Cancer or Tumor Profiling Market Size, Share, Trends, Industry Analysis Report: By Cancer Type (Breast Cancer, Lung Cancer, Colorectal Cancer, Prostate Cancer, Melanoma Cancer, and Others), Technology, Technique, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 116

- Format: PDF

- Report ID: PM1713

- Base Year: 2024

- Historical Data: 2020-2023

Cancer or Tumor Profiling Market Overview

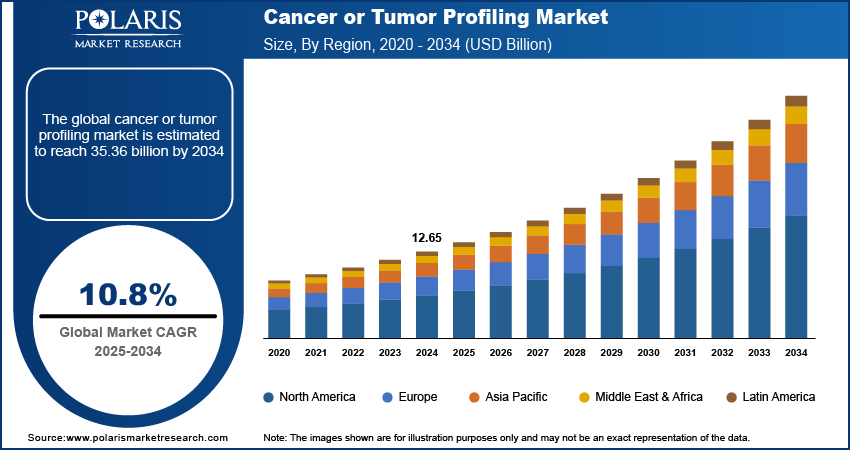

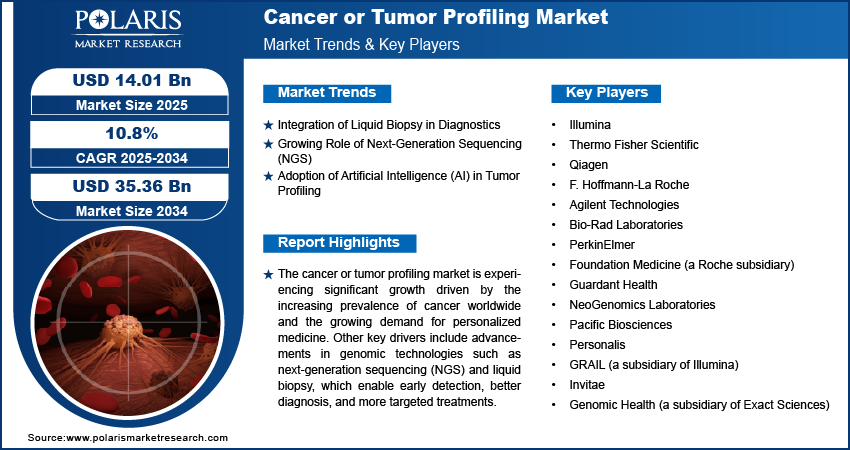

The cancer or tumor profiling market size was valued at USD 12.65 billion in 2024. The market is projected to grow from USD 14.01 billion in 2025 to USD 35.36 billion by 2034, exhibiting a CAGR of 10.8% during 2025–2034.

The global cancer or tumor profiling market involves the analysis of tumor-specific biomarkers to assist in cancer diagnosis, prognosis, and personalized treatment. It includes technologies such as next-generation sequencing (NGS), polymerase chain reaction (PCR), immunohistochemistry (IHC), and mass spectrometry. Key drivers for market growth include the increasing prevalence of cancer worldwide, advancements in precision medicine, and growing investments in oncology research. Trends such as the adoption of liquid biopsy techniques and the integration of artificial intelligence (AI) in cancer diagnostics are further propelling market expansion. Additionally, regulatory approvals for novel diagnostics and rising demand for biomarker discovery support the cancer or tumor profiling market development.

