Breast Cancer Liquid Biopsy Market Size, Share, Trends, Industry Analysis Report: By Circulating Biomarkers [Circulating Tumor Cells (CTCs), Circulating Cell-Free DNA (cfDNA), Extracellular Vesicles (EVs), and Other Circulating Biomarkers], Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast (2025–2034)

- Published Date:Nov-2024

- Pages: 116

- Format: PDF

- Report ID: PM5160

- Base Year: 2024

- Historical Data: 2020-2023

Breast Cancer Liquid Biopsy Market Overview

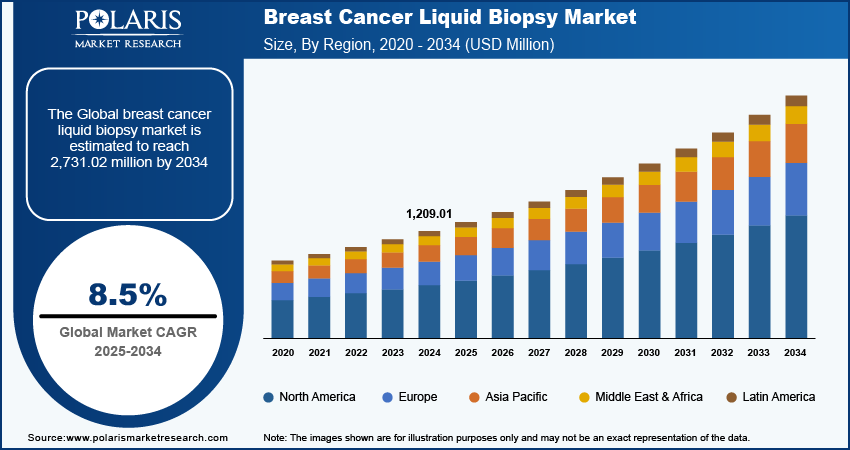

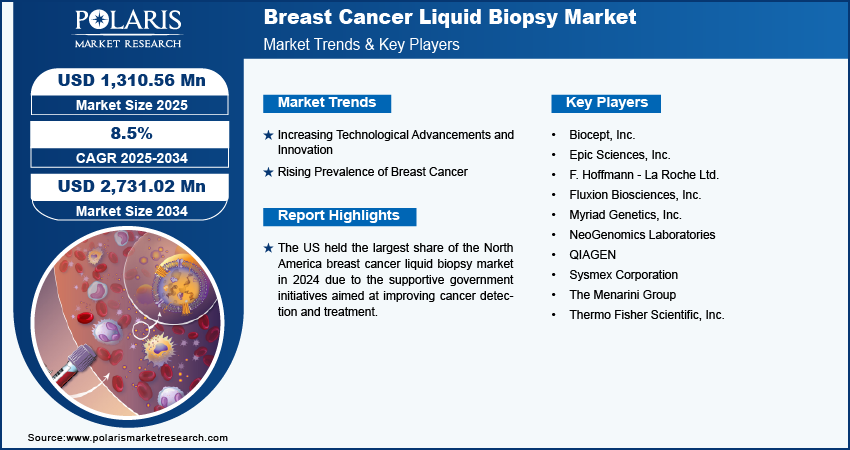

The global breast cancer liquid biopsy market size was valued at USD 1,209.01 million in 2024. The market is projected to grow from USD 1,310.56 million in 2025 to USD 2,731.02 million by 2034, exhibiting a CAGR of 8.5% during the forecast period.

Breast cancer liquid biopsy is a noninvasive diagnostic tool used to detect and monitor breast cancer through the analysis of blood samples. The rising trend toward personalized medicine, where treatments are tailored to individual patients based on the genetic makeup of their cancer, is driving the growth of the breast cancer liquid biopsies market. Furthermore, liquid biopsies are increasingly being used in clinical trials for breast cancer drug development, as they provide a real-time, noninvasive method for monitoring drug efficacy and disease progression, which is fueling the market growth.

