Bluetooth LE Audio Market Size, Share, Trends, Industry Analysis Report: By Type, Component (Hardware, Software, and Services), Technology, Application, End User, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5577

- Base Year: 2024

- Historical Data: 2020-2023

Bluetooth LE Audio Market Overview

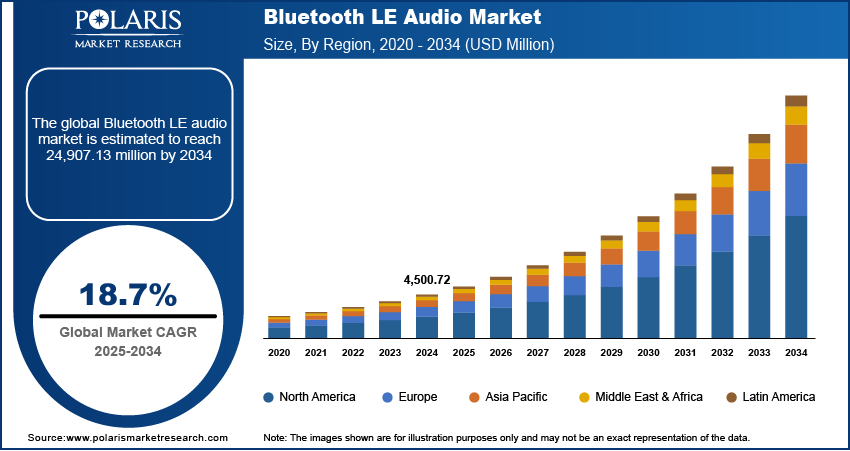

