Canine Orthopedics Market Size, Share, Trends, Industry Analysis Report: By Product, Application, End Use (Hospitals & Clinics and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 118

- Format: PDF

- Report ID: PM5351

- Base Year: 2024

- Historical Data: 2020-2023

Canine Orthopedics Market Overview

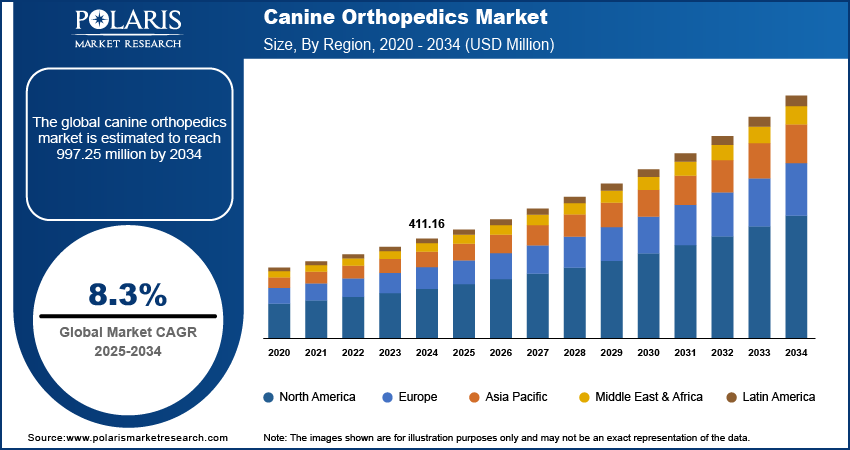

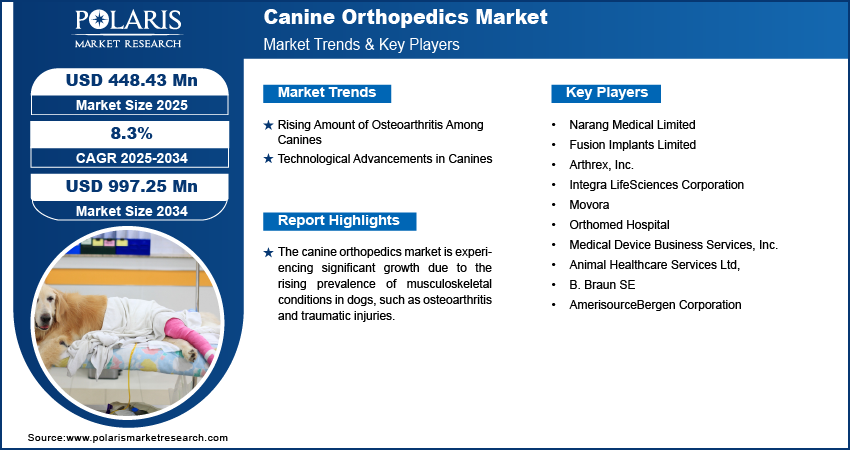

The canine orthopedics market size was valued at USD 411.16 million in 2024. The market is projected to grow from USD 448.43 million in 2025 to USD 997.25 million by 2034, exhibiting a CAGR of 8.3% during the forecast period.

The canine orthopedics market focuses on products and solutions for diagnosing, treating, and managing musculoskeletal conditions in dogs, such as fractures, ligament injuries, and arthritis.

The market is driven by growing pet ownership, increased awareness of advanced veterinary care, and rising demand for specialized treatments such as joint replacements and minimally invasive surgeries. For instance, in September 2024, PetVivo, a medical device and biomedical therapeutics company specializing in equines and companion animals, introduced Spryng with OsteoCushion Technology at PNWVC. The medical device is designed for treating osteoarthritis and other musculoskeletal conditions in equines and companion animals, offering an advanced solution for joint health management.

Technological advancements, such as 3D printing for custom implants and innovations in orthopedic implants, have further enhanced the quality of care. The trend toward personalized and precise treatments for pets continues to support market growth, making it a dynamic segment within the veterinary healthcare industry.

