Building Twin Market Size, Share, Trends, Industry Analysis Report: By Offering (Software Solutions and Services), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 – 2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM5222

- Base Year: 2024

- Historical Data: 2020-2023

Building Twin Market Overview

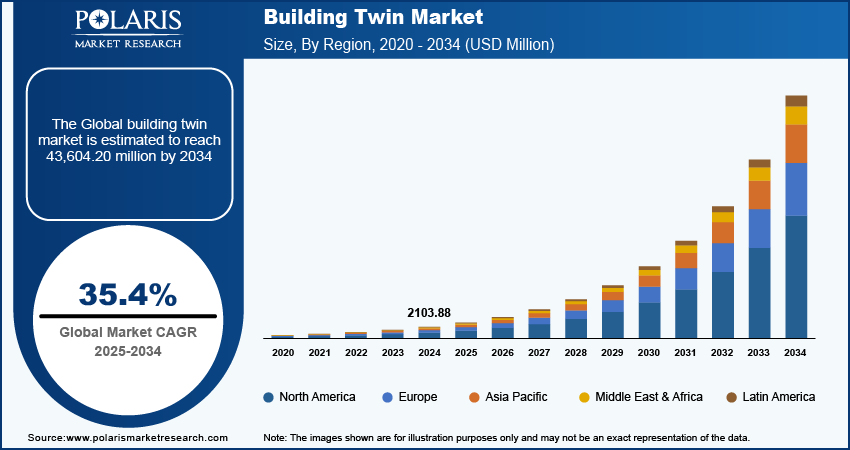

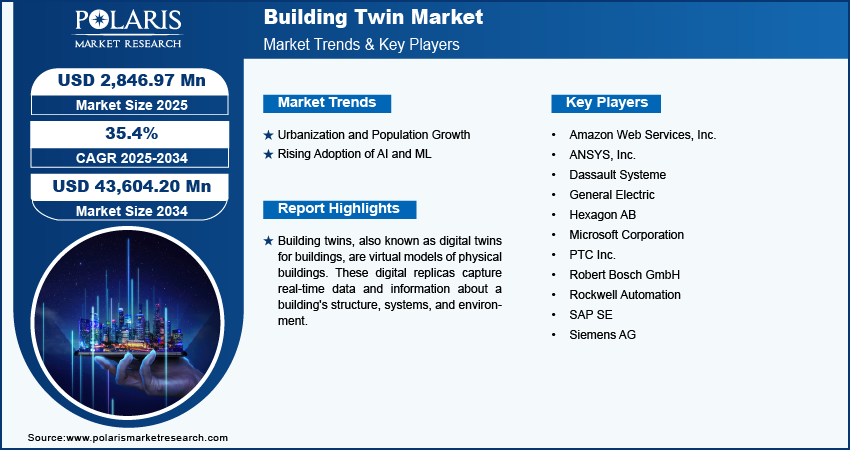

Global building twin market size was valued at USD 2,103.88 million in 2024. The market is projected to grow from USD 2,846.97 million in 2025 to USD 43,604.20 million by 2034, exhibiting a CAGR of 35.4% during the forecast period.

Building twins, also known as digital twins for buildings, are virtual models of physical buildings. These digital replicas capture real-time data and information about a building's structure, systems, and environment. The proliferation of IoT devices and smart building technologies provides the necessary data for building twins. Furthermore, building twins enhance facility management by providing detailed insights into the building’s operations.

To Understand More About this Research: Request a Free Sample Report

During the design and construction phases, building twins are being used to improve accuracy and efficiency. They allow for virtual testing of designs and construction plans, which reduces errors and rework, leading to cost savings and faster project completion. Additionally, the increasing number of private and commercial properties makes efficient property management more critical, significantly driving the building twin market.

Building Twin Market Dynamics

Building Twin Market Driver Analysis

Urbanization and Population Growth

The demand for building twins has accelerated with rapid urbanization and population growth. This surge drives the demand for new commercial and residential buildings, which has led to the increasing adoption of building twins for managing complex structures and large-scale facilities. For instance, according to the United Nations, the global population is projected to grow by approximately 2 billion people over the next three decades, rising from the current 8 billion to 9.7 billion by 2050 and potentially reaching a peak of nearly 10.4 billion in the mid-2080s.

Rising Adoption of AI and ML

The adoption of artificial intelligence (AI) and machine learning (ML) enables the development of building twins that are more adaptable and scalable across various building types and infrastructures, ranging from small office buildings to large industrial complexes. Furthermore, AI and ML technologies play a crucial role in increasing the capability of building twins to identify and respond to security threats by leveraging real-time security data analysis. These systems are proactively predicted and prevent potential breaches, consequently bolstering building safety and security, which propels demand for building twin.