To Understand More About this Research: Request a Free Sample Report

Cancer or Tumor Profiling Market Dynamics

Integration of Liquid Biopsy in Diagnostics

The adoption of liquid biopsy is transforming cancer profiling by enabling minimally invasive diagnostics and monitoring. Liquid biopsies analyze circulating tumor DNA (ctDNA), RNA, and exosomes in blood samples, providing insights into tumor heterogeneity and genetic mutations without the need for tissue samples. According to a study published in Nature Reviews Clinical Oncology, liquid biopsy techniques can detect actionable mutations in up to 70% of advanced cancer cases. Integration of liquid biopsy is gaining traction due to its ability to improve early detection, track treatment responses, and identify resistance mechanisms, thereby facilitating personalized therapy strategies.

Growing Role of Next-Generation Sequencing (NGS)

Next-generation sequencing (NGS) is emerging as a cornerstone technology in cancer profiling due to its capacity to provide comprehensive genomic information. NGS enables the simultaneous analysis of multiple genes, identifying mutations, gene fusions, and other alterations that drive tumor progression. Reports from the American Cancer Society indicate that NGS-based tests are increasingly used for actionable mutation detection, with over 55% of oncologists in the US utilizing these tests to guide targeted therapies. This trend is supported by decreasing costs of sequencing technologies and increasing regulatory approvals for NGS-based diagnostic assays.

Adoption of Artificial Intelligence (AI) in Tumor Profiling

Artificial intelligence (AI) is being extensively integrated into cancer profiling to enhance diagnostic accuracy and data analysis. AI algorithms can analyze large datasets, including genomic, transcriptomic, and proteomic profiles, to identify patterns and biomarkers with high precision. A report from the Journal of the American Medical Association (JAMA) highlights that AI-powered tools can reduce diagnostic errors by up to 30% in cancer profiling. Furthermore, AI applications are improving the efficiency of drug discovery processes by identifying potential therapeutic targets, a development expected to drive further adoption of AI in this domain.

Cancer or Tumor Profiling Market Segment Insights

Cancer or Tumor Profiling Market Outlook – Cancer Type-Based Insights

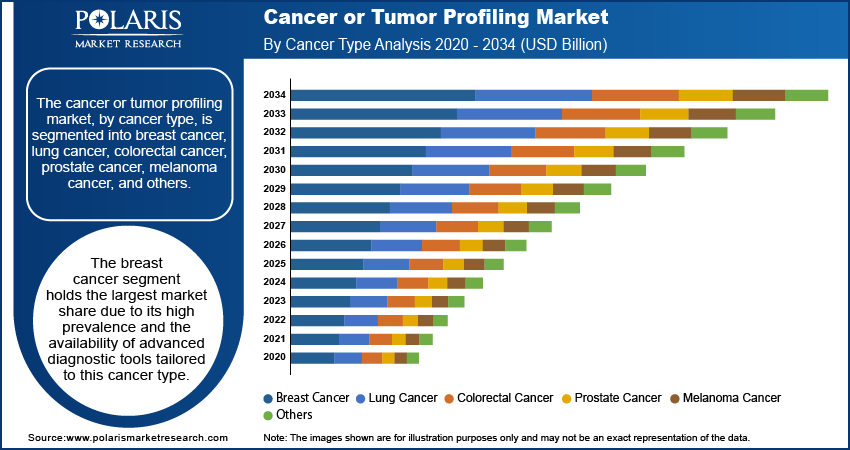

The cancer or tumor profiling market, by cancer type, is segmented into breast cancer, lung cancer, colorectal cancer, prostate cancer, melanoma cancer, and others. The breast cancer segment holds the largest market share due to its high prevalence and the availability of advanced diagnostic tools tailored to this cancer type. According to data from the World Health Organization (WHO), breast cancer is the most commonly diagnosed cancer worldwide, with over 2.3 million new cases annually. Profiling techniques such as immunohistochemistry (IHC) and next-generation sequencing (NGS) are widely adopted for identifying hormone receptor status and genetic mutations, which are critical for guiding personalized treatment plans. Continuous advancements in biomarker discovery, such as HER2 and BRCA mutation testing, further drive the demand for breast cancer profiling.