To Understand More About this Research: Request a Free Sample Report

Canine Orthopedics Market Dynamics

Rising Amount of Osteoarthritis Among Canines

The rising prevalence of osteoarthritis among canines is a key canine orthopedics market driver, as osteoarthritis is a common degenerative joint condition in dogs and is linked to aging, obesity, and genetic predisposition in certain breeds. This growing health issue has increased demand for advanced orthopedic treatments, including surgical interventions, medical devices, and rehabilitation solutions. For instance, in May 2023, Zoetis Animal Health company received approval from the US Food and Drug Administration (FDA) for Librela (bedinvetmab injection), a treatment designed to manage osteoarthritis (OA) pain in dogs. Owners seek effective options to improve mobility and improve the quality of life for affected pets, prompting innovations in veterinary orthopedic technology and products. The expanding awareness of pet health and the willingness to invest in veterinary care further propel market growth.

Technological Advancements in Canines

Technological advancements in veterinary medicine are driving the canine orthopedics market demand by introducing innovative solutions that improve diagnosis, treatment, and rehabilitation. Modern technologies, such as 3D printing, advanced imaging systems, and minimally invasive surgical tools, allow for precise customization of orthopedic implants and more effective surgical outcomes. These innovations improve the mobility and quality of life for dogs suffering from orthopedic conditions such as fractures and osteoarthritis.

Advancements in biomaterials and regenerative therapies, such as stem cell treatments, have opened new avenues for treating complex joint and bone issues. For instance, in June 2024, the FDA authorized clinical trials at Cornell University Hospital for Animals (CUHA) to consider stem cell treatments for musculoskeletal and neurological conditions in dogs and horses. This initiative highlights advancements in veterinary regenerative medicine aimed at addressing complex animal health issues. These developments meet the growing demand for sophisticated veterinary care from pet owners seeking the best outcomes for their companions.

Canine Orthopedics Market Segment Analysis

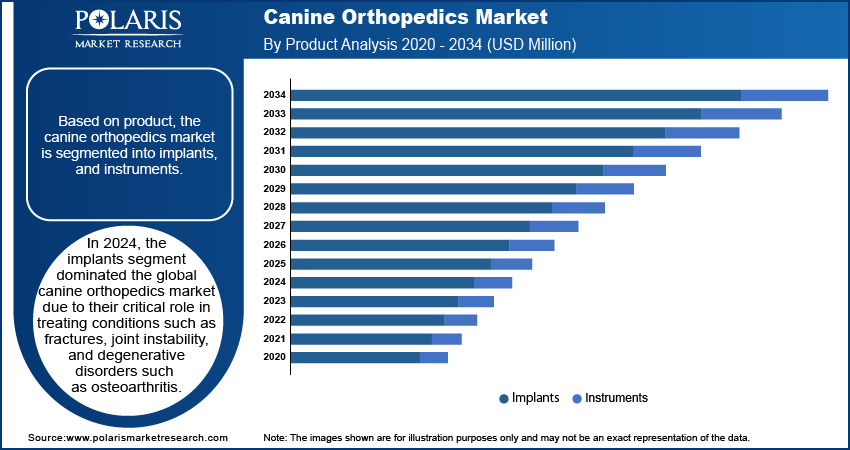

Canine Orthopedics Market Assessment by Product Outlook

The global canine orthopedics market segmentation, based on product, includes implants and instruments. In 2024, the implants segment dominated the global market due to their critical role in treating conditions such as fractures, joint instability, and degenerative disorders such as osteoarthritis. Implants, including plates, screws, and prosthetics, offer effective and durable solutions to restore mobility and improve quality of life in affected canines. The rising prevalence of orthopedic conditions among dogs, coupled with advancements in implant design and materials, has driven the adoption of these products. Additionally, the increasing willingness of pet owners to invest in advanced treatments and the growing availability of veterinary specialists contributed to the segment's leadership in the market.

