Building Information Modeling Market Size, Share, Trends, Industry Analysis Report: By Solution Type (Software and Services), Project Type, Deployment Type, Building Type, Application, End User, and Region (North America, Europe, Asia Pacific, Latin America, And Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Oct-2024

- Pages: 119

- Format: PDF

- Report ID: PM5097

- Base Year: 2023

- Historical Data: 2019-2022

Building Information Modeling Market Overview

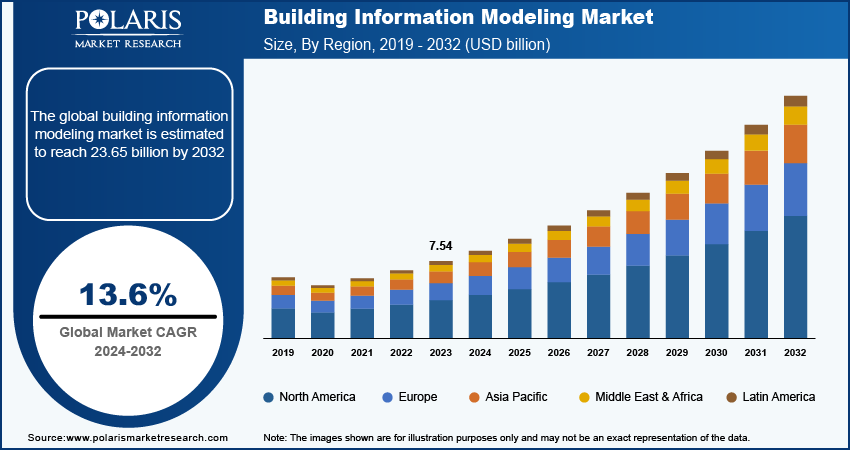

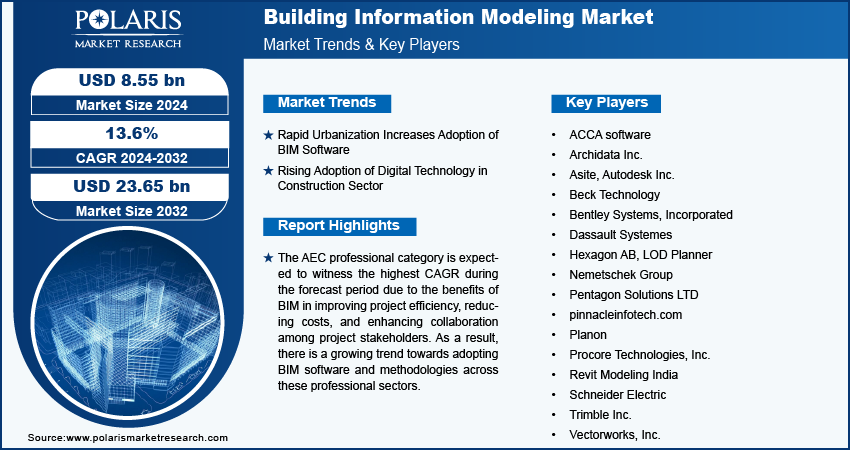

Global building information modeling market size was valued at USD 7.54 billion in 2023. The market is projected to grow from USD 8.55 billion in 2024 to USD 23.65 billion by 2032, exhibiting a CAGR of 13.6% during the forecast period.

Building information modeling (BIM) is a digital representation of the physical and functional characteristics of a building or infrastructure. It is a process supported by various tools, technologies, and methodologies that enable the creation and management of a comprehensive digital model throughout a project's lifecycle, from design and construction to operation and maintenance. It has revolutionized the architecture, engineering, and construction (AEC) industry by transforming the way buildings and infrastructure are planned, designed, constructed, and managed.

The building information modeling market has experienced significant growth over the past decade, driven by advancements in technology and a shift toward sustainable building practices. Moreover, BIM software helps architects, engineers, contractors, and project managers to work together in a coordinated manner, reducing errors, improving productivity, and enhancing decision-making throughout the project lifecycle. This meets the growing demand for efficient project delivery and propels the building information modeling market growth.

