Board Insulation Market Size, Share, Trends, Industry Analysis Report: By Material Type, Application (Thermal Insulation, Sound Insulation, Fire Insulation, and Waterproof Insulation), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2025–2034

- Published Date:Dec-2024

- Pages: 128

- Format: PDF

- Report ID: PM5273

- Base Year: 2024

- Historical Data: 2020-2023

Board Insulation Market Overview

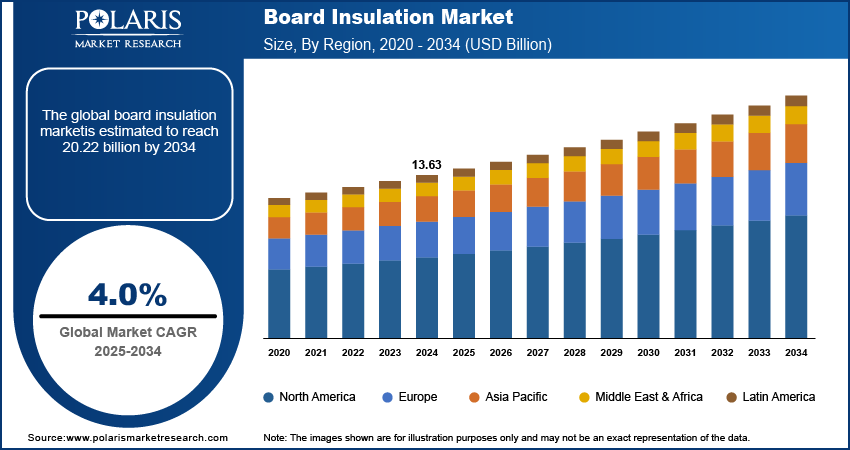

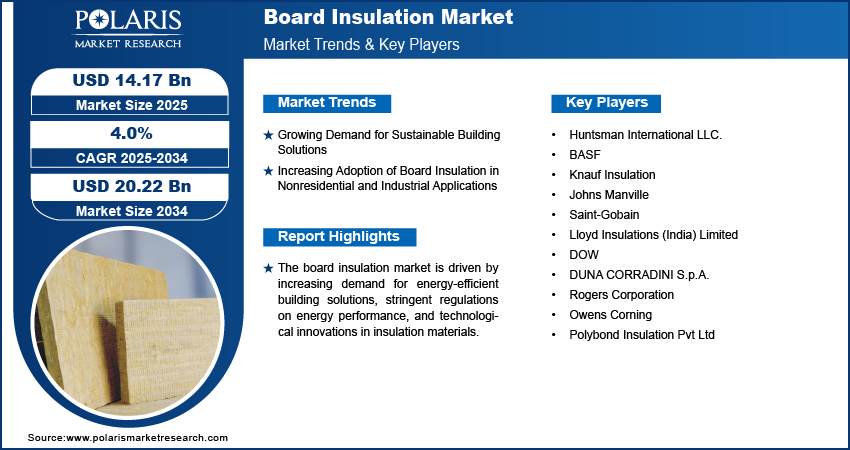

The board insulation market size was valued at USD 13.63 billion in 2024. The market is projected to grow from USD 14.17 billion in 2025 to USD 20.22 billion by 2034, exhibiting a CAGR of 4.0% during 2025–2034.

Board insulation refers to rigid panels made from materials such as polystyrene, polyisocyanurate, or mineral wool. They are designed to provide thermal resistance and enhance energy efficiency in construction. These boards are commonly used in walls, roofs, and floors to reduce heat transfer and improve building insulation performance.

The board insulation market growth is attributed to rising demand for energy-efficient and sustainable building materials. Insulation products such as polyisocyanurate (PIR), polystyrene (XPS), and mineral wool have gained importance in residential and commercial sectors as the global focus shifts toward reducing energy consumption and minimizing environmental impact. The market is driven by strict building codes and regulations promoting energy conservation and the growing trend of green building initiatives. Additionally, the increased adoption of energy-efficient construction techniques and the need for improved thermal performance in buildings have fueled the board insulation market demand. Technological advancements, such as the development of fire-resistant and moisture-resistant board insulation, have expanded their applicability across various applications, including roofs, walls, and floors. In October 2020, Promat, a specialist in passive fire protection, introduced Promatect-XW, a 60-minute fire protection board designed for steel encasements. This product aims to improve on-site productivity and is particularly effective in protecting steel columns and beams. It can resist temperatures ranging from 300°C to 650°C, making it a suitable and cost-effective solution for multi-residential, commercial, healthcare, and educational projects.