To Understand More About this Research: Request a Free Sample Report

Liquid biopsies are an essential tool for clinicians and patients, enabling early cancer detection and continuous monitoring of tumor dynamics, including treatment response. This is driving the adoption of liquid biopsies for breast cancer, which is contributing to market growth. Furthermore, the growing number of regulatory approvals for liquid biopsy tests, particularly by bodies such as the US Food and Drug Administration, is boosting the breast cancer liquid biopsy market growth.

Breast Cancer Liquid Biopsy Market Driver

Increasing Technological Advancements and Innovation

Increasing technological advancements such as innovations in molecular biology, next-generation sequencing (NGS), and advanced ctDNA detection technologies fuel the growth of the breast cancer liquid biopsy market. Furthermore, the launch of new advanced assays for tumor detection has significantly driven market growth. In November 2023, Illumina Inc. launched an updated version of its distributed liquid biopsy assay, the TruSight Oncology 500 ctDNA v2. Liquid biopsy assay allows noninvasive comprehensive genomic profiling of circulating tumor DNA from blood, particularly when tissue testing is not possible or to complement tissue-based testing. Thus, the rising innovation and technological advancements boost the growth of the breast cancer liquid biopsy market

Rising Prevalence of Breast Cancer

The rising cases of breast cancer globally, especially in developed regions, lead to a heightened need for noninvasive diagnostic techniques such as liquid biopsy for early detection and disease monitoring. In 2022, according to the Breast Cancer Research Foundation report, about 2.3 million women were diagnosed with cancer, and about 0.67 million deaths were recorded due to cancer across the world. The rising prevalence of breast cancer globally is increasing the demand for breast cancer liquid biopsies.

Breast Cancer Liquid Biopsy Market Segment Insights

Breast Cancer Liquid Biopsy Market Breakdown by Circulating Biomarkers Outlook

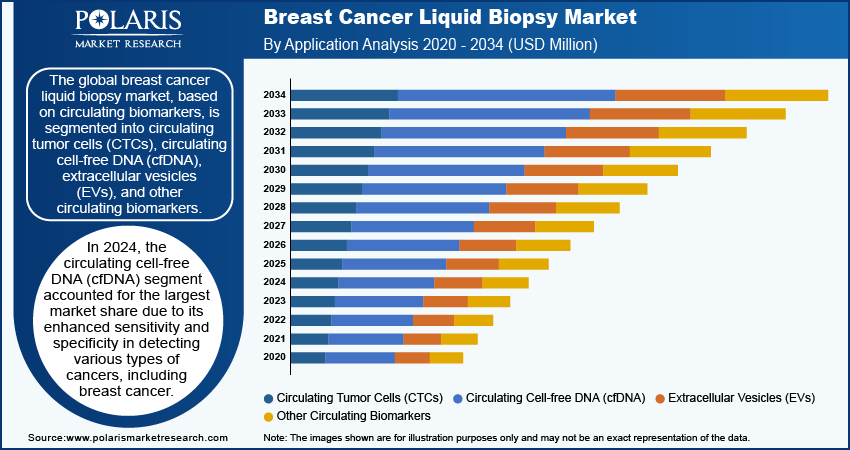

The global breast cancer liquid biopsy market segmentation, based on circulating biomarkers, includes circulating tumor cells (CTCs), circulating cell-free DNA (cfDNA), extracellular vesicles (EVs), and other circulating biomarkers. In 2024, the circulating cell-free DNA (cfDNA) segment accounted for the largest market share due to its enhanced sensitivity and specificity in detecting various types of cancers, including breast cancer. Cell-free DNA is made up of small DNA fragments released into the bloodstream by dying cells, which offers important information about a tumor's genetics and behavior. The ability to analyze cfDNA allows for the identification of specific mutations and alterations associated with tumor growth, making it an essential tool for early detection and monitoring of cancer progression. Additionally, the noninvasive nature of cfDNA analysis makes it a preferred choice for clinicians and patients, as it minimizes the discomfort and risks associated with traditional biopsy methods. The growing emphasis on personalized medicine further propels the demand for cfDNA testing.

