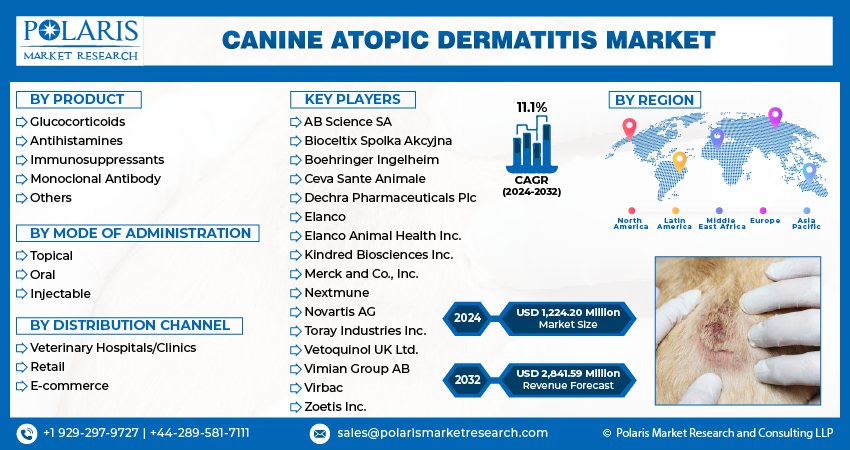

Canine Atopic Dermatitis Market Share, Size, Trends, Industry Analysis Report, By Product (Glucocorticoids, Antihistamines, Immunosuppressants, Monoclonal Antibody, Others); By Mode of Administration; By Distribution Channel; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4317

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

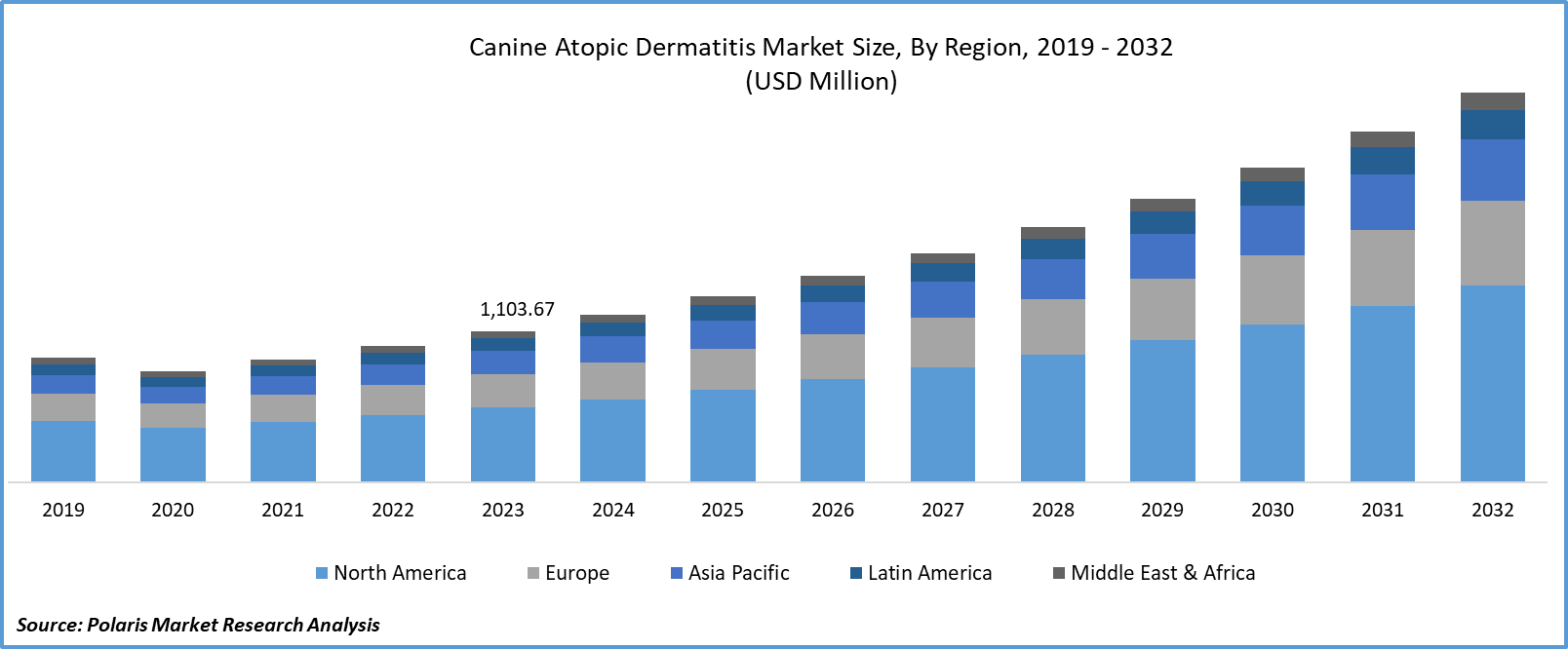

The global canine atopic dermatitis market size and share was valued at USD 1,103.67 million in 2023 and is expected to grow at a CAGR of 11.1% during the forecast period.