Building Twin Market Segment Analysis

Building Twin Market Analysis by Offering Outlook

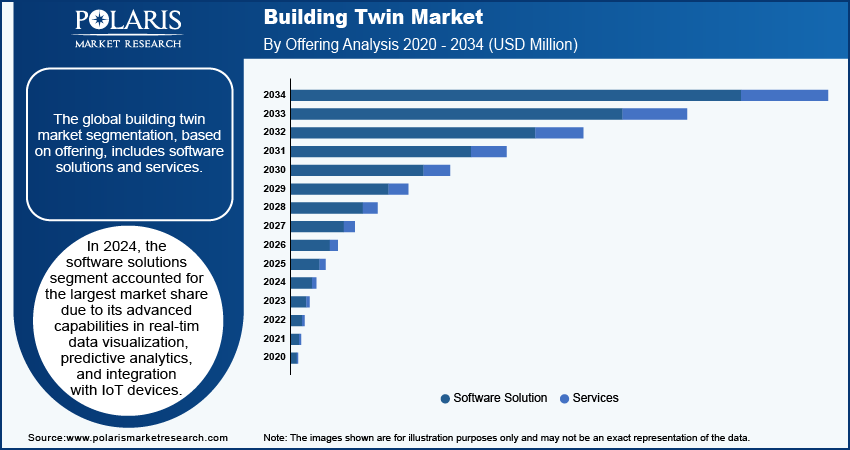

The global building twin market segmentation, based on offering, includes software solutions and services. In 2024, the software solutions segment accounted for the largest market share due to its advanced capabilities in real-time data visualization, predictive analytics, and integration with IoT devices, which enable comprehensive management and optimization of building systems, driving demand for advanced software platforms. Furthermore, the software solutions segment offers significant flexibility and customization options, allowing users to tailor the digital twin models to specific building types and operational needs. This adaptability makes software solutions more appealing to a wide range of industries, from commercial real estate to manufacturing, further boosting the market segment.

Building Twin Market Analysis by End-Use Industry Insights

The global building twin market segmentation, based on the end-use industry, includes commercial and industrial. The industrial category is expected to be the fastest-growing market segment due to its significant potential for optimizing complex operations and enhancing productivity. Industries such as manufacturing, oil and gas, and logistics are increasingly adopting building twin technologies to simulate and monitor their facilities in real time. These digital replicas enable industrial operators to predict equipment failures, optimize energy consumption, and streamline processes, leading to reduced downtime and operational costs. Additionally, the growing emphasis on sustainability and the need to comply with stringent environmental regulations are driving industries to invest in building twins to monitor and minimize their carbon footprints. The ability to integrate with advanced technologies such as IoT, AI, and predictive analytics further enhances the value of building twins in industrial settings.

Building Twin Market Share by Region

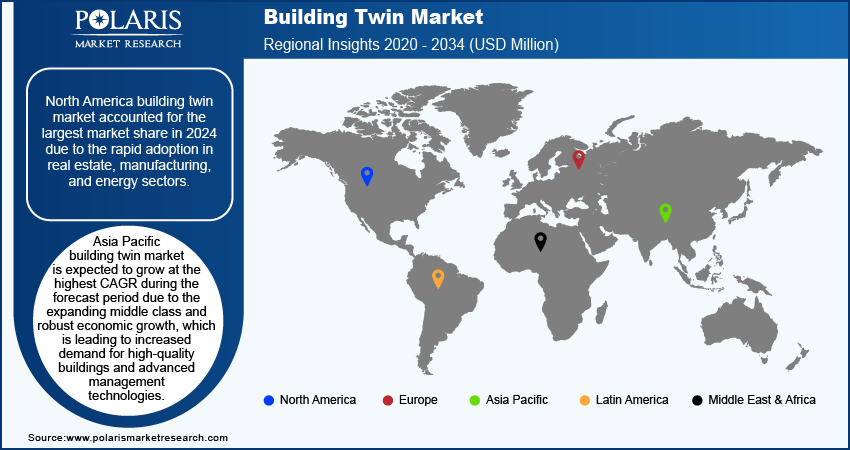

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America building twin market accounted for the largest market share in 2024 due to the rapid adoption in real estate, manufacturing, and energy sectors. Increased emphasis on sustainability and energy efficiency in North America has spurred the uptake of building twins. Organizations are leveraging digital twins to mitigate energy usage, decrease carbon footprints, and achieve sustainability objectives, contributing to the market's growth in the region. For instance, the US Department of Energy’s Office of Technology Transitions announced a USD 41.4 million investment in 50 clean energy projects through the Technology Commercialization Fund. These projects aim to advance clean energy technologies and contribute to climate change mitigation and economic stability, in line with US decarbonization goals, thus significantly contributing to the building twin market growth.

The US building twin market accounted for the largest market share in 2024 due to its well-established infrastructure and a large number of early adopters of smart technologies, providing a solid foundation for the widespread implementation of building twins. The market presence of leading software providers and technology integrators has also contributed to the dominance of building twins in the US.