To Understand More About this Research: Request a Free Sample Report

The Building Information Modeling (BIM) market is experiencing significant growth, driven by key components such as 3D modeling, data integration, visualization, simulation, and collaboration tools. These technologies enable stakeholders to simulate construction processes, analyze performance, and optimize building operations efficiently.

Global adoption of BIM is being accelerated by government mandates and widespread recognition within the Architecture, Engineering, and Construction (AEC) industry of its efficiency and cost-saving potential. As the AEC sector continues to advance digitally, BIM is well-positioned to integrate emerging technologies like artificial intelligence (AI), machine learning, and the Internet of Things (IoT).

This integration will pave the way for smarter and more sustainable built environments, further increasing the demand for BIM solutions. As the market evolves, stakeholders will increasingly leverage BIM to enhance project outcomes and streamline workflows, solidifying its role as a cornerstone of modern construction practices.

Building Information Modeling Market Drivers and Trends

Rapid Urbanization Increases Adoption of BIM Software

As populations grow and urban areas expand, there is a pressing need for infrastructure development, housing, transportation networks, and utilities. This surge in smart city construction activity has driven the adoption of BIM software. Urban projects tend to be more complex due to dense populations, limited space, and intricate infrastructure requirements. BIM allows stakeholders to manage these complexities by providing a digital platform to visualize, design, and simulate various aspects of the project. This helps in coordinating multiple disciplines (architecture, engineering, construction) and ensuring seamless integration of building systems.

In dense urban environments, construction project coordination and management are crucial to avoid delays, cost overruns, and disruptions. BIM enhances collaboration among stakeholders by providing real-time access to project data, allowing for better decision-making and proactive issue resolution.

For instance, in January 2024, a report from the World Bank Group highlighted India's rapid urbanization. By 2036, cities are projected to house 600 million people, constituting 40% of the population and contributing nearly 70% to GDP. With substantial urban infrastructure yet to be built, about 70% by 2047, significant investments, estimated at $840 billion by 2036, indicate a growing demand for solutions as BIM to manage and develop urban infrastructure efficiently.

Rising Adoption of Digital Technology in Construction Sector

The building information modeling market is experiencing significant growth, driven by the adoption of digital technologies in construction sectors, including BIM, to streamline workflows and enhance productivity across the construction lifecycle. BIM allows for the creation of detailed 3D models that integrate various aspects of a building project, such as architecture, structural engineering, and MEP (Mechanical, Electrical, Plumbing) systems. This integration reduces errors, minimizes rework, and speeds up project delivery. BIM promotes collaboration among different stakeholders—architects, engineers, contractors, and clients—by providing a centralized platform for sharing and accessing project information. Real-time collaboration improves communication, coordination, and decision-making, leading to smoother project execution.

This trend is driven by its ability to enhance efficiency, collaboration, cost management, quality, safety, regulatory compliance, data-driven decision-making, and sustainability. As urban areas increasingly undergo construction development to meet growing population demands, the integration of BIM is crucial for managing complex urban projects effectively.

For instance, in September 2022, Autodesk introduced a range of new capabilities within Autodesk Construction Cloud aimed at enhancing the utilization of BIM throughout construction projects.

In November 2020, Autodesk Inc. introduced a cloud-based AEC (Architecture, Engineering, and Construction) solution tailored for the design industry. This innovation seamlessly integrates with Autodesk Construction Cloud and BIM 360, offering features such as Autodesk BIM Collaborate. Such companies embrace digital transformation in BIM and continue to play a pivotal role in shaping the future of the market and driving the building information modeling market revenue.

