Bookbinding Adhesives Market Share, Size, Trends, Industry Analysis Report

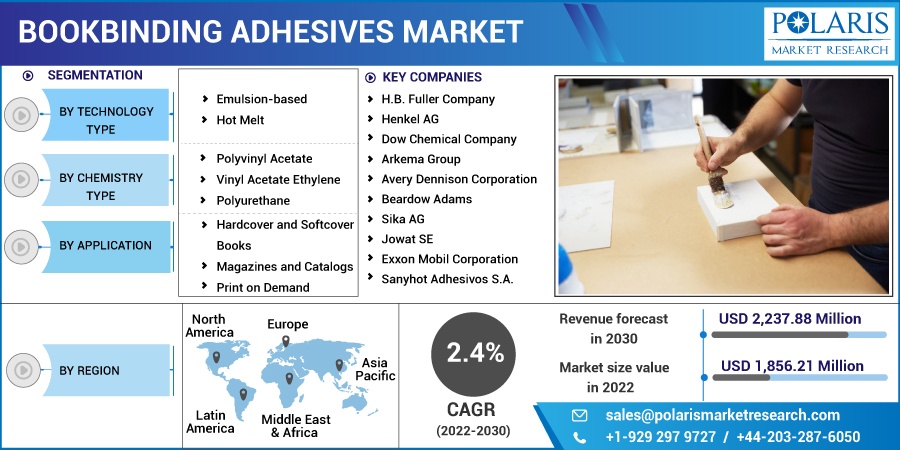

By Technology Type (Emulsion-based and Hot Melt); By Chemistry Type; By Application; By Region; Segment Forecast, 2022-2030

- Published Date:Dec-2022

- Pages: 118

- Format: PDF

- Report ID: PM2911

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

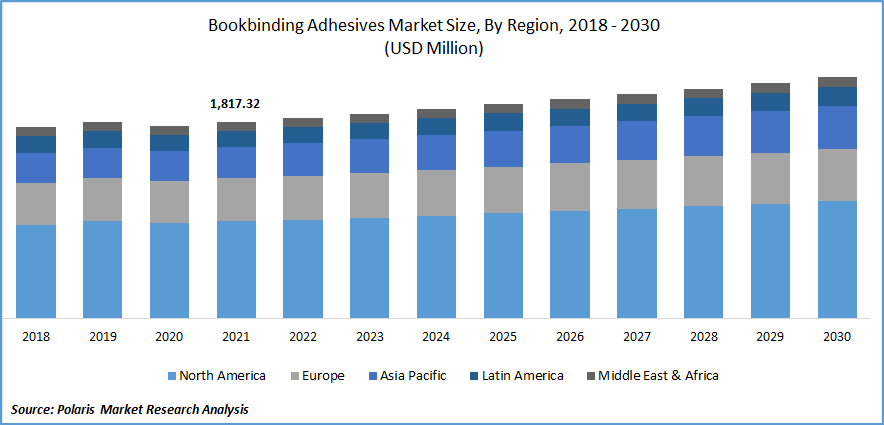

The global bookbinding adhesives market was valued at USD 1,817.32 million in 2021 and is expected to grow at a CAGR of 2.4% during the forecast period.

A rapid increase in the number of applications of bookbinding adhesive from a wide range of applications such as hardcover & softcover books, print on demand, and magazines & catalogs among many others along with the growing prevalence of improved adhesives are key factors influencing the market growth. In addition, increasing government favorable policies and heavily investing in advanced HMAs by both private and public organizations around the world is likely to contribute positively to the market demand and growth in the next coming years.

Know more about this report: Request for sample pages

For instance, in May 2022, H.B. Fuller Company announced the launch of its metallocene range of solutions for various bookbinding applications. This hot melt adhesive offers many advantages for the production process and even for end-use applications including robust temperature strength, lower coat weight, and high adhesion strength. It further enables the easy recyclability of books and reduces the consumption of adhesives.

However, high advances in technology in the last few years and the growing prevalence of remote learning during the COVID-19 pandemic along with the easy and cheap availability of internet facilities across the globe are likely to be major restraining factors for the market growth. Moreover, the increasing popularity of various online learning platforms and eBooks providers like Amazon Kindle is also impacting the demand for physical books, and in turn, hampering the global market demand and growth.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the bookbinding adhesives market. The rapid emergence of the deadly coronavirus has forced government authorities of various countries to impose lockdowns and many other stringent regulations. It has resulted in a temporary shutdown of production facilities and highly impacted the global supply chain, due to which, many global companies have seen a slight decline in their sales and revenue and are likely to recover over the projected period.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

High technological advancements and the introduction of various innovative hot melt adhesives, which provides high thermal stability and outstanding results in the terms of heat & cold is a key factor anticipated to drive the global market growth significantly over the next coming years. This type of innovative adhesive has helped to reduce the overall cost of bookbinding with a better finish, which is resulting in high adoption of these types of adhesives by various manufacturers and suppliers of magazines, and books, among others.

Furthermore, a continuous rise in the demand for physical books from educational institutions all over the world along with the rapidly growing need for polyurethane for the production of raw materials is also likely to foster market growth over the course of the anticipated period. Polyurethane is specially designed for the purpose to hold together non-porous materials, which makes them suitable for bookbinding and many other applications.

Report Segmentation

The market is primarily segmented based on technology type, chemistry type, application, and region.

|

By Technology Type |

By Chemistry Type |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Hot melt technology segment accounted for the largest market share

The hot melt segment accounted for a significant global market share in 2021 and is likely to register considerable growth in the coming years. A wide range of adhesion materials and surfaces offering through hot melt adhesives such as papers, ceramic, fabric, cardboard, and plastics, which makes it highly suitable for a variety of applications including bookbinding and DIY, are key major factors driving the segment market growth. In addition, the growing prevalence of plant-based hot melt adhesives mainly in developed nations such as the U.S., U.K., France, and Germany owing to their high sustainability is also propelling the demand and growth.

Furthermore, the emulsion-based technology segment is expected to grow at a fastest CAGR during the anticipated period owing to a rapid surge in applications including paper & packaging, and growing investment by government organizations for research and development activities, especially in developing countries like China, India, and South Korea. Additionally, increasing consumer awareness towards the benefits of these types of adhesives including eco-friendliness and modernization of products are augmenting the segment growth.

The vinyl acetate-ethylene segment held the largest market share in 2021

The vinyl acetate-ethylene segment held the largest share. This is attributed to its wide range of benefits such as excellent adhesion, paraffin solubility, superior flexibility, and strong mechanical strength. In addition, the high deployment of this material in various industries, as a copolymer adhesive all over the world are also influencing the growth and demand of the market.

Moreover, the polyurethane segment is expected to be the fastest growing segment over the coming years due to growing popularity and rapid growth in adoption because of its advantages such as high flexibility, excellent cohesive strength, and availability in various viscosity. Furthermore, it has good resilience at low temperatures and it is used largely in the production of hardcover & softcover books, magazines & catalogs, and print on demand, which is likely to impact the market positively in the near future.

Hardcover & softcover books dominated the global market in 2021

The hardcover & softcover books segment dominated the global market in 2021 with a holding of significant market share and is projected to maintain its dominance over the anticipated period. The demand for physical books is surging rapidly in various emerging nations including China and India and growing development in educational institutions coupled with a high gross enrolment ration in the higher education sector are major reasons propelling the growth and demand of the segment market. In addition, continuous growth in the sales of physical books across the globe is likely to boost the demand for bookbinding adhesives extensively

For instance, according to our findings, in 2021, a total of 825.75 million units of print books were sold among outlets, with a significant growth of 8.9 percent from the sales of the previous year in the United States. And, trade paperbacks retained their position as the dominant format with a total number of sales of 450 thousand units in 2021.

The demand in Asia Pacific is expected to witness significant growth

The Asia Pacific region is anticipated to be the fastest growing region over the projected period on account of the continuous rise in the manufacturing and high consumption of adhesive products along with the growing exports related activities for bookbinding adhesives, especially in emerging economies like China, India, and South Korea. Moreover, the increasing population, growing product innovations, and high industry consolidations are further expected to fuel the demand and growth of the segment market.

Furthermore, North America accounted for the largest market share in 2021, owing to the early adoption of advanced technology and the increasing prevalence of various types of hot melt adhesives due to their ability to provide high thermal stability and reduce give a smooth finish at a very competitive cost. The U.S. is the major and prominent manufacturer and consumer of bookbinding adhesives due to the rapid growth of many end-use industries in the country.

Competitive Insight

Some of the major players operating in the global market include H.B. Fuller Company, Henkel AG, Dow Chemical Company, Arkema Group, Avery Dennison Corporation, Beardow Adams, Sika AG, Jowat SE, Exxon Mobil Corporation, Sanyhot Adhesivos S.A., Embagrap SA, Bostik, Franklin International, Lord Corporation, Hubei Huitian Adhesive Enterprise Co. Ltd., and Ashland.

Recent Developments

In February 2022, Arkema Group announced the acquisition of well-known brands of Ashland Performance Adhesives and various key technologies as well. The acquisition aligns with the aim of the company to become a leader in the specialty chemical materials industry and highly focus on the development of sustainable high-performance solutions.

In February 2022, H.B. Fuller Company acquired its acquisition of Belgium-based provider of construction adhesives, Fourny NV. With this acquisition, the company will accelerate its growth in the Europe region and will localize products imported from the United States. It will also strengthen the company’s expertise, deep market knowledge, and better customer relationships.

Bookbinding Adhesives Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 1,856.21 million |

|

Revenue forecast in 2030 |

USD 2,237.88 million |

|

CAGR |

2.4% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Technology Type, By Chemistry Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

H.B. Fuller Company, Henkel AG, Dow Chemical Company, Arkema Group, Avery Dennison Corporation, Beardow Adams, Sika AG, Jowat SE, Exxon Mobil Corporation, Sanyhot Adhesivos S.A., Embagrap SA, Bostik, Franklin International, Lord Corporation, Hubei Huitian Adhesive Enterprise Co. Ltd., and Ashland. |