To Understand More About this Research: Request a Free Sample Report

Board Insulation Market Drivers Analysis

Growing Demand for Sustainable Building Solutions

Increasing environmental concerns push the construction industry to adopt energy-efficient materials. Board insulation materials, such as mineral wool, polystyrene, and polyisocyanurate (PIR) boards, offer excellent thermal resistance, reducing the need for energy-intensive heating and cooling systems. The demand for these materials is accelerating as building regulations worldwide tighten around energy performance and carbon emissions. For instance, a European Council report published in December 2023 highlighted that The European Parliament and Council have reached an agreement on a revised Energy Performance of Buildings Directive (EPBD). It mandates that by 2030, all new buildings must be zero-emission, and public authorities must comply with these standards for new properties by 2028, aiming to reduce energy consumption and carbon emissions. Furthermore, the growing awareness of climate change and the rising emphasis on reducing a building's carbon footprint contribute to the rising preference for sustainable insulation solutions. Board insulation's durability, efficiency, and recyclability make it an attractive choice for green building certifications such as LEED and BREEAM. Thus, the growing demand for sustainable building solutions is driving the board insulation market expansion.

Increasing Adoption of Board Insulation in Nonresidential and Industrial Applications

The nonresidential and industrial sectors focus on improving energy efficiency and meeting strict environmental regulations. Board insulation provides superior thermal performance, helping to reduce energy consumption in large-scale commercial, industrial, and public infrastructure. These applications often require materials that can withstand harsh environments and offer long-lasting durability, which board insulation delivers. In June 2023, Isover launched QTech, a new light mineral wool product for medium-temperature industrial applications with (≤ 300°C), further reflecting the growing demand for board insulation in nonresidential spaces. Additionally, the push for more sustainable building practices and the need for cost-effective solutions for climate control boost demand for board insulation in these sectors. Therefore, the increasing adoption of board insulation in nonresidential and industrial applications is driving the board insulation market demand.

Board Insulation Market Segment Analysis

Board Insulation Market Assessment by Material Type Outlook

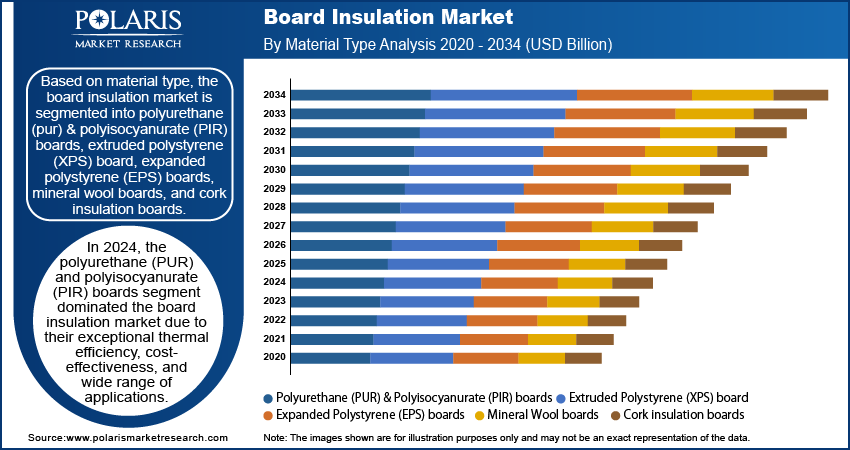

The global board insulation market segmentation, based on material type, includes polyurethane (PUR) & polyisocyanurate (PIR) boards, extruded polystyrene (XPS) boards, expanded polystyrene (EPS) boards, mineral wool boards, and cork insulation boards. In 2024, the polyurethane (PUR) and polyisocyanurate (PIR) boards segment dominated the board insulation market share due to their exceptional thermal efficiency, cost-effectiveness, and wide range of applications. These materials offer superior thermal performance, helping to meet the growing demand for energy-efficient buildings driven by more rigid regulations and sustainability efforts. PUR and PIR boards also provide high durability, moisture resistance, and ease of installation, which makes them highly favored in residential and commercial construction. Thus, their adoption is increasing across various sectors, including industrial and nonresidential applications, further driving the board insulation market growth.

Board Insulation Market Evaluation by Application Outlook

The global board insulation market segmentation, based on application, includes thermal insulation, sound insulation, fire insulation, and waterproof insulation. The thermal insulation segment is expected to grow during the forecast period due to the increasing focus on energy efficiency and sustainable building practices. The demand for materials that reduce energy consumption, such as thermal insulation, has increased as global energy consumption rises and regulations around energy performance become more stringent. Additionally, with rising awareness about carbon emissions and global warming, the need for energy-efficient buildings that maintain temperature control year round is becoming a priority. Thermal insulation helps achieve these goals by minimizing heat loss or gain, which results in cost savings for residential and commercial sectors. The growth in green building certifications and governmental incentives also supports the growing use of thermal insulation in construction.

