Bus Market Share, Size, Trends, Industry Analysis Report, By Length (Below 6m, 6-8m, 8-10m, 10-12m, Above 12m); By Fuel Type; By Seating Capacity; By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Jun-2024

- Pages: 119

- Format: PDF

- Report ID: PM4942

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

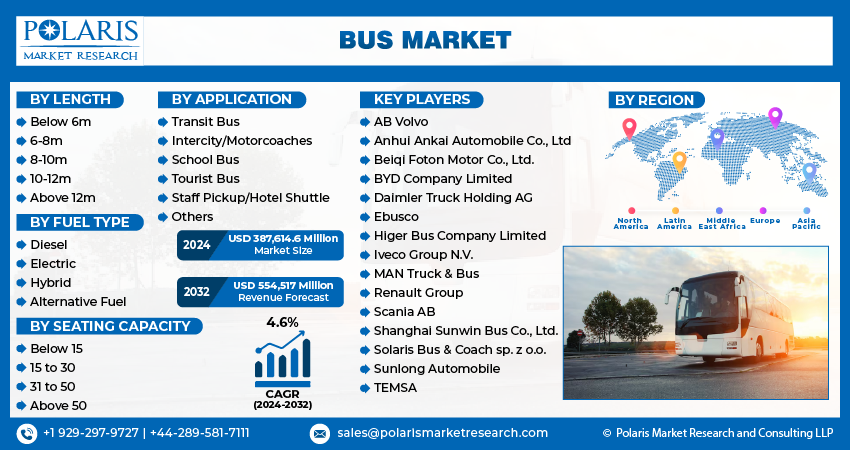

The bus market size was valued at USD 376,602 million in 2023. The market is anticipated to grow from USD 387,614 million in 2024 to USD 554,517 million by 2032, exhibiting a CAGR of 4.6% during the forecast period.

Industry Trend

The bus market stands as a dynamic and crucial sector within the transportation industry, expert at fulfilling various passenger transportation needs across diverse regions and applications. Buses serve as an economical and effective mode of travel for intercity journeys, urban tourism, school commutes, and beyond. As urbanization progresses and cities expand, the necessity for efficient and sustainable public transportation systems becomes essential. Buses emerge as pivotal players in meeting this demand, providing a cost-efficient solution for mass transit.

To Understand More About this Research:Request a Free Sample Report

Governments and municipal authorities recognize the significance of bolstering bus fleets and modernizing infrastructure to enhance public transportation, alleviate congestion, and mitigate emissions. Consequently, investments are channeled into expanding and updating bus fleets to meet evolving mobility requirements. With an escalating emphasis on environmental sustainability and carbon footprint reduction, there's a notable pivot towards electric and hybrid buses. Electric buses, leveraging battery technology, garner traction owing to their emission-free operation, lowered operational expenses, and heightened energy efficiency.

This shift towards electric and hybrid buses is fueling the expansion of this sector, as governments and public transport operators progressively embrace these environmentally friendly alternatives. According to European Automobile Manufacturers' Association (ACEA), new bus registrations demonstrated robust growth in the first half of 2023, with sales surging by 15% to reach 14,781 units. France emerged as the leader in sales volume, with 2,982 units sold, marking a notable 22.3% increase. Other significant markets also witnessed substantial growth, including Italy (+62.6%), Spain (+58.7%), and Germany (+27.8%). This surge in sales reflects the increasing adoption of electric and hybrid buses by governments and public transport operators, propelling growth within this segment.

Moreover, the expanding middle-class population in developing countries is contributing to the demand for personal transportation, including buses. As disposable incomes rise, more individuals and families are seeking affordable mobility options. Buses offer a cost-effective mode of travel for commuting within urban areas and towns, making them an appealing choice for middle-class consumers.

- For instance, in October 2023, Ebusco secured a contract with Multiobus for 20 new Ebusco 2.2 electric buses, expanding their partnership, with the buses set to join the De Lijn fleet in Belgium.

The bus sector is experiencing notable strides in technology aimed at elevating passenger comfort, safety, and operational effectiveness. These advancements encompass enhancements in seating configurations, state-of-the-art infotainment systems, seamless connectivity options, driver assistance features, and intelligent fleet management solutions. This technological evolution is driving market momentum by delivering enhanced passenger journeys and streamlining operational processes.

