Brazil Frozen Food Market Share, Size, Trends, Industry Analysis Report, By Product; By Consumption (Food Service and Retail); By Type; Segment Forecast, 2023 - 2032

- Published Date:May-2023

- Pages: 118

- Format: PDF

- Report ID: PM3282

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

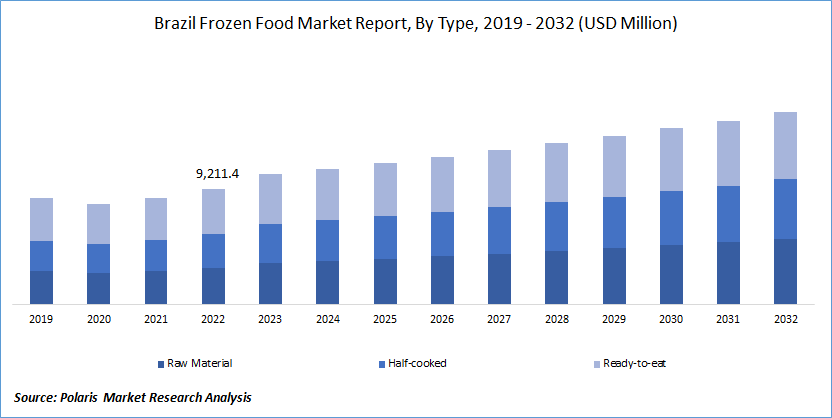

The brazil frozen food market was valued at USD 9,211.4 million in 2022 and is expected to grow at a CAGR of 4.4% during the forecast period. The frozen food market in Brazil has experienced significant growth in recent years. The key driver is the changing consumer lifestyles, where busy schedules and urbanization have increased demand for convenient and ready-to-eat food options. Frozen foods provide a quick and easy solution for consumers, offering a wide range of products from fruits and vegetables to ready meals and desserts.

To Understand More About this Research: Request a Free Sample Report

The expansion of organized retail chains has also played a crucial role in Brazil’s frozen food market’s growth. Supermarkets and hypermarkets have witnessed significant growth in the country, making frozen food products more accessible. These retail chains offer a wide variety of frozen food options and invest in marketing campaigns to educate consumers about the benefits and quality of frozen products.

Increasing disposable incomes and a growing middle class have contributed to Brazil’s rising demand for frozen foods. As people have more disposable income, they are willing to spend on convenient food options that save time and effort. Moreover, the middle class has expanded, leading to a larger consumer base for frozen food products. This demographic shift has resulted in increased consumption of frozen fruits, vegetables, meat, and seafood.

Improvements in cold chain infrastructure have also played a crucial role in the market’s growth. The country has made significant investments in developing a robust cold storage and transportation network. This has helped maintain the quality and freshness of frozen food products throughout the supply chain, ensuring consumers access to high-quality frozen options. Furthermore, advancements in freezing technology have improved the shelf life and taste of frozen foods, further driving their popularity in the market.

The COVID-19 pandemic had a significant impact on the frozen food market in Brazil. With lockdown measures and restrictions on movement, consumers turned to frozen foods as a convenient and long-lasting option. The demand for frozen fruits, vegetables, meat, and ready meals surged during the pandemic as people stocked up on essential food items. However, there were also challenges in the supply chain due to disruptions in logistics and transportation. Despite these challenges, the pandemic highlighted the importance of frozen foods in ensuring food security and convenience, leading to increased awareness and growth in the market.

For Specific Research Requirements, Request For Customized Report

Industry Dynamics

Growth Drivers

Changing consumer lifestyles have significantly driven brazil frozen food market growth. With urbanization and busy schedules, consumers seek convenient and time-saving food options. The demand for frozen foods has surged as they offer a quick and easy solution, requiring minimal preparation. Consumers can find a wide variety of frozen food products, including fruits, vegetables, meat, and ready meals, providing them with options for quick and hassle-free meals.