Board Insulation Market Regional Analysis

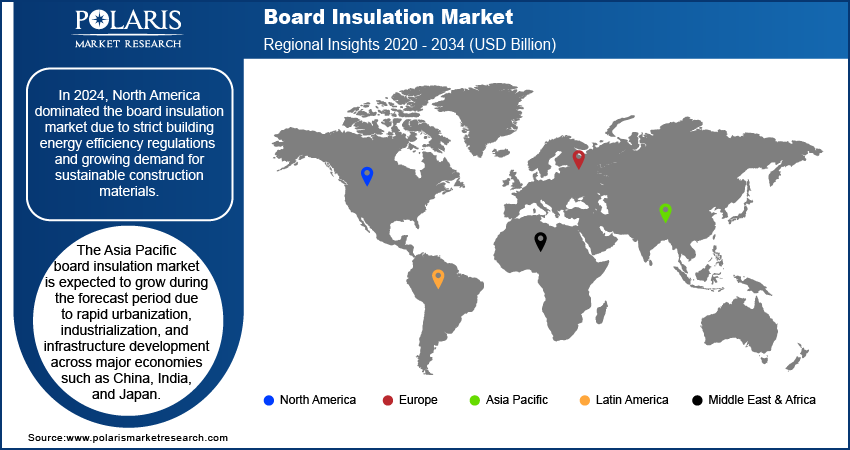

By region, the study provides board insulation market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the board insulation market revenue share due to strict building energy efficiency regulations and growing demand for sustainable construction materials. The US and Canada have robust building codes that promote the use of energy-efficient materials, encouraging the adoption of insulation solutions. Additionally, increasing investments in residential, commercial, and industrial infrastructure projects are driving market growth. The region’s strong focus on reducing carbon footprints and the growing trend of retrofitting older buildings further boost demand for board insulation. Leading manufacturers, along with innovations in eco-friendly materials, also contribute to North America's market dominance. Furthermore, governmental incentives and subsidies for energy-efficient building practices play a significant role in supporting the board insulation market expansion in the region. For instance, a report from October 2024 by the US EPA outlined its ENERGY STAR program's efforts in greenhouse gas (GHG) reduction. Partnering with over 15,000 organizations, ENERGY STAR promotes energy efficiency, certifies high-performing commercial buildings and plants, and provides tools such as Portfolio Manager to track energy, water use, and emissions. It also helps small businesses reduce energy waste and costs. The program certifies more than 80 product categories, encouraging lower energy consumption and environmental impact while offering energy-saving tips for workplaces. Thus, these combined efforts position North America as a leader in the global board insulation market.

The Asia Pacific board insulation market is expected to grow during the forecast period due to rapid urbanization, industrialization, and infrastructure development across major economies such as China, India, and Japan. The region’s construction sector is experiencing exponential growth, driven by rising demand for residential, commercial, and industrial buildings. The adoption of insulation materials has surged with stricter building codes and regulations promoting energy efficiency and sustainability. Moreover, the region's increasing focus on reducing carbon emissions and energy consumption accelerates the demand for thermal insulation. Government initiatives promoting energy-efficient building designs and green construction practices, along with growing awareness about climate change, are also contributing factors. The region’s cost-effective manufacturing capabilities and increasing investments in the construction industry make it a major market for insulation products, including board insulation. These combined factors are expected to boost the board insulation market development in the region during the forecast period.

Board Insulation Market – Key Players and Competitive Analysis Report

The competitive landscape of the board insulation market features a mix of global industry leaders and regional players competing for market share through innovation, partnerships, and regional expansion. Leading companies such as Owens Corning, Saint-Gobain, BASF, and Knauf Insulation leverage their extensive R&D capabilities, manufacturing expertise, and global distribution networks to provide advanced insulation products, including polyisocyanurate (PIR) and polyurethane (PUR) boards. The board insulation market trends show a rising demand for eco-friendly, energy-efficient solutions, such as the growing adoption of mineral wool and polyisocyanurate boards, in line with tightening global building codes and energy regulations. According to the board insulation market statistics, technological advancements, including the development of high-performance insulation boards with improved fire, moisture, and thermal resistance, are driving innovation in the market. Regional players are capitalizing on local needs and cost-effective offerings, particularly in emerging markets such as Asia Pacific, which is expected to grow at the fastest rate due to rapid urbanization, industrial expansion, and increased construction activity. Competitive strategies in the market include mergers and acquisitions, strategic alliances with construction firms, and the introduction of advanced insulation technologies. These developments highlight the importance of sustainability, technological innovation, and regional market dynamics in shaping the future growth of the board insulation industry. A few key major players are Huntsman International LLC., BASF, Knauf Insulation, Johns Manville, Saint-Gobain, Lloyd Insulations (India) Limited, DOW, DUNA CORRADINI S.p.A., Rogers Corporation, Owens Corning, and Polybond Insulation Pvt Ltd.