Asia Pacific building twin market is expected to grow at the highest CAGR during the forecast period due to the expanding middle class and robust economic growth, which is leading to increased demand for high-quality buildings and advanced management technologies. The increasing number of businesses and residential projects seek to enhance their operational efficiency and sustainability. Thus, the adoption of building twins is expected to grow rapidly. Furthermore, the region is witnessing significant advancements in technology, including the development of IoT, AI, and cloud computing. These technologies are integral to building twin solutions, enabling more accurate simulations, real-time data analysis, and improved operational efficiency. The rapid advancement and adoption of these technologies contribute to the high growth rate of the building twin market.

China building twin market is expected to grow significantly during the forecast period due to its rapid urbanization, with numerous large-scale construction projects and the development of new urban areas. This surge in infrastructure expansion will create a higher demand for building twin technologies to effectively manage and optimize these developments, thereby increasing the overall demand for building twin solutions.

Building Twin Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the building twin market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the building twin industry must offer cost-effective items.

In recent years, the building twin market has offered some technological advancements. Major players in the market include ABB Group; Amazon Web Services, Inc.; ANSYS, Inc.; Dassault Systeme; General Electric; Hexagon AB; Microsoft Corporation; PTC Inc.; Robert Bosch GmbH; Rockwell Automation; SAP SE; and Siemens AG.

Siemens AG specializes in electrification, automation, and digitalization and operates in a diverse range of industries, such as energy, healthcare, financing, building technology, transportation, and manufacturing. The company provides a comprehensive range of products and services, including power generation systems, turbines, medical imaging equipment, trains, and automation software, as well as building technologies and smart grid solutions. In July 2023, Siemens is set to implement digital twin technology to model and simulate acoustics for the first time at the Großes Festspielhaus.

Amazon.com, Inc. is a multinational technology company that specializes in e-commerce, digital streaming, cloud computing, and artificial intelligence. The company operates into three segments: North America, International, and Amazon Web Services. In addition to its retail activities, Amazon designs manufactures and sells a range of electronic devices such as Fire tablets, Kindle e-readers, Fire TVs, Ring doorbells, Echo smart speakers, Blink security cameras, and eero networking products. Furthermore, Amazon is involved in the development and production of digital media content across various platforms. For instance, in December 2021, Amazon Web Services, Inc. launched IoT TwinMaker, a new service designed to facilitate the creation of digital twins for complex real-world systems such as factories, production lines, buildings, and industrial equipment. This service is intended to enable developers to efficiently generate accurate digital representations of physical assets, facilitating rapid prototyping and simulation for a wide range of applications.

List of Key Companies in Building Twin Industry Outlook

- ABB Group

- Amazon Web Services, Inc.

- ANSYS, Inc.

- Dassault Systeme

- General Electric

- Hexagon AB

- Microsoft Corporation

- PTC Inc.

- Robert Bosch GmbH

- Rockwell Automation

- SAP SE

- Siemens AG

Building Twin Industry Developments

November 2023: AWS and NVIDIA collaborated to introduce new supercomputing infrastructure to support the development of digital twins.

April 2024: Siemens and Microsoft, announced to converge Digital Twin Definition Language with W3C Thing Description Standard to provide customers with a consistent modeling experience and mitigate fragmentation in IoT.

June 2023: Hexagon AB, a digital reality solutions company, partnered with NVIDIA to enable industrial digital twin solutions. This collaboration integrates reality capture, AI, manufacturing twins, simulation, and visualization for real-time comparisons with real-world models.

Building Twin Market Segmentation

By Offering Outlook (Revenue - USD Million, 2020 - 2034)

- Software Solutions

- Services

By Application Outlook (Revenue - USD Million, 2020 - 2034)

- Design & Construction

- Facility Management

- Predictive Maintenance

- Safety and Security Management

- Other Applications

By End Use Outlook (Revenue - USD Million, 2020 - 2034)

- Commercial

- Industrial

By Regional Outlook (Revenue - USD Million, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Building Twin Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,103.88 Million |

|

Market Size Value in 2025 |

USD 2,846.97 Million |

|

Revenue Forecast in 2034 |

USD 43,604.20 Million |

|

CAGR |

35.4% from 2025 – 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global building twin market size was valued at USD 2,103.88 million in 2024.

The global market is projected to register at a CAGR of 35.4% during the forecast period, 2025-2034.

North America had the largest share of the global market in 2024 due to the rapid adoption of real estate.

The key players in the market are ABB Group; Amazon Web Services, Inc.; ANSYS, Inc.; Dassault Systeme; General Electric; Hexagon AB; Microsoft Corporation; PTC Inc.; Robert Bosch GmbH; Rockwell Automation; SAP SE; and Siemens AG.

The software solutions category dominated the market in 2024 due to its significant flexibility and customization options.

The industrial category had the highest share in the global market due to industries increasingly adopting building twin technologies to simulate and monitor their facilities.