Business Jet Market Size, Share, Trends & Industry Analysis Report

By Type (Light Bizjet, Mid-Size Bizjet, Large Bizjet); By Platform; By System; By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 130

- Format: PDF

- Report ID: PM2782

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

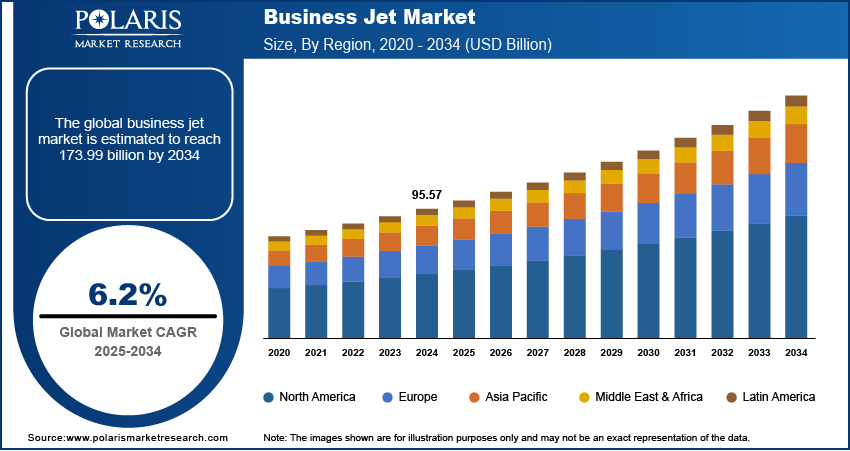

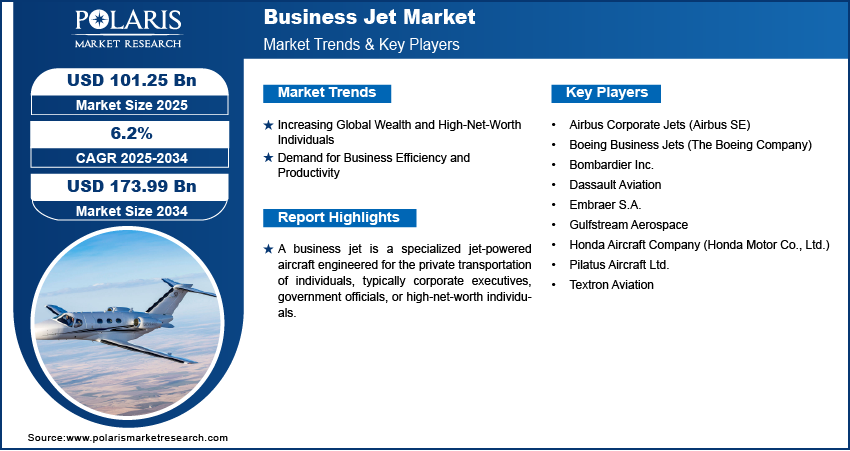

The business jet market was valued at USD 95.57 billion in 2024. It is projected to exhibit a CAGR of 6.2% during 2025–2034. It is driven by rising demand for private air travel, increased global wealth, improved aircraft technology, and expanding infrastructure in emerging markets.

Market Insights

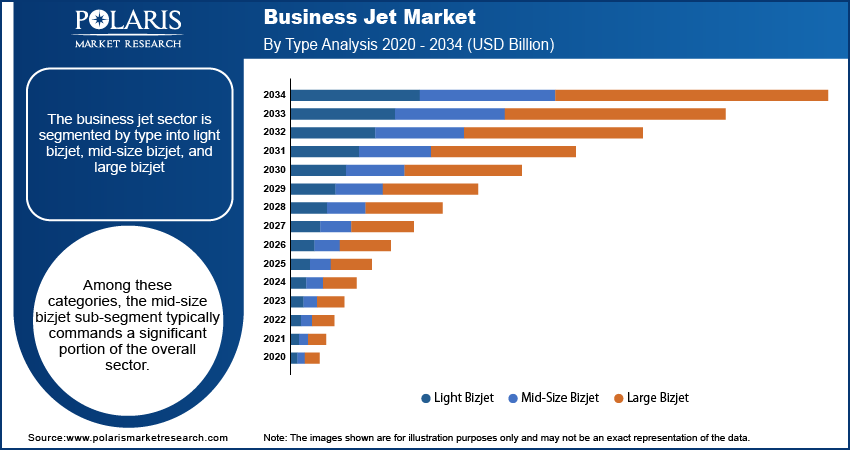

- Among the major types, the mid-size business jet segment is expected to hold a significant revenue share during the forecast period. The growth of this segment is attributed to the versatile operational profile of these jets, in terms of range and passenger count, which maximizes operational efficiency.

