Bulk Filtration Market Size, Share, Trends, Industry Analysis Report: By Filtration System (Cartridge Filter, Bag Filter, Membrane Filter, Coalescer, Filter Press, and Others), Application, End Use, Fluid Type, Mounting, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 131

- Format: PDF

- Report ID: PM5240

- Base Year: 2024

- Historical Data: 2020-2023

Bulk Filtration Market Overview

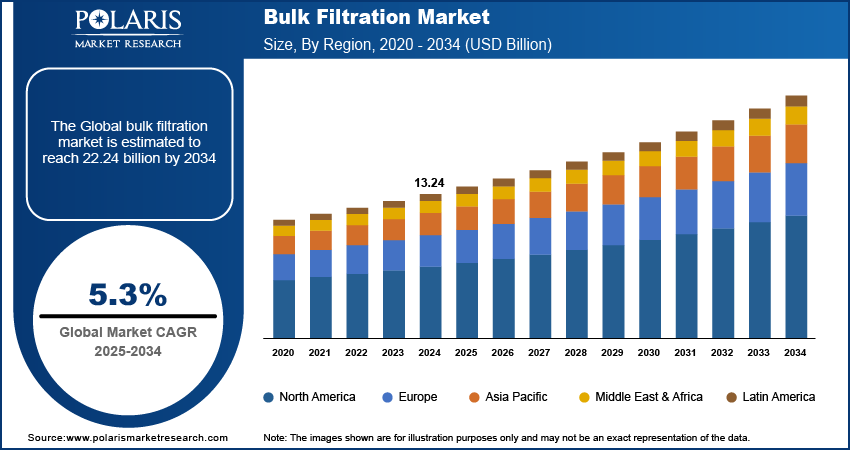

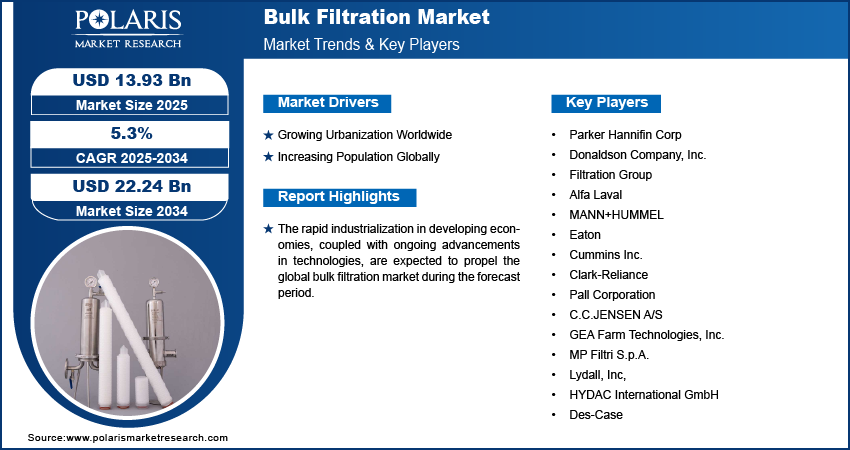

The bulk filtration market size was valued at USD 13.24 billion in 2024. The market is projected to grow from USD 13.93 billion in 2025 to USD 22.24 billion by 2034, exhibiting a CAGR of 5.3% during 2025–2034.

Bulk filtration is the process of separating solids from liquids or gases on a large scale. It plays a vital role in maintaining product purity and operational efficiency.

The rapid industrialization in developing economies is driving the bulk filtration market. According to the Economic Survey 2023–2024, 9.5% growth was witnessed in the Indian industrial sector. The volume of waste generated, both liquid and airborne, rises as industries expand. Industries such as manufacturing, chemicals, and food processing require effective industrial filtration systems to remove or lower impurities and contaminants from their operations activities, leading to a high demand for bulk filtration solutions.

The ongoing advancement in technologies is expected to propel the global bulk filtration market. Technological innovations in filtration processes, such as improved membrane technologies and advanced materials, enhance the efficiency of bulk filtration systems. These advancements allow for faster processing times and higher contaminant removal rates, making them more appealing to industries seeking optimal performance, thereby boosting demand.