Canine Orthopedics Market Evaluation by Application Outlook

The global canine orthopedics market segmentation, based on application, includes TPLO plates, TTA plates, specialty plates, trauma plates, and others. Trauma plates are expected to grow the fastest in the global market during the forecast period due to their critical role in treating complex fractures and bone injuries. The increasing incidence of trauma-related conditions in canines caused by accidents, falls, or high-impact injuries has increased the demand for effective surgical solutions. Trauma plates provide structural stability and facilitate proper bone healing, making them a preferred choice for veterinarians. Advances in plating systems, such as lightweight designs and biocompatible materials, further enrich their appeal. Additionally, the growing awareness among pet owners regarding advanced treatment options contributes to the rising adoption of trauma plates.

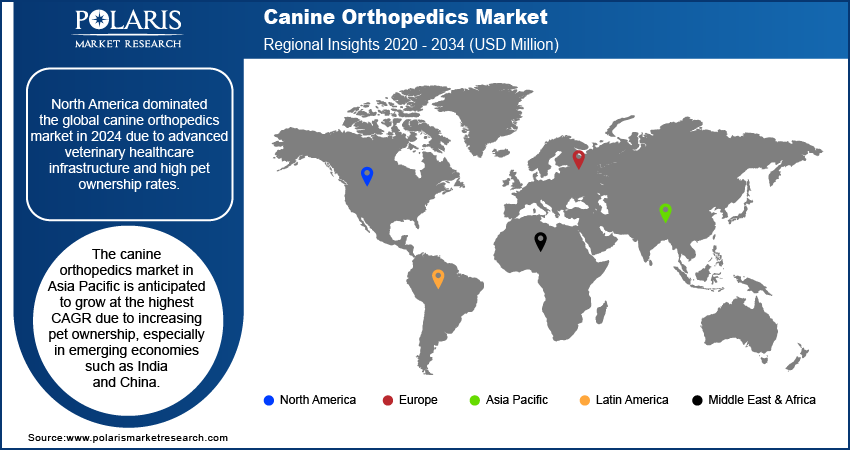

Canine Orthopedics Market Share Regional Insights

By region, the study provides canine orthopedics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market in 2024 due to advanced veterinary healthcare infrastructure and high pet ownership rates. The region has a well-established and technologically advanced veterinary care system, allowing for the adoption of advanced treatments and technologies. For instance, in January 2024, Laurent Guiot, DVM, DACVS, DECVS, developed a robotic device designed to aid in minimally invasive orthopedic surgeries for dogs and cats. This innovation aims to improve the surgical process by potentially reducing recovery time, minimizing infection risks, and providing a less invasive experience for pets undergoing treatment.

Increasing awareness about pet health and the growing willingness of pet owners to invest in advanced medical care contribute significantly to market growth. The presence of key market players and the region’s high per capita spending on pets further drive the demand for orthopedic products. There is a high demand for orthopedic solutions with an aging pet population and increasing cases of conditions such as osteoarthritis. North America's strong veterinary research and development sector also fosters innovation, leading to more effective treatment options for canine orthopedic issues.

The canine orthopedics market in Asia Pacific is anticipated to grow at the highest CAGR due to increasing pet ownership, especially in emerging economies such as India and China. The rising awareness of pet healthcare, coupled with improving veterinary infrastructure, drives demand for advanced orthopedic solutions. Additionally, the growing middle-class population and increasing disposable incomes enable pet owners to invest in specialized treatments for conditions such as osteoarthritis and traumatic injuries. Regional advancements in veterinary education and the adoption of innovative technologies further contribute to the market's rapid expansion.

