Building and Construction Sheets Market Size, Share, Trends, Industry Analysis Report: By Product, Function, Application, Distribution Channel (Direct and Dealer), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 125

- Format: PDF

- Report ID: PM5296

- Base Year: 2024

- Historical Data: 2020-2023

Building and Construction Sheets Market Overview

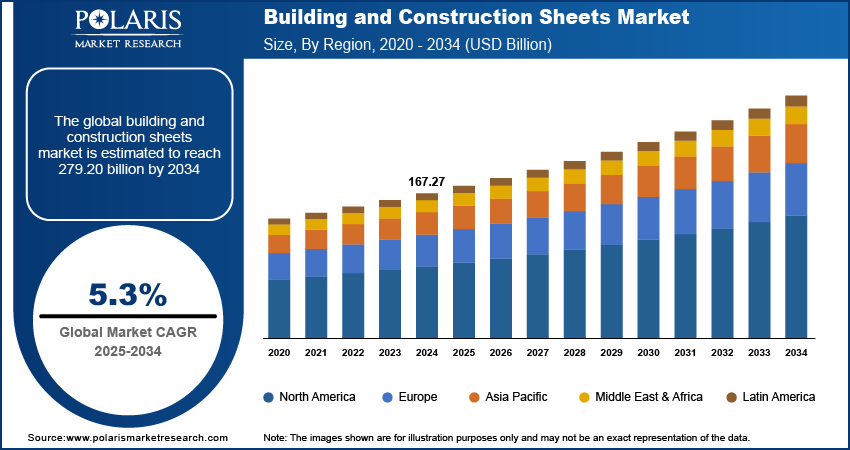

The building and construction sheets market size was valued at USD 167.27 billion in 2024. The market is projected to grow from USD 175.70 billion in 2025 to USD 279.20 billion by 2034, exhibiting a CAGR of 5.3% during 2025–2034.

Building and construction sheets are versatile products used in construction for a range of applications. These sheets are designed for durability and performance, offering benefits such as weather resistance, moisture protection, thermal insulation, and structural reinforcement to the buildings.

The growing emphasis on lightweight materials in the construction industry is driving the building and construction sheets market demand. Builders worldwide prefer lightweight materials by replacing traditional bricks for better efficiency and environmental protection, due to which the demand for construction sheets is rising. Builders primarily incorporate these lightweight sheets for their advantages, such as easier handling and faster installation. Additionally, the growing preference for faster construction and cost-effective building solutions is fueling the shift toward these materials.

To Understand More About this Research: Request a Free Sample Report

Technological advancements in building and construction sheets are expected to provide various growth opportunities. New formulations are likely to reduce production costs while improving the durability and sustainability of these sheets. As a result, the rising adoption of technological advancements in sheets is anticipated to encourage wider adoption of construction sheets among various end users, propelling the building and construction sheets market development.

Building and Construction Sheets Market Driver Analysis

Rising Investments in Construction

Growth in capital funding is supporting the company to spend more on advanced materials for better and faster output. According to the US Department of Treasury, the US funded USD 1.2 trillion for construction development under the Bipartisan Infrastructure Law, showcasing the large volume of investments in construction. Such an increase in investments is driving the demand for advanced materials such as construction sheets. Thus, rising investments in construction fuel the building and construction sheets market growth.

Growth in Urbanization

The growth of urbanization is increasing the demand for housing, commercial spaces, and infrastructure, which is driving the demand for building materials like construction sheets. Many people are moving to cities, which propels the requirement for faster and more efficient construction, leading to a higher demand for materials that are durable, lightweight, and easy to use. For instance, according to the United Nations, currently, 68% of the global population lives in urban areas, showcasing the growth in urbanization. This growth in urbanization is boosting the building and construction sheets market expansion.