To Understand More About this Research: Request a Free Sample Report

The bulk filtration market is driven by the imposition of stringent environmental regulations. Many industries face strict regulations governing the discharge of pollutants into air and water. Bulk filtration systems are essential for removing contaminants to meet these regulatory standards, compelling companies to invest in effective filtration solutions to avoid fines and legal repercussions.

Bulk Filtration Market Opportunity and Driver Analysis

Growing Urbanization Worldwide

The growing urbanization worldwide propels the global bulk filtration market growth. According to a report published by the World Bank, 4.4 billion inhabitants live in cities, and it is expected get double by 2050. Urbanization often leads to increased pollution from industrial activities, runoff, and sewage. This necessitates advanced bulk filtration solutions to manage and treat contaminated water, ensuring that it is safe for consumption and compliant with environmental regulations.

Increasing Population Globally

The increasing population globally is estimated to fuel the global bulk filtration market growth in the coming years. As per a report published by the United Nations, the global human population reached 8.0 billion in mid-November 2022 from an estimated 2.5 billion people in 1950, adding 1 billion people since 2010 and 2 billion since 1998. The demand for clean and potable water increases as the global population grows. Thus, owing to the rising population, there would be an increasing requirement for robust bulk filtration systems to treat water supplies, ensuring they meet safety and quality standards for consumption.

Bulk Filtration Market Segment Analysis

Bulk Filtration Market Assessment by Filtration System

Based on filtration system, the bulk filtration market is segmented into cartridge filters, bag filters, membrane filters, coalescers, filter presses, and others. The membrane filters segment dominated the market in 2024 due to their efficiency and versatility in various applications. Membrane filtration technologies, including microfiltration, ultrafiltration, nanofiltration, and reverse osmosis, excel at removing particles, bacteria, and dissolved solids from liquids. Industries such as water treatment, pharmaceuticals, and food & beverage increasingly rely on these systems due to their ability to deliver high-quality results with minimal chemical usage. The growing emphasis on sustainability and the need for cleaner processes further propel the adoption of membrane filters. Additionally, advancements in membrane materials and designs enhance performance, making them an attractive option for new installations and upgrades in existing systems.

The cartridge filters segment is expected to grow at a robust pace in the coming years, owing to the rising demand for efficient filtration solutions across various sectors, including industrial processes, water purification, and residential applications. The filters offer several advantages such as easy installation, low maintenance requirements, and effective particulate contaminants removal, which increases its adoption. The growing awareness of water quality and safety, coupled with increasing regulatory pressures, drives industries to adopt cartridge filtration systems for consistent performance and compliance. Moreover, the shift toward point-of-use water treatment solutions in residential settings contributes to the growing popularity of cartridge filters, as consumers seek convenient and reliable options for improving water quality in their homes.

Bulk Filtration Market Evaluation by Mounting

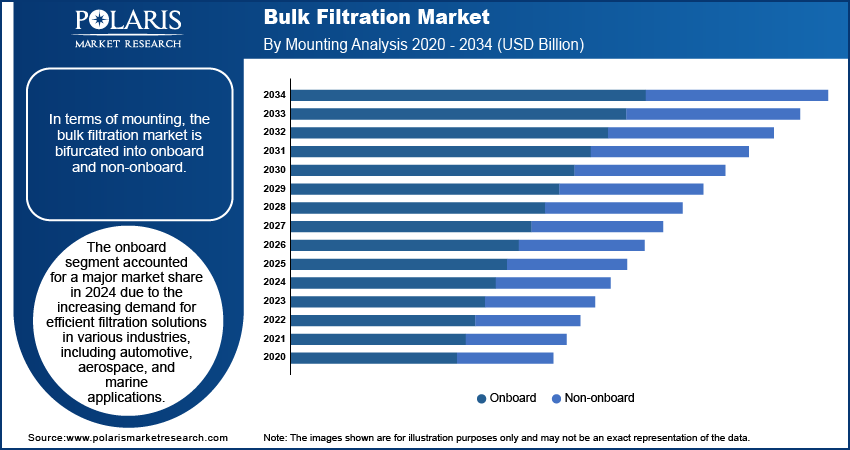

In terms of mounting, the bulk filtration market is bifurcated into onboard and non-onboard. The onboard segment accounted for a major market share in 2024 due to the increasing demand for efficient filtration solutions in various industries, including automotive, aerospace, and marine. Onboard systems integrate filtration directly within equipment, ensuring real-time treatment of fluids and gases. This approach enhances operational efficiency and reliability, as it prevents contamination and extends the life of machinery. The growth of the onboard segment aligns with the rising focus on performance and safety standards, especially in industries where the quality of fluids is critical for operational integrity. Furthermore, advancements in filtration technologies, such as compact designs and improved filter materials, make onboard systems more effective and easier to implement, thereby boosting their adoption across multiple industries.