The lung cancer segment is registering the highest growth rate in the market, driven by the increasing focus on precision oncology and the adoption of advanced profiling technologies. The American Cancer Society highlights that lung cancer accounts for nearly 25% of cancer-related deaths globally, underscoring the urgent need for accurate diagnostic and prognostic tools. Tumor profiling in lung cancer frequently involves liquid biopsies and NGS to detect actionable mutations such as EGFR, ALK, and KRAS, which are pivotal for targeted therapies. The rising implementation of molecular profiling programs and growing awareness of personalized treatment options contribute significantly to the growth of this segment.

Cancer or Tumor Profiling Market Assessment – Technology-Based Insights

The cancer or tumor profiling market, by technology, is segmented into next-generation sequencing (NGS), polymerase chain reaction (PCR), immunohistochemistry (IHC), in-situ hybridization (ISH), microarray, and others. The next-generation sequencing (NGS) segment holds the largest share of the market due to its ability to provide comprehensive genomic insights, enabling precision medicine in oncology. NGS technology is widely adopted for detecting mutations, gene fusions, and other genetic alterations across various cancer types. It supports the development of targeted therapies by offering a high-throughput platform for analyzing tumor heterogeneity and actionable biomarkers. As per industry estimates, the widespread application of NGS in clinical and research settings is fueled by declining sequencing costs and regulatory approvals for NGS-based diagnostic assays, driving its dominance in the market.

The polymerase chain reaction (PCR) segment is registering the highest growth rate in the cancer or tumor profiling market, supported by its versatility, speed, and cost-effectiveness. PCR is frequently used for detecting specific genetic mutations, amplifying DNA samples, and monitoring treatment responses in cancer patients. Technological advancements, such as real-time PCR and digital PCR, have enhanced the precision and sensitivity of tumor profiling applications. Additionally, its compatibility with liquid biopsy samples has expanded its adoption, particularly in detecting circulating tumor DNA (ctDNA) for noninvasive cancer diagnostics. These attributes, combined with increasing research initiatives and clinical applications, contribute to the rapid growth of the PCR segment in the cancer profiling market.

Cancer or Tumor Profiling Market Evaluation – Technique-Based Insights

The cancer or tumor profiling market, by technique, is segmented into genomics, proteomics, epigenetics, and metabolomics. The genomics segment dominates the market, holding the largest market share due to its pivotal role in identifying genetic mutations, structural variations, and gene expression patterns associated with cancer. Genomic profiling enables the identification of actionable mutations that guide targeted therapies and immunotherapies, making it integral to precision oncology. The increasing adoption of technologies such as next-generation sequencing (NGS) and advancements in bioinformatics tools further drive its demand. According to the National Cancer Institute, genomic techniques are widely utilized in both research and clinical settings to improve diagnostic accuracy and treatment outcomes, solidifying its position as the leading segment.

The epigenetics segment is experiencing the highest growth rate in the cancer or tumor profiling market, fueled by its emerging significance in understanding cancer development and progression. Epigenetic profiling focuses on modifications such as DNA methylation, histone acetylation, and chromatin remodeling, which are key regulators of gene expression in cancer. The growing availability of advanced tools, such as methylation arrays and CRISPR-based editing, enhances the precision of epigenetic studies. Additionally, epigenetic biomarkers are increasingly being incorporated into diagnostic assays and therapeutic strategies, particularly in cancers with limited genomic mutations. This expanding scope of application is driving the rapid growth of the epigenetics segment.

