Business Intelligence Market Size, Share, Trends, Industry Analysis Report: By Component (Solutions and Services), Deployment, Organization Size, Business Function, Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 125

- Format: PDF

- Report ID: PM5613

- Base Year: 2024

- Historical Data: 2020-2023

Business Intelligence Market Overview

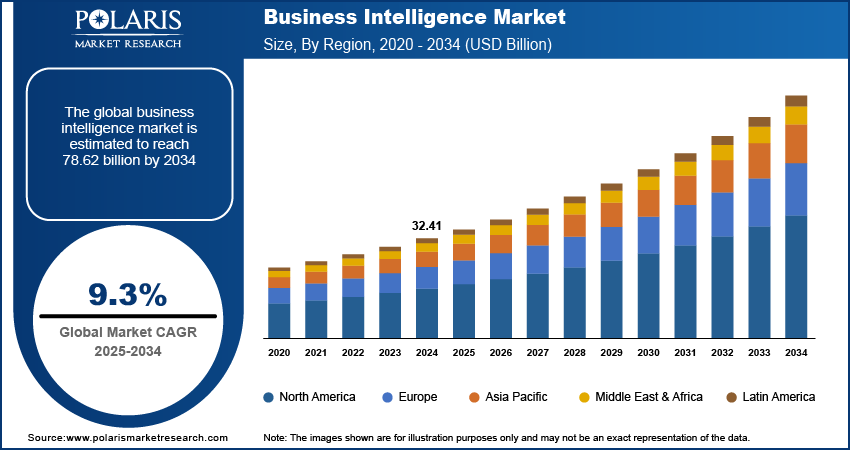

The global business intelligence market size was valued at USD 32.41 billion in 2024. The market is projected to grow from USD 35.35 billion in 2025 to USD 78.62 billion by 2034, exhibiting a CAGR of 9.3% during the forecast period.

Business intelligence (BI) refers to the technologies, processes, and tools that collect, analyze, and present business data to help organizations make informed decisions. It involves transforming raw data into actionable insights for improving business performance and strategic planning.

Organizations are shifting from intuition-based decision-making to data-driven decision-making. Businesses rely on analytics to make decisions and improve outcomes with the amount of data available. BI tools provide businesses with the ability to track performance, forecast trends, and assess risks in real-time. Companies can reduce errors, make more accurate predictions, and identify opportunities faster by using data for decision-making. This advantage is driving the adoption of business intelligence tools and services.

To Understand More About this Research: Request a Free Sample Report

The integration of artificial intelligence (AI) and deep learning into business intelligence tools has revolutionized how data is analyzed. Major players operating in the market, such as SAP, Databricks, and AWS, are actively integrating AI and ML algorithms to process massive datasets more efficiently and identify complex patterns that would be impossible for humans to detect. For instance, Databricks offers Native Databricks tools for business intelligence, which are AI-assisted business intelligence solutions. These integrations allow BI tools to provide predictive insights, automate repetitive tasks, and offer recommendations for decision makers, which drives BI service's appeal and accuracy, thereby boosting their adoption by companies and fueling business intelligence market growth.

Business Intelligence Market Dynamics

Rising Data Volume

The volume of data generated by businesses is growing rapidly due to rapid digital transformations, social media penetration, IoT technology adoption, and more. According to the World Economic Forum, 181 zettabytes of data are expected to be created by 2025, which is three times of data created in 2020. This vast amount of data is nearly impossible to analyze without proper tools. Companies are utilizing business intelligence (BI) tools to manage and analyze this data to understand patterns, trends, and insights. Thus, rising data volume drives the business intelligence market expansion.

Rising Adoption of Cloud Computing

Enterprises are shifting to cloud computing for flexibility, scalability, cost-effectiveness, security, improved data access, and collaboration. This shift is supporting better BI infrastructure management. According to Eurostat, 42.5% of enterprises have adopted cloud services in Europe in 2023. Companies no longer need to invest in expensive hardware or worry about managing on-premise data centers. Cloud-based BI solutions offer easy access to data from anywhere, enabling businesses to collaborate more efficiently and make real-time decisions. Additionally, cloud BI solutions often come with built-in security features and automatic updates, making them a more attractive option for businesses looking to scale their analytics capabilities, thereby driving the business intelligence market development.

