Border Security Market Size, Share, Trends, Industry Analysis Report: By Platform (Land, Maritime, and Airborne), Systems, Installation, Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Sep-2024

- Pages: 118

- Format: PDF

- Report ID: PM5074

- Base Year: 2023

- Historical Data: 2019-2022

Border Security Market Overview

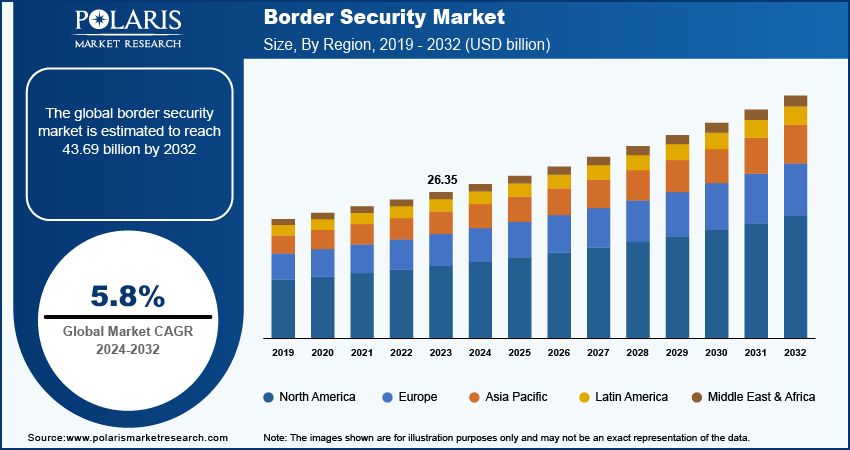

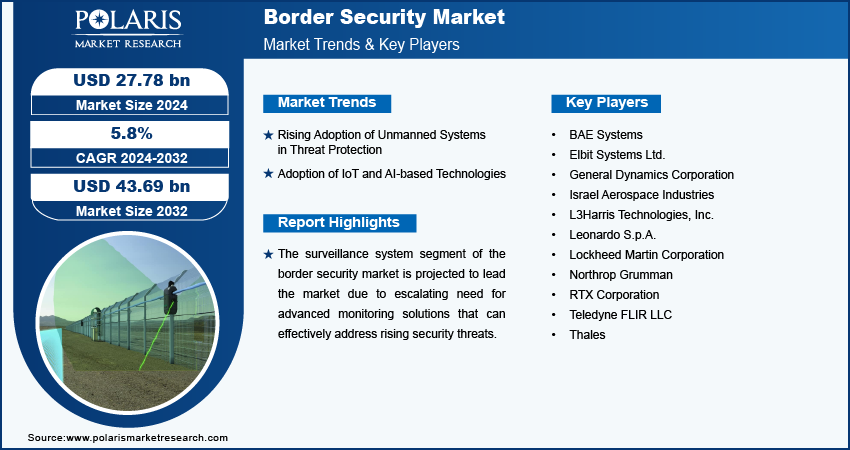

Global border security market size was valued at USD 26.35 billion in 2023. The market is projected to grow from USD 27.78 billion in 2024 to USD 43.69 billion by 2032, exhibiting a CAGR of 5.8% during the forecast period (2024 - 2032).

The border security market refers to providing technologies, services, and solutions designed to secure national borders to monitor and control the movement of people, animals, and goods across land, air, and maritime borders.

The rising prevalence of global terrorism, cross-border crime, illegal immigration, and drug trafficking has intensified the need for advanced border security solutions worldwide. According to the Institute for Economics & Peace, published global terrorism index 2024 report, there was a 22% increase in terrorism-related deaths to 8,352, the highest since 2017, despite a 22% decrease in incidents to 3,350, and the Central Sahel region emerging as the most fatal area.

Governments are increasingly investing in advanced technologies such as surveillance drones, biometric identification systems, and AI-powered analytics to enhance border monitoring and enforcement capabilities. These technologies help in detecting and preventing illicit activities and also enable quicker response times to security threats, ensuring safer and more secure borders drive the demand for border security concerns.

To Understand More About this Research: Request a Free Sample Report

The interconnected nature of security challenges necessitates a comprehensive approach that combines advanced technology with strategic policy frameworks. Collaboration between governments, international organizations, and private sector innovators developing integrated solutions that address the multifaceted nature of modern border security threats effectively. Further, threats continue to evolve, and the demand for adaptive and scalable border security solutions is expected to grow, driving further innovation and investment in the border security market.

Border Security Market Drivers and Trends

Rising Adoption of Unmanned Systems in Threat Protection

The increasing adoption of unmanned systems for security purposes is expected to boost market growth significantly. These systems, including unmanned aircraft and ground or underwater vehicles, are becoming integral in the defense sector due to their ability to enhance long-range obstacle detection and collision avoidance capabilities.

There is a rising demand for autonomous systems across various applications such as site exploration, rescue operations, surveillance, and crowd monitoring. This is driven by defense forces and regulatory authorities seeking more effective and efficient solutions for security challenges. For instance, in July 2023, Teledyne FLIR Defense secured a $93.9 million IDIQ contract to supply Black Hornet 3 nano-drones to the US Army, enhancing soldier reconnaissance capabilities. This enhances security concerns and defense capabilities and drives the rising demand for threat protection drives the border security market.

The integration of unmanned systems with advanced security products is also expanding their utility beyond traditional military roles into areas such as border patrol, disaster response, and infrastructure protection. This approach underscores the transformative impact of unmanned systems in bolstering security measures across diverse operational environments.

Adoption of IoT and AI-based Technologies

Technological innovations such as AI (Artificial Intelligence), IoT (Internet of Things), drones, biometrics, and facial recognition are pivotal in driving growth in the border security market. These advancements enable border authorities to enhance their capabilities significantly. AI algorithms, for instance, analyze vast amounts of data to detect potential threats swiftly and accurately, improving preemptive security measures. IoT devices provide real-time monitoring and data collection across border areas, enhancing situational awareness and enabling rapid response to incidents.

Drones play a crucial role in border surveillance by offering flexible and cost-effective aerial monitoring capabilities, particularly in remote or challenging terrains. For instance, in June 2024, The Indian Navy planned to procure four domestically developed Tapas surveillance drones from DRDO designed for maritime surveillance.

Biometric technologies such as fingerprint and iris scans boost security at entry points by ensuring robust identity verification, thereby reducing the risk of unauthorized access. Facial recognition systems automate identity verification processes, improving operational efficiency and accuracy in processing travelers. These technological advancements strengthen border security measures and also drive market growth.

Border Security Market Segment Insights

Border Security Market Analysis by Platform Insights

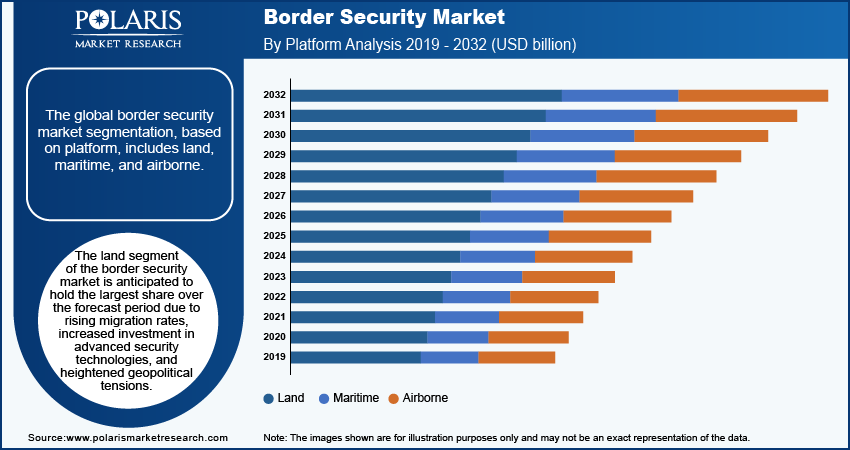

The global border security market segmentation, based on platform, includes land, maritime, and airborne. The land segment of the border security market is anticipated to hold the largest share over the forecast period due to rising migration rates, increased investment in advanced security technologies, and heightened geopolitical tensions. According to the United Nations, global migration has reached over 280 million international migrants recorded in 2020. Nations are driven to strengthen their land borders to manage influxes and mitigate threats from transnational crime, such as drug and human trafficking. According to the US Drug Enforcement Administration (DEA), over 90% of the cocaine consumed in the US is trafficked through land borders.

The impact of climate change is also expected to displace millions, creating a new wave of climate refugees and necessitating improved border management. Stricter immigration laws and growing public advocacy for enhanced border security further drive segment growth. Countries are increasingly collaborating on initiatives to share intelligence and best practices, ensuring that the land border segment remains a critical focus for national security efforts in an evolving global landscape.

Border Security Market Analysis by Systems Insights

The global border security market segmentation, based on systems, includes surveillance systems, detection systems, communication systems, border security systems, laser systems, unmanned systems, perimeter intrusion detection systems, cybersecurity systems, and others. The surveillance system segment of the border security market is projected to lead the market due to escalating need for advanced monitoring solutions that can effectively address rising security threats. Governments and border control agencies are increasingly investing in technologies such as AI, machine learning, and high-resolution imaging. These advancements enable real-time monitoring and improved accuracy, allowing for rapid threat detection and response to illegal activities, such as drug trafficking and terrorism.

The integration of surveillance systems with other security technologies, including biometric identification and access control, enhances overall security effectiveness. Increased public safety concerns, driven by recent global events, are boosting investments in comprehensive border monitoring solutions.

Border Security Regional Insights

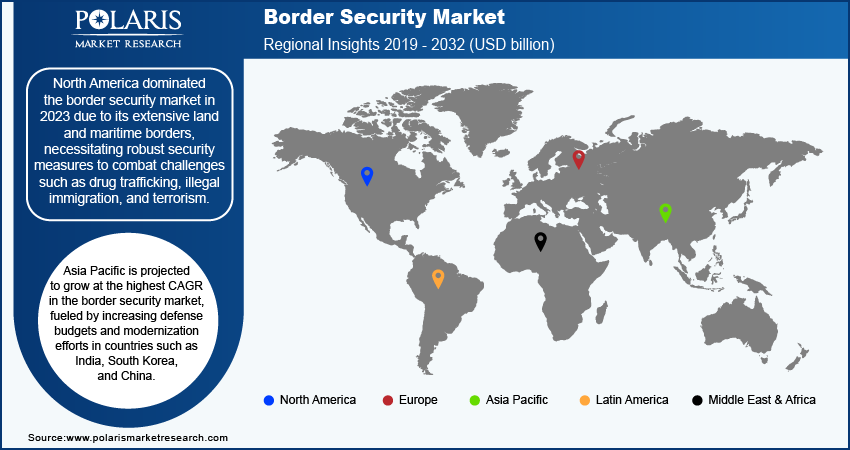

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the border security market in 2023 due to its extensive land and maritime borders, necessitating robust security measures to combat challenges such as drug trafficking, illegal immigration, and terrorism. According to a report by the US Department of Homeland Security, nearly 3.3 million apprehensions occurred at the US-Mexico border in 2022, highlighting the critical need for enhanced border security solutions. Further, significant investments in advanced technologies, including unmanned aerial vehicles (UAVs) and biometric systems, are being made to improve surveillance and identity verification.

The presence of major defense contractors such as Lockheed Martin and Northrop Grumman fosters rapid innovation in border security technologies. Collaborative efforts between North American countries and international partners to share intelligence further enhance security capabilities. Legislative frameworks, such as the US Customs and Border Protection modernization initiatives, emphasize the importance of investing in advanced security measures, solidifying North America’s position as a leader in the border security market as it addresses both current and emerging threats.

Asia Pacific is projected to grow at the highest CAGR in the border security market, fueled by increasing defense budgets and modernization efforts in countries such as India, South Korea, and China. China’s defense budget and India's planning to increase spending, these nations are investing heavily in advanced border security technologies, such as surveillance systems and biometrics. Rising geopolitical tensions, including territorial disputes in the South China Sea and the India-Pakistan border, further drive the need for enhanced border security to protect national sovereignty and address issues like illegal migration and drug trafficking.

Small and medium-sized enterprises (SMEs) in the region are increasingly recognizing the importance of robust border protection solutions as they expand operations and engage in cross-border trade. This demand is propelling market growth for technologies such as access control and threat detection systems tailored to SMEs.

Border Security Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the border security market expand. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, border security industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global border security industry to benefit clients and increase the market sector. In recent years, the border security market has offered some technological advancements. Major players in the border security market include BAE Systems; Elbit Systems Ltd.; General Dynamics Corporation; Israel Aerospace Industries; L3Harris Technologies, Inc.; Leonardo S.p.A.; Lockheed Martin Corporation; Northrop Grumman; RTX Corporation; Teledyne FLIR LLC; and Thales

Lockheed Martin Corporation is a security and aerospace company formed by combining the businesses of Martin Marietta Corporation and Lockheed Corporation. The company is engaged in diverse industry sectors, including research, development, design, integration, and manufacture of advanced technology products, systems, and services. In November 2023, Lockheed Martin opened a $16.5 million Missile System Integration Lab in Huntsville, Alabama, to advance missile defense capabilities and develop the Next Generation Interceptor.

Teledyne FLIR is a provider of thermal imaging and sensing technologies specializing in products for government, defense, industrial, and commercial markets. Founded in 1978 and acquired by Teledyne Technologies in 2021, the company offers a diverse range of products, including thermal cameras, sensor systems, and threat-detection solutions. In March 2022, Teledyne FLIR Defense unveiled the Lightweight Vehicle Surveillance System (LVSS), featuring advanced counter-drone capabilities and a combination of 3D radar, EO/IR cameras, and RF detection to combat small drone threats.

List of Key Companies in Border Security Market

- BAE Systems

- Elbit Systems Ltd.

- General Dynamics Corporation

- Israel Aerospace Industries

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman

- RTX Corporation

- Teledyne FLIR LLC

- Thales

Border Security Industry Developments

- June 2024: Teledyne FLIR Defense launched the SUGV 325, a portable and modular unmanned ground robot weighing about 20 pounds, designed for military applications such as surveillance, EOD, and CBRN inspection.

- March 2024: Garuda Aerospace launched its flagship Border Patrol Surveillance Drone, Trishul, designed for monitoring and analysis of people movement, natural disasters, and traffic situations using advanced sensors and wide-angle visibility.

- February 2023: BAE Systems secured a £38 million contract with the UK Home Office to develop advanced risk analytics services for real-time threat detection at the border, enhancing national security and streamlining processes for traders and travelers.

Border Security Market Segmentation

By Platform Outlook

- Land

- Maritime

- Airborne

By Systems Outlook

- Surveillance Systems

- Detection Systems

- Communication Systems

- Border security systems

- Laser Systems

- Unmanned Systems

- Perimeter Intrusion Detection Systems

- Cybersecurity Systems

- Others

By Installation Outlook

- New Installations

- Upgradation

By Vertical Outlook

- Military

- Homeland Security

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Border Security Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 26.35 billion |

|

Market Size Value in 2024 |

USD 27.78 billion |

|

Revenue Forecast in 2032 |

USD 43.69 billion |

|

CAGR |

5.8% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global border security market size was valued at USD 26.35 billion in 2023 and is anticipated to reach at USD 43.69 billion in 2032.

The global market is expected to register a CAGR of 5.8% during the forecast period, 2024-2032.

North America had the largest share of the global market

The key players in the market are BAE Systems; Elbit Systems Ltd.; General Dynamics Corporation; Israel Aerospace Industries; L3Harris Technologies, Inc.; Leonardo S.p.A.; Lockheed Martin Corporation; Northrop Grumman; RTX Corporation; Teledyne FLIR LLC; and Thales.

The land category dominated the market in 2023.

The surveillance systems had the largest share of the global market.