Key Takeaway

- Asia Pacific dominated the largest market and contributed to more than 38% of the share in 2023.

- The Europe market is expected to be the fastest-growing CAGR during the forecast period.

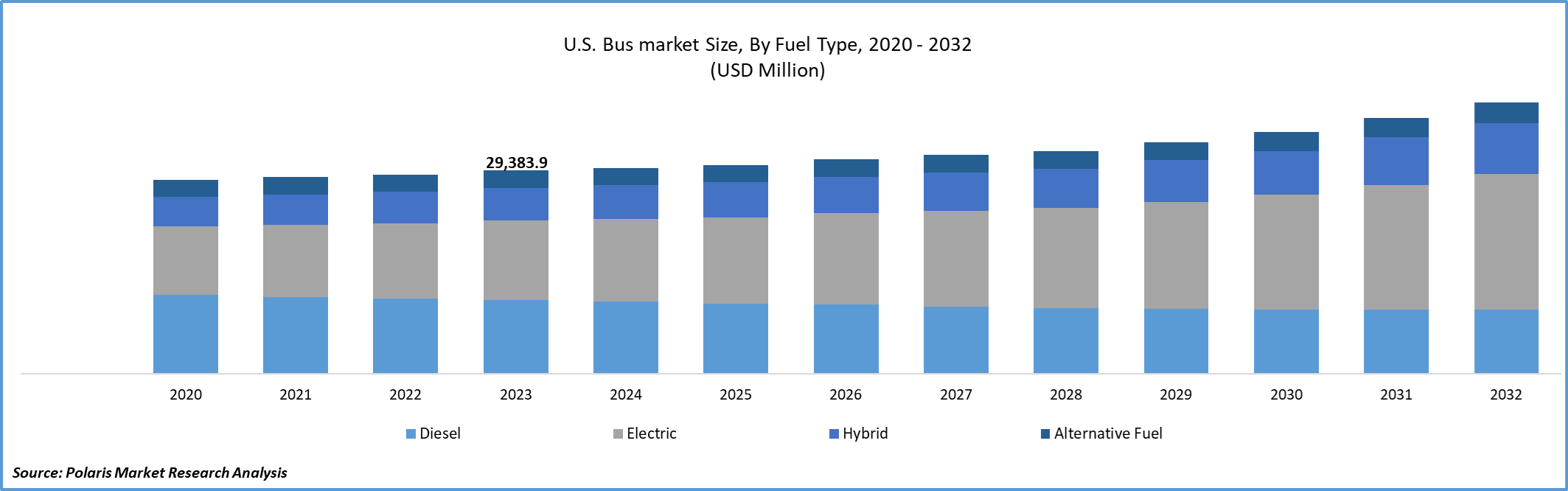

- By fuel type category, the diesel segment accounted for the largest market share in 2023.

- By application category, the transit bus segment is projected to grow at a high CAGR during the projected period.

What Are the Market Drivers Driving the Demand for the Bus Market?

Urbanization and Increased Public Transit Demand

Urbanization is transforming global demographics, with an ever-increasing number of people relocating from rural areas to urban centers. This migration is spurred by the pursuit of better employment, education, and healthcare services, leading to denser cities where the use of private vehicles becomes impractical due to congestion, high costs, and limited parking. Public transit, particularly buses, emerges as a critical solution, offering an efficient way to move large numbers of commuters and thereby serving as a major driver of the bus market.

As cities expand, the challenge of managing increased traffic and pollution intensifies, placing a premium on effective public transportation systems. Buses play a vital role in this ecosystem, providing a scalable and flexible option that can be adjusted to varying urban layouts and passenger demands. The implementation of dedicated bus lanes and bus rapid transit (BRT) systems has further enhanced the efficiency and reliability of bus services, making them more attractive to daily commuters and reducing reliance on private vehicles.

The shift towards urban living also necessitates advancements in public transit infrastructure to accommodate growing passenger numbers. Modern buses are equipped with technology that enhances the commuting experience, including real-time tracking, onboard Wi-Fi, and advanced ticketing systems. These features not only make public transport more user-friendly but also help in integrating bus services with other modes of transit such as subways and trams, creating a seamless network that supports the diverse mobility needs of urban populations.