Cancer or Tumor Profiling Market Assessment – Application-Based Insights

The cancer or tumor profiling market, by application, is segmented into personalized medicine, diagnostics, biomarker discovery, prognostics, and others. The personalized medicine segment holds the largest share of the market, as it plays a critical role in tailoring treatments based on an individual’s genetic and molecular profile. Advances in profiling technologies, such as next-generation sequencing (NGS) and liquid biopsy, have enhanced the precision of personalized treatment strategies. Personalized medicine enables the identification of actionable biomarkers and drug targets, facilitating the selection of therapies with optimal efficacy and minimal side effects. Studies from the National Institutes of Health (NIH) indicate that over 70% of oncology drugs approved in recent years are aligned with personalized approaches, underscoring its widespread adoption and significance in cancer management.

The biomarker discovery segment is registering the highest growth in the cancer or tumor profiling market, driven by the increasing focus on identifying novel biomarkers for early cancer detection, prognosis, and therapy selection. The integration of multi-omics approaches, including genomics, proteomics, and epigenetics, is accelerating the identification of potential biomarkers across diverse cancer types. Furthermore, advancements in data analytics and artificial intelligence (AI) tools have improved the ability to analyze complex datasets, expediting the biomarker discovery process. This growth is supported by rising investments in oncology research and the growing emphasis on developing noninvasive diagnostic assays based on biomarkers, boosting the prominence of this segment.

Cancer or Tumor Profiling Market Regional Insights

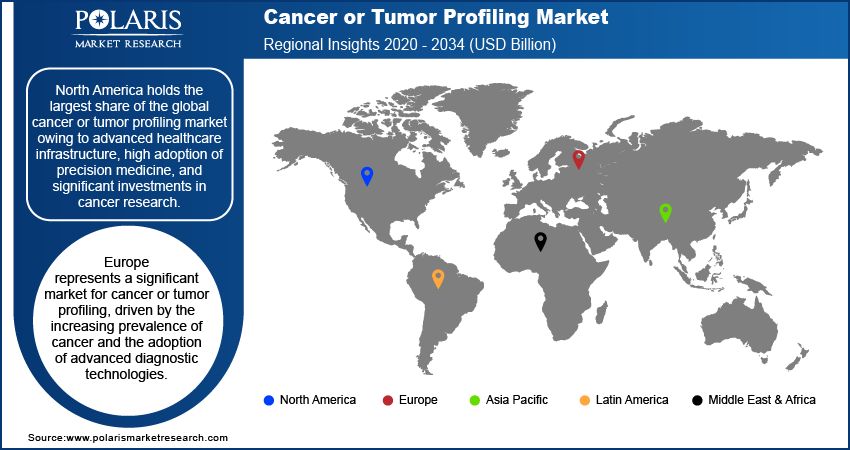

By region, the study provides cancer or tumor profiling market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share owing to advanced healthcare infrastructure, high adoption of precision medicine, and significant investments in cancer research. The region benefits from the presence of leading biotechnology and pharmaceutical companies, coupled with extensive clinical trial activities and regulatory support for innovative diagnostic technologies. The increasing prevalence of cancer, with the American Cancer Society estimating over 1.9 million new cases in the US annually, further drives the demand for profiling technologies. Additionally, robust government initiatives and reimbursement policies for genomic and biomarker-based diagnostics contribute to the dominance of North America in the market.

Europe represents a significant market for cancer or tumor profiling, driven by the increasing prevalence of cancer and the adoption of advanced diagnostic technologies. Countries such as Germany, the UK, and France are leading in this region due to strong investments in biotechnology research and the presence of key market players. The European Union’s emphasis on precision medicine initiatives and regulatory frameworks supporting biomarker-based diagnostics further enhance market growth. Additionally, collaborative efforts such as Horizon Europe are propelling advancements in cancer profiling through cross-border research and innovation.

The Asia Pacific cancer or tumor profiling market is experiencing rapid growth, fueled by the rising cancer burden and increasing awareness of personalized medicine. Countries such as China, Japan, and India are at the forefront, with expanding healthcare infrastructure and growing investments in genomic research. Government initiatives such as China’s Precision Medicine Initiative and Japan’s focus on genomic medicine are driving the adoption of tumor profiling technologies. Moreover, the region's large population and improving access to advanced diagnostics are contributing to the growing demand for cancer profiling solutions.