The non-onboard segment is projected to grow at a rapid pace during the forecast period, owing to the increasing emphasis on centralized filtration systems in industrial and municipal applications. Non-onboard solutions offer significant advantages, including higher capacity and the ability to treat larger volumes of fluids or air, making them ideal for wastewater treatment plants, food processing facilities, and industrial manufacturing. The rising regulatory requirements regarding environmental protection and waste management further drive the adoption of these centralized systems, as they provide efficient ways to ensure compliance. Additionally, the trend toward automation and smart technologies in filtration systems enhances the appeal of non-onboard solutions, allowing for better monitoring and control.

Bulk Filtration Market Regional Insights

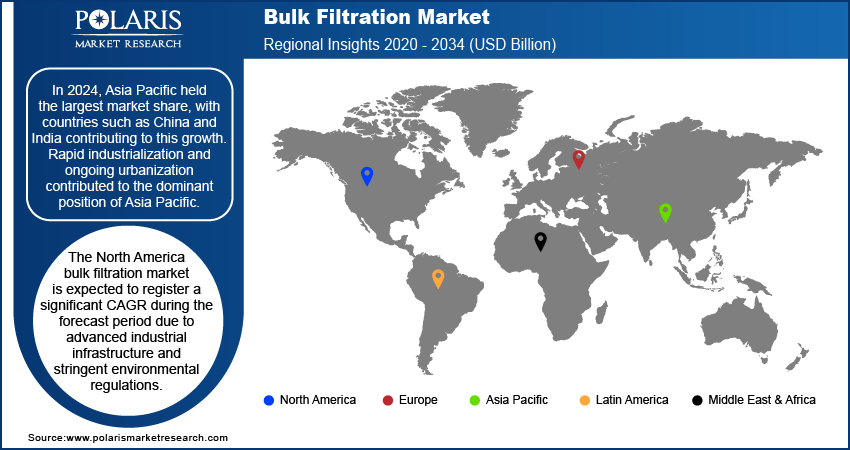

By region, the study provides bulk filtration market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific held the largest market share, with countries such as China and India contributing to this growth. Rapid industrialization, urbanization, and increasing population pressures drive the demand for effective filtration systems across various sectors, including manufacturing, municipal water treatment, and food processing. China, in particular, focuses on improving its environmental standards, prompting industries to adopt advanced filtration solutions to comply with government regulations. Moreover, the growing awareness of health and safety among consumers encourages industries to invest in high-quality filtration technologies.

The North America bulk filtration market is expected to register a significant CAGR during the forecast period due to advanced industrial infrastructure and stringent environmental regulations. The US dominated the regional market, benefiting from its robust manufacturing sector and growing emphasis on sustainability. Industries such as pharmaceuticals, food & beverage, and water treatment increasingly adopted advanced filtration technologies to meet regulatory compliance and improve product quality. The rising awareness of water quality issues and the need for effective wastewater treatment solutions further fueled the market in the region. Additionally, significant investments in research and development have led to innovative filtration technologies, enhancing performance and efficiency, which attracts various industries to adopt these technologies in North America.

Bulk Filtration Market – Key Players and Competitive Insights

Prominent market players are investing heavily in research and development to expand their offerings, which will boost the bulk filtration market growth in the coming years. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a competitive and rising market environment, market players must offer innovative solutions.

The bulk filtration market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are Parker Hannifin Corp; Donaldson Company, Inc.; Filtration Group; Alfa Laval; MANN+HUMMEL; Eaton; Cummins Inc.; Clark-Reliance; Pall Corporation; C.C.JENSEN A/S; GEA Farm Technologies, Inc.; MP Filtri S.p.A.; Lydall, Inc; HYDAC International GmbH; and Des-Case.