Building and Construction Sheets Market Segment Analysis

Building and Construction Sheets Market Assessment by Product Outlook

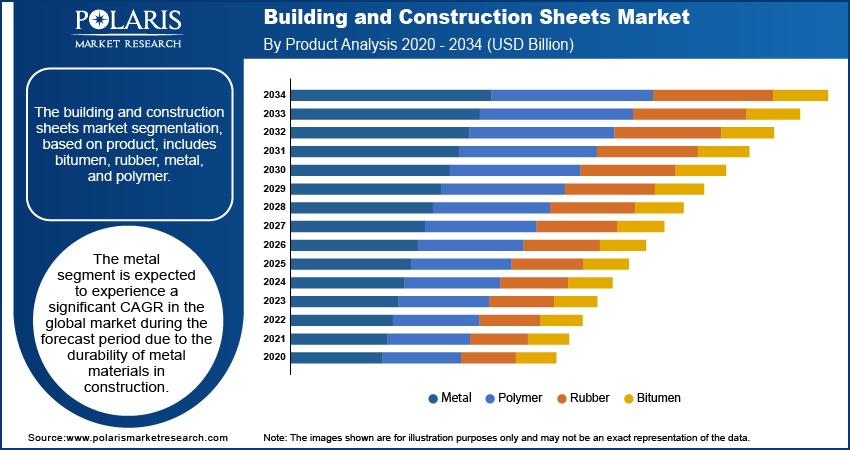

The building and construction sheets market segmentation, based on product, includes bitumen, rubber, metal, and polymer. The metal segment is expected to experience a significant CAGR in the global market during the forecast period. Metal materials, such as steel and aluminum, are highly durable and resistant to weather, which makes them ideal for construction projects. Their strength and versatility make them popular for residential and commercial buildings. Therefore, the durability of metal materials is driving the metal segment growth in the global market.

Building and Construction Sheets Market Evaluation by Application Outlook

The building and construction sheets market segmentation, based on application, includes flooring, walls & ceiling, windows, doors, roofing, building envelop, electrical, HVAC, and plumbing. The roofing segment dominated the building and construction sheets market share in 2024 due to the rise in residential and nonresidential construction projects. The increasing demand for new homes, offices, and commercial buildings is fueling the need for durable and cost-effective roofing materials. This growing construction activity is propelling the roofing segment growth in the global market.

Building and Construction Sheets Market Regional Insights

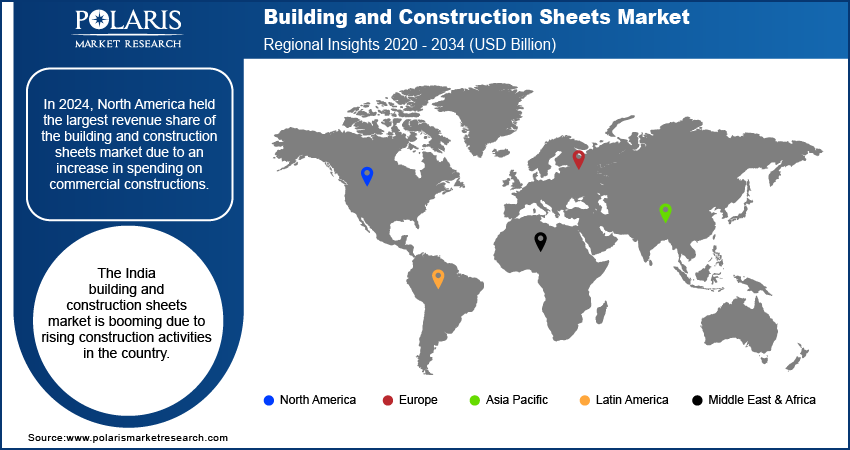

By region, the study provides the building and construction sheets market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest revenue share of the market due to the increase in spending on commercial building construction. A large number of offices are being built, supported by an increase in spending, due to which the demand for construction sheets is rising. According to Construction Analytics, the spending on the construction of nonresidential buildings in the US increased by 23% in 2023, showcasing an increase in spending on commercial buildings. Therefore, rising spending on commercial building construction is driving the building and construction building sheets market growth in North America.

The Asia Pacific building and construction sheets market growth is attributed to rapid population growth in the region. The population growth in the region is fueling the demand for more housing, schools, hospitals, and infrastructure. This is leading to an increased demand for building and construction sheets. For instance, according to the Economic and Social Commission of Asia Pacific, the annual population growth rate in the region is currently 0.96%. This growth in population is creating a high demand for buildings and construction, thereby driving the building and construction sheets market demand in Asia Pacific.

The building and construction sheets market in India is experiencing substantial growth due to the growing construction activity. More residential, commercial, and infrastructure projects are being launched across the country, due to which the demand for construction sheets is rising. According to the Indian Department of Economic Affairs, in 2024, the country recorded new construction worth USD 819.64 billion by public–private partnerships, showcasing growth in construction activity in the country. Additionally, increased urbanization, government initiatives, and rising investments in real estate and infrastructure are further driving the building and construction sheets market demand in India.

Building and Construction Sheets Market – Key Players and Competitive Analysis

The building and construction sheets market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific sectors. This competitive environment is amplified by continuous progress in product offerings. A few major players in the building and construction sheets market are Paul Bauder GmbH & Co. KG; GAF Materials Corporation; Atlas Roofing Corporation; CertainTeed Corporation; Owens Corning Corp.; Etex; Fletcher Building Limited; North American Roofing Services, Inc.; Icopal ApS; and EURAMAX.

Atlas Roofing Corporation is a manufacturer of building materials, specializing in residential and commercial roofing products. Established in 1982, the company has 36 manufacturing plants in locations across North America, including the US, Canada, and Mexico. It operates through four major divisions. The Shingle & Underlayment division offers a wide array of asphalt shingles in which products include Pinnacle Pristine shingles featuring Scotchgard Protector and StormMaster shingles, which are designed for high wind resistance and impact ratings. In addition to roofing materials, Atlas produces Polyiso Roof & Wall Insulation. The Molded Products division manufactures molded polystyrene solutions used in various construction applications, including lightweight fill and protective packaging materials. Furthermore, the Web Technologies division focuses on advanced coated fiberglass facers and underlayments. Atlas Roofing's operations are primarily concentrated in North America, with a significant presence across the US, Canada, and Mexico. In April 2023, the company announced its plans for a new USD 200 billion shingle manufacturing facility in Clinton, Iowa, to expand its manufacturing capabilities in the Midwest.

Paul Bauder GmbH & Co. KG, established in Stuttgart, Germany, is a manufacturer of roofing systems in Europe. Bauder specializes in delivering comprehensive solutions for a variety of roofing needs, including insulation, waterproofing, green roofs, photovoltaic systems, and fall protection. Bauder’s extensive product portfolio covers several key segments. Its waterproofing systems are used for protecting buildings from water ingress, while its thermal insulation products are used to improve energy efficiency. The company is a pioneer in green roof solutions that promote biodiversity and improve urban environments. Additionally, Bauder offers photovoltaic systems designed for sustainable energy generation and utility roof structures for various applications. Notably, Bauder supplies waterproofing materials for one-in-four-flat roofs and insulation for one-in-five-pitched roofs in Germany. Operating primarily in Europe, Bauder has its main facility in Stuttgart and additional production sites across Germany in Bochum, Herten, Landsberg, Achim, Bernsdorf, and Schwepnitz. The company is expanding its footprint with the construction of a new plant in Drusenheim, France.

Key Companies in Building and Construction Sheets Market

- Paul Bauder GmbH & Co. KG

- GAF Materials Corporation

- Atlas Roofing Corporation

- CertainTeed Corporation

- Owens Corning Corp.

- Etex

- Fletcher Building Limited

- North American Roofing Services, Inc.

- Icopal ApS

- EURAMAX

Building and Construction Sheets Market Segmentation

By Product Outlook (Volume, Million Square Meter, Revenue USD Billion, 2020–2034)

- Bitumen

- Rubber

- Metal

- Polymer

By Function Outlook (Volume, Million Square Meter, Revenue USD Billion, 2020–2034)

- Bonding

- Protection

- Insulation

- Glazing

- Water Proofing

By Application Outlook (Volume, Million Square Meter, Revenue USD Billion, 2020–2034)

- Flooring

- Walls & Ceiling

- Windows

- Doors

- Roofing

- Building Envelop

- Electrical

- HVAC

- Plumbing

By Distribution Channel Outlook (Volume, Million Square Meter, Revenue USD Billion, 2020–2034)

- Direct

- Dealer

By End Use Outlook (Volume, Million Square Meter, Revenue USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

By Regional Outlook (Volume, Million Square Meter, Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Building and Construction Sheets Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 167.27 billion |

|

Market Size Value in 2025 |

USD 175.70 billion |

|

Revenue Forecast by 2034 |

USD 279.20 billion |

|

CAGR |

5.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Million Square Meters, Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Volume Forecast, Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 167.27 billion in 2024 and is projected to grow to USD 279.20 billion by 2034.

The global market is projected to grow at a CAGR of 5.3% during 2025–2034.

North America held the largest share of the global market in 2024.

A few key players in the market are Paul Bauder GmbH & Co. KG; GAF Materials Corporation; Atlas Roofing Corporation; CertainTeed Corporation; Owens Corning Corp.; Etex; Fletcher Building Limited; North American Roofing Services, Inc.; Icopal ApS; and EURAMAX.

The metal segment is expected to experience significant CAGR in the global market during the forecast period due to the durability of metal materials.

The roofing segment dominated the building and construction sheets market share in 2024 due to the rise in residential and nonresidential construction projects.