Buy Now Pay Later Market Share, Size, Trends, Industry Analysis Report, By Channel (Online, POS), By End-use (Retail, Automotive), By Enterprise Size, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM3910

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

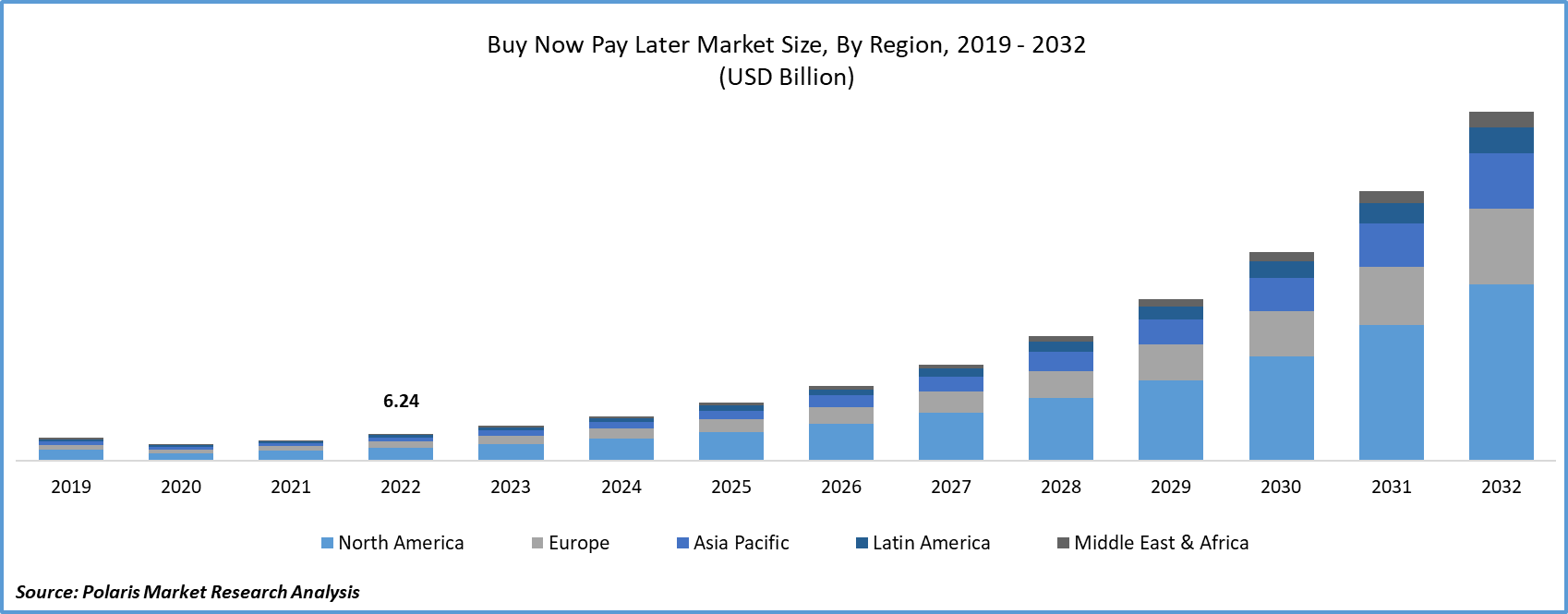

The global buy now pay later market size was valued at USD 10.38 billion in 2024. The buy now pay later industry is projected to USD 80.52 billion by 2032, exhibiting a CAGR of 29.20% during 2024- 2032.

Growth can be attributed to consumers' strong preference for flexible payment choices. BNPL services offer the advantage of deferred payment, granting customers greater financial flexibility and relieving them of the immediate burden of upfront expenses. The rise of online shopping has also played a pivotal role in propelling the BNPL sector. As online retail gains prominence, consumers are in search of seamless and effective payment methods. BNPL services seamlessly integrate into online checkout procedures, ensuring a smooth and convenient payment experience. Given the expansion of online marketplaces and the widespread adoption of digital wallets, BNPL solutions have emerged as an appealing choice for both consumers and merchants, catering to their mutual needs.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces Buy Now Pay Later Market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

Buy now, pay later (BNPL) is a type of short-term financing that allows customers to buy products or services and pay for them over time. In doing so, consumers have the ability to immediately finance their purchases and pay them back in installments over a stipulated time. When compared to personal loans, BNPL services are fairly easy for consumers to get approved of and don’t charge any interest. BNPL has end uses in several sectors, including retail, healthcare, leisure & entertainment, and the automotive industry.

