Building Integrated Photovoltaic Market Size, Share, Trends, Industry Analysis Report: By Technology (Crystalline Silicon, Thin Film, and Others), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2025–2034

- Published Date:Feb-2025

- Pages: 128

- Format: PDF

- Report ID: PM5365

- Base Year: 2024

- Historical Data: 2020-2023

Building Integrated Photovoltaic Market Overview

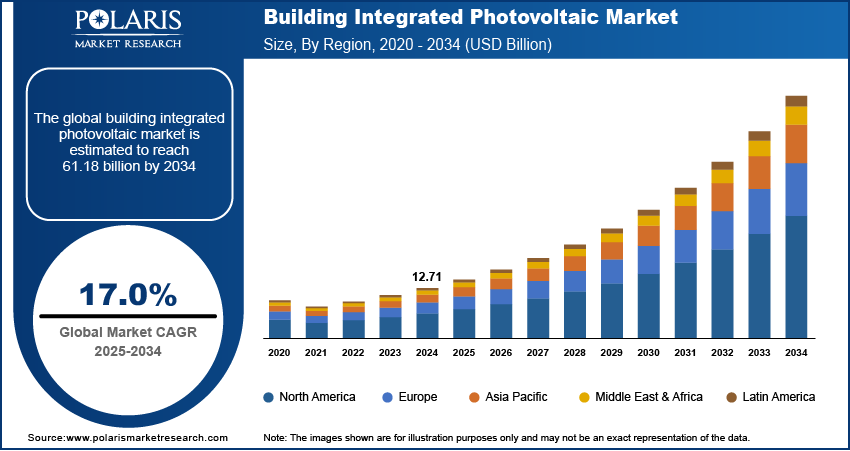

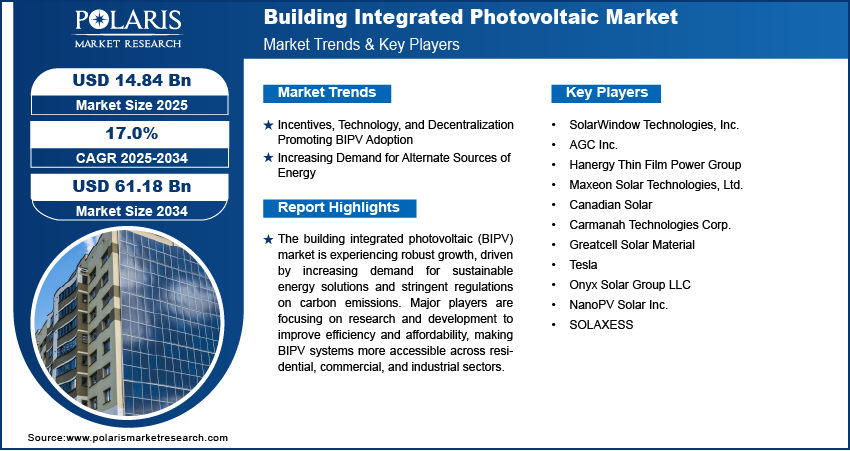

The global building integrated photovoltaic market size was valued at USD 12.71 billion in 2024. The market is projected to grow from USD 14.84 billion in 2025 to USD 61.18 billion by 2034, exhibiting a CAGR of 17.0% from 2025 to 2034.

Building integrated photovoltaics (BIPV) refers to solar energy technologies that are integrated into the building envelope, such as roofs, facades, or windows, serving both as a functional element and a power-generating system. BIPV systems generate electricity while enhancing the aesthetics and energy efficiency of buildings, contributing to renewable energy generation in urban environments.

The building integrated photovoltaic market is experiencing significant growth, driven by the increasing demand for sustainable and energy-efficient building solutions. As urbanization accelerates and governments implement stricter regulations on energy consumption and carbon emissions, BIPV technologies offer a dual advantage of generating renewable energy while improving building aesthetics. For instance, Ghana launched West Africa's first hydro-solar plant in January 2023, supported by USAID and NREL, which aims to reduce greenhouse gas emissions by 235,000 tons annually. The project integrates 50 MW of solar capacity with an existing hydroelectric dam, with plans to expand to 250 MW and include a 20-MW-hour battery storage system.