Business Intelligence Market Segment Analysis

Business Intelligence Market Assessment by Component Outlook

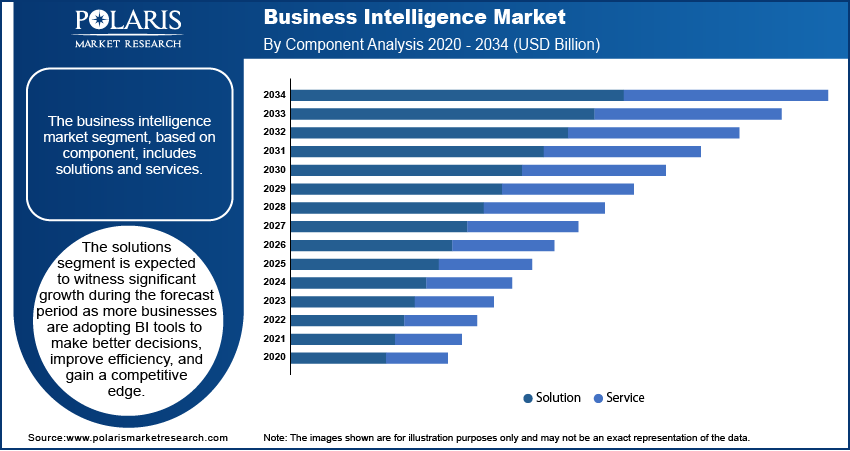

The market segmentation, based on component, includes solutions and services. The services segment is expected to witness significant growth during the forecast period as more businesses are adopting BI tools to make better decisions, improve efficiency, and gain a competitive edge. BI solutions such as dashboards, data visualization, and reporting tools help companies turn raw data into clear, useful insights. The demand for these solutions is expected to grow with the rising need for data-driven decision-making and the increasing availability of user-friendly BI platforms, thereby driving segmental growth in the global market.

Business Intelligence Market Evaluation by Vertical Outlook

The market segmentation, based on vertical, includes retail, manufacturing, government and public services, media and entertainment, transportation and logistics, BFSI, and other. The BFSI segment dominated the business intelligence market share in 2024 as companies in this sector handle massive amounts of data daily and need advanced tools to manage risks, detect fraud, and improve customer experiences. BI solutions help financial institutions analyze customer behavior, streamline operations, and make faster and more accurate decisions. The need for reliable and real-time insights has grown as the industry is becoming more competitive and regulated, thereby driving segmental growth.

Business Intelligence Market Regional Analysis

By region, the study provides the business intelligence market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market due to the strong presence of major BI vendors such as Microsoft, IBM, and AWS, and the early adoption of advanced technologies. Companies in the US and Canada are increasingly using BI tools to improve decision-making, drive innovation, and gain a competitive edge. According to Microsoft, in 2020, 1.7 million people utilized power platforms in the US alone. The region benefits from high digital maturity, robust IT infrastructure, and strong investments in AI and data analytics. Industries such as healthcare, finance, and retail are heavily using BI to analyze customer data and monitor performance, thereby driving market expansion in North America.

Asia Pacific is expected to record the highest CAGR during the forecast period due to increasing digital transformation in major industries of China, Japan, South Korea, and Australia. These countries are investing in data analytics to improve business efficiency and customer engagement. The region’s expanding internet penetration, growing e-commerce sector, and government support for technology adoption are driving BI demand. According to ITU, 66% of the total Asia Pacific population had internet access in 2023. There is a growing demand for tools that provide real-time insights and predictive analytics as companies are seeking to compete in global markets. Additionally, the rise of small and medium-sized enterprises (SMEs) is contributing to the adoption of affordable cloud-based BI solutions, thereby driving market growth in the region.

The market in India is experiencing substantial growth, driven by a strong focus on digitalization and datax-driven decision-making. Indian businesses across sectors, especially IT, banking, smart retail, and manufacturing, are increasingly using BI tools to improve operations and customer satisfaction. There is a growing need for cost-effective and scalable BI solutions with the rapid rise of startups and SMEs. Additionally, government initiatives such as Digital India and growing investments in cloud technology are supporting the expansion of BI in the country. The demand for easy-to-use and affordable BI tools is rising as more organizations are recognizing the value of data, thereby driving the market growth in India.

Business Intelligence Market – Key Players & Competitive Analysis Report

The market opportunity is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific sectors. According to the market stats, this competitive trend is amplified by continuous progress in product offerings. A few major players in the market are IBM, Oracle, Microsoft, SAP, SAS, AWS, Salesforce, MicroStrategy, Teradata, DOMO, TIBCO, Information Builders, Sisense, Yellowfin, and Qlik.

International Business Machines Corporation (IBM) is an American multinational technology company headquartered in Armonk, New York. Established in 1911 and renamed IBM in 1924, the company operates in over 175 countries. It has a long history of research and development, holding the record for the most US patents granted to a business for nearly three decades. IBM’s operations are divided into five main segments. The global technology services (GTS) segment, which accounts for over one-third of the company’s revenue, provides IT infrastructure, cloud services, and outsourcing. The global business services (GBS) segment offers consulting and application management services. The systems & technology segment includes mainframe computers, power systems, storage solutions, and quantum computing products. The software segment delivers solutions in artificial intelligence, cloud computing, data analytics, cybersecurity, and blockchain, supporting hybrid cloud environments with products such as IBM Storage Fusion. The global financing segment offers financing and asset management services to clients and operates in more than 55 countries. IBM’s global presence includes operations in more than 170 countries and 19 research facilities. Its cloud data centers are located across several regions, such as North America (US), Europe (Germany, UK, Italy, Norway, and France), Asia Pacific (India, Australia, Hong Kong, China, South Korea, Singapore, and Japan), and South America (Brazil).

Microsoft is a multinational technology company headquartered in Redmond, Washington. Microsoft offers various products and services, including operating systems, productivity software, gaming consoles, and cloud-based solutions. Its flagship product, Microsoft Windows, is the world's most widely used operating system. Other popular products include Microsoft Office, Skype, and the Xbox gaming console. Microsoft has invested heavily in artificial intelligence (AI) and machine learning technologies in recent years. The company has been using AI to improve its products and services and developing new AI-based applications. For Instance, Microsoft's Cortana virtual assistant uses machine learning to provide personalized recommendations and insights to users. Microsoft has also developed several AI-based products and services, including the Azure Machine Learning platform, which allows developers to build, deploy, and manage machine learning models at scale. The company has also developed AI tools for healthcare, such as Microsoft Healthcare Bot, which helps patients get answers to their health-related questions. Furthermore, Microsoft is actively involved in AI research and development and has established partnerships with leading universities and research institutions worldwide. The company is committed to using AI to solve the world's most pressing problems, such as climate change, healthcare, and education. Microsoft Azure’s business intelligence solutions offer self-service analytics, data modeling, and interactive visualizations through tools such as Power BI, Azure Analysis Services, and Azure Synapse Analytics for informed decision making.

List of Key Companies in Business Intelligence Market

- AWS

- DOMO

- IBM

- Information Builders

- Microsoft

- MicroStrategy

- Oracle

- Qlik

- Salesforce

- SAP

- SAS

- Sisense

- Teradata

- TIBCO

- Yellowfin

Business Intelligence Industry Development

In April 2025, Databricks Ventures' investment in Omni's Series B round was announced, alongside a partnership for seamless integration with the Databricks Data Intelligence Platform, enhancing business intelligence and analytics capabilities.

In September 2022, an omnichannel workforce management solution, Flow, was launched by Intellicus to enable BPM companies to optimize workforce productivity using AutoML, data science, and machine learning technologies.

Business Intelligence Market Segmentation

By Component Outlook (Revenue USD Billion, 2020–2034)

- Solutions

- Services

By Deployment Outlook (Revenue USD Billion, 2020–2034)

- Cloud

- On-Premise

By Organization Size Outlook (Revenue USD Billion, 2020–2034)

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

By Business Function Outlook (Revenue USD Billion, 2020–2034)

- Human Resource

- Finance

- Operations

- Sales and Marketing

By Vertical Outlook (Revenue USD Billion, 2020–2034)

- Retail

- Manufacturing

- Government and Public Services

- Media and Entertainment

- Transportation and Logistics

- BFSI

- Other

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Business Intelligence Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 32.41 billion |

|

Market Size Value in 2025 |

USD 35.35 billion |

|

Revenue Forecast by 2034 |

USD 78.62 billion |

|

CAGR |

9.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 32.41 billion in 2024 and is projected to grow to USD 78.62 billion by 2034.

The global market is projected to register a CAGR of 9.3% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players in the market are IBM, Oracle, Microsoft, SAP, SAS, AWS, Salesforce, MicroStrategy, Teradata, DOMO, TIBCO, Information Builders, Sisense, Yellowfin, and Qlik.

The BFSI segment dominated the business intelligence market revenue share in 2024 as companies in this sector handle massive amounts of data daily and need advanced tools to manage risks, detect fraud, and improve customer experiences.

The solution segment is expected to witness significant growth during the forecast period as more businesses are adopting BI tools to make better decisions, improve efficiency, and gain a competitive edge.