Calcium Formate Market Share, Size, Trends, Industry Analysis Report, By Grade (Industrial Grade, Feed Grade), By Application (Feed Additive, Concrete Additive), By End-use (Construction, Leather & Textile), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM4235

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

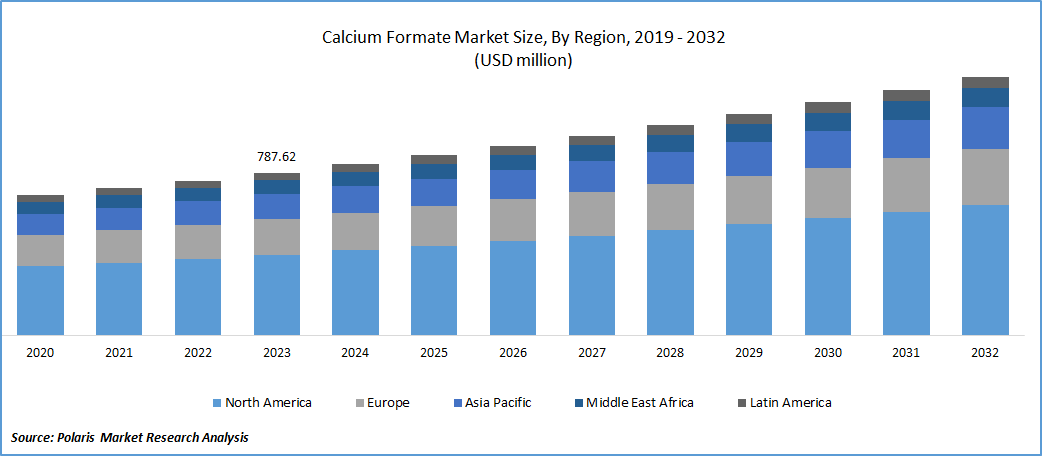

The global calcium formate market was valued at USD 787.62 million in 2023 and is expected to grow at a CAGR of 5.3% during the forecast period.

The demand for the calcium formate is strongly influenced by the construction industry, where it serves as a cement additive. Its use enhances properties like faster setting time, greater strength, and reduced shrinkage in concrete. Ongoing infrastructure development initiatives including roads, bridges, airports, and railways necessitate this product to improve concrete performance. As these global infrastructure projects continue to expand, the market demand for this product is expected to rise.

To Understand More About this Research: Request a Free Sample Report

Calcium formate market finds application in both residential and commercial construction projects, contributing to the enhancement of concrete quality and durability in various structural elements like foundations, floors, and walls. The rising demand for this product in these sectors is a result of the growing need for construction materials that offer superior strength and reliability.

The growing market demand in the U.S. is mainly propelled by the construction sector. This product serves as a crucial accelerator in concrete setting applications, particularly vital in construction. The rising construction projects and infrastructure development across the U.S. significantly drive the product's demand in the construction industry. Moreover, it is utilized as a feed additive in animal husbandry to boost animal growth and enhance feed quality. Additionally, it is applied in the leather industry during tanning processes.

Growth Drivers

Rising construction activity across the globe

In residential construction, homeowners and builders seek durable materials to ensure the longevity and stability of their homes. The product strengthens the concrete used in foundations, making them more resistant to wear and environmental factors. Similarly, in commercial construction, businesses and developers prioritize robust structural elements to ensure the safety and longevity of their buildings. By incorporating this product into concrete, the construction industry can create structures that withstand the test of time and environmental stressors.

Furthermore, the emphasis on sustainable and eco-friendly construction practices has also led to the increased adoption of this product. By enhancing the durability of concrete, it contributes to the longevity of buildings, reducing the need for frequent repairs or replacements. This, in turn, aligns with the sustainability goals of conserving resources and reducing construction-related waste.

Report Segmentation

The market is primarily segmented based on grade, application, end use and region.

|

By Grade |

By Application |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Grade Analysis

Industrial grade segment held the largest share

Industrial grade segment garnered the largest share in market. It is utilized across diverse industries for specific applications, including serving as a setting accelerator in cement & concrete formulations. In the construction sector, industrial grade is employed as a cement additive, enhancing concrete properties like setting time, strength, and shrinkage control. This grade plays a vital role in enhancing the performance and durability of concrete in construction endeavors.

The industrial grade is employed in the textile & leather sectors, functioning as the catalyst in the dyeing & printing processes. It enhances color retention & dye penetration in fibers & fabrics, ensuring vibrant and consistent results. Additionally, it also functions as pH regulator and buffering agent, maintaining the dyeing process's stability and vibrancy.

