Bone Grafts and Substitutes Market Share, Size, Trends, Industry Analysis Report, By Material (Synthetic, Allograft, Others); By Application; By End Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 117

- Format: PDF

- Report ID: PM1650

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

Market Outlook

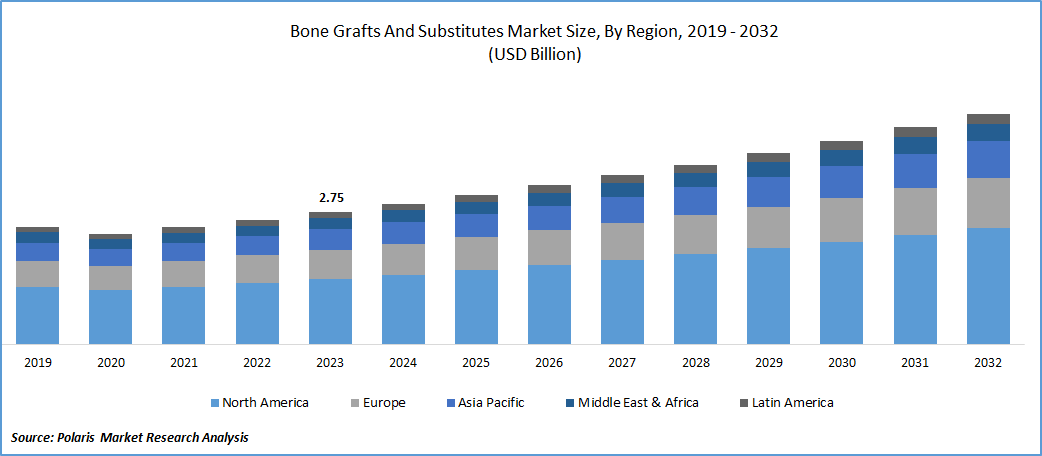

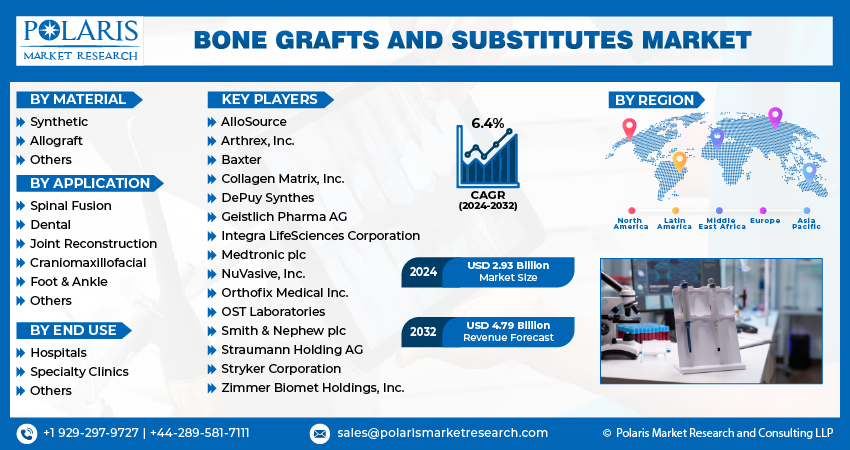

Bone Grafts and Substitutes Market size was valued at USD 2.75 billion in 2023.

The market is anticipated to grow from USD 2.93 billion in 2024 to USD 4.79 billion by 2032, exhibiting the CAGR of 6.4% during the forecast period.

Market Introduction

The bone grafts and substitutes market is experiencing substantial growth due to the rising aging population globally. With an increasing prevalence of musculoskeletal disorders and degenerative bone conditions among older individuals, there is a heightened demand for advanced orthopedic interventions. Bone grafts and substitutes play a crucial role in addressing these issues by promoting bone regeneration and aiding in the healing process. Ongoing advancements in medical technologies and innovative grafting materials contribute to the expansion of the market.

In addition, companies operating in the market are collaborating to expand their market reach and strengthen presence.

To Understand More About this Research: Request a Free Sample Report

For instance, in March 2022, Molecular Matrix, Inc. introduced its Osteo-P Synthetic Bone Graft Substitute (BGS) designed for applications within the musculoskeletal system. The Osteo-P BGS is crafted utilizing MMI’s hyper-crosslinked carbohydrate polymer technology platform, specifically engineered to enhance the microenvironment for effective bone repair and regeneration.