Cancer or Tumor Profiling Market – Key Players and Competitive Insights

Illumina, Thermo Fisher Scientific, Qiagen, F. Hoffmann-La Roche, Agilent Technologies, Bio-Rad Laboratories, PerkinElmer, Foundation Medicine (a Roche subsidiary), Guardant Health, NeoGenomics Laboratories, Pacific Biosciences, Personalis, GRAIL (a subsidiary of Illumina), Invitae, and Genomic Health (a subsidiary of Exact Sciences) are a few key players active in the cancer or tumor profiling market. These companies are at the forefront of developing technologies and platforms such as next-generation sequencing, polymerase chain reaction, and liquid biopsy solutions to address the growing demand for precision oncology tools.

The competitive landscape is marked by significant investments in R&D, with players focusing on technological innovation and the development of robust diagnostic and therapeutic solutions. Companies such as Illumina and Thermo Fisher Scientific maintain strong market positions due to their extensive portfolios of sequencing platforms and bioinformatics tools. Roche, through Foundation Medicine, and Guardant Health are expanding their offerings in liquid biopsy and comprehensive genomic profiling, addressing the need for minimally invasive diagnostics. Emerging companies such as NeoGenomics and Personalis are enhancing their capabilities in biomarker discovery and oncology-specific services, broadening the market's competitive dynamics.

Insights reveal a growing trend toward strategic collaborations and acquisitions to expand product portfolios and market reach. For example, Illumina’s acquisition of GRAIL emphasizes a focus on early cancer detection using liquid biopsy technologies. Similarly, partnerships between pharmaceutical companies and diagnostic firms are advancing biomarker-based clinical trials and drug development. This competitive environment underscores a shift toward integrated approaches combining genomics, proteomics, and data analytics, aimed at improving patient outcomes through precision medicine.

Illumina is a prominent player in the cancer or tumor profiling market, specializing in next-generation sequencing (NGS) technologies. The company offers a range of sequencing platforms and associated software that enable comprehensive genomic analysis for cancer diagnostics and research. Illumina focuses on advancing precision medicine by providing tools for biomarker discovery and molecular diagnostics.

Thermo Fisher Scientific is a key company in the market, offering a diverse portfolio of technologies, including polymerase chain reaction (PCR), NGS, and mass spectrometry, for cancer profiling. The company is actively involved in enhancing its oncology diagnostics and research capabilities.

List of Key Companies in Cancer or Tumor Profiling Market

- Illumina

- Thermo Fisher Scientific

- Qiagen

- F. Hoffmann-La Roche

- Agilent Technologies

- Bio-Rad Laboratories

- PerkinElmer

- Foundation Medicine (a Roche subsidiary)

- Guardant Health

- NeoGenomics Laboratories

- Pacific Biosciences

- Personalis

- GRAIL (a subsidiary of Illumina)

- Invitae

- Genomic Health (a subsidiary of Exact Sciences)

Cancer or Tumor Profiling Industry Developments

- In October 2024, Illumina announced a collaboration with AstraZeneca to develop advanced NGS-based companion diagnostics, strengthening its position in oncology solutions.

- In September 2024, Thermo Fisher launched its Oncomine Comprehensive Assay Plus, a targeted NGS solution designed to detect key mutations in solid tumors, demonstrating its commitment to expanding diagnostic options in the field of cancer genomics.

