Butane Market Size, Share, Trends, Industry Analysis Report: By Application (LPG, Petrochemicals, Refineries, and Others) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 118

- Format: PDF

- Report ID: PM1541

- Base Year: 2024

- Historical Data: 2020-2023

Butane Market Overview

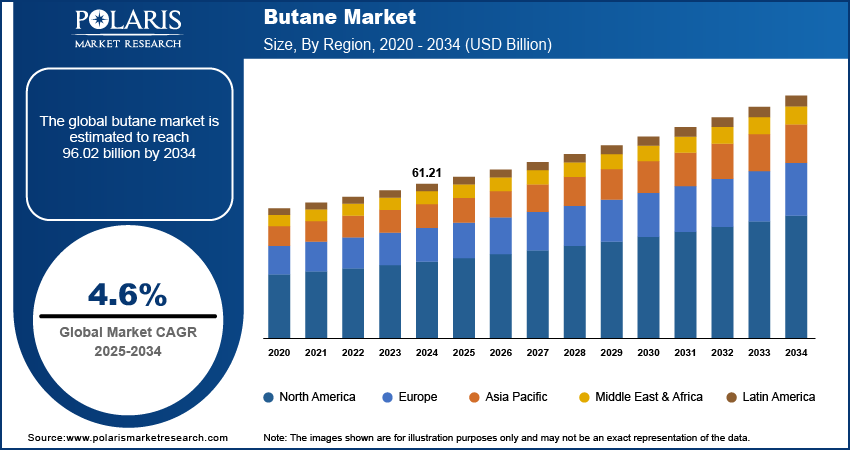

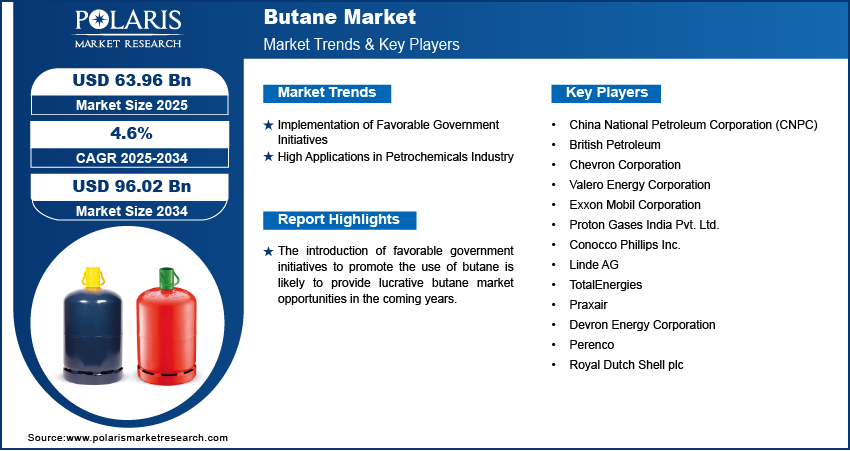

The global butane market size was valued at USD 61.21 billion in 2024. The market is projected to grow from USD 63.96 billion in 2025 to USD 96.02 billion by 2034. It is projected to exhibit a CAGR of 4.6% from 2025 to 2034.

Butane is an organic compound and a highly flammable, colorless, odorless, and easily liquefied gas. It is derived from petroleum and is used in a wide range of products and applications. Butane serves as a fuel, propellant, refrigerant, and solvent in residential, commercial, and industrial applications.

To Understand More About this Research: Request a Free Sample Report

Butane, as a component of LPG, is commonly utilized in residential and commercial applications for cooking and heating purposes. The increased use of LPG in rural areas of developing countries, such as India, has driven higher demand for butane. This shift toward the use of LPG to reduce the dependency on forest wood and address the incomplete combustion issues associated with its use drives the butane market growth. In addition, its high applications in the petrochemicals industry are another major factor fueling the market growth.

The increasing use of butane as a propellant in deodorant cans and other aerosol products, due to its cost-effectiveness, easy liquefication, and safety in conjunction with cosmetic formulations, is a key trend anticipated to boost the butane market demand in the future. The implementation of favorable government regulations and policies to promote the use of butane is likely to provide lucrative butane market opportunities during the forecast period.

Butane Market Dynamics

Implementation of Favorable Government Initiatives

Governments across the world are implementing favorable initiatives to promote the use of LPG over other fossil fuels. Butane is a necessary component of LPG. Therefore, rising government initiatives that boost the usage of LPG are propelling the butane market development. Also, the increasing adoption of natural gas vehicles in countries such as the US, Germany, and China due to government support is fueling the consumption of butane.

High Applications in Petrochemicals Industry

Butane is used as a feedstock to produce several petrochemicals, including downstream petrochemicals such as butadiene and primary petrochemicals like ethylene. It is also used to increase the octane number of gasoline and control its volatility. Further, it finds applications as a propellant in aerosol products such as deodorants and fuel in cigarette lighters. Thus, the high applications of butane in the petrochemicals industry contribute to the rising butane market revenue.