Building Information Modeling Market Segment Insights

Building Information Modeling Solution Type Insights

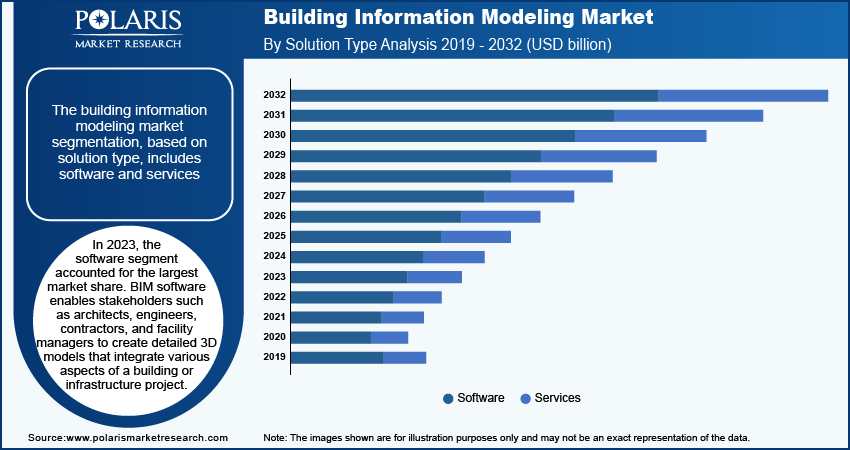

The building information modeling market segmentation, based on solution type, includes software and services. In 2023, the software segment accounted for the largest market share. BIM software enables stakeholders such as architects, engineers, contractors, and facility managers to create detailed 3D models that integrate various aspects of a building or infrastructure project. These models encompass architectural design, structural engineering, MEP (Mechanical, Electrical, Plumbing) systems, and more, providing a comprehensive view of the project.

The BIM software market is competitive, with numerous vendors continually innovating to offer enhanced features and better user experiences. This competition fosters innovation and drives the adoption of BIM across various sectors of the construction industry.

For instance, in May 2023, Autodesk introduced Autodesk Forma, an industry cloud aimed at optimizing workflows across design, construction, and operations teams. Its contextual modeling simplifies the initiation of new building information modeling (BIM) projects, allowing users to create a 3D model of the entire project area swiftly. This introduction underscores the growing software segment within the building information modeling market, catering to enhanced efficiency and creativity in building information modeling projects.

Building Information Modeling End User Insights

The building information modeling market segmentation, based on end users, includes builders & contractors, AEC professionals, consultants & facility managers, and others. The AEC professional category is expected to witness the highest CAGR during the forecast period due to the benefits of BIM in improving project efficiency, reducing costs, and enhancing collaboration among project stakeholders. As a result, there is a growing trend towards adopting BIM software and methodologies across these professional sectors.

Modern construction projects are increasingly complex, necessitating advanced tools such as BIM for managing design intricacies, coordinating tasks, and optimizing construction phases. AEC professionals use BIM to streamline processes, identify clashes, sequence construction activities effectively, and enhance overall project management.

For instance, in April 2024, ALLPLAN, a provider of BIM solutions for the AEC industry, unveiled Allplan 2024-1, a significant update aimed at boosting productivity and enhancing design-to-build workflows. With new cloud-based processes and enhanced BIM functionalities, Allplan 2024-1 supports sustainable design practices and accelerates project delivery. These innovations contribute to driving the demand for AEC professionals in the building information modeling market by enabling more efficient and environmentally conscious project management.