Cancer or Tumor Profiling Market Segmentation

By Cancer Type Outlook

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate Cancer

- Melanoma Cancer

- Others

By Technology Outlook

- Next-Generation Sequencing (NGS)

- Polymerase Chain Reaction (PCR)

- Immunohistochemistry (IHC)

- In-Situ Hybridization (ISH)

- Microarray

- Others

By Technique Outlook

- Genomics

- Proteomics

- Epigenetics

- Metabolomics

By Application Outlook

- Personalized Medicine

- Diagnostics

- Biomarker Discovery

- Prognostics

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cancer or Tumor Profiling Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.65 billion |

|

Market Size Value in 2025 |

USD 14.01 billion |

|

Revenue Forecast by 2034 |

USD 35.36 billion |

|

CAGR |

10.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The cancer or tumor profiling market has been broadly segmented on the basis of cancer type, technology, technique, and application. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The cancer or tumor profiling market growth and marketing strategies focus on expanding product offerings, strategic partnerships, and technological advancements. Companies are investing heavily in research and development to introduce innovative diagnostic solutions, particularly in next-generation sequencing and liquid biopsy technologies. Collaborations with pharmaceutical firms for companion diagnostics and precision medicine are enhancing market penetration. Additionally, players are increasing their focus on emerging markets in Asia Pacific and Latin America, where rising healthcare access and cancer awareness are fueling demand. Targeted marketing campaigns aimed at educating healthcare professionals and patients about the benefits of personalized cancer treatments are also driving market growth.

FAQ's

The global cancer or tumor profiling market size was valued at USD 12.65 billion in 2024 and is projected to grow to USD 35.36 billion by 2034.

The global market is projected to register a CAGR of 10.8% during the forecast period.

North America had the largest share of the global market in 2024.

A few key players active in the cancer or tumor profiling market are Illumina, Thermo Fisher Scientific, Qiagen, F. Hoffmann-La Roche, Agilent Technologies, Bio-Rad Laboratories, PerkinElmer, Foundation Medicine (a Roche subsidiary), Guardant Health, NeoGenomics Laboratories, Pacific Biosciences, Personalis, GRAIL (a subsidiary of Illumina), Invitae, and Genomic Health (a subsidiary of Exact Sciences).

The breast cancer segment accounted for the largest share of the global market in 2024.

The NGS segment accounted for the largest share of the global market in 2024.

Cancer or tumor profiling is a diagnostic process that involves analyzing the genetic, molecular, and biochemical characteristics of cancer cells to better understand their behavior and guide treatment decisions. This profiling typically includes techniques such as next-generation sequencing (NGS), polymerase chain reaction (PCR), and immunohistochemistry (IHC) to identify mutations, gene expressions, and other molecular alterations in the tumor. The goal of cancer profiling is to provide personalized treatment plans based on the specific genetic makeup of the tumor, enabling more effective and targeted therapies, as well as predicting the likely course of the disease.

A few key cancer or tumor profiling market trends are described below: Adoption of Liquid Biopsy: Noninvasive testing through liquid biopsy is gaining traction, allowing for early detection and monitoring of cancer with blood samples. Integration of Artificial Intelligence (AI): AI is being used to enhance data analysis, improve diagnostic accuracy, and predict treatment outcomes by processing complex molecular data. Growth of Next-Generation Sequencing (NGS): NGS technologies continue to advance, enabling more comprehensive and cost-effective genomic profiling for personalized cancer treatment. Focus on Personalized Medicine: There is an increasing emphasis on tailoring cancer treatments based on individual genetic profiles, improving the efficacy of therapies.

A new company entering the cancer or tumor profiling market must focus on developing innovative, cost-effective solutions in liquid biopsy and next-generation sequencing (NGS), as these are key growth areas with strong demand for noninvasive diagnostics and comprehensive genetic analysis. Incorporating artificial intelligence (AI) into data analysis for faster and more accurate decision-making could also provide a competitive edge. Additionally, the company could prioritize personalized medicine by offering targeted diagnostic tools that align with evolving cancer treatments. Expanding into emerging markets with growing healthcare access and forming strategic partnerships with pharmaceutical companies for companion diagnostics could further differentiate the company from competitors.

Companies manufacturing, distributing, or purchasing cancer or tumor profiling and related products, and other consulting firms must buy the report.