Breast Cancer Liquid Biopsy Market Breakdown by Application Outlook

The global breast cancer liquid biopsy market segmentation, based on application, includes early detection/screening, diagnosis, treatment selection, and monitoring. The early detection/screening segment is expected to register the highest CAGR during the forecast period due to increasing awareness about the importance of early cancer detection in improving patient outcomes. Technological advancements in screening techniques are enhancing the sensitivity and specificity of tests, making them reliable and accessible. The increasing prevalence of breast cancer, combined with efforts to promote routine screening as part of public health initiatives, is further driving demand in this category. In August 2024, the Biden-Harris Administration’s Advanced Research Projects Agency for Health launched a program to develop an at-home multi-cancer screening test.

Regional Insights

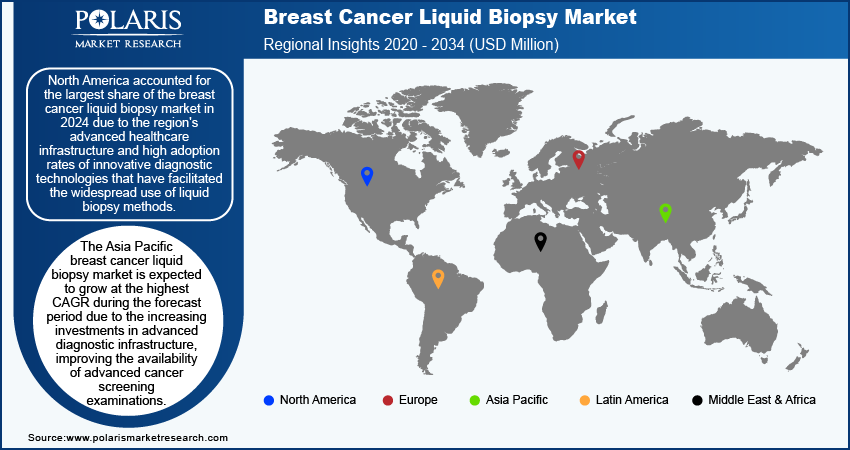

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of the breast cancer liquid biopsy market in 2024 due to the region's advanced healthcare infrastructure and high adoption rates of innovative diagnostic technologies that have facilitated the widespread use of liquid biopsy methods. Additionally, increasing awareness among healthcare providers and patients about the benefits of early cancer detection and personalized treatment options has driven demand for noninvasive diagnostic tools. The presence of major pharmaceutical and biotechnology companies, along with robust research and development activities in North America, further supports market growth.

The US held the largest share of the breast cancer liquid biopsy market in 2024 due to the supportive government initiatives aimed at improving cancer detection and treatment.

The Asia Pacific breast cancer liquid biopsy market is expected to register the highest CAGR during the forecast period due to the increasing investments in advanced diagnostic infrastructure, improving the availability of advanced cancer screening examinations. The market is also being driven by technological advancements, including accurate and less invasive diagnostic techniques.

The Japan breast cancer liquid biopsy market is expected to grow significantly during the forecast period due to the rising prevalence of cancer. According to the WHO, 1.04 million new cases of cancer were reported in 2022, among which 91,916 were breast cancer cases. Therefore, the increasing number of breast cancer cases is driving the adoption of liquid biopsy in Japan.

Breast Cancer Liquid Biopsy Market – Key Players and Competitive Insights

The competitive landscape of the breast cancer liquid biopsy market is characterized by a diverse array of key players, including established biotechnology companies, emerging startups, and academic institutions, all striving to innovate and capture market share. Major companies such as Guardant Health, GRAIL, Freenome, and Foundation Medicine are at the forefront, developing advanced liquid biopsy assays that utilize circulating tumor DNA (ctDNA) and circulating tumor cells (CTCs) for early cancer detection and monitoring. The competitive landscape is also marked by significant investments in research and development, with companies striving to obtain regulatory approvals for their assays. Collaborative efforts between industry players and academic institutions are common, aimed at advancing the science of liquid biopsy and improving test reliability. A few major market players are Biocept, Inc.; Epic Sciences, Inc.; F. Hoffmann - La Roche Ltd.; Fluxion Biosciences, Inc.; Myriad Genetics, Inc.; NeoGenomics Laboratories; QIAGEN; Sysmex Corporation; The Menarini Group; and Thermo Fisher Scientific, Inc.

