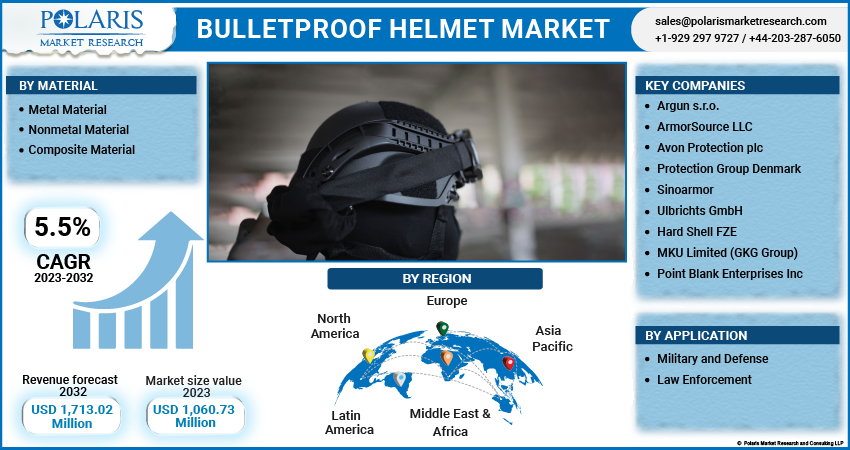

Bulletproof Helmet Market Share, Size, Trends, Industry Analysis Report, By Material (Metal Material, Non-metal Material, Composite Material); By Application; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 114

- Format: PDF

- Report ID: PM3617

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

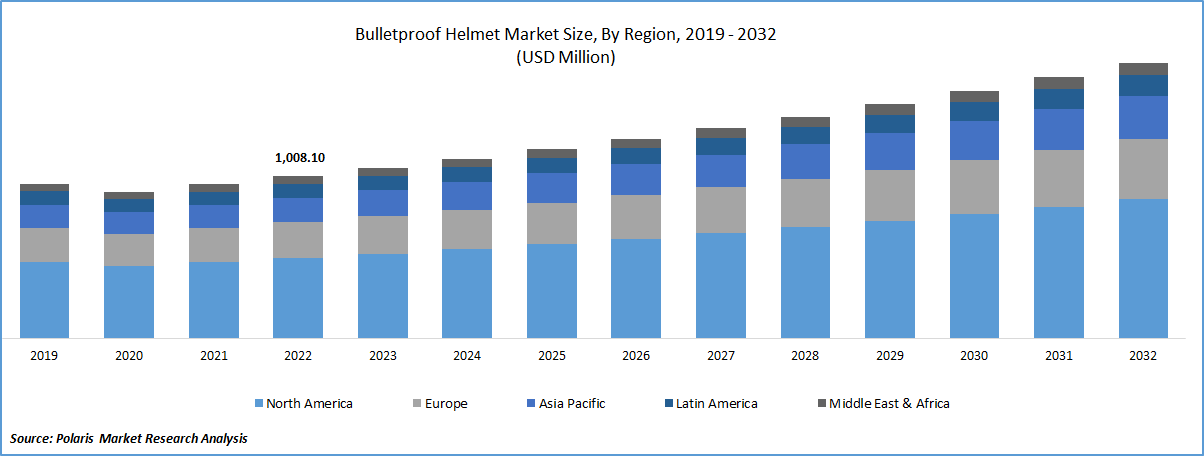

The global bulletproof helmet market was valued at USD 1,008.10 million in 2022 and is expected to grow at a CAGR of 5.5% during the forecast period.Rising prevalence of cross-border breaches, internal issues, and insurgencies, can increase the demand for bulletproof helmets, especially in regions that are prone to conflict and violence. These helmets can offer protection to military personnel, law enforcement officers, and civilians, reducing the risk of head injuries and fatalities. The increasing use of lightweight materials in the manufacturing of bulletproof helmets can also contribute to the growth of the market. Lightweight helmets can provide better comfort and mobility to the users, which is crucial in combat situations.

To Understand More About this Research: Request a Free Sample Report

Moreover, the use of advanced materials such as aramid fibers, ceramics, and polyethylene can enhance the ballistic performance of the helmets, making them more effective in stopping projectiles. Lastly, the rise in defense budgets can also drive the demand for bulletproof helmets. Governments and defense organizations may allocate more resources for the procurement of advanced equipment and technologies, including bulletproof helmets, to improve the capabilities of their armed forces and enhance their security.

A bulletproof or ballistic helmet shields the wearer's head against a variety of hazards, including bullets, physical contact, and explosion debris. It is used in conjunction with ballistic-resistant body armor to provide total covering and protection. Military personnel use it in combat, and it is common equipment for police enforcement in tactical situations. Bulletproof helmets have evolved to fit the needs of today's military and law enforcement personnel. It has gone through multiple material, shape, and weight alterations, becoming lighter, stronger, and sleeker in cut to enable good visibility without losing performance. It protects the head from numerous hazards while also functioning as a mount for supplementary gear.

Manufacturers are working on building bulletproof helmets that accommodate communications devices as well as other gear and attachments, such as an NVG shroud, as combat technology advances. Bulletproof helmets were traditionally built using half-retention mechanisms and nylon webbing. With rising demand, however, manufacturers have decided to incorporate unique cushioning and suspension technologies that give the greatest bulletproof helmets.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the bulletproof helmet market. The pandemic crisis had a significant economic impact. Still, practically every country's military purchase remains ongoing because national security is paramount. As a result of the ongoing COVID-19 epidemic, a modest reduction has been observed due to the permanent shutdown of production facilities in several nations exporting guns and equipment.