The way BNPL services work is simple. After purchasing at a participating retailer, consumers need to opt for the Buy Now, Pay Later option. Then, they have to make a small down payment of the overall purchase amount. The remaining amount is then deducted in a series of easy monthly installments (EMIs). There are several benefits associated with using BNPL services, including increased affordability, instant access to credit, and safe and secure transactions. Also, BNPL is a simple and transparent process where consumers can choose the repayment tenure. With rising demand from consumers and the presence of a supportive regulatory environment, the Buy Now Pay Later market is projected to witness rapid growth in the upcoming years.

To Understand More About this Research: Request a Free Sample Report

Buy now pay later (BNPL) services effectively tackle the issue of affordability encountered by customers. By enabling the division of payments into interest-free installments, BNPL providers empower consumers to engage in larger purchases without experiencing financial stress. As a result, merchants witness a rise in average order values and repeat business as customers find it more convenient to make substantial transactions. Furthermore, the accessibility and simplicity of enrolling in BNPL services have significantly contributed to their widespread appeal. Many BNPL platforms offer swift and uncomplicated registration procedures, often with minimal credit assessments. This inclusive approach resonates with a wider spectrum of consumers, encompassing those with limited credit history or lower credit scores, who might encounter difficulties when seeking conventional credit options.

The buy now pay later market experienced a favorable outcome due to the COVID-19 pandemic. Numerous individuals encountered financial difficulties and uncertainties in the wake of the pandemic, prompting them to explore adaptable payment alternatives for managing their expenditures. In this scenario, BNPL services emerged as an appealing solution, enabling consumers to distribute their payments across a period, thereby alleviating financial pressure. Additionally, as physical stores shuttered and in-person shopping faced restrictions, there was a notable upswing in online commerce. Consumers shifted towards online platforms for both essential and non-essential purchases, and BNPL services seamlessly melded into these digital transactions, presenting a convenient and uncomplicated method of payment.

Industry Dynamics

Growth Drivers

- Rising demands for BNPL among consumers

BNPL providers extend appealing collaborations and incentives to merchants. Through affiliations with BNPL platforms, retailers can draw in fresh clientele, elevate customer loyalty, and amplify conversion rates. These services additionally aid merchants in curbing instances of abandoned shopping carts by furnishing an alternative payment avenue that motivates customers to finalize their purchases.

Furthermore, the supportive regulatory environment and the ongoing evolution of payment regulations have exerted a positive impact on the buy now pay later market. Governments and financial oversight bodies in diverse countries have acknowledged the legitimacy of BNPL services as a valid payment mechanism, which in turn augments their credibility and fosters consumer trust. This regulatory endorsement has emboldened BNPL providers to broaden their service scope and venture into new markets, thereby fostering the expansion of the industry.

Report Segmentation

The market is primarily segmented based on channel, enterprise size, end use, and region.

|

By Channel |

By Enterprise Size |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Channel Analysis

- Online segment accounted for the largest market share in 2022

The online segment accounted for the largest market share. Businesses across the globe are actively forging partnerships to emphasize the integration of various online payment avenues, including BNPL, as an integral facet of their strategies for post-pandemic recovery. To illustrate, in August 2021, Uplift, Inc., a provider of BNPL solutions, established a collaboration with Tripster, an encompassing travel booking platform.

POS segment will grow at a steady pace. With a growing number of consumers showing a preference for both physical and online shopping experiences, the attractiveness of utilizing BNPL services directly at the point of sale is heightened. The POS approach grants consumers the advantage of making on-the-spot purchasing choices, obviating the necessity for pre-authorization or credit evaluations. This expedites transactions, ensuring a smooth and expeditious process.

By Enterprise Size Analysis

- Large enterprises held the largest share in 2022

Large enterprises garnered the largest revenue share. Large enterprises have embraced these solutions to furnish their customers with an affordable and adaptable payment avenue, particularly beneficial for acquiring high-value items. The utilization of BNPL often results in an increased number of products being acquired by shoppers due to the streamlined purchasing process, consequently propelling sales expansion. Hence, BNPL contributes substantially to the enhancement of the overall customer experience, a benefit particularly significant for large enterprises.