Environmental concerns are also paramount, as urban areas struggle with pollution and its impact on public health and the environment. In response, there is a growing shift towards sustainable transit solutions, with cities increasingly investing in electric, hybrid, and alternative fuel buses. These vehicles help reduce emissions and operate more quietly, contributing to cleaner and more livable urban environments. The move towards greener buses is supported by governmental policies and incentives that promote environmental sustainability and climate resilience.

Which Factor Is Restraining the Demand for Bus?

High Initial Investment Costs Are Expected to Hinder the Growth of the Market

One of the primary restraints facing the bus market is the high initial cost associated with purchasing and deploying new bus technologies, particularly electric and autonomous buses. These vehicles often come with a premium price tag due to the advanced technologies they embody, such as sophisticated battery systems and autonomous driving hardware. The infrastructure required to support these technologies, including charging stations for electric buses and advanced navigation systems for autonomous buses, also requires significant investment. These costs can be prohibitively expensive for public transit authorities and private operators, particularly in less economically developed regions.

Report Segmentation

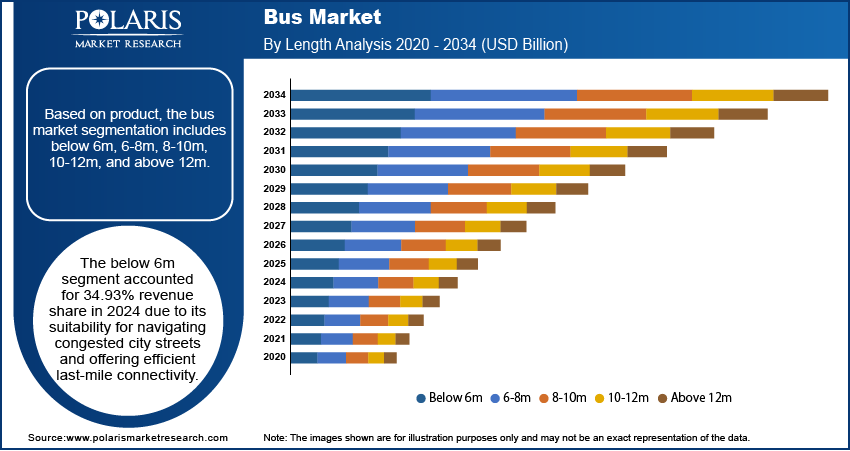

The market is primarily segmented based on length, fuel type, seating capacity, application, and region.

|

By Length |

By Fuel Type |

By Seating Capacity |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Fuel Type Insights

Based on fuel type analysis, the market is segmented on the diesel, electric, hybrid, alternative fuel. Diesel segment held the largest market share in 2023. Diesel-powered buses have traditionally been widely used for public transportation due to their fuel efficiency, range, and infrastructure support. However, concerns about air pollution and emissions have led to increased scrutiny and the adoption of cleaner alternatives. Despite challenges related to emissions, diesel buses remain a significant part of the market, especially for long-distance travel and applications where electric or alternative fuel options may not be viable yet. Manufacturers focus on optimizing diesel engines for lower emissions and improved efficiency.

By Application Insights

Based on application analysis, the market has been segmented on the basis of transit bus, intercity/motorcoaches, school bus, tourist bus, staff pickup/hotel shuttle, others. The transit bus segment expected to be the fastest growing CAGR during the forecast period. Transit buses are primarily used for public transportation within urban and suburban areas. They serve regular routes, provide mass transit services, and play a key role in city mobility systems.

Manufacturers in this segment focus on designing buses for high passenger capacity, efficient boarding and alighting, accessibility features, and integration with urban transport infrastructure such as bus lanes and terminals. Sustainability, reliability, and passenger comfort are key considerations.