Moreover, the COVID-19 pandemic further accelerated the adoption of frozen foods. With lockdown measures and restrictions on movement, consumers turned to frozen foods to ensure food availability and longer shelf life. The convenience of having frozen foods stocked up at home became essential during the pandemic, aligning perfectly with changing consumer lifestyles.

The increasing preference for frozen foods also ties into the growing trend of convenience-oriented consumption patterns. As consumers have less time for meal preparation and cooking, frozen foods provide an easy solution to meet their dietary needs. Additionally, the rise of dual-income households and the expanding middle class in Brazil have contributed to the changing consumer lifestyles, where convenience and time-saving options are highly sought.

Report Segmentation

The market is primarily segmented based on product, consumption, and type.

|

By Product |

By Consumption |

By Type |

|

|

|

For Specific Research Requirements: Request for Customized Report

Meat & Seafood Products segment was dominant in 2022

The Meat & Seafood Products segment is dominant, driven by the consistently high demand for frozen meat and seafood. Brazil's reputation as a major meat exporter and its abundant coastline contribute to the availability of a diverse range of frozen meat and seafood products. Factors such as convenience, longer shelf life, and ease of storage contribute to the sector's dominance.

The sector's strong position is further supported by consumer awareness regarding food safety and quality and the growing popularity of ready-to-cook and ready-to-eat frozen meat and seafood products. Overall, the Meat & Seafood Products sector caters to consumers’ preferences seeking convenient and high-quality options in the Brazilian frozen food market.

Retail segment is expected to dominate over the projected period.

Retail segment is expected to dominate the market over the projected period. The retail sector includes supermarkets, hypermarkets, convenience stores, and online platforms that cater to consumer demand for frozen food products. The growth in the retail sector can be attributed to various factors, including increasing consumer awareness and demand for frozen food products, expanding retail infrastructure, and the convenience of purchasing frozen food items from retail outlets.

The retail sector has witnessed significant investments in recent years, with both domestic and international players expanding their presence and product offerings in the frozen food category. These retailers are actively marketing and promoting frozen food products, offering consumers a wide range of options and providing convenient shopping experiences.

While the Food Service sector, which includes restaurants, hotels, cafeterias, and catering services, also plays a crucial role in the consumption of frozen food products, the retail sector is experiencing faster growth at present. However, market dynamics can change over time, and it is essential to monitor industry trends and developments for the most up-to-date information on the growth of these sectors in the Brazil frozen food market.

Competitive Insight

Some of the major players operating in the brazil frozen food market include BRF S.A., JBS S.A., Nestlé, Aurora Alimentos, Marfrig Global Foods, McCain Foods, Yoki Alimentos, Kellogg Company, Unilever Brasil Ltda., Kellogg Company, Dr. Oetker Brasil Ltda, Brazi Bites.

Recent Developments

In June 2021, Brazi Bites, a leading provider of Latin-inspired, naturally gluten-free foods, introduced Pizza'nadas, a new addition to their frozen pizza offerings. This product expansion builds upon the success of their Empanadas line and aims to offer customers even more delicious options for their pizza cravings.

Brazil Frozen Food Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 10,411 million |

|

Revenue forecast in 2032 |

USD 15,386 million |

|

CAGR |

4.4% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Product, By Consumption, By Type |

|

Key Companies |

BRF S.A., JBS S.A., Nestlé, Aurora Alimentos, Marfrig Global Foods, McCain Foods, Yoki Alimentos, Kellogg Company, Unilever Brasil Ltda., Kellogg Company, Dr. Oetker Brasil Ltda, Brazi Bites |

FAQ's

key companies in brazil frozen food market are BRF S.A., JBS S.A., Nestlé, Aurora Alimentos, Marfrig Global Foods, McCain Foods, Yoki Alimentos, Kellogg Company, Unilever Brasil Ltda., Kellogg Company.

The brazil frozen food market expected to grow at a CAGR of 4.4% during the forecast period.

The brazil frozen food market report covering key segments are product, consumption, and type.

key driving factors in brazil frozen food market are rapid development of the food service industry.

The brazil frozen food market size is expected to reach USD 15,386 million by 2032.