Global Botanical Supplements Market Size, Share, Trends, Industry Analysis Report: By Source, By Form, By Distribution Channel, By End-Use, By Application, and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Aug-2024

- Pages: 119

- Format: PDF

- Report ID: PM1872

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

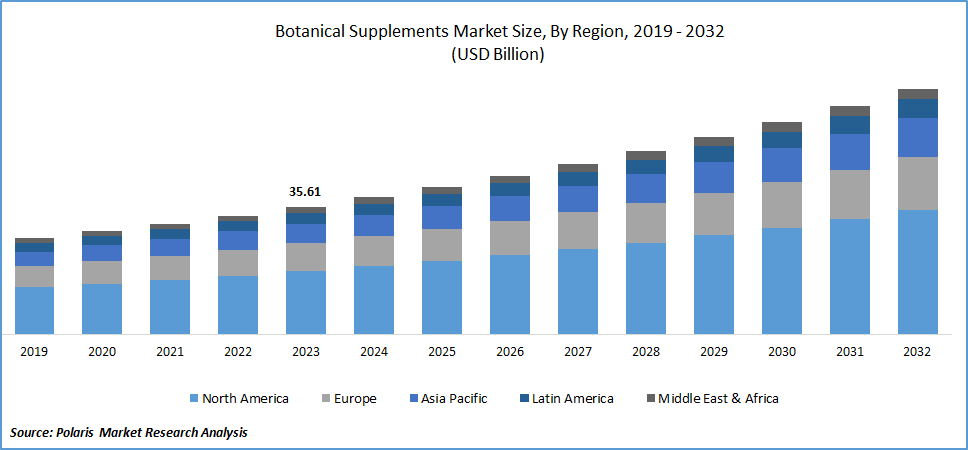

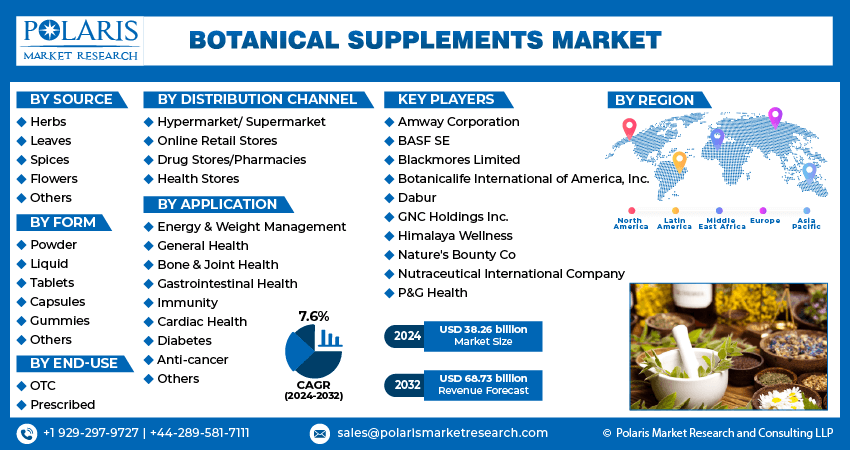

The global botanical supplements market size was valued at USD 35.61 billion in 2023. The industry is projected to grow from USD 38.26 billion in 2024 to USD 68.73 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.6% during the forecast period (2024 - 2032).

Botanical supplements are products made from plants, plant parts, or plant extracts intended to supplement the diet and maintain or improve health.

The botanical supplements market is experiencing robust growth driven by the increasing acceptance and consumption of botanical supplements among consumers across various demographics. Moreover, these supplements have presented a significant opportunity for manufacturers to develop and launch new products to meet the growing need for botanical supplements, thus boosting botanical supplements market growth.

The increased funding and research and development initiatives are supporting advancements in extraction technologies, quality control methods, and formulation techniques. This is leading to higher-quality products with standardized doses and improved bioavailability, which is propelling innovation and boosting the market expansion for botanical supplements.

To Understand More About this Research:Request a Free Sample Report

In April 2024, new funding opportunities were released by New CARBON to improve our understanding of the mechanisms of bioavailability, action, and optimal use of botanical supplements. This collaboration involves the National Center for Complementary and Integrative Health, the NIH Office of Dietary Supplements, and the National Institute on Drug Abuse.