SMEs will grow at a substantial pace. (SMEs) are directing their attention toward the implementation of BNPL solutions to bolster merchants' sales conversion rates. For instance, Dukaan is a startup enterprise facilitating the establishment of online stores for SMEs. Dukaan recently unveiled a collaboration with Simpl, a provider of BNPL solutions. This partnership enables Dukaan to extend BNPL services to its network of merchants.

By Distribution Channel Analysis

- Retail segment held the largest share in 2022

The retail segment dominated the market. Within this industry, there is a noticeable uptick in the acceptance of BNPL solutions. These solutions are gaining traction due to their capacity to facilitate customers in effortlessly spreading the expense of their acquisitions across a predetermined timeline characterized by interest-free payments.

The healthcare segment will grow at the fastest rate. Within this industry, there is a growing reception of BNPL payment mechanisms, primarily due to their provision of a low-resistance alternative to credit cards. Additionally, customers exhibit a preference for BNPL payment avenues over credit cards, largely to steer clear of the accumulation of costly compounded interest and concealed charges. Furthermore, the escalating expenses linked to the management of various ailments, including cancer, chronic heart conditions, and cardiovascular diseases, are poised to act as driving forces for the demand surge in BNPL services during the forecast period.

Regional Insights

- North America region dominated the global market in 2022

North America held the largest share in 2022. The driving force behind the robust growth in this region can be ascribed to the substantial presence of prominent market players within this area. Furthermore, the region is witnessing a notable trend where several fintech entities are collaborating with entertainment companies to provide BNPL services tailored for hotel bookings, adding an extra layer of versatility to the market landscape.

APAC will grow at a steady pace during forecast period. This buoyant growth trajectory can be attributed to the region's burgeoning population, characterized by an escalating number of tech-savvy consumers who eagerly embrace digital payment solutions and online marketplaces. Southeast Asian nations exhibit pervasive smartphone usage and robust internet connectivity, which have significantly contributed to the burgeoning adoption of BNPL services. This payment method has gained substantial popularity within the domain of online shopping. This trend is further buoyed by the region's diverse & dynamic retail landscape.

Key Market Players & Competitive Insights

The buy now pay later (BNPL) payment approach is witnessing a rapid surge in favor among consumers, facilitating purchases both in brick-and-mortar establishments and across online platforms. A multitude of retailers are directing their attention towards integrating the BNPL solution into their operations, aiming to empower their patrons with the ability to access interest-free installment plans.

Some of the major players operating in the global market include:

- Affirm, Inc.

- Klarna Inc.

- Splitit Payments, Ltd.

- Sezzle

- Perpay Inc.

- Zip Co, Ltd

- PayPal Holdings, Inc.

- AfterPay Limited

- Openpay

- LatitudePay Financial Services

- HSBC Group

Recent Developments

- In March 2023, Apple has unveiled a novel feature named Apple Pay Later, which bolsters the functionalities of its digital wallet by presenting customers with the choice to settle payments for online acquisitions through instalment plans.

- In March 2021, Payflex has revealed the introduction of a buy now pay later (BNPL) characteristic tailored for South African shoppers. This initiative extends the opportunity for local customers to make purchases from a range of 500 widely recognized stores.

Buy Now Pay Later Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 10.38 billion |

|

Revenue forecast in 2032 |

USD 80.52 billion |

|

CAGR |

29.20% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Channel, By Enterprise Size, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

In today’s hyper-connected world, running a business around the clock is no longer an option. And at Polaris Market Research, we get that. Our sales & analyst team is available 24x5 to assist you. Get all your queries and questions answered about the Buy Now Pay Later Market report with a phone call or email, as and when needed.

Browse Our Top Selling Reports

Bioanalytical Testing Services Market Size, Share 2024 Research Report

Ecotoxicological Studies Market Size, Share 2024 Research Report

Anti-Acne Cosmetics Market Size, Share 2024 Research Report

Buttock Augmentation Market Size, Share 2024 Research Report

Surgical Instrument Tracking Systems Market Size, Share 2024 Research Report