Canine Orthopedics Market – Key Players and Competitive Analysis Report

The competitive landscape of the canine orthopedics industry combines global leaders and regional players competing to capture market share through innovation, strategic alliances, and regional expansion. Global players such as B. Braun SE, Movora, Integra LifeSciences Corporation, and others leverage robust R&D capabilities and extensive distribution networks to deliver advanced orthopedic implants, instruments, and minimally invasive surgical tools. Market trends indicate rising demand for solutions such as 3D-printed implants and regenerative technologies, including stem cell therapies, reflecting advancements in veterinary science and surgical techniques. According to market statistics, the canine orthopedics market is projected to grow significantly, driven by increasing cases of osteoarthritis, trauma, and other musculoskeletal conditions. Regional companies capitalize on localized needs by offering cost-effective and tailored products, especially in emerging markets such as Asia Pacific, which is anticipated to grow at the highest CAGR. Competitive strategies include mergers and acquisitions, partnerships with veterinary institutions, and the introduction of innovative orthopedic products to address the growing awareness and willingness of pet owners to invest in high-quality care. These developments underline the role of technological innovation, market adaptability, and regional investments in driving the canine orthopedics industry expansion. A few key major players are B. Braun SE; Movora; Integra LifeSciences Corporation; Medical Device Business Services, Inc.; AmerisourceBergen Corporation; Arthrex, Inc.; Orthomed Hospital; Veterinary Instrumentation; Fusion Implants Limited; and Narang Medical Limited.

B. Braun SE is a medical technology company that produces a wide range of medical devices and pharmaceutical products. These include surgical instruments, infusion pumps and systems, suture materials, dialysis equipment and accessories, hip and knee implants, and products for disinfection, ostomy, and wound care. The company operates through hospital care, avitum, and aesculap. The hospital care division specializes in providing nutrition, infusion, and pain therapy products. Its system solutions include single-use products, drugs, and smart medical device systems for infusion therapy. The division also offers parenteral and enteral nutrition products and drink solutions for nutritional therapy.

Integra LifeSciences Holdings Corporation, headquartered in Princeton, New Jersey, USA is a global medical technology company that develops and manufactures engineered collagen-based products. The company's portfolio includes surgical instruments, advanced wound care, orthopedic hardware, specialty metal implants, dermal regeneration products, orthobiologic products, tissue-engineered wound dressings, and nerve and tendon repair products. The company is committed to developing innovative medical solutions that improve patient outcomes and enhance the quality of life for those suffering from various medical conditions.

Key Companies in Canine Orthopedics Market

- Narang Medical Limited

- Fusion Implants Limited

- Arthrex, Inc.

- Integra LifeSciences Corporation

- Movora

- Orthomed Hospital

- Medical Device Business Services, Inc.

- Animal Healthcare Services Ltd,

- B. Braun SE

- AmerisourceBergen Corporation

Canine Orthopedics Market Developments

April 2024: UC Davis inaugurated the Advanced Veterinary Surgery Center, designed to meet the increasing demand for orthopedic procedures. The facility features 25 rooms, including three advanced operating rooms, aimed at enhancing the quality and efficiency of veterinary surgical services.

October 2024: VCA Animal Hospitals launched a 3D printing lab designed for pet orthopedic surgeries. This technology will allow surgeons to create personalized care plans tailored to each pet, leveraging precise data and scientific modeling to improve surgical outcomes.

Canine Orthopedics Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Implants

- Plates

- Instruments

By Application Outlook (Revenue, USD Million, 2020–2034)

- TPLO Plates

- TTA Plates

- Specialty Plates

- Trauma Plates

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals & Clinics

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Canine Orthopedics Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 411.16 million |

|

Market Size Value in 2025 |

USD 448.43 million |

|

Revenue Forecast by 2034 |

USD 997.25 million |

|

CAGR |

8.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global canine orthopedics market size was valued at USD 411.16 million in 2024 and is projected to grow to USD 997.25 million by 2034.

The global market is projected to register a CAGR of 8.3% during the forecast period.

North America dominated the global canine orthopedics market in 2024.

A few key players in the market are B. Braun SE; Movora; Integra LifeSciences Corporation; Medical Device Business Services, Inc.; AmerisourceBergen Corporation; Arthrex, Inc.; Orthomed Hospital; Veterinary Instrumentation; Fusion Implants Limited; and Narang Medical Limited.

In 2024, the implants segment dominated the global canine orthopedics market.

Trauma plates are expected to grow the fastest in the global canine orthopedics market during the forecast period.