Thermo Fisher Scientific Inc. is a biotechnology research company engaged in life science research and various diagnostic and laboratory solutions. The company specializes in analytical, diagnostic instruments, laboratory supply chain programs and e-commerce, laboratory equipment, lab services, life sciences, specialty diagnostics, and pharma services. The company delivers pharmaceutical services under various brands such as Thermo Scientific, Applied Biosystems, Invitrogen, Fischer Scientific, Unity Lab Services, Patheon, and PPD. The company’s products and solutions are utilized by various end-use industries, including of biotechnology, pharmaceuticals, healthcare, industrial & applied sciences, food & beverage, and forensics. In May 2023, Thermo Fisher Scientific and Pfizer collaborated to enhance the availability of localized Next Generation Sequencing-based testing for cancer patients in global markets.

QIAGEN N.V. was founded in 1984 by a group of scientists at Heinrich Heine University in Düsseldorf, Germany. The company is a prominent global provider of sample and assay technologies, primarily focused on molecular diagnostics and life sciences. QIAGEN has evolved into a leading entity in the biotechnology sector. The company specializes in solutions that enable customers to extract valuable molecular insights from biological samples, including DNA, RNA, and proteins. Its core offerings encompass sample technologies that isolate biomolecules, assay technologies that prepare these molecules for analysis, and bioinformatics software that interprets complex genomic data. In February 2020, QIAGEN launched FFPE and Liquid Biopsy PIK3CA diagnostics in Europe to advance precision medicine for advanced breast cancer.

Key Companies in Breast Cancer Liquid Biopsy Market

- Biocept, Inc.

- Epic Sciences, Inc.

- F. Hoffmann - La Roche Ltd.

- Fluxion Biosciences, Inc.

- Myriad Genetics, Inc.

- NeoGenomics Laboratories

- QIAGEN

- Sysmex Corporation

- The Menarini Group

- Thermo Fisher Scientific, Inc.

Breast Cancer Liquid Biopsy Industry Developments

In July 2024, Guardant Health, Inc. launched an upgraded Guardant360 liquid biopsy test that evaluates biomarkers in 739 genes, ten times more than the previous version. This enhanced test identifies a wide array of emerging biomarkers, enabling precise characterization of cancer and more sensitive disease burden quantification.

In August 2021, Illumina acquired GRAIL, a company specializing in early cancer detection. The acquisition aims to enhance Illumina’s capabilities in personalized medicine and genomic-based diagnostics

Breast Cancer Liquid Biopsy Market Segmentation

By Circulating Biomarkers Outlook (Revenue – USD Million, 2020–2034)

- Circulating Tumor Cells (CTCs)

- Circulating Cell-Free DNA (cfDNA)

- Extracellular Vesicles (EVs)

- Other Circulating Biomarkers

By Application Outlook (Revenue – USD Million, 2020–2034)

- Early Detection/Screening

- Diagnosis

- Treatment Selection

- Monitoring

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Breast Cancer Liquid Biopsy Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,209.01 million |

|

Market Size Value in 2025 |

USD 1,310.56 million |

|

Revenue Forecast by 2034 |

USD 2,731.02 million |

|

CAGR |

8.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global breast cancer liquid biopsy market size was valued at USD 1,209.01 million in 2024 and is projected to grow to USD 2,731.02 million by 2034.

The global market is projected to register a CAGR of 8.5% during the forecast period.

North America accounted for the largest share of the global market in 2024 due to the region's advanced healthcare infrastructure.

A few key players in the market are Biocept, Inc.; Epic Sciences, Inc.; F. Hoffmann - La Roche Ltd.; Fluxion Biosciences, Inc.; Myriad Genetics, Inc.; NeoGenomics Laboratories; QIAGEN; Sysmex Corporation; The Menarini Group; and Thermo Fisher Scientific, Inc.

The circulating cell-free DNA (cfDNA) segment dominated the market in 2024 due to its enhanced sensitivity and specificity in detecting various types of cancers, including breast cancer.

The early detection/screening segment is expected to record the highest CAGR during the forecast period due to increasing awareness about the importance of early cancer detection in improving patient outcomes.