- Based on platform, the aircraft management service segment held a significant share in 2024. The demand for these services is attributed to the increasing practice of outsourcing jet management by jet owners to specialized management firms, which assume responsibilities such as crew recruitment and training, maintenance, regulatory inspections, hangarage, and insurance.

- In terms of system, the propulsion system segment dominates the overall market value. Its dominance is largely due to the expensive and sophisticated design and engineering of aircraft engines.

- North America holds the largest share of the business jet market. Its growth is primarily driven by the prevalence of an advanced corporate culture prioritizing time management. Moreover, a highly developed airline industry favors efficient business jet operations across the region.

- Asia Pacific is expected to register the fastest CAGR during the forecast period, driven by rapid economic growth in several countries, an increasing population of ultrahigh-net-worth individuals, and a larger volume of international business activities involving enterprises from this region.

Industry Dynamics

- Business jets facilitate direct end-to-end travel, enabling travel to various cities in a single day, which signifies their importance. Business leaders and teams require immediate access to various locations, often bypassing the complexities and time constraints associated with airline travel.

- The expansion of the global pool of wealthy population serves as a primary driver for the business jet sector, directly increasing its demand and encouraging an upsurge in its potential.

- Consistent improvements in overall aviation safety, coupled with the unparalleled privacy offered, act as a significant growth factor for the business jet sector.

- High operating and maintenance costs limit the profitability of business jet companies.

Market Statistics

Market Size, 2024: USD 95.57 billion

Projected Market Size, 2034: USD 101.25 billion

CAGR (2025–2034): 6.2%

Largest Market in 2024: North America

AI Impact on Business Jet Market

- The use of AI systems in jets enable real-time monitoring, which helps predict component failures in advance, thereby reducing downtime and improving operational efficiency.

- AI algorithms can be utilized to optimize flight routes and fuel management, thereby reducing operational costs and emissions.

- Business jet operators can utilize AI to provide personalized in-flight services, including entertainment and enhanced connectivity tailored to passenger preferences.

- AI tools can be used to streamline scheduling, utilization analysis, and market demand forecasting, among other tasks.

- AI systems drive the demand for advanced digital solutions in maintenance, repair, and overhaul (MRO) operations, creating new service revenue streams for business aviation companies.

To Understand More About this Research: Request a Free Sample Report

The business jet market includes the industry involved in the design, manufacture, sale, and operation of aircraft intended to carry small groups of people, usually corporate executives or affluent individuals, for business or leisure purposes. These private jets are highly efficient and flexible, operate on smooth aircraft hydraulic systems, and maintain a high level of privacy, as they provide travel and experience that is unmatched compared to commercial airline services. The segment comprises different types of aircraft, from light jets used for shorter distances to ultra-long-range jets meant for intercontinental travel. This niche aviation segment is part of a nation’s global business infrastructure, aiding the mobility and productivity of executives by reducing travel time and increasing work capability during the journey.

A key factor contributing to growth is the high-net-worth individual population and the globalization of business around the world, which requires quick and on-demand travel logistics for executives. Other major growth factors include technological innovation that results in economical aircraft with more range, better cabin space, and advanced electronics, increasing overall demand and market penetration. Moreover, the growing acceptance of partial ownership and jet card schemes has enabled increased access to private aviation services, making it easier for businesses and people who wouldn’t usually take up full ownership.

Industry Dynamics

Increasing Global Wealth and High-Net-Worth Individuals

The expansion of the global wealthy population serves as a primary driver for the business jet sector, directly increasing its potential and demand. As economies grow and individual net worth increases, particularly among top executives and entrepreneurs, there is a corresponding rise in the need for exclusive, time-efficient, and flexible travel solutions. For instance, according to the U.S. Bureau of Economic Analysis, personal income in the metropolitan portion of the United States increased by 6.0% in 2023, following a 3.2% rise in 2022. This sustained growth in personal income provides a solid economic foundation for a greater adoption rate of private air travel services. This ongoing growth in personal income creates a strong economic foundation for a higher adoption rate of private air travel services. This increasing affluence leads to a larger client base and heightened demand for business jet acquisitions and charter services, which significantly impacts the overall size and growth of the business jet sector.