Botanical Supplements Market Trends:

Rising Consumer Spending is Driving the Market Growth

The market (CAGR) for botanical supplements is increasing due to the rising consumer spending power, as a result of increased health consciousness and a preference for natural products. Consumers are choosing botanical supplements more frequently because of their enhanced therapeutic properties compared to traditional pharmaceuticals, which may have side effects.

The R&D efforts supporting the efficacy and safety of botanical supplements are driving consumers to shift towards preventive healthcare and wellness lifestyles, thus, propelling the botanical supplements market.

For instance, according to the American Botanical Council’s (ABC’s) 2020 Herb Market Report, botanical supplements in the United States achieved a total annual sale of over $10 billion in 2020. Consumers invested $11.261 billion in these products, marking a significant 17.3% surge and more than double the growth rate from the previous year.

Rising Consumption of Botanical Supplements in the Sports Industry

The market for botanical supplements is growing significantly due to the increased awareness and consumption of these supplements by athletes, who are drawn to their therapeutic properties. Also, botanical supplements improve the training and overall performance of athletes. Hence, the sports nutrition and health industries are offering a wide range of products that can enhance different facets of athletic performance, driving the botanical supplements market revenue.

For instance, in March 2024, Garden of Life expanded its range of botanical supplements into a sports line by including products like micronized creatine monohydrate probiotics powder, whey younger, healthier looking skin powder, whey weight management powder, organic greens powder, and Dr. formulated probiotics sports capsule. These sports botanical supplements are multi-tasking formulas designed for athletes and are USDA-certified.

Botanical Supplements Market Segment Insights:

Botanical Supplements Form Insights:

The global botanical supplements market segmentation, based on form, includes powder, liquid, tablets, capsules, gummies, and others. In 2023, the tablets segment dominated the market owing to the increased consumer preference for tablets due to their convenience, ease of consumption and availability in different dosage sizes. Additionally, increased research and development in the pharmaceutical sector has resulted in a rising demand for tablets within the botanical supplements industry.

For instance, in November 2020, Kunnath Pharmaceuticals introduced an antiviral immunity booster tablet named Viromune, which contains a blend of 17 potent herbs. The company is further investing more than Rs.100 crores in R&D for new product development.

Botanical Supplements Application Insights:

The global botanical supplements market segmentation, based on application, includes energy & weight management, general health, bone & joint health, gastrointestinal health, immunity, cardiac health, diabetes, anti-cancer, and others. The energy & weight management category dominated the market owing to the sedentary lifestyles giving rise to health issues such as diabetes, gastrointestinal disorders, cancer, and chronic diseases.

These conditions require energy and weight management, leading to the use of plant-based supplements. Additionally, market players are introducing energy and weight management products to target health-conscious consumers.

For instance, in January 2024, GNC introduced GlucaTrim, a weight management botanical-focused supplement specifically designed to preserve lean muscle mass and maintain healthy blood sugar and insulin levels for health-conscious individuals interested in weight management.

Global Botanical Supplements Market, Segmental Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Botanical Supplements Regional Insights:

By region, the study provides the market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. The North American region dominated the botanical supplements market in 2023. This dominance is due to increased awareness among consumers regarding the preventive health and immunity-boosting properties of botanical supplements for managing health risks.

For instance, according to the U.S. National Institutes of Health, 20% of American adults use botanical supplements to manage health risks, as they are approved and considered safe by the U.S. FDA.

Consumers are becoming aware of the beneficial properties possessed by botanical supplements, such as curcumin, fenugreek, ashwagandha, and quercetin to enhance immunity and protect against infections.

For instance, according to the American Botanical Council's 2021 Herb Market Report, ashwagandha and quercetin experienced a significant increase in sales, with triple-digit growth, and achieved a total of $12.35 billion in sales for the year.

Further, the major countries studied in the market report are the US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Europe’s botanical supplements market accounted for a significant market share due to the increasing demand for botanical products. Consumers, including children, pregnant women, and those suffering from diseases, are incorporating botanical supplements into their diets for health benefits.

Key players in this region are expanding their product offerings by launching new products to meet the rising consumer demands. For instance, in August 2022, Stada's Nature Aid division expanded its product offerings by introducing children's vitamin/mineral botanical-based supplements in the United Kingdom.

The Asia-Pacific botanical supplements market is expected to grow at the fastest CAGR from 2024 to 2032. This is due to the strong preference for botanical and herb products in Asian nations like India, China, and Japan. This region is a major hub for herb production and exportation worldwide to meet the rising demand for medicinal and herbal components from manufacturers to incorporate them into new product formulations.