Parker Hannifin Corporation, founded in 1917 by Arthur LaRue Parker in Cleveland, Ohio, is a motion and control technology company. Over the decades, Parker Hannifin has evolved through strategic mergers and acquisitions, most notably its merger with Hannifin Corporation in 1957, which expanded its capabilities into hydraulic and pneumatic systems. Parker employs ∼61,000 people across 50 countries. The company's expertise spans various industries, including aerospace, industrial machinery, and life sciences, with a robust portfolio that includes filtration solutions essential for maintaining operational efficiency and compliance with environmental standards. In October 2019, The Industrial Gas Filtration and Generation Division of Parker Hannifin Corp launched a new cartridge filter.

Donaldson Company, Inc., established in 1915 by Frank Donaldson and headquartered in Minneapolis, Minnesota, is a global player in the filtration industry, specializing in the design and manufacture of filtration systems and replacement parts. The company initially focused on air filtration, creating the first effective air cleaner. Over the years, Donaldson has expanded its product offerings to include a wide range of filtration solutions for various sectors, including industrial, aerospace, agriculture, and pharmaceuticals. The company operates through diverse segments that encompass engine filtration, industrial filtration, and gas turbine systems, providing essential products such as air filters, liquid filters, dust collectors, and emission control systems.

List of Key Companies in Bulk Filtration Market

- Parker Hannifin Corp

- Donaldson Company, Inc.

- Filtration Group

- Alfa Laval

- MANN+HUMMEL

- Eaton

- Cummins Inc.

- Clark-Reliance

- Pall Corporation

- C.C.JENSEN A/S

- GEA Farm Technologies, Inc.

- MP Filtri S.p.A.

- Lydall, Inc,

- HYDAC International GmbH

- Des-Case

Bulk Filtration Market Developments

December 2023: Pall Corporation, a global player in filtration, separation, and purification, and Tanajib, a petroleum services company, announced the expansion of its Pall Arabia facility to include filter coalescer manufacturing capabilities to support the oil & gas and petrochemical industries in Saudi Arabia.

November 2022: Alfa Laval, a global company that provides products and solutions for heat transfer, separation, and fluid handling, introduced the new Alfa Laval Moatti 180 automatic self-cleaning filters featuring Atrium 2.0 technology for even greater efficiency and reduced pressure drop.

December 2021: Pall Arabia, a joint venture between Pall Corporation and Tanajib for Oil & Gas Company Ltd, expanded its capabilities to include a state-of-the-art manufacturing line for Pall’s SepraSol Plus liquid/gas coalescers.

Bulk Filtration Market Segmentation

By Filtration System Outlook (Revenue, USD Billion, 2020–2034)

- Cartridge Filter

- Bag Filter

- Membrane Filter

- Coalescer

- Filter Press

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Liquid-Liquid Filtration

- Solid-Liquid Filtration

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Heavy Equipment

- Machinery & Equipment

- Pulp & Paper Mills

- Commercial Marine

- Power Generation

- Steel & Aluminum Mills

By Fluid Type Outlook (Revenue, USD Billion, 2020–2034)

- Fuels

- Lubricants

- Hydraulic Fluids

By Mounting Outlook (Revenue, USD Billion, 2020–2034)

- Onboard

- Non-onboard

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Bulk Filtration Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 13.24 billion |

|

Market Size Value in 2025 |

USD 13.93 billion |

|

Revenue Forecast by 2034 |

USD 22.24 billion |

|

CAGR |

5.3 % from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global bulk filtration market size was valued at USD 13.24 billion in 2024 and is projected to grow to USD 22.24 billion by 2034.

The global market is projected to record a CAGR of 5.3% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

A few key players in the market are Parker Hannifin Corp; Donaldson Company, Inc.; Filtration Group; Alfa Laval; MANN+HUMMEL; Eaton; Cummins Inc.; Clark-Reliance; Pall Corporation; C.C.JENSEN A/S; GEA Farm Technologies, Inc.; MP Filtri S.p.A.; Lydall, Inc; HYDAC International GmbH; and Des-Case.

The cartridge filter segment is projected for significant growth in the global market during the forecast period.

The onboard segment dominated the market in 2024.