Butane Market Segment Insights

Butane Market Outlook by Application Insights

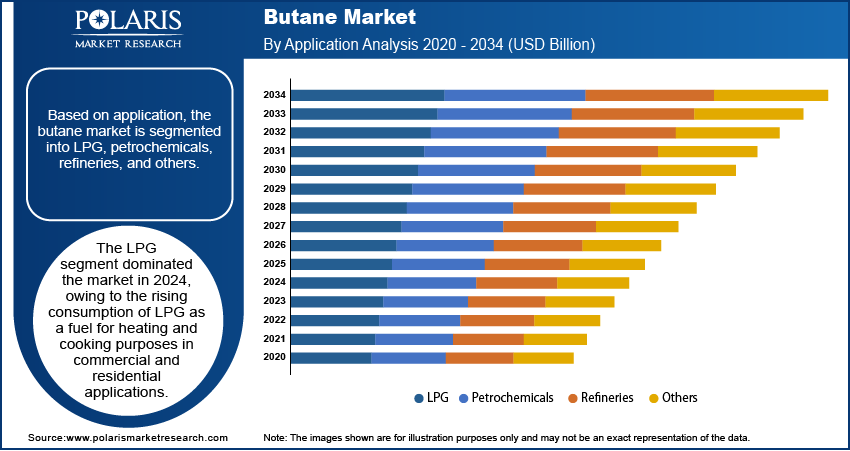

The butane market, based on application, is segmented into LPG, petrochemicals, refineries, and others. The LPG segment dominated the market with a revenue share of 72.5% in 2024. The rising consumption of LPG as a fuel for heating and cooking purposes in commercial and residential applications primarily drives the robust growth of the segment. Further, the rising demand for auto fuel due to the increasing use of cars and other vehicles for daily commutes contributes to the segment’s dominance in the market.

The petrochemicals segment is projected to witness the fastest growth from 2025 to 2034. Petrochemicals are found in several modern energy systems, including solar panels and wind turbine blades. Also, they are used in thermal insulation for batteries, building, and electric vehicle (EV) components. The growing utilization of petrochemicals in applications such as medical equipment, detergent, tires, plastics, and fertilizers is projected to influence the segment’s growth in the coming years.

Butane Market Regional Analysis

By region, the butane market research report offers market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the market with a revenue share of 39.4% in 2024. Supportive government policies and subsidies in countries such as India have significantly contributed to the rising usage of LPG, which has increased the demand for butane. In addition, the growth of end-use industries, such as automobile and petrochemical downstream sectors, has driven higher consumption of butane in the region.

The butane market in North America is anticipated to witness significant growth from 2025 to 2034, with the US being the major contributing country. The rapid advancement of the shale revolution in the US has positively impacted the market. The North America butane market expansion is further supported by the development of new hydrocarbon gas liquid facilities along the Gulf Coast to capitalize on the rising supply of butane in the region, driven by increased shale production.

Butane Market – Key Players and Competitive Insights

The key players in the butane market are focusing on research and development to enhance their products and services offerings and drive market demand. Also, they are adopting various strategic initiatives, including collaborations, mergers and acquisitions, new product launches, and increased investments, to improve their global footprint. To expand and survive in a more competitive environment, market participants must offer innovative solutions.

In recent years, the market for butane has witnessed several innovations, with key players seeking to provide advanced solutions that help meet sustainability goals. The butane market research report offers a market assessment of all the key players, including China National Petroleum Corporation (CNPC), British Petroleum, Chevron Corporation, Valero Energy Corporation, Exxon Mobil Corporation, Proton Gases India Pvt. Ltd., Conocco Phillips Inc., Linde AG, TotalEnergies, Praxair, Devron Energy Corporation, Perenco, and Royal Dutch Shell plc.

List of Key Companies in Butane Market

- China National Petroleum Corporation (CNPC)

- British Petroleum

- Chevron Corporation

- Valero Energy Corporation

- Exxon Mobil Corporation

- Proton Gases India Pvt. Ltd.

- Conocco Phillips Inc.

- Linde AG

- TotalEnergies

- Praxair

- Devron Energy Corporation

- Perenco

- Royal Dutch Shell plc

Butane Market Industry Developments

November 2022: BW LPG announced the completion of the acquisition of the LPG Trading Operations from Vilma Oil. The company stated that the acquisition is set to expand its Product Services division.

June 2022: Otodata Holdings, Inc. acquired the LPG brand of AIUT, a provider of IoT ecosystems for LPG remote monitoring and metering. According to Otodata, the acquisition will help enhance its expansion and leverage its advanced solutions across five continents.

Butane Market Segmentation

By Application Outlook

- LPG

- Residential/Commercial

- Chemical/Petrochemical

- Industrial

- Auto Fuel

- Refinery

- Others

- Petrochemicals

- Refineries

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Butane Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 61.21 billion |

|

Market Size Value in 2025 |

USD 63.96 billion |

|

Revenue Forecast by 2034 |

USD 96.02 billion |

|

CAGR |

4.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market was valued at USD 61.21 billion in 2024 and is projected to grow to USD 96.02 billion by 2034.

The market is projected to register a CAGR of 4.6% from 2025 to 2034.

Asia Pacific accounted for the largest region-wise market size in 2024.

China National Petroleum Corporation (CNPC), British Petroleum, Chevron Corporation, Valero Energy Corporation, Exxon Mobil Corporation, Proton Gases India Pvt. Ltd., Conocco Phillips Inc., Linde AG, TotalEnergies, Praxair, Devron Energy Corporation, Perenco, and Royal Dutch Shell plc. are a few of the key players in the market.

The LPG segment accounted for the largest market share in 2024.

The petrochemicals segment is projected to witness the fastest growth during the forecast period.