The bone grafts and substitutes market is also surging due to the escalating incidence of musculoskeletal disorders. Conditions like fractures and osteoporosis, prevalent across diverse age groups, are driving demand for advanced orthopedic solutions. These grafts play a crucial role in reconstructive procedures, aiding bone regeneration and structural support. The market is propelled by technological advancements in graft materials, including synthetic and biocompatible alternatives. With increasing orthopedic surgeries globally, the bone grafts and substitutes market addresses the imperative need for innovative solutions in orthopedic care.

Market Trends

Industry Growth Drivers

Growing Number of Orthopedic Procedures is Projected to Spur the Product Demand

The bone grafts and substitutes market is on the rise, driven by a surge in orthopedic procedures worldwide. Increasing numbers of joint replacements, spinal surgeries, and trauma-related interventions necessitate efficient solutions for bone regeneration. These interventions play a pivotal role in addressing fractures, bone defects, and degenerative conditions. Technological advancements and innovative biomaterials, alongside minimally invasive surgical techniques, further propel market growth.

Advancements in Surgical Techniques are Expected to Drive Bone Grafts and Substitutes Market Growth

Advancements in surgical techniques are driving substantial growth in the bone grafts and substitutes market. Minimally invasive procedures, computer-assisted surgeries, and 3D printing innovations empower surgeons with precise tools, improving outcomes and accelerating recovery. These technological strides enhance the integration of bone grafts and substitutes in modern orthopedic interventions. The evolution of regenerative medicine further propels the market, offering state-of-the-art solutions for efficient bone repair.

Industry Challenges

High Cost of Bone Graft Procedures is Likely to Impede the Market Growth

The bone grafts and substitutes market encounters constraints due to the high costs linked to traditional graft procedures. Conventional methods, involving autografts, allografts, and xenografts, incur substantial expenses, impacting both patients and healthcare systems. This financial burden hinders widespread adoption. However, the market is shifting towards more cost-effective alternatives, such as synthetic and bioactive substitutes, offering comparable efficacy without the same financial constraints. As advancements progress in developing affordable solutions, addressing the cost challenges associated with bone graft procedures, the market holds potential to address limitations and cater to a broader patient demographic in need of musculoskeletal interventions.

Report Segmentation

The bone grafts and substitutes market analysis is primarily segmented based on material, application, end use, and region.

|

By Material |

By Application |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Material Analysis

Allograft Segment Held Significant Market Revenue Share in 2023

The allograft segment held significant market revenue share in 2023. Allograft bone grafts and substitutes excel in medical procedures, particularly in orthopedics and dentistry. By eliminating the need for autografts, allografts reduce patient morbidity, providing a versatile solution for diverse musculoskeletal treatments. Their ready availability and diverse shapes and sizes streamline surgical procedures, contributing to reduced surgical time. Allografts maintain consistent quality through rigorous processing, ensuring reliability for surgeons and enhanced outcomes. With lower infection risks and the avoidance of donor site pain, they prioritize patient safety and comfort. Their larger graft volumes make them apt for extensive bone defects, and their adaptability proves advantageous in complex cases, emphasizing their pivotal role in advancing musculoskeletal treatments.

By Application Analysis

Spinal Fusion Segment Held Significant Market Revenue Share in 2023

The spinal fusion segment held significant market revenue share in 2023. Bone grafts and substitutes are pivotal in spinal fusion procedures, addressing diverse spinal conditions. Autografts, sourced from the patient's hip or pelvis, are renowned for their rich bone-forming cells but entail additional surgical risks. Allografts, derived from donors, can be cadaveric or synthetic, presenting concerns about disease transmission and long-term integration. Synthetic substitutes like ceramics offer alternatives. Growth factors, either from the patient or synthetically produced, accelerate bone cell activity. Minimally invasive techniques aim to reduce grafting needs, emphasizing biomechanical stability. Postoperative care is crucial for successful healing, and ongoing technological advancements focus on improving graft efficacy in spinal fusion procedures.