Demand for Business Efficiency and Productivity

The imperative for enhanced business efficiency and executive productivity is a crucial driver in the business jet sector. In today's fast-paced globalized economy, business leaders and teams require immediate access to various locations, often bypassing the complexities and time constraints of commercial electric aircraft and airline travel. Business jets facilitate direct point-to-point travel, enabling multiple meetings in diverse cities within a single day, and offer a private, secure environment for confidential discussions and work. While specific government statistics on productivity directly linked to business jet use are not readily available, the U.S. Bureau of Economic Analysis reports on overall economic growth, indicating a robust environment where efficiency gains are highly valued. For example, the real gross domestic product (GDP) in the U.S. increased by 2.5% in 2022 and 2.9% in 2023, reflecting a healthy economic landscape where businesses prioritize operational agility. This sustained focus on optimizing time and maximizing output fuels the demand trends for business jet services, driving growth within the business jet sector.

Enhanced Safety and Privacy Concerns

The inherent advantages of private aviation in terms of safety and privacy are increasingly influencing its demand trends, especially in light of evolving global health and security landscapes. Business jet travel offers a controlled environment, significantly reducing exposure to public health risks and ensuring sensitive corporate information remains secure from unauthorized access. The ability to manage passenger lists and flight schedules privately appeals strongly to corporations and high-profile individuals. While specific government safety data for business jets alone is not easily disaggregated from general aviation, the overall safety record of aviation, overseen by regulatory bodies, instills confidence. The International Air Transport Association (IATA) reported that the all-accident rate improved to 0.80 per million sectors in 2023, the lowest in over a decade, indicating continuous improvements in global aviation safety standards. This consistent improvement in overall aviation safety, coupled with the unparalleled privacy offered, acts as a significant growth factor for the business jet sector, bolstering its potential and penetration.

Segmental Insights

Market Assessment By Type

The business jet market is segmented by type into light bizjet, mid-size bizjet, and large bizjet. Among these categories, the mid-size bizjet sub-segment typically holds a significant market share of the overall sector during the forecast period. This is mainly because mid-size jets enjoy a versatile operational profile, including range and passenger count, which maximizes operational efficiency. These planes are fit for transcontinental and regional corporate travel, making them popular among businesses and individuals. Mid-size businesses have well-balanced attributes, such as performance and cost. These factors establish a strong presence across business aviation and contribute significantly to the mid-sized jet trend.

The light bizjet subsegment is anticipated to grow at the fastest CAGR within the business jet segment. This increase is believed to be caused by greater marketing fraction ownership, jet card programs, and other services enabling private travel. Newer models that were launched are known for enhancing fuel efficiency. The use of modern avionic systems also attracts clients who want to target efficient short- to medium-range travel.

Market Evaluation By Platform

The business jet market is segmented by platform into on-demand service and aircraft management service. The aircraft management service sub-segment holds a significant share of the business jet sector. This segment is characterized by jet owners outsourcing the operational management of their jets to specialized management firms. These firms take over and handle most, if not all, responsibilities, which include crew recruitment and training, maintenance and regulatory inspections, hangarage, insurance, and so on. For many aircraft owners, choosing an aircraft management service is a rational decision. It allows them to avoid dealing with operational and safety issues, as well as handling the chartering of the aircraft when it is not in use.

On-demand service sub-segment within the business jet industry is expected to grow significantly over the anticipated period. This sub-segment, which comprises predominantly charter service, enables business executives and other individuals to purchase private jet travel on a single-flight basis without the associated costs of long-term contracts, waiting periods, or down payments needed for purchasing an aircraft.

Market Evaluation By System

The business jet market is segmented by the system into the propulsion system, aerostructure, avionics, and others. Within the system segment, the propulsion system sub-segment typically commands a substantial share of the overall value. This is largely due to the expensive and sophisticated design and engineering of aircraft engines. The most crucial elements of a business jet are its engines because they determine the performance, operational range, fuel consumption, and reliability of the aircraft. A significant amount of funding is consistently available for research and development to enhance engine technology concerning noise reduction and environmental compliance.

Among the different segments, the avionics sub-segment has the fastest growth rate within business jets. This is the result of the very dynamic rate of technology improvements, resulting in new sophisticated navigation, communication, and flight management systems. Today’s modern avionics systems increase flight safety while decreasing the workload of the pilot and operational efficiency, and they enable a wide range of functions for in-flight entertainment and communications.

Regional Analysis

North America business jet market consistently holds the largest share during the forecast period. This region's dominance is due to an advanced corporate culture that places a premium on time and offers considerable spillover of high-net individuals and large corporations. The general aviation industry in this area is more developed than in other parts of the world, having many airports and business services, which allow for easy access and flexible operations. The economy is currently very active, with a clear understanding of the importance of business aviation as a key driver of productivity. This sector consistently maintains its leadership in fleet size and business activity in the region.