For Specific Research Requirements, Speak to Research Analyst

Industry Dynamics

Growth Drivers

Due to rising geopolitical tensions and increased terrorist activity, the military and defense industry is placing a greater emphasis on the need for bulletproof helmets. The purpose of a bulletproof helmet is to shield the wearer's head against ballistic hazards like bullets and shrapnel. The materials used to make these helmets, which include metal, nonmetal, and composite materials, offer a high level of protection while being lightweight and easy to wear. For instance, the conflict between Russia and Ukraine, which started on February 2022, shows no prospects of ending as both nations and their supporters continue to engage in destructive operations.

The rising use of modern technology, such as smart helmets, which provide extra features like communication systems, night vision, and GPS tracking, is one of the major reasons fueling the growth of the worldwide market for bulletproof helmets. In combat circumstances, these helmets are especially beneficial since they improve the wearer's situational awareness.

In addition, the use of asymmetric warfare strategies and urban warfare by non-state actors has increased the demand for bulletproof helmets. In order to assure the security and protection of their military forces, governments all over the world are making significant investments in the creation and acquisition of modern bulletproof helmets.

Report Segmentation

The market is primarily segmented based on material, application, and region.

|

By Material |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Composite Material segment accounted for the largest market share in 2022

Composite materials are made up of multiple materials that are stacked together to give better ballistic protection, such as Aramid fibers, UHMWPE (Ultra-High-Molecular-Weight Polyethylene), and ceramics. These materials provide a good blend of strength, weight, and flexibility. For example, the FAST (Future Assault Shell Technology) ballistic helmet used by law enforcement and the military is comprised of a composite material with a shell made of Aramid fibers, UHMWPE, and ceramics.

Non-metal materials like aramid fibers & UHMWPE are lightweight, flexible, and strong. Because of their exceptional ballistic protection, these materials are commonly employed in the manufacture of bulletproof helmets. Non-metal materials have risen in popularity in recent years due to their comfort, mobility, and personalization possibilities. Metal materials have traditionally been used to make bulletproof helmets. Metals with great strength and durability, such as steel and titanium, are suitable for resisting penetration. Metal helmets, on the other hand, are heavy and can be uncomfortable to wear. Due to the development of more modern, lightweight materials, the usage of metal materials in bulletproof helmets has declined in recent years.

Military and Defense sector is expected to hold the significant revenue share

Military and defense section comprises military forces, special operations units, and other government entities. The rising need for lightweight and robust helmets, technological improvements, and the necessity for greater military safety are the major drivers for this category. Bulletproof helmets' performance has increased due to the use of sophisticated materials such as aramid fibers, ceramics, and composites. Law enforcement sector comprises police departments, SWAT teams, and other law enforcement entities. The increased danger of terrorism, rising crime rates, and the need for greater officer safety are the key drivers for this industry. Due to the rising frequency of high-powered weaponry, bulletproof helmets are becoming more widespread in police enforcement.

North American demand is projected to expand significantly over the forecast period

North America is one of the largest and most developed markets for bulletproof helmets, owing to significant demand from law enforcement agencies, military forces, and private security firms. During the projection period, the region is predicted to develop steadily, propelled by an increased emphasis on security measures and the rising danger of terrorism. The market is dominated by significant manufacturers that are continually spending R&D to produce new lightweight helmets that provide optimum protection and comfort. The United States is the region's largest market, accounting for the bulk of sales. Another key market in the area is Canada, which has a large demand for bulletproof helmets from its law enforcement and military.

Asia Pacific is expected to be the fastest growing in the global market over the forecast period. It arises as a result of increased knowledge of improved ballistic helmets in developing countries such as China and India. Furthermore, the lightweight helmet is widely employed for homeland security in South Korea, which aids market expansion.

Competitive Insight

Some of the major players operating in the global market include Argun, ArmorSource, Avon Protection, Protection Group, Sinoarmor, Ulbrichts, Hard Shell, MKU Limited, & Point-Blank Enterprises.

Recent Developments

- In January 2023, the Indian Army declared its plan to purchase bulletproof helmets, specifically for Sikh soldiers who could not use the other options. The agency will purchase 12,730 Kavro SCH 111 T.

- In April 2022, the Indian Army developed the 1st bulletproof helmet in the history. It can stop an AK-47 bullet round fired from a distance of 10 meters. It was developed as a part of the "Abhedya" project for the Indian Army.

Bulletproof Helmet Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1,060.73 million |

|

Revenue forecast in 2032 |

USD 1,713.02 million |

|

CAGR |

5.5% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2021- 2022 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Material, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Argun s.r.o., ArmorSource LLC, Avon Protection plc, Protection Group Denmark, Sinoarmor, Ulbrichts GmbH, Hard Shell FZE, MKU Limited (GKG Group), and Point Blank Enterprises Inc. |

FAQ's

key companies in Bulletproof Helmet Market are Argun, ArmorSource, Avon Protection, Protection Group, Sinoarmor, Ulbrichts, Hard Shell, MKU Limited.

The global bulletproof helmet market expected to grow at a CAGR of 5.5% during the forecast period.

The Bulletproof Helmet Market report covering key are material, application, and region.

key driving factors in Bulletproof Helmet Market are The rising number of security measures undertaken for counterterrorism activities by various governments is a significant factor driving the market.

The global bulletproof helmet market size is expected to reach USD 1713.02 million by 2032.