Major sectors contributing to market expansion include residential, commercial, and industrial applications, with innovative designs enabling seamless integration of solar panels into roofs, facades, and windows. Key players such as AGC, Hanergy, and others are investing in R&D to enhance the efficiency and affordability of BIPV systems, broadening their accessibility. These growing trend underscores the vital role of BIPV in promoting renewable energy solutions in the built environment.

To Understand More About this Research: Request a Free Sample Report

Building Integrated Photovoltaic Market Dynamics

Incentives, Technology, and Decentralization Promoting BIPV Adoption

Governments worldwide are implementing financial incentives such as tax credits, grants, and subsidies to encourage the adoption of BIPV solutions, making them more financially viable for homeowners and businesses. Technological innovations, such as improved solar cell efficiency and aesthetic designs, have made BIPV systems more appealing and easier to integrate into various building structures. Moreover, the trend towards decentralized energy systems allows for localized energy generation, reducing reliance on traditional power grids and enhancing energy security. For instance, in July 2020, the Swedish Energy Agency approved a project with RISE ETC to simplify BIPV installations on prefabricated buildings like datacenter modules. The initiative aimed to reduce planning time and costs, while improving resource efficiency, and provided a model to estimate energy production and financial savings from solar PV integration. This combination of incentives, technology, and decentralization positions BIPV as a vital component in the transition to sustainable urban energy solutions and drives the building integrated photovoltaic market development.

Increasing Demand for Alternate Energy Sources

BIPV offers a sustainable solution by integrating solar technology directly into building materials. Also, it enhances energy efficiency and aligns with green building initiatives that prioritize lowering carbon emissions. For instance, in 2022, the New York State Energy Research and Development Authority (NYSERDA) launched a project to incorporate BIPV panels into urban structures, supporting the city’s goal of reducing greenhouse gases by 85% by 2050. Such initiatives highlight the role of BIPV in meeting energy needs while promoting environmental sustainability in urban settings. Thus, the rising global demand for alternative energy sources is driving the building integrated photovoltaic market expansion.

Building Integrated Photovoltaic Market Segment Insights

Building Integrated Photovoltaic Market Evaluation by Technology Outlook

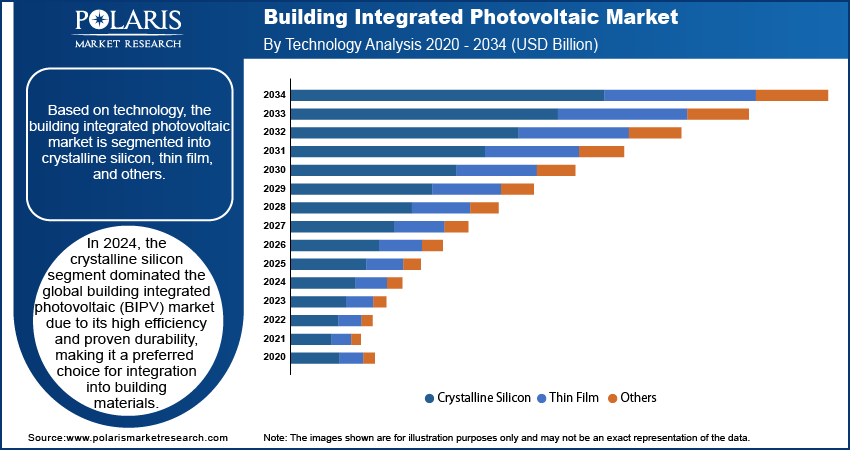

The global building integrated photovoltaic market segmentation, based on technology, includes crystalline silicon, thin film, and others. In 2024, the crystalline silicon segment dominated the global building integrated photovoltaic market due to its high efficiency and proven durability, making it a preferred choice for integration into building materials. Crystalline silicon solar cells, particularly monocrystalline, offer greater energy conversion efficiency than other technologies, which is critical for buildings in urban areas with limited space for solar installations. Additionally, crystalline silicon technology benefits from extensive research and development, resulting in consistent advancements that improve its performance, longevity, and affordability. Its long-established manufacturing base further supports widespread availability, making it a reliable and scalable option for large-scale BIPV projects.