For instance, according to the Ministry of Commerce & Industry, in 2017-18, India exported herbs worth USD 330.18 million, showing a growth rate of 14.22% compared to the previous year. Additionally, the export of value-added extracts of medicinal herbs and herbal products reached USD 456.12 million during the same period, marking a growth rate of 12.23% over the previous year.

Global Botanical Supplements Market, Regional Coverage, 2019 - 2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Botanical Supplements Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the botanical supplements market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, botanical supplements industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global botanical supplements industry to benefit clients and increase the market sector. In recent years, the botanical supplements industry has offered some technological advancements. Major players in the botanical supplements market, including Amway Corporation, BASF SE, Blackmores Limited, Botanicalife International of America, Inc., Dabur, GNC Holdings Inc., Himalaya Wellness, Nature's Bounty Co., Nutraceutical International Company, and P&G Health.

BASF SE is a global chemical corporation with seven distinct business segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The Nutrition & Care sector provides pharmaceutical as well as food and feed producers, detergent, cleaner industries and cosmetics. BASF SE and Mazza Innovation formed a partnership to collaborate on the development of an environmentally friendly extraction of plants for cosmetic applications by using PhytoClean technology.

Himalaya Wellness is a global herbal health and personal care company. Himalaya offers a range of over 500 scientifically validated herbal products. The company’s product portfolio includes baby care, wellness, personal care, Himalaya for moms, animal health, home care, nutrition, and pharmaceuticals. Himalaya has a global presence in over 100 countries with R&D facilities. In August 2023, Himalaya Wellness introduced Ashwagandha Organic Gummies containing clinically researched KSM-66 Ashwagandha root extract. These gummies offer a daily supply of energy and relaxation from stress.

Key Companies in the Botanical Supplements market include:

- Amway Corporation

- BASF SE

- Blackmores Limited

- Botanicalife International of America, Inc.

- Dabur

- GNC Holdings Inc.

- Himalaya Wellness

- Nature's Bounty Co

- Nutraceutical International Company

- P&G Health

Botanical Supplements Industry Developments

May 2024: Phytaphix launched Neuro Phix, a capsule containing boswellic acid, ellagic acid, curcuminoids, ginger root, silymarin, and vitamins B12 and D3 to address inflammation, fatigue, and nervous system function in individuals with multiple sclerosis (MS).

December 2023: Garden of Life launched six botanical supplement products, Liposomal Berberine, Stress Relief Gummies, Brain Health Capsules, Heart Health Capsules, Menopause Hair Growth Softgels, and Eye Health Softgels to maintain or enhance health.

January 2021: Prorganiq introduced a new range of botanical supplements containing the natural benefits of herbs and are manufactured in facilities registered with FSSAI and approved by GMP.

Botanical Supplements Market Segmentation:

Botanical Supplements Source Outlook

- Herbs

- Leaves

- Spices

- Flowers

- Others

Botanical Supplements Form Outlook

- Powder

- Liquid

- Tablets

- Capsules

- Gummies

- Others

Botanical Supplements Distribution Channel Outlook

- Hypermarket/ Supermarket

- Online Retail Stores

- Drug Stores/Pharmacies

- Health Stores

Botanical Supplements End-Use Outlook

- OTC

- Prescribed

Botanical Supplements Application Outlook

- Energy & Weight Management

- General Health

- Bone & Joint Health

- Gastrointestinal Health

- Immunity

- Cardiac Health

- Diabetes

- Anti-cancer

- Others

Botanical Supplements Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Botanical Supplements Report Scope:

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 35.61 billion |

|

Market size value in 2024 |

USD 38.26 billion |

|

Revenue Forecast in 2032 |

USD 68.73 billion |

|

CAGR |

7.6% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global botanical supplements market size was valued at USD 35.61 billion in 2023 and is projected to be valued at USD 68.73 billion in 2032

The global market is projected to grow at a CAGR of 7.6% during the forecast period, 2024-2032

North America held the largest share of the global market

The key players in the market are Amway Corporation, BASF SE, Blackmores Limited, Botanicalife International of America, Inc., Dabur, GNC Holdings Inc., Himalaya Wellness, Nature's Bounty Co., Nutraceutical International Company, and P&G Health.

The tablet category dominated the market in 2023.

The energy & weight management category held the largest share of the global market.