Borage Oil Market Size, Share, Trends, Industry Analysis Report: By Nature, By Delivery Form (Liquid and Capsule), Application, Distribution Channel, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 125

- Format: PDF

- Report ID: PM5313

- Base Year: 2024

- Historical Data: 2020-2023

Borage Oil Market Overview

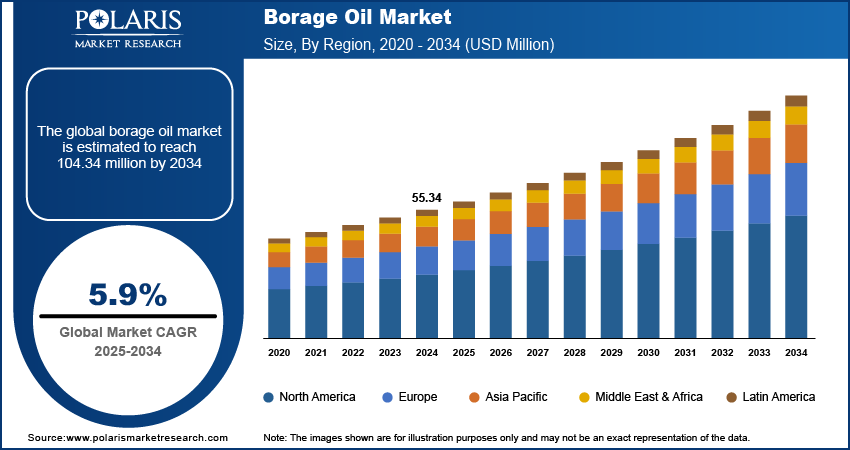

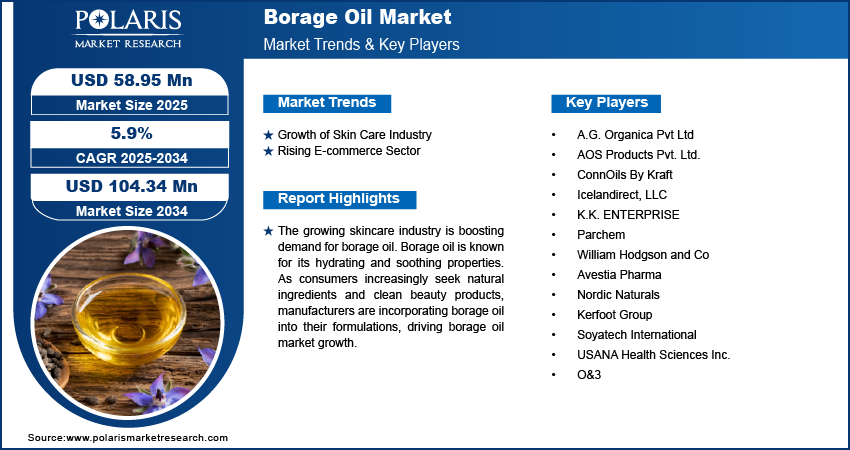

Borage oil market size was valued at USD 55.34 million in 2024. The market is projected to grow from USD 58.95 million in 2025 to USD 104.34 million by 2034, exhibiting a CAGR of 5.9% during the forecast period.

Borage oil is made from the seeds of the borage plant. It contains a lot of gamma-linolenic acid (GLA), which is an omega-6 fatty acid. GLA is known for helping reduce inflammation. It is commonly used in dietary supplements and skincare products to support skin health and alleviate conditions such as eczema and premenstrual syndrome.

The rising demand for natural ingredients in dietary and cosmetic products is driving the borage oil market growth. With consumers becoming more health-conscious, there is an increasing preference for products made from natural sources. Known for its beneficial properties and high gamma-linolenic acid (GLA) content, borage oil is widely used in dietary supplements for its anti-inflammatory effects and in skincare for its hydrating and soothing qualities. This shift towards natural ingredients is boosting the popularity of borage oil among both manufacturers and consumers, contributing to the borage oil market expansion.

To Understand More About this Research: Request a Free Sample Report

The rising prevalence of inflammatory and hormonal disorders is significantly driving the market. Conditions such as arthritis, eczema, and hormonal imbalances are becoming more common, leading many people to look for natural remedies for relief. Borage oil, rich in gamma-linolenic acid (GLA), is known for its anti-inflammatory properties, making it an attractive option for those looking to manage these health issues. Additionally, borage oil has the potential to benefit skin health and hormone regulation. As a result, the growing awareness of these disorders is expanding the borage oil market demand.

Borage Oil Market Dynamics

Growth of Skin Care Industry

The expansion of the skincare industry is driving the market demand for borage oil. With consumers increasingly seeking effective and natural ingredients for their skincare routines, borage oil is gaining attention for its hydrating and soothing properties. Manufacturers are incorporating borage oil into their formulations for its ability to enhance skin elasticity and reduce inflammation. This demand is further fueled by a growing interest in clean beauty products that emphasize natural and beneficial ingredients. With the continued growth of the skincare industry, the need for borage oil among manufacturers is expected to rise, further propelling the market growth.

Rising E-Commerce Sector

The growing e-commerce sector is becoming a significant driver for the borage oil market. As online shopping continues to rise, consumers have greater access to natural health products, including borage oil, which is gaining popularity for its anti-inflammatory properties and skin benefits. E-commerce platforms provide an easy and convenient way for consumers to purchase borage oil in various forms, such as capsules, creams, and oils. This accessibility is boosting market demand, as people are increasingly turning to online stores for health and wellness products.

Additionally, the e-commerce industry allows brands to reach a wider audience, including those in regions where borage oil might not be readily available in physical stores. With growing awareness about the benefits of borage oil for conditions like arthritis, skin disorders, and hormonal imbalances, the convenience of online shopping has made it easier for consumers to integrate these products into their daily routines, driving the market's growth.

Borage Oil Market Segment Insights

Borage Oil Market Assessment by Delivery Form

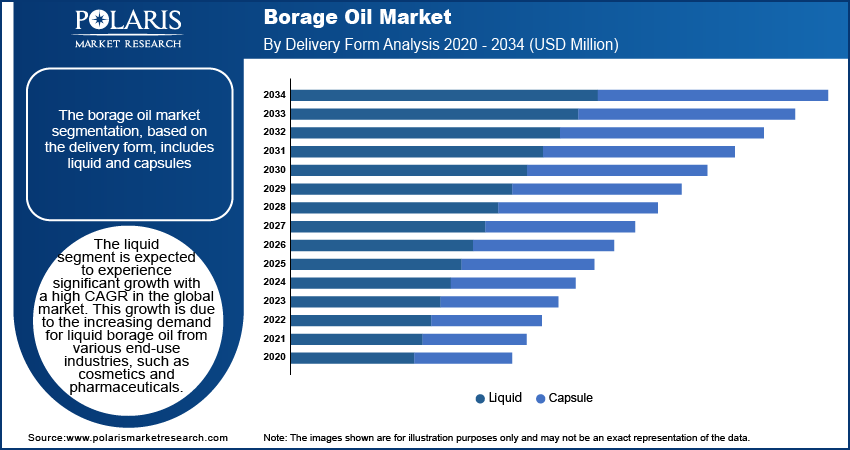

The borage oil market segmentation, based on the delivery form, includes liquid and capsule. The liquid segment is expected to register a significant CAGR in the global market. This growth is due to the increasing demand for liquid borage oil from various end-use industries, such as cosmetics and pharmaceuticals. In cosmetics, liquid borage oil is favored for its moisturizing and anti-inflammatory properties, making it ideal for skincare products. In pharmaceuticals, its health benefits support a range of treatments, including managing inflammatory conditions, improving skin health, reducing symptoms of eczema, and alleviating joint pain, making borage oil a valuable ingredient in natural remedies and wellness products.

Borage Oil Market Assessment by End Use

The borage oil market segmentation, based on end use, includes pharmaceuticals, cosmetics, food and beverages, and animal feed. The cosmetics segment dominated the borage oil market in 2024 due to the increase in the application of borage oil in the cosmetic industry. Borage oil is known for its moisturizing and soothing properties, making it a popular ingredient in skincare products. Consumers are increasingly looking for natural solutions to improve skin health, which has driven the growth of borage oil in cosmetics. Its ability to reduce inflammation and enhance skin elasticity makes it particularly appealing for anti-aging and hydrating formulations.

Borage Oil Market Regional Insights

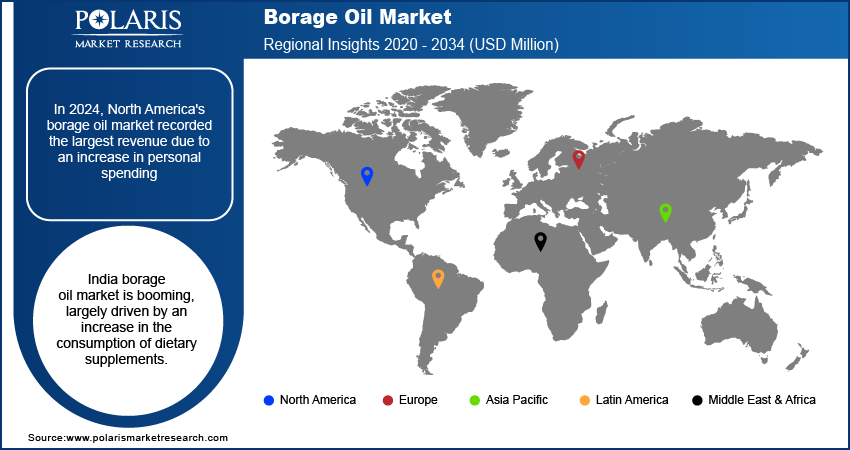

By region, the study provides the borage oil market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest borage oil market revenue share due to an increase in personal spending. For instance, according to the United States Bureau of Economic Analysis, in August 2024, personal spending in the US rose by 0.2% from the previous month, showing consumers' willingness to invest in quality skincare and health products. This increase in spending indicates that more people are spending on their health and beauty needs, leading to higher demand for natural ingredients as borage oil. Thus, the rise in spending in North America is driving the demand for borage oil.

Asia Pacific is expected to experience significant growth over the forecast period due to the growth of the food and beverage industry. For instance, according to the Center for Indonesia Policy Study, in Indonesia, the food and beverage industry contributed 6.70% to the country's GDP in 2021, highlighting its rapid growth. More consumers are looking for natural and healthy ingredients in their diets due to which borage oil is becoming increasingly popular for its nutritional benefits and potential health advantages. This rising demand for natural food products is driving manufacturers to incorporate borage oil into various food and beverage applications, fueling the market growth in Asia Pacific.

The borage oil market in India is set for substantial growth due to an increase in the consumption of dietary supplements. For instance, according to the Indian Department of Pharmaceuticals, sales of dietary supplements rose by 7.44% in 2021 from 2017, indicating a growing awareness among consumers about health and wellness. More people are looking for natural solutions for various health issues, and borage oil is becoming a popular choice due to its rich content of gamma-linolenic acid (GLA) and its potential anti-inflammatory benefits. This rising interest in dietary supplements is driving demand for borage oil, positively impacting the growth of the borage oil in India.

Borage Oil Market Key Market Players & Competitive Insights

The borage oil industry is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative formulations to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the borage oil market include A.G. Organica Pvt, Ltd; AOS Products Pvt. Ltd.; ConnOils by Kraft, Icelandirect, LLC, K.K. ENTERPRISE; Parchem, William Hodgson and Co, Avestia Pharma, Nordic Naturals, Kerfoot Group, Soyatech International, USANA Health Sciences Inc.; and O&3

A.G. Organica Pvt. Ltd. is a manufacturer and supplier of essential oils, carrier oils, and cosmetic products, established in 2020 and headquartered in Delhi, India. The company evolved from A.G. Industries, which began its operations in 1990 with a focus on mint products. The company operates primarily within the chemicals and materials industry, offering a diverse range of products for both domestic and international markets. Its product portfolio includes essential oils derived from various botanical sources for aromatherapy and natural skincare applications. Additionally, A.G. Organica provides carrier oils that serve as bases for essential oils and are used in cosmetic formulations. The company has also expanded its offerings to include a variety of skincare, haircare, and personal care items.

Connoils by Kraft is a manufacturer and supplier of bulk oil ingredients and oil powders to a diverse clientele that includes both startups and large corporations. The company focuses on providing essential raw materials for various applications such as gels, capsules, pills, and beverages. Connoils offers a wide range of oils sourced from conventional, organic, and biodynamic origins, designed to support industries such as pet nutrition, functional foods, health and beauty, and sports nutrition. In addition to oil ingredients, Connoils specializes in high-oil load powders that for traditional drying methods. Connoils offers private labelling options for businesses looking to market their products under their brand names.

Key Companies in Borage Oil Market

- A.G. Organica Pvt Ltd

- AOS Products Pvt. Ltd.

- ConnOils By Kraft

- Icelandirect, LLC

- K.K. ENTERPRISE

- Parchem

- William Hodgson and Co

- Avestia Pharma

- Nordic Naturals

- Kerfoot Group

- Soyatech International

- USANA Health Sciences Inc.

- O&3

Borage Oil Market Segmentation

By Nature Outlook (USD Million, 2020–2034)

- Organic

- Conventional

By Delivery Form Outlook (USD Million, 2020–2034)

- Liquid

- Capsule

By Application Outlook (USD Million, 2020–2034)

- Skin Care

- Anti-Inflammatory

- Antioxidant

- Haircare

- Anti-Ageing

By Distribution Channel Outlook (USD Million, 2020–2034)

- Online

- Retail

- Pharmacies

By End Use Outlook (USD Million, 2020–2034)

- Pharmaceutical

- Cosmetics

- Food and Beverages

- Animal Feed

By Regional Outlook (USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Borage Oil Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 55.34 million |

|

Market Size Value in 2025 |

USD 58.95 million |

|

Revenue Forecast in 2034 |

USD 104.34 million |

|

CAGR |

5.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report End User |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The borage oil market size was valued at USD 55.34 million in 2024 and is projected to grow to USD 104.34 million by 2034.

The global market is projected to grow at a CAGR of 5.9% during 2025-2034.

North America had the largest share of the global market.

The key players in the market are A.G. Organica Pvt, Ltd; AOS Products Pvt. Ltd.; ConnOils by Kraft, Icelandirect, LLC, K.K. ENTERPRISE; Parchem, William Hodgson and Co, Avestia Pharma, Nordic Naturals, Kerfoot Group, Soyatech International, USANA Health Sciences Inc.; and O&3.

The liquid segment is expected to experience significant growth with a high CAGR in the global market due to an increase in demand for liquid borage oil from various end-use industries, such as cosmetics and pharmaceuticals.

The cosmetics segment dominated the market in 2024 due to an increase in the application of borage oil in the cosmetic industry.