Regional Insights

Asia Pacific

Asia Pacific region accounted to be the largest market share in 2023. Asia Pacific is home to a significant portion of the world's population, with densely populated countries like China and India leading the way. As urbanization accelerates in these countries, there's a growing demand for efficient public transportation systems, including buses, to cater to the transportation needs of the burgeoning urban populations. Countries in the Asia Pacific region are financing heavily in infrastructure expansion, including transportation infrastructure. Governments are expanding public transportation networks, building new roads, and improving existing ones to address the challenges of urbanization and economic growth. This investment creates a ripe market for bus manufacturers and suppliers. Top of FormNorth

Europe

Europe is expected for the growth of fastest CAGR during the forecast period. Europe has been at the forefront of environmental initiatives, particularly in the transportation sector. There's a strong push to reduce greenhouse gas emissions and combat air pollution, leading to stringent regulations and targets for vehicle emissions. This drive towards cleaner transportation solutions, such as electric and hydrogen fuel cell buses, creates a favorable market environment for manufacturers and suppliers of eco-friendly buses in Europe. European governments are actively supporting the adoption of sustainable transportation solutions. Subsidies, grants, and incentives are often provided to encourage the purchase and operation of electric and low-emission buses. Additionally, funding is allocated for the development of charging infrastructure and research and development in clean transportation technologies. This support stimulates market growth and innovation within the bus industry.

Competitive Landscape

The bus market is fiercely competitive, with several key players vying for market share. Established giants like Golden Dragon, King Long, Zhong Tong, Yutong, Daimler Truck Holding AG, AB Volvo, and Scania AB, with their long-standing reputation and extensive product offerings, continue to dominate. Yutong remains a significant contender, known for its versatile range of commercial vehicles. Daimler Truck Holding AG and King Long bolster the competition with their diverse portfolio. Notably, the growing trend towards electric and sustainable transportation solutions has opened doors for companies like Ebusco, Solaris Bus & Coach sp. z o.o., and BYD Company Limited, who are making strides in the electric bus segment. Meanwhile, Zhong Tong, AB Volvo, and Scania AB comfortable buses cater to specific market niches, adding to the dynamic competition in the bus market. The push for sustainability, technological advancements, and customer preferences will likely shape the competitive landscape in the coming years as companies strive to meet evolving market demands.

Some of the major players operating in the global market include:

- AB Volvo

- Anhui Ankai Automobile Co., Ltd

- Beiqi Foton Motor Co., Ltd.

- BYD Company Limited

- Daimler Truck Holding AG

- Ebusco

- Golden Dragon (Xiamen Golden Dragon Bus Co., Ltd.)

- Higer Bus Company Limited

- Iveco Group N.V.

- MAN Truck & Bus

- Renault Group

- Scania AB

- Shanghai Sunwin Bus Co., Ltd.

- Solaris Bus & Coach sp. z o.o.

- Sunlong Automobile

- TEMSA

- Xiamen King Long United Automotive Industry Co., Ltd.

- Yutong Bus Co., Ltd.

- Zhongtong Bus Holding Co., Ltd.

Recent Developments

- In April 2024, 530 Ankai buses have been incorporated into the public transportation network in Saudi Arabia, with a focus on serving the high end passenger vehicle and company reception market in the country.530 Ankai buses have been incorporated into the public transport network in Saudi Arabia, with a focus on serving the high-end passenger transportation and business reception market in the country.

- In March 2024, Yutong hosted a significant press conference in Harare, the capital of Zimbabwe, to unveil the latest C12PRO 12m luxury coach. The goal was to enhance the company's product lineup in the country.

- In October 2023, At Busworld, Scania revealed its latest battery-electric bus platform featuring high-capacity batteries of up to 520 kWh, designed for heavy commercial vehicles. This technology allows for a range of over 500 km, showcasing Scania's strong dedication to electrification and CO2 reduction targets through advanced e-mobility solutions.

- In August 2023, BYD- Alexander Dennis partnership celebrated the delivery of their 1,500th electric bus, an Enviro200EV for Go-Ahead London, marking a significant milestone in sustainable transportation.

Report Coverage

The bus market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, length, fuel type, seating capacity, application, and their futuristic growth opportunities.

Bus Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 387,614.6 million |

|

Revenue forecast in 2032 |

USD 554,517 million |

|

CAGR |

4.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Length, By Fuel Type, By Seating Capacity, By Application And By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Bus Market report covering key segments are length, fuel type, seating capacity, application, and region

Bus Market Size Worth $ 554,517 Million by 2032.

The bus market exhibiting a CAGR of 4.6% during the forecast period.

Asia Pacific is leading the global market.

The key driving factors in Bus Market are Urbanization and increased public transit demand