Canine atopic dermatitis (CAD) is a hereditary predisposition towards developing a pruritic inflammatory skin condition triggered by immune globulin antibodies targeting environmental allergens. This ailment primarily affects dogs aged six months to a few years. It is characterized by itching and distinctive secondary skin lesions that appear around the face (mouth, eyes), the saclike sides of the ear pinnae, the ventral abdomen, the flexor muscle areas of the carpal, elbow, interdigital skin, tarsal joints, and other regions.

The increasing prevalence of canine atopic dermatitis is the primary driving factor behind expanding the market for this condition. Additionally, the growing awareness of early signs and symptoms of allergic reactions in animals, the development of advanced therapeutic methods to manage symptoms, and the rise in pollution levels associated with allergens are all expected to contribute to market growth. However, challenges persist regarding inadequate management practices, such as improper dosages, drug administration, and combinations, as well as serious adverse reactions caused by certain medications that can exacerbate allergic reactions, hampering market growth. On the other hand, opportunities are presented by gold-standard allergy therapies and injectable treatments, which are poised to create significant avenues for growth in the market. The market is also anticipated to benefit from increased company research and development partnerships.

To Understand More About this Research: Request a Free Sample Report

- For instance, in January 2020 Boragen entered into a partnership with a major global animal health company, with the shared goal of collaboratively researching and developing an innovative medication to address canine atopic dermatitis. As a result, the canine atopic dermatitis market is projected to experience revenue growth due to escalating allergen-related pollution and the rising ownership of dogs.

Over recent decades, the veterinary healthcare sector has witnessed remarkable transformations, with global advancements in new drugs, treatments, and administration methods for approved medications. Companies are continually engaged in research and development efforts to bolster this field. A case in point is the partnership between Bioiberica Companion Animal Health and the University of Florida, which, in April 2020, revealed the successful results of a clinical study involving Atopivet Spot-On topical preparation. This formulation was proven to restore and moisturize the skin, improve skin barrier function, and alleviate itching in dogs with atopic dermatitis, either as a standalone treatment or as part of a comprehensive approach.

An article published in Wiley Online Library in November 2020 delved into the clinical significance of the spray performance of a veterinary product, including heat-killed lactobacilli as an adjuvant therapy for allergic dogs suffering from canine atopic dermatitis. These studies highlight the growing emphasis on research and development and the adoption of new technologies in veterinary healthcare and medicines worldwide. The collaborations among companies underscore their commitment to innovation in this market, presenting considerable opportunities for future growth.

Industry Dynamics

Growth Drivers

Rising Dog Ownership

The adoption of pet animals, particularly dogs, has increased. This trend can be attributed to the fact that animals offer humans unwavering love and have been scientifically proven to bring emotional, psychological, and physical benefits to their companions. Nurturing a pet animal imparts a sense of purpose and satisfaction to daily life, countering feelings of solitude in an era characterized by busy schedules and nuclear families. For example, as revealed by the American Pet Products Association's National Pet Owners Survey for 2019-2020, approximately 63.4 million households in the United States are proud dog owners.

Furthermore, as dog ownership increases, so does the expenditure on their health and visits to veterinary professionals. Taking on the responsibility of a dog includes the commitment to its well-being, as dogs are susceptible to various allergies. As a result, the demand for treatments addressing atopic dermatitis in pets has experienced a substantial surge. Atopic dermatitis, a prevalent allergy, can be triggered by environmental allergens. This surge in dog adoption and the simultaneous rise in investment in pet healthcare are projected to be significant drivers of market expansion.

Report Segmentation

The market is primarily segmented based on product, mode of administration, distribution channel, and region.

|

By Product |

By Mode of Administration |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

The monoclonal antibodies segment accounted for the largest market share in 2023

Monoclonal Antibodies accounted for the largest market share in 2023. These antibodies are characterized by being monospecific and produced by identical immune cells with monovalent affinity. Ongoing research in this realm is further fueling its growth. For example, Regeneron Pharmaceuticals, Inc. and Zoetis Inc. have entered a five-year collaboration to investigate the application of Regeneron's monoclonal antibody therapeutics in animals and explore novel veterinary treatments, thereby substantially boosting this segment's expansion. These factors collectively contribute to the anticipated growth of this segment within the forecast period.

Another important aspect is the utilization of Glucocorticoids. These rapid-acting compounds deactivate a range of inflammatory cells and mitigate the presence of inflammatory and itch mediators. In treating canine atopic dermatitis (CAD), they play a pivotal role in inducing remission and sustaining long-term control. Glucocorticoids are extensively employed in managing atopic dermatitis in dogs, often recommended as the primary therapeutic approach according to updated guidelines for addressing this condition.