Building Information Modeling Regional Insights

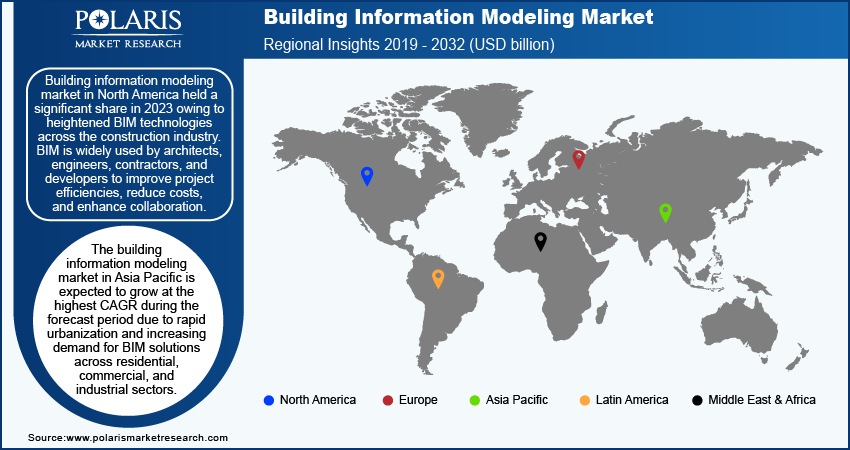

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Building information modeling market in North America held a significant share in 2023 owing to heightened BIM technologies across the construction industry. BIM is widely used by architects, engineers, contractors, and developers to improve project efficiencies, reduce costs, and enhance collaboration.

The presence of major companies such as Autodesk Inc., Archidata Inc., and Trimble Inc. offers their solutions to strengthen the building information modeling market landscape in North America further. These companies in North America leverage BIM to differentiate themselves, improve project outcomes, and meet client expectations effectively, further driving the BIM market demand.

In 2023, the U.S. Building Information Modeling (BIM) market held the largest share, driven by a surge in construction activity and the widespread adoption of BIM across the sector. Architects, engineers, contractors, and developers are increasingly utilizing BIM to improve project coordination, reduce errors, and enhance collaboration. This trend underscores the effectiveness of BIM in streamlining processes and delivering more efficient construction outcomes.

For instance, in July 2024, the US Census Bureau reported that construction spending in May 2024 reached an estimated seasonally adjusted annual rate of $2,139.8 billion, with a revised April estimate of $2,142.1 billion. This marks a steady increase from the $2,011.8 billion recorded in May 2023. Over the first five months of 2024 year, construction spending counted $836.3 billion, representing an 8.8% growth compared to the same period in 2023. These underscore the growing construction activity in the US, which drives demand for BIM solutions and increases the building information modeling market revenue.

The building information modeling market in Canada held a significant share due to technological innovation in BIM software and related technologies, which enhance the capabilities of BIM and support more efficient project delivery.

The building information modeling market in Asia Pacific is expected to grow at the highest CAGR during the forecast period due to rapid urbanization and increasing demand for BIM solutions across residential, commercial, and industrial sectors.

India's building information modeling market held the largest market share in 2023, driven by rising BIM centers with the key player's partnership.

For instance, in April 2024, Neilsoft and Fujita Corporation unveiled their plan to significantly expand their cooperative efforts by enlarging their BIM Center in Pune, India, from a current team of 90 persons to accommodate 300 persons. This expansion highlights the increasing demand for BIM technology services and underscores the strengthening of bilateral business relations between Japan and India. On the other hand, Japan's building information modeling market is expected to continue its significant growth during the forecast period.

Building Information Modeling Key Market Players & Competitive Insights

Leading market players are pivotal in advancing BIM solutions, enhancing project efficiencies, and shaping industry standards. Competitive insights into their strategies, innovations, and market dynamics provide a comprehensive view of how BIM is transforming the architecture, engineering, and construction (AEC) sector globally. This introduction explores the roles of these key players, their contributions to BIM market developments, and the competitive dynamics driving the growth of the industry.

The continuous technology in BIM serves as a transformative force, enhancing project efficiency, collaboration, and sustainability across construction projects worldwide. Understanding the strategies and innovations of building information modeling market players, as well as emerging challengers, illuminates the competitive dynamics that drive advancements in digital construction solutions. This explores the innovative trends, key players, and competitive strategies shaping the building information modeling market with new developments.

Major players in the building information modeling market includes ACCA software; Archidata Inc.; Asite; Autodesk Inc.; Beck Technology; Bentley Systems; Incorporated; Dassault Systemes; Hexagon AB; LOD Planner; Nemetschek Group; Pentagon Solutions LTD; pinnacleinfotech.com; Planon; Procore Technologies, Inc.; Revit Modeling India; Schneider Electric; Trimble Inc.; and Vectorworks, Inc.