BASF, a global player in chemical manufacturing, has made remarkable progress in board insulation, prioritizing energy efficiency and sustainability in construction. The company's diverse product portfolio caters to residential and commercial building needs, featuring innovative mineral-based and polymeric insulation systems designed to meet the growing demand for energy-efficient solutions. Cavipor is a non-combustible, mineral-based insulation foam developed over eight years of extensive research. Cavipor is particularly suited for renovating double-wall masonry structures, providing effective thermal insulation through seamless cavity filling without expansion or internal pressure. Another key product is BASF's polyisocyanurate (PIR) boards and rigid polyurethane foam, which deliver exceptional thermal performance and durability. These materials are vital for applications such as commercial roofing and structural insulated panels, with their high R-values and ease of installation ensuring energy efficiency. BASF further demonstrates its commitment to sustainability with Neopor BMB, a raw insulation material created through a climate-friendly biomass balance method. This innovation significantly reduces carbon emissions by replacing up to 90% of traditional fossil fuel usage during production. Additionally, BASF has pioneered technologies such as contactless thermal welding for thick insulation boards, enhancing installation efficiency.

Saint-Gobain specializes in the construction and building materials industry, renowned for its innovative solutions that improve sustainability, performance, and safety. Saint-Gobain develops a wide range of products across various sectors, including insulation, which is a critical focus area for the company. The insulation division offers an extensive portfolio that includes fiberglass batts and rolls, blown-in insulation, and polyurethane spray foam, all designed to improve thermal efficiency and acoustic comfort in buildings. The products are the Twigainsul Glass Wool Boards and Weber XPS Boards. Twigainsul insulation products are made from resin-bonded glass wool that provides excellent thermal resistance with thermal conductivity values ranging from 0.030 to 0.034 W/m.K. These boards are also non-combustible and resistant to mold growth, making them suitable for various applications, including residential and commercial buildings where fire safety is paramount. Weber XPS Boards, on the other hand, feature a closed-cell structure that offers superior compressive strength and low thermal conductivity, making them ideal for energy conservation in cold storage and other demanding environments. Saint-Gobain's commitment to innovation is clear in its advanced manufacturing processes and rigorous quality control measures. The company operates several state-of-the-art facilities in India, producing high-performance mineral wool insulation products that cater to diverse building needs. Its insulation solutions enhance energy efficiency and also contribute to improved indoor air quality by managing moisture and air tightness effectively. Furthermore, Saint-Gobain prioritizes sustainability in its operations by investing in recycling programs and developing products that minimize environmental impact. For instance, In April 2024, Isover, a subsidiary of Saint-Gobain, introduced closed loop recycling services for construction waste, reinforcing the company's dedication to circular economy principles.

Key Companies in Board Insulation Market

- Huntsman International LLC.

- BASF

- Knauf Insulation

- Johns Manville

- Saint-Gobain

- Lloyd Insulations (India) Limited

- DOW

- DUNA CORRADINI S.p.A.

- Rogers Corporation

- Owens Corning

- Polybond Insulation Pvt Ltd

Board Insulation Industry Development

In June 2024, Nuvoco Vistas Corp. Ltd. introduced Ecodure Thermal Insulated Concrete, an innovative material designed to address challenges such as global warming and rising indoor temperatures. This eco-friendly solution enhances energy efficiency in buildings and helps reduce cooling costs.

In May 2024, Mannok launched IsoCavity, a PIR cavity wall insulation board that improves thermal performance with a conductivity of 0.022 W/mk. It features tongue-and-groove edges for easy installation, moisture protection, and improved energy efficiency.

Board Insulation Market Segmentation

By Material Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Polyurethane (PUR) & Polyisocyanurate (PIR) Boards

- Extruded Polystyrene (XPS) Board

- Expanded Polystyrene (EPS) Boards

- Mineral Wool Boards

- Cork Insulation Boards

By Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Thermal Insulation

- Sound Insulation

- Fire Insulation

- Waterproof Insulation

By Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Board Insulation Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 13.63 billion |

|

Market Size Value in 2025 |

USD 14.17 billion |

|

Revenue Forecast by 2034 |

USD 20.22 billion |

|

CAGR |

4.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 13.63 billion in 2024 and is projected to grow to USD 20.22 billion by 2034.

The global market is projected to register a CAGR of 4.0% during the forecast period.

In 2024, North America dominated the board insulation market share due to strict building energy efficiency regulations and growing demand for sustainable construction materials.

A few key players in the market are Huntsman International LLC., BASF, Knauf Insulation, Johns Manville, Saint-Gobain, Lloyd Insulations (India) Limited, DOW, DUNA CORRADINI S.p.A., Rogers Corporation, Owens Corning, and Polybond Insulation Pvt Ltd.

In 2024, the polyurethane (PUR) and polyisocyanurate (PIR) boards segment dominated the market.

The thermal insulation segment is expected to grow during the forecast period.