By Distribution Channel Analysis

The retail segment held the highest market share in 2023

In 2023, the retail segment held the highest market share, primarily due to a surge in product availability. The emergence of retail pharmacy chains plays a pivotal role in bolstering the distribution channel's market share. The adoption of digitalized systems within retail pharmacies, aimed at minimizing the risk of prescription errors, is foreseen to be a driving force behind revenue growth in the forthcoming years. Additionally, a trend has emerged where veterinarians increasingly rely on general pharmacies to fulfill prescriptions for medications not readily accessible in veterinary pharmacies. This trend acts as an additional catalyst for market expansion.

The escalating popularity of e-commerce platforms stands out as a key determinant in driving the appeal of the e-commerce segment throughout the projected period. The convenience of perusing websites offering an extensive array of products and comprehensive product descriptions contributes to the segment's growth. Furthermore, the availability of discounts across various online platforms and the growing consumer inclination toward online purchases are both factors expected to boost this segment's revenue growth significantly.

Regional Insights

North America accounted for the largest market share in 2023

In 2023, North America accounted for the largest market share, driven by escalated investment in R&D, a concentrated presence of key industry players, and a notable rate of dog ownership within households across the region. For instance, data from the Canadian Animal Health Institute (CAHI) in September 2022 indicated that 60% of Canadian households owned at least one dog or cat, with the dog population reaching 7.9 million in the same year. This substantial dog population signifies a higher incidence of atopic dermatitis among canines, expected to drive market growth.

The United States is anticipated to hold a significant market share in North America due to its substantial dog population, high animal health expenditure, and a noteworthy prevalence of canine atopic dermatitis cases. The 2021-2022 American Pet Product Association (APPA) National Pet Owners Survey revealed that approximately 70% of U.S. households owned pets, including a dog population of 69 million. Pet owners in the U.S. also allocated substantial resources for veterinary care, spending around USD 458 for surgical vet visits and USD 242 for routine dog visits, as per the same source. Furthermore, the contributions of key market players' advancements are expected to stimulate market growth further.

The European market is expected to witness the fastest growth as Germany emerged as the primary driving force. The expansion in Germany can be ascribed to the increasing adoption of pets in the region and major enterprises introducing novel products. Numerous German companies provide solutions for addressing canine atopic dermatitis. Boehringer Ingelheim, for instance, stands out as a prominent German-based manufacturer specializing in veterinary drugs for dogs. These combined factors are anticipated to play a substantial role in fostering market growth throughout the forecast period.

Key Market Players & Competitive Insights

In the dynamic landscape of the Canine Atopic Dermatitis market, several key market players are actively shaping the competitive landscape. These industry leaders are pivotal in driving advancements, introducing innovative solutions, and contributing to the overall growth and development of the market. Their strategic initiatives, research endeavors, and product offerings are essential factors that influence the competitive dynamics within this specialized sector.

Some of the major players operating in the global market include:

- AB Science SA

- Bioceltix Spolka Akcyjna

- Boehringer Ingelheim

- Ceva Sante Animale

- Dechra Pharmaceuticals Plc

- Elanco

- Elanco Animal Health Inc.

- Kindred Biosciences Inc.

- Merck and Co., Inc.

- Nextmune

- Novartis AG

- Toray Industries Inc.

- Vetoquinol UK Ltd.

- Vimian Group AB

- Virbac

- Zoetis Inc.

Recent Developments

- In October 2020, Virbac obtained approval from the US FDA for its modified CYCLAVANCE (cyclosporine oral solution) USP, designed to manage atopic dermatitis in dogs with a minimum weight of 4 lbs (1.8 kg).

- In January 2023, Royal Canin North America introduced SKINTOPIC, a dietary solution tailored for the control of canine atopic dermatitis.

- In January 2022, Zoetis declared that the European Commission (EC) had provided marketing approval for Apoquel chewable tablets (oclacitinib). These tablets were approved for addressing clinical manifestations of atopic dermatitis in dogs aged 12 months and above.

Canine Atopic Dermatitis Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,224.20 million |

|

Revenue Forecast in 2032 |

USD 2,841.59 million |

|

CAGR |

11.1% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Mode of Administration, By Distribution Channel, By Region |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Navigate through the intricacies of the 2024 canine atopic dermatitis market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2032. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.

FAQ's

The global canine atopic dermatitis market size is expected to reach USD 2,841.59 million by 2032

Key players in the market are AB Science SA, Bioceltix Spolka Akcyjna, Boehringer Ingelheim, Ceva Sante Animale

North America contribute notably towards the global Canine Atopic Dermatitis Market

The global canine atopic dermatitis market is expected to grow at a CAGR of 11.1% during the forecast period.

The Canine Atopic Dermatitis Market report covering key segments are product, mode of administration, distribution channel, and region.