Autodesk Inc. is a prominent software development company specializing in digital prototyping, 3D designs, sustainable design, consumer software, media & entertainment, cloud services, PLM, and mobile applications. Its technology spans architecture, engineering, construction, product design, manufacturing, and media & entertainment sectors, empowering creative and innovative design solutions. Autodesk's software portfolio includes industry-leading tools such as Revit, AutoCAD, Maya, Fusion 360, 3ds Max, SketchBook, and more, catering to both personal computers and mobile devices. In December 2021, Capgemini and Autodesk bolstered their collaboration to enhance the delivery of comprehensive building information modeling platforms and digital transformation services.

Trimble Inc. is a technology company that empowers customers to innovate in the construction, measurement, agriculture, and transportation sectors, aiming to enhance quality of life. The company's expertise in positioning, modeling, connectivity, and data analytics bridges the gap between digital and physical realms, fostering productivity, safety, and sustainability. Trimble offers purpose-built products, enterprise lifecycle solutions, and industry cloud services that revolutionize critical industries as construction and geospatial mapping. In March 2024, Trimble declared the release of the 2024 versions of its Tekla software suite, designed for constructible Building Information Modeling (BIM), structural engineering, and steel fabrication management, further solidifying its commitment to advancing digital solutions in these sectors.

List of Key Companies in Building Information Modeling Market

- ACCA software

- Archidata Inc.

- Asite

- Autodesk Inc.

- Beck Technology

- Bentley Systems, Incorporated

- Dassault Systemes

- Hexagon AB

- LOD Planner

- Nemetschek Group

- Pentagon Solutions LTD

- pinnacleinfotech.com

- Planon

- Procore Technologies, Inc.

- Revit Modeling India

- Schneider Electric

- Trimble Inc.

- Vectorworks, Inc.

Building Information Modeling Industry Developments

June 2023: OpenSpace introduced OpenSpace BIM+, a suite of user-friendly 3D tools facilitating faster job completion for field teams and Virtual Design and Construction (VDC) teams through enhanced BIM coordination on-site.

August 2020: Spacewell, a part of Nemetschek Group, launched its MCS Integrated Workplace Management System (IWMS), featuring a unified user interface and seamless user experience across devices. This integration supports the easy adoption of BIM-enabled Facility Management (FM), enabling organizations to optimize building operations and maintenance effectively.

April 2023: Asite announced its acquisition of 3D Repo, a player in cloud-based Building Information Modeling (BIM) collaboration software. This merger combines two innovative firms with complementary technologies and expertise, aiming to advance digital transformation in the construction industry.

Building Information Modeling Market Segmentation

By Solution Type Outlook

- Software

- Services

By Project Type Outlook

- Preconstruction

- Construction

- Operations

By Deployment Type Outlook

- On Premises

- Cloud Based

By Building Type Outlook

- Residential

- Commercial

- Industrial

- Public Infrastructure

- Others

By Application Outlook

- Construction & Design

- Planning & Modelling

- Asset Management Building System Analysis & Maintenance Scheduling

- Others

By End User Outlook

- Builders & Contractors

- AEC Professionals

- Consultants & Facility Managers

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Building Information Modeling Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 7.54 billion |

|

Market Size Value in 2024 |

USD 8.55 billion |

|

Revenue Forecast in 2032 |

USD 23.65 billion |

|

CAGR |

13.6% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global building information modeling market size was valued at USD 7.54 billion in 2023 and is expected to grow at 23.65 billion in 2032.

The global market is expected to exhibit a CAGR of 13.6% during the forecast period, 2023-2032.

Asia Pacific building information modeling market is expected to grow at the highest CAGR during the forecast period.

The key players in the market are ACCA software; Archidata Inc.; Asite; Autodesk Inc.; Beck Technology; Bentley Systems; Incorporated; Dassault Systemes; Hexagon AB; LOD Planner; Nemetschek Group; Pentagon Solutions LTD; pinnacleinfotech.com; Planon; Procore Technologies, Inc.; Revit Modeling India; Schneider Electric; Trimble Inc.; and Vectorworks, Inc.

In 2023, the software segment accounted for the largest market share.

The AEC professional category is expected to witness the highest CAGR during the forecast period.