Building Integrated Photovoltaic Market Assessment by End Use Outlook

The global building integrated photovoltaic market segmentation, based on end use, includes industrial, commercial, residential, and utility. The residential sector is expected to be the fastest growing segment in the building integrated photovoltaic (BIPV) market due to the rising awareness of sustainable energy solutions, government incentives, and a desire to reduce energy costs. Homeowners increasingly view BIPV as a dual-purpose investment that improves property aesthetics while generating renewable energy. Additionally, BIPV’s integration into roofs, facades, and windows aligns with green building certifications and sustainability goals, which are becoming more popular among residential consumers. The push for net-zero homes and advancements in BIPV aesthetics and installation ease are further accelerating its adoption in the residential segment.

Building Integrated Photovoltaic Market Regional Analysis

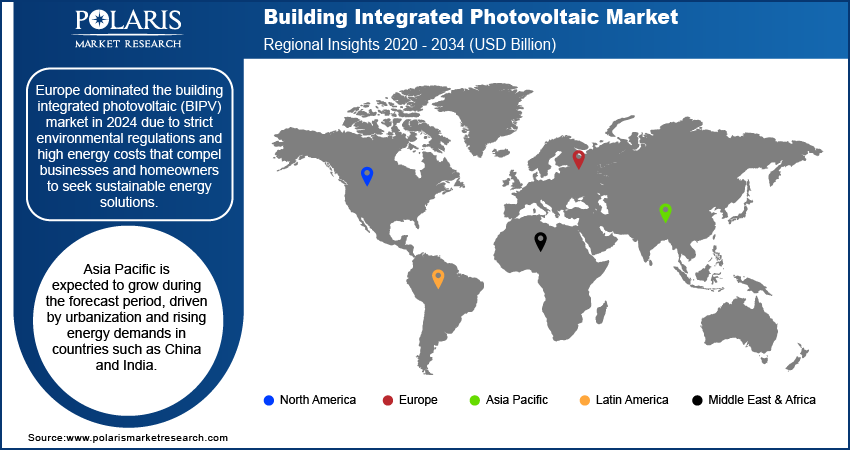

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe dominated the building integrated photovoltaic (BIPV) market in 2024, due to strict environmental regulations and high energy costs that compel businesses and homeowners to seek sustainable energy solutions. Countries such as Germany, France, and the Netherlands are at the forefront of this movement, having implemented robust climate policies that incentivize the adoption of renewable energy technologies. For instance, Germany's Renewable Energy Sources Act (EEG) has significantly boosted investments in solar energy, including BIPV systems, by offering feed-in tariffs and subsidies. This combination of supportive legislation and growing consumer awareness has led to increased demand for BIPV solutions in residential, commercial, and industrial applications, with innovative designs allowing for seamless integration of solar technology into architectural structures. As a result, Europe continues to set the benchmark for sustainable building practices globally.

The Asia Pacific building integrated photovoltaics (BIPV) market is expected to grow during the forecast period due to urbanization and rising energy demands in countries like China and India. Government initiatives, such as China’s 14th Five-Year Plan and India’s investments in solar energy, are promoting renewable energy solutions. Furthermore, advancements in BIPV technology are improving efficiency and aesthetics, making these systems more appealing for urban infrastructures. The increasing awareness of climate change and the need for energy independence are also motivating businesses and homeowners to adopt BIPV, positioning the region as a leader in sustainable building practices.

Building Integrated Photovoltaic Market – Key Players and Competitive Insights

The competitive landscape of the building integrated photovoltaic market is characterized by a mix of global leaders and regional players competing for market share through innovation, strategic partnerships, and geographical expansion. Major companies such as SolarWindow Technologies, Canadian Solar, and others leverage their robust research and development capabilities and extensive distribution networks to provide advanced BIPV solutions for various applications, including residential, commercial, and industrial sectors. These leading firms focus on product innovation, enhancing efficiency, aesthetic integration, and cost-effectiveness to meet the rising demand for sustainable energy solutions. Simultaneously, smaller regional companies are emerging with specialized BIPV products tailored to local markets, offering unique solutions that cater to specific needs. Competitive strategies in this market include mergers and acquisitions, collaborations with technology providers, and the diversification of product offerings to strengthen market presence in key regions. A few key major players are SolarWindow Technologies, Inc.; AGC Inc.; Hanergy Thin Film Power Group; Maxeon Solar Technologies, Ltd.; Canadian Solar; Carmanah Technologies Corp.; Greatcell Solar Material; Tesla; Onyx Solar Group LLC; NanoPV Solar Inc.; and SOLAXESS.