The Asia Pacific business jet market is currently experiencing the highest growth rate within the business jet market. This development is primarily driven by the phenomenal growth in the economy, an increasing population of ultra-high-net-worth individuals, and a greater volume of inter-border business activities throughout the continent. There is a growing demand for business jets as companies and individuals in this region seek safe and efficient travel solutions to navigate the diverse and often rapidly expanding economies.Investment in aviation-related infrastructure, increased awareness regarding the advantages associated with private travel, and greater inclination towards luxury services further drive the penetration and growth of the business jet industry in Asia Pacific.

Key Players and Competitive Insights

Key players actively shaping this market include Bombardier Inc., Dassault Aviation, Embraer S.A., Gulfstream Aerospace (General Dynamics Corporation), Textron Aviation, Pilatus Aircraft Ltd., Honda Aircraft Company (Honda Motor Co., Ltd.), Airbus Corporate Jets (Airbus SE), and Boeing Business Jets (The Boeing Company). These entities are continually innovating to meet evolving demand for private air travel, offering a diverse range of business jets from light to ultra-long-range models.

The market competition in the business jet market involves aggressive product development, joint ventures, and a strong customer service focus. Complete manufacturers place their focus on technological advancements in performance, comfort, and the level of support offered globally, as well as on overall brand image. Primary attention is paid towards providing services that improve the privacy, safety, and efficiency of high-net-worth individuals and corporate entities. Competitive strategies tend to focus on increasing aircraft fuel efficiency, expanding maintenance services, and offering customized acquisition strategies like fractional ownership models to sustain demand and broaden the clientele base.

List of Key Companies

- Airbus Corporate Jets (Airbus SE)

- Boeing Business Jets (The Boeing Company)

- Bombardier Inc.

- Dassault Aviation

- Embraer S.A.

- Gulfstream Aerospace (General Dynamics Corporation)

- Honda Aircraft Company (Honda Motor Co., Ltd.)

- Pilatus Aircraft Ltd.

- Textron Aviation

Industry Developments

- March 2024: Gulfstream Aerospace announced that its all-new Gulfstream G700 aircraft received Federal Aviation Administration (FAA) type certification, paving the way for customer deliveries. This certification also confirmed new performance enhancements for range, speed, and cabin altitude

- November 2023: Dassault Aviation announced the entry into service of its Falcon 6X business jet. This super widebody aircraft, certified in August 2023 by both the European Union Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA), is designed to offer exceptional comfort, efficiency, and range.

Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Light Bizjet

- Mid-Size Bizjet

- Large Bizjet

By Platform Outlook (Revenue – USD Billion, 2020–2034)

- On-Demand Service

- Aircraft Management Service

By System Outlook (Revenue – USD Billion, 2020–2034)

- Propulsion System

- Aero structure

- Avionics

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Business Jet Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 95.57 billion |

|

Market Size Value in 2025 |

USD 101.25 billion |

|

Revenue Forecast by 2034 |

USD 173.99 billion |

|

CAGR |

6.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 95.57 billion in 2024 and is projected to grow to USD 173.99 billion by 2034.

The market is projected to register a CAGR of 6.2% during the forecast period, 2024-2034.

North America had the largest share of the market.

Key players include Bombardier Inc., Dassault Aviation, Embraer S.A., Gulfstream Aerospace (a subsidiary of General Dynamics Corporation), Textron Aviation (the parent company of Cessna and Beechcraft), Pilatus Aircraft Ltd., Honda Aircraft Company (a subsidiary of Honda Motor Co., Ltd.), Airbus Corporate Jets (a division of Airbus SE), and Boeing Business Jets (a division of The Boeing Company).

The mid-size bizjet segment accounted for the largest share of the market in 2024.

The following are some of the market trends: ? Sustainability Commitment: Greater focus on the design and implementation of sustainable aviation fuels (SAF), hybrid-electric engines including electric aircrafts, and lighter materials designed to lower carbon emissions, as well as align with eco-friendly policies and rules. ? Technological Progress: Ongoing integration of new cabin surveillance systems for safety, better navigation, and greater connectivity including connected aircaft, as well as advancements in cabin design focused on comfort and custom-tailored personal spaces.

These jets are an example of an aircraft that is specially designed for personal or business travel and caters to a small number of guests, especially high-ranking executives, businesspeople, or people with significant wealth. Unlike commercial airlines, which follow predetermined routes and schedules, these jets offer customized, direct travel services that allow for increased privacy and time efficiency. They include light and ultra-long-range jets, which can be used for intercontinental travel, and are fitted with special features that enhance productivity and comfort while traveling.