Feed grade segment will grow at significant pace. This can be attributed to the incorporation of feed grade into products as an additive for animals. It provides numerous advantages in animal nutrition and health, including enhancing digestion, reducing the likelihood of diarrhea, and more. When added to animal feed, feed grade improves its quality and promotes animal well-being. It serves as a preservative, inhibiting the growth of harmful bacteria and extending the feed's shelf life. Additionally, it helps maintain the proper pH balance in animals' digestive systems, leading to improved digestion. Furthermore, it possesses antibacterial properties, lowering the risk of bacterial infections in animals.

By Application Analysis

Concrete setting segment accounted for the largest market share in 2022

Concrete setting segment accounted for the largest market share. This can be attributed to its widespread use as a concrete additive in the construction sector. It functions as an accelerator in cement-based formulations, effectively reducing the setting time of concrete and enhancing its early strength development. This characteristic proves invaluable in situations demanding rapid setting and early strength gain, such as in cold-weather concrete applications or for expedited construction projects.

When employed as a feed additive in animal nutrition, this product acts as a valuable source of calcium and formic acid, delivering essential nutritional advantages to livestock. It aids in enhancing digestion, fostering growth, and improving the overall health of animals. It also finds application in the textile industry during the dyeing and finishing processes. It functions as a buffering agent, playing a role in stabilizing the pH of dye baths and ensuring uniform color outcomes. Additionally, it enhances the dye's adhesion to the fabric, leading to enhanced dye absorption and color retention.

By End Use Analysis

Construction segment accounted for the largest market share in 2022

Construction segment accounted for the largest market share. It serves as an additive in cement-based formulations, like concrete, to expedite setting time and enhance early strength development. This feature proves especially advantageous in chilly weather conditions or for projects demanding swift setting and early strength enhancement.

Textile dyeing will grow at the significant pace. It is utilized in both the leather and textile industries, acting as a buffering agent to stabilize the pH of dye baths in the dyeing and finishing process. By preserving the necessary pH level, the product guarantees uniform color outcomes and boosts dye absorption, ultimately leading to enhanced color retention.

Regional Insights

APAC region accounted for the largest share of global market in 2022

APAC region witnessed the global market. This is primarily due to extensive infrastructure development, ongoing construction projects, and a growing need for animal feed additives. The construction sector in the region is experiencing robust growth due to urbanization, population expansion, and economic progress.

It finds application in diverse construction uses, including tile adhesives, cement-based mortars, and self-leveling compounds. Moreover, the rising demand for the product is driven by infrastructure development initiatives in the region, encompassing the construction of roads, bridges, buildings, and various public facilities. It is frequently employed as a concrete additive in these projects to enhance concrete properties.

North America will grow at the substantial pace. This is primarily due to growing public infrastructure needs, government housing initiatives, transportation infrastructure development, and urbanization. These elements fuel the expansion of the construction sector, leading to a heightened demand for concrete additives.

Key Market Players & Competitive Insights

The market is highly competitive, with numerous multinational companies operating within it. Manufacturers and formulators along the supply chain are involved in both backward and forward integration strategies. To execute their long-term plans, companies are focusing on establishing subsidiaries and achieving comprehensive integration throughout the entire supply chain.

Some of the major players operating in the global market include:

- LANXESS

- Perstorp Holding AB

- Chongqing Chuandong Chemical (Group) Co. Ltd.

- Zibo ruibao chemical Co., LTD.

- Henan Botai Chemical Building Material Co., Ltd.

- Shandong Baoyuan Chemical Co. Ltd

- Jiangxi Kosin Frontier Technology Co., Ltd.

- SIDLEY CHEMICAL CO., LTD.

- Zouping Fenlian Biotech Co., Ltd.

- American Elements

- Wujiang yingchuang chemical co., ltd.

- Minerals Technologies Inc.

- Cerne Calcium Company

Recent Developments

- In June 2022, LANXESS complete the acquisition of the microbial control business from the IFF Inc.

- In April 2022, LANXESS acquired Theseo group, a prominent manufacturer specializing in animal health and biosecurity solutions.

Calcium Formate Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 828.26 million |

|

Revenue forecast in 2032 |

USD 1251.49 million |

|

CAGR |

5.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2020 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Grade, By Application, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Explore the market dynamics of the 2024 Calcium Formate Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports. The analysis of Calcium Formate Market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Browse Our Top Selling Reports

Industrial Utility Communication Market Size, Share 2024 Research Report

Electronic Wet Chemicals Market Size, Share 2024 Research Report

Brushless DC Motor Market Size, Share 2024 Research Report

Solar Encapsulation Market Size, Share 2024 Research Report

Nutraceutical Excipients Market Size, Share 2024 Research Report

FAQ's

The global calcium formate market size is expected to reach USD 1.25 billion by 2032

LANXESS, Perstorp Holding, Henan Botai Chemical, American Elements, Minerals Technologies are the top market players in the market.

APAC region contribute notably towards the global Calcium Formate Market.

The global calcium formate market is expected to grow at a CAGR of 5.3% during the forecast period.

Grade, application, end use and region are the key segments in the Calcium Formate Market.