Canadian Solar Inc. operates in the renewable energy sector, particularly known for its BIPV advancements in Ontario. The company specializes in solar photovoltaic (PV) modules and is a prominent player in large-scale solar projects. It operates in over 150 countries and has a vertically integrated business model, allowing it to manage the entire production process, from ingots to solar panels. With a significant project pipeline of 26.3 GW and extensive manufacturing capabilities across multiple continents, Canadian Solar has established itself as one of the solar panel manufacturers globally, expanding its global footprint and product offerings, including innovative technologies such as PERC and bifacial solar panels.

AGC Inc., formerly known as Asahi Glass Co., Ltd., is a leading global materials manufacturer headquartered in Tokyo, Japan. Established in 1907, AGC has evolved from its origins in glass production to encompass a diverse portfolio that includes chemicals, electronics, and ceramics. The company is recognized as the largest glass manufacturer worldwide and is a key player within the Mitsubishi Group. AGC's commitment to innovation is evident in its extensive research and development efforts. The company operates on a global scale, with manufacturing facilities and subsidiaries across Asia, Europe, and the Americas, focusing on high-performance materials for various industries, including automotive, construction, and electronics. In November 2023, AGC showcased its BIPV product, SunEwat (known as Sunjoule in Japan), at the Japan Pavilion during the 28th UN Climate Change Conference (COP28) in Dubai.

List of Key Companies in Building Integrated Photovoltaic Market

- SolarWindow Technologies, Inc.

- AGC Inc.

- Hanergy Thin Film Power Group

- Maxeon Solar Technologies, Ltd.

- Canadian Solar

- Carmanah Technologies Corp.

- Greatcell Solar Material

- Tesla

- Onyx Solar Group LLC

- NanoPV Solar Inc.

- SOLAXESS

Building Integrated Photovoltaic Industry Developments

In June 2024, DAH Solar announced the mass production of its Full-Screen DBB (no-bus bar) PV Module, which took six months from design to production. This module offers higher efficiency and performance compared to traditional PV modules.

In March 2022, Canadian Solar Inc. announced the commencement of mass production for its new 54-cell format module featuring a 182 mm cell designed for residential, commercial, and industrial rooftop solar systems.

Building Integrated Photovoltaic Market Segmentation

By Technology Outlook (Volume – Thousand sq. m; Capacity – MW, Revenue – USD Billion, 2020–2034)

- Crystalline Silicon

- Thin Film

- Others

By Application Outlook (Volume – Thousand sq. m; Capacity – MW, Revenue – USD Billion, 2020–2034)

- Roof

- Glass

- Wall

- Façade

- Others

By End Use Outlook (Volume – Thousand sq. m; Capacity – MW, Revenue – USD Billion, 2020–2034)

- Industrial

- Commercial

- Residential

- Utility

By Regional Outlook (Volume – Thousand sq. m; Capacity – MW, Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Building Integrated Photovoltaic Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.71 billion |

|

Market Size Value in 2025 |

USD 14.84 billion |

|

Revenue Forecast by 2034 |

USD 61.18 billion |

|

CAGR |

17.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Thousand sq. m; Capacity, MW; Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global building integrated photovoltaic market size was valued at USD 12.71 billion in 2024 and is projected to grow to USD 61.18 billion by 2034.

• The market is projected to register a CAGR of 17.0% from 2025 to 2034.

• Europe dominated the global market in 2024, driven by strict environmental regulations and high energy costs that compel businesses and homeowners to seek sustainable energy solutions.

• A few key players in the market are SolarWindow Technologies, Inc.; AGC Inc.; Hanergy Thin Film Power Group; Maxeon Solar Technologies, Ltd.; Canadian Solar; Carmanah Technologies Corp.; Greatcell Solar Material; Tesla; Onyx Solar Group LLC; NanoPV Solar Inc.; and SOLAXESS.

• In 2024, the crystalline silicon segment dominated the global building integrated photovoltaic market due to its high efficiency and proven durability, making it a preferred choice for integration into building materials.

• The residential sector is expected to be the fastest growing segment in the building integrated photovoltaic (BIPV) market.