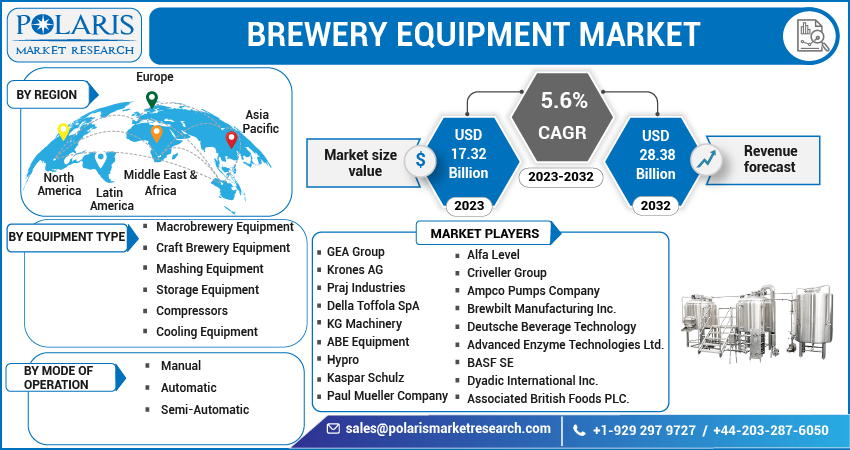

Brewery Equipment Market Share, Size, Trends, Industry Analysis Report, By Equipment Type (Macrobrewery Equipment, Craft Brewery Equipment, Mashing Equipment, Storage Equipment, Compressors, Colling Equipment, and Others); By Mode of Operation; By Region; Segment Forecast, 2023- 2032

- Published Date:Jun-2023

- Pages: 114

- Format: PDF

- Report ID: PM3408

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

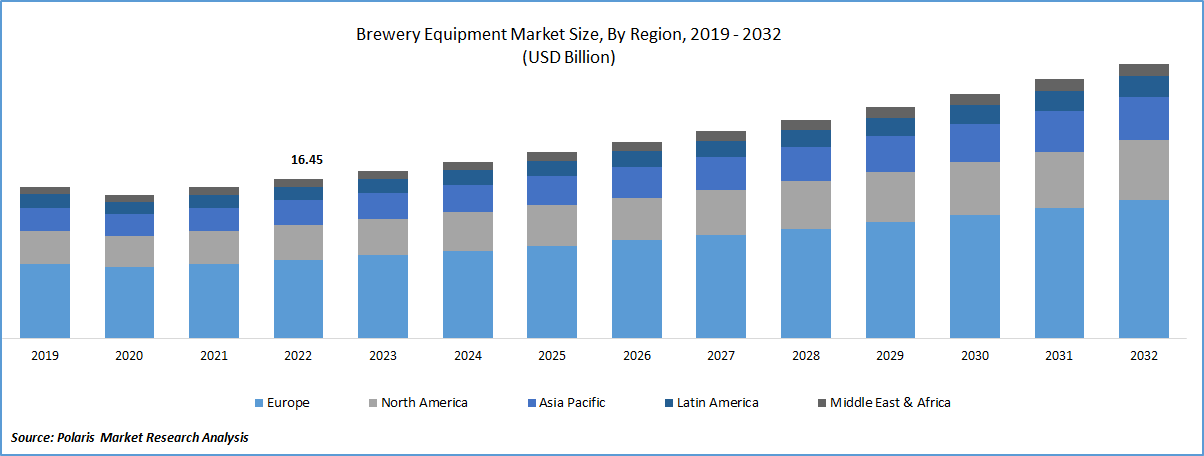

The global brewery equipment market was valued at USD 16.45 billion in 2022 and is expected to grow at a CAGR of 5.6% during the forecast period. Rapid expansion of craft brewery industry and surge in the demand for low and premium-alcohol beer, that has led to the establishment of various microbreweries and taprooms along with the evolving new technologies and innovative equipment through craft beer producers, are major factors driving the demand and growth of the global market.

To Understand More About this Research: Request a Free Sample Report

In addition, to ensure the hygiene and standard quality standards in the modern brewing industry all over the world has made the incorporation of automation very critical, as a result, artificial intelligence, robotics, sensors, and Internet of Things are being increasingly indispensable and expected to have positive impact on brewery equipment market growth.

For instance, in February 2022, Siemens, announced the launch of its new and more improved product named “BRAUMAT” in India for brewing and beverage industries. The latest version of BRAUMAT 8.0 is based on Simatic S7-1500 controller and has been optimized in the areas of weighing systems, security, and reporting and this system is perfect fit for craft breweries.

The rising popularity of beer culture globally is encouraging large manufacturers of beer to heavily invest in the market thus market participants are focusing on activities such as cellular equipment, energy recovery methods, outdoor expansion, and brewery expansion to strengthen their market presence.

The high penetration towards the modification of beer regulations across both developed and developing economies including Germany, France, and China, is opening huge potential for the market growth at significant pace. The rapid emergence of deadly coronavirus across the globe has forced economies to impose lockdowns and other mass movement restrictions, that resulted in closer of breweries and also beer retail shops globally due to which, the demand for brewery equipment has drastically decreased during the pandemic.

For Specific Research Requirements, Request a Customized Report

Industry Dynamics

Growth Drivers

Increase in the number of microbreweries and brewpubs globally and rise in the consumer preferences for artisanal and handcrafted beer in place of traditional brews and other distilled liquors are primary factors boosting the growth of the global market. In addition, several large market participants are highly engaging in numerous activities including brewery expansion, greater emphasis on cellular equipment, and enhanced yield management are further strengthening the market.

Furthermore, the enormous growth potential of food & beverage industry as the global economy enhances and various end user verticals like healthcare, chemicals, food & beverages, and many others are likely to offer lucrative growth opportunities for small scale businesses and is directly proportional to rising consumer demand globally.

Report Segmentation

The market is primarily segmented based on equipment type, mode of operation, and region.

|

By Equipment Type |

By Mode of Operation |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Macrobrewery equipment segment accounted for the largest market share in 2022

The extensive rise in the demand for standard type of beer rises because of its easy availability of beer from various different brands at varying price ranges and high prevalence for the use of this machinery for producing beer on a large scale, are among the key factors fueling the demand and growth of the segment market.

The craft brewery equipment segment is anticipated to grow at fastest growth rate during the projected period, on account of continuously growing popularity of craft beer across the globe due to its distinct flavor and natural ingredients. Additionally, its providers wide range of health benefits such as reduced risk of cardiovascular diseases, diabetes, and arthritis, that has led to higher consumption of craft beer globally, and resulting in significant market expansion.

In addition, as consumers worldwide are significantly developing a better taste for the beers that are made through craft breweries, the segment will likely to have a positive impact in the coming years.

Semi-automatic segment is expected to witness highest growth

The semi-automatic segment is projected to grow at a high CAGR over the anticipated period, primarily due to changing consumer preferences for artisanal and handcrafted beer over several other distilled liquors or routinely brewed beer worldwide. The rapid increase in the need for high-quality and cost-effective brewing equipment and high penetration for usage of semi-automatic equipment as compared to manual brewing equipment.

Automatic brewery segment led the industry market with largest revenue share in 2022, which is mainly driven by growing prevalence towards the use of automation in craft brewing process mainly to simplify the overall process along with the growing investments in the development of automated equipment for producing better quality beers across the globe. Additionally, large market players are using automation as a crucial and infrastructure component to strengthen their industry including beer production, thereby the aforementioned factors are projected to boost the growth of the segment market.

Europe region dominated the global market in 2022

Europe region dominated the global market share, in 2022, which can be attributed to robust presence of large manufacturers of beer across the region including Carlsberg, SABMiller, & Heineken that produces beer on extremely large scale, due to which the use of brewery equipment is rapidly increasing. Moreover, a drastic shift in consumption patterns from wine to beer especially in countries like France and United Kingdom, due to easy availability of beer and focus of major brands on making its accessible to wide range of population to choose their products, that is positively influencing the growth of the regional market.

Asia Pacific region is expected to register highest growth rate during the projected period, owing to increasing consumer knowledge and adoption of a healthy lifestyles and eating habits mainly in countries like China, India, and Indonesia along with the increasing number of regulations pertaining to alcoholic beverages in the region.

Competitive Insight

Some of the major players operating in the global market include GEA Group, Krones, Praj Industries, Della Toffola, KG Machinery, ABE Equipment, Hypro, Kaspar Schulz, Paul Mueller Company, Alfa Level, Criveller Group, Ampco Pumps, Brewbilt Manufacturing, Deutsche Beverage, BASF.

Recent Developments

- In May 2022, American Brew introduced BLOCKBUSTER beer, that offer an unparalleled experience for the connoisseurs. It prefers to make the beer in very small pouches and giving enough attention to each beer recipe.

- In August 2022, Alfa Level ompleted the acquisition of the Scanjet. With this acquisition, the company will expand its extensive tanker offering and further expanding its cargo tanks portfolio.

Brewery Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 17.32 billion |

|

Revenue forecast in 2032 |

USD 28.38 billion |

|

CAGR |

5.6% from 2023– 2032 |

|

Base year |

2022 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2023– 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Equipment Type, By Mode of Operation, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

GEA Group, Krones AG, Praj Industries, Della Toffola SpA, KG Machinery, ABE Equipment, Hypro, Kaspar Schulz, Paul Mueller Company, Alfa Level, Criveller Group, Ampco Pumps Company, Brewbilt Manufacturing Inc., Deutsche Beverage Technology. BASF SE |

FAQ's

The Brewery Equipment Market report covering key equipment type, mode of operation, and region.

Brewery Equipment Market Size Worth $ 28.38 Billion By 2032.

The global brewery equipment market expected to grow at a CAGR of 5.6% during the forecast period.

Europe is leading the global market.

Top market players in the Brewery Equipment Market are GEA Group, Krones, Praj Industries, Della Toffola, KG Machinery, ABE Equipment, Hypro, Kaspar Schulz.