Busbar Coating Material Market Share, Size, Trends, Industry Analysis Report By Product (Epoxy Powder, Mylar, Tedlar, Teonex, Kapton, Nomex, Others); By Region, Segment Forecast, 2021 - 2029

- Published Date:Nov-2021

- Pages: 78

- Format: PDF

- Report ID: PM2131

- Base Year: 2020

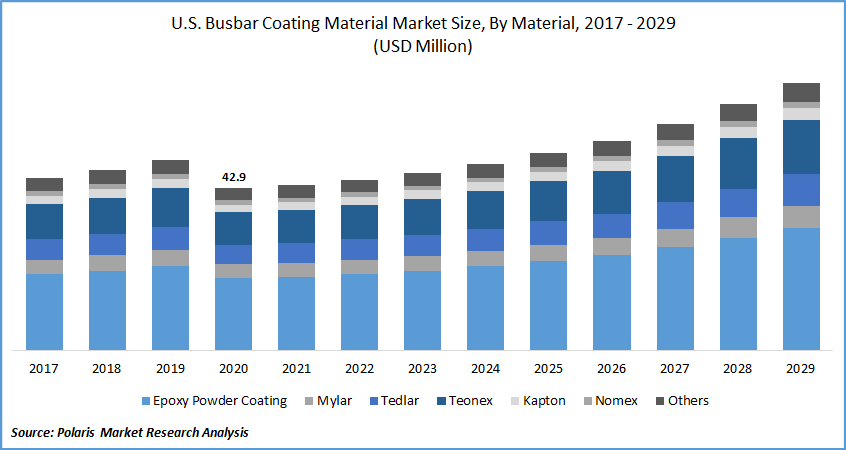

- Historical Data: 2017 - 2019

Report Outlook

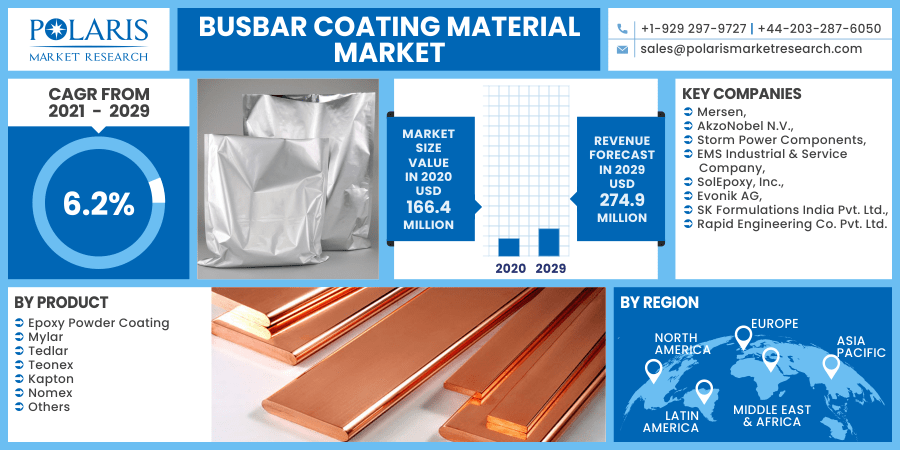

The global busbar coating material market size was valued at USD 166.4 million in 2020 and is expected to grow at a CAGR of 6.2% during the forecast period. Advancements in road infrastructure, rapid economic growth, increasing government spending, and increasing inclination of consumers towards personal conveyance are expected to propel market growth for busbar coating materials in the automotive industry.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Established coating companies are expected to expand into the busbar coating material space, due to the high market growth and lucrative opportunities. Companies are also exploring the D2C model as a means to gain increased market share. The model is being perceived and utilized by companies to gain valuable intelligence and insights pertaining to consumer behavior, preferences, decisions, influences, etc.

Low supplier bargaining power can be ascribed to the limited existence of vendors, and difficult substitute availability. Moreover, the cost of switching suppliers is also high. The pricing and availability of these raw materials are highly volatile owing to domestic and international economic conditions. Due to this volatility, manufacturers find it problematic to produce low-cost products and increase their profit margin.

Know more about this report: request for sample pages

Market Dynamics

Growth Drivers

Rising demand for busbars from industrial applications and the increasing trend of using renewable energy is fueling the growth of the busbar coating materials market. Other factors driving the market include supportive government regulations, increasing awareness, growing demand for power electronics, and technological advancements.

The development of materials that guarantee smooth coating over busbars is a primary factor behind the reduction in insulation failure. Several times, busbars are required to bend in order to conform to design specifications and the insulation gets compressed where it is subject to bending. Smooth coating offsets this factor and results in a reduction in insulation failure driving the busbar coating material market.

Report Segmentation

The market is primarily segmented on the basis of product and region.

|

By Product |

By Region |

|

|

Know more about this report: request for sample pages

Insight by Product

The busbar coating material segment is further bifurcated into epoxy powder, mylar, Tedlar, Teonex, Kapton, Nomex, and other materials. The epoxy powder accounted for 55.1% in 2020 owing to its high chemical and heat resistance, along with excellent electrical insulating properties. Moreover, rising demand for material from emerging regions such as the Asia Pacific will further drive the segment growth.

The demand for epoxy busbar coatings is expected to witness growth as it is widely used for insulation and added to copper busbar coatings for improved performance. The epoxy material provides corrosion protection, high voltage arcing protection, and current-induced magnetic field protection. This is likely to complement the demand for epoxy powder over the forecast period.

Geographic Overview

Asia Pacific busbar coating materials industry is expected to witness significant growth mainly in China, Japan, India, and various other countries on account of the expansion of the manufacturing base. In addition, the presence of major players including Toyota Industries, Komatsu Limited, and Nissan Motor Company is expected to create immense market potential over the forecast period. Technological advancements by various players in order to reduce production costs will fuel its demand over the forecast period.

Furthermore, the growing per capita income in developing economies has resulted in increased demand for vehicles in the domestic market. In addition, a growing number of luxury brands, such as BMW, have shifted their manufacturing plants to China due to lower labor costs and overheads. This is likely to have a positive impact on the demand for coating materials in the automotive industry in Asia Pacific.

Competitive Landscape

Key Players operating in the busbar coating materials market include Mersen, AkzoNobel N.V., Storm Power Components, EMS Industrial & Service Company, SolEpoxy, Inc., Evonik AG, SK Formulations India Pvt. Ltd., and Rapid Engineering Co. Pvt. Ltd.

The busbar coating material market is competitive. Price competition is intense, owing to the presence of several local providers offering a variety of products. Product innovation, brand preference, distribution, and scale efficiency play a vital role in shaping competition. Chief players are undertaking technological advancements and product differentiation so as to gain an advantage.

Busbar Coating Material Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 166.4 million |

|

Revenue forecast in 2029 |

USD 274.9 million |

|

CAGR |

6.2% from 2021 - 2029 |

|

Base year |

2020 |

|

Historical data |

2017 - 2019 |

|

Forecast period |

2021 - 2029 |

|

Quantitative units |

Revenue in USD million and CAGR from 2021 to 2029 |

|

Segments covered |

By Product and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Mersen, AkzoNobel N.V., Storm Power Components, EMS Industrial & Service Company, SolEpoxy, Inc., Evonik AG, SK Formulations India Pvt. Ltd., and Rapid Engineering Co. Pvt. Ltd. |