By End Use Analysis

Hospitals Segment Held Significant Market Revenue Share in 2023

The hospitals segment held significant revenue share in 2023. Within hospital settings, bone grafts and substitutes are integral components, playing diverse and critical roles. In orthopedic surgeries, they are indispensable for joint replacements, spinal fusions, and trauma-related procedures, supporting efficient bone regeneration. In dental procedures, these materials prove vital in dental implants and periodontal interventions, enhancing bone density and contributing to implant stability. Additionally, bone grafts play crucial roles in reconstructive surgeries, fracture treatments, and revision surgeries, reinforcing failed orthopedic implants. Their applications extend to craniofacial procedures, trauma care, and maxillofacial surgeries, emphasizing their versatility.

Regional Insights

North America Region Dominated the Global Market in 2023

In 2023, North America region dominated the global market. The North American bone grafts and substitutes market showcases a robust landscape shaped by technological advancements, a surge in orthopedic procedures, and a growing aging population with musculoskeletal concerns. Strategic collaborations among industry players, stringent regulatory oversight from the FDA, and substantial healthcare expenditures collectively propel the market forward. The preference for biologics, increased awareness campaigns, and ongoing research investments contribute to a dynamic and competitive market. Addressing prevalent issues like osteoporosis, adapting to minimally invasive procedures, and ensuring comprehensive insurance coverage underscore the versatility and resilience of the market, which is experiencing a post-pandemic resurgence in elective procedures.

Asia-Pacific is expected to experience significant growth during the forecast period. Asia-Pacific has witnessed a remarkable surge in healthcare infrastructure development, with substantial investments in cutting-edge hospitals, clinics, and medical facilities. This expansion is a driving force behind the escalating demand for orthopedic procedures, particularly spinal fusion surgeries where bone grafts and substitutes are integral. The region grapples with an increasing prevalence of orthopedic issues, spanning degenerative bone diseases, fractures, and sports-related injuries. This prevalence underscores the indispensability of bone grafts and substitutes in various orthopedic surgical interventions.

Key Market Players & Competitive Insights

The bone grafts and substitutes market involves a diverse range of participants, and the expected increase in new players entering the industry is poised to intensify competition. Established leaders in the market consistently enhance their technologies to maintain a competitive advantage, placing substantial emphasis on efficiency, reliability, and safety. These entities give precedence to strategic endeavors, including forging partnerships, improving product offerings, and participating in collaborative ventures with the goal of outperforming others in the industry. Their ultimate aim is to secure a significant bone grafts and substitutes market share.

Some of the major players operating in the global bone grafts and substitutes market include:

- AlloSource

- Arthrex, Inc.

- Baxter

- Collagen Matrix, Inc.

- DePuy Synthes

- Geistlich Pharma AG

- Integra LifeSciences Corporation

- Medtronic plc

- NuVasive, Inc.

- Orthofix Medical Inc.

- OST Laboratories

- Smith & Nephew plc

- Straumann Holding AG

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

Recent Developments

- In October 2023, Orthofix Medical Inc. revealed the 510k clearance and complete commercial introduction of OsteoCove, an innovative bioactive synthetic graft. OsteoCove, offered in both putty and strip forms, was meticulously designed to offer exceptional bone-forming capabilities while boasting top-notch handling characteristics. This makes it suitable for a diverse array of spine and orthopedic procedural applications.

- In January 2023, Nobel Biocare collaborated with Mimetis Biomaterials S.L. to introduce creos syntogain, a biomimetic bone graft substitute, to the market.

- In April 2023, ZimVie Inc. unveiled two new products as part of its biomaterials lineup. The first is the RegenerOss CC Allograft Particulate, which comprises a natural combination of cortical and cancellous bone particles. This product is designed for filling bony voids in various dental applications. The second addition is the RegenerOss Bone Graft Plug, a convenient grafting solution crafted for effortlessly filling extraction sockets and addressing periodontal defects.

Report Coverage

The bone grafts and substitutes market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, materials, applications, end uses, and their futuristic growth opportunities.

Bone Grafts and Substitutes Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.93 billion |

|

Revenue forecast in 2032 |

USD 4.79 billion |

|

CAGR |

6.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global Bone Grafts and Substitutes market size is expected to reach USD 4.79 billion by 2032

AlloSource, Arthrex, Inc., Medtronic plc, NuVasive, Inc., Orthofix Medical Inc are the top market players in the market.

North America region contribute notably towards the global Bone Grafts and Substitutes Market.

Bone Grafts and Substitutes market is expected CAGR: 6.4% (2023-2032)

Material, application, end use, and region are the key segments in the Bone Grafts and Substitutes Market