pharmaceutical companies help improve market access and accelerate product distribution.

FAQ's

The global cannabis pharmaceuticals market size was valued at USD 5.30 billion in 2024 and is projected to grow to USD 357.96 billion by 2034

The global market is projected to register a CAGR of 52.4% during 2025–2034

North America held the largest share of the global market in 2024

A few key players in the cannabis pharmaceuticals market are GW Pharmaceuticals (now part of Jazz Pharmaceuticals), Tilray, Canopy Growth, Aurora Cannabis, Organigram, Altria Group (parent company of Cronos Group), Zynerba Pharmaceuticals, MedReleaf, Green Thumb Industries, Aphria (now part of Tilray), Hexo Corporation, Cresco Labs, Charlotte's Web, Cannabis Science, and Tilray Health

The Epidiolex segment accounted for the largest share of the global market in 2024.

Cannabis pharmaceuticals refer to medical products derived from cannabis plants specifically designed for therapeutic use. These products contain active compounds such as cannabidiol (CBD) and tetrahydrocannabinol (THC), which have been researched for their potential to treat a variety of medical conditions, including chronic pain, epilepsy, anxiety, and multiple sclerosis. Cannabis pharmaceuticals are typically developed through scientific research and undergo rigorous clinical trials to ensure their safety and efficacy. These products are regulated by health authorities such as the US FDA. They are available in various forms, such as oils, capsules, sprays, and tinctures, for medical use under prescribed conditions.

A few key trends in the cannabis pharmaceuticals market are described below: Increasing Acceptance of Medical Cannabis: Growing recognition of cannabis as a legitimate treatment option for various medical conditions, supported by increasing clinical evidence. Rise of Non-Psychoactive Products: Increasing demand for CBD-based products due to their non-psychoactive nature and perceived safety for treating conditions such as epilepsy, anxiety, pain, and others. Expanding Research and Clinical Trials: Ongoing studies and clinical trials exploring cannabis' potential in treating additional medical conditions such as cancer, Parkinson's disease, and multiple sclerosis. Regulatory Changes and Legalization: Relaxation of cannabis laws in various regions, enabling greater access to cannabis-based therapies and fostering market growth

A new company entering the cannabis pharmaceuticals market must focus on areas such as developing non-psychoactive, evidence-backed products such as CBD-based therapies, which are in high demand for treating conditions, including chronic pain and anxiety. Investing in research and clinical trials to explore new medical applications of cannabis would differentiate the company by offering innovative solutions. Additionally, prioritizing regulatory compliance and building strong relationships with healthcare professionals for product credibility can provide a competitive edge. Focusing on personalized medicine, where treatments are tailored to individual needs, and expanding into emerging markets with evolving cannabis regulations could also offer significant growth opportunities.

Companies manufacturing, distributing, or purchasing cannabis pharmaceuticals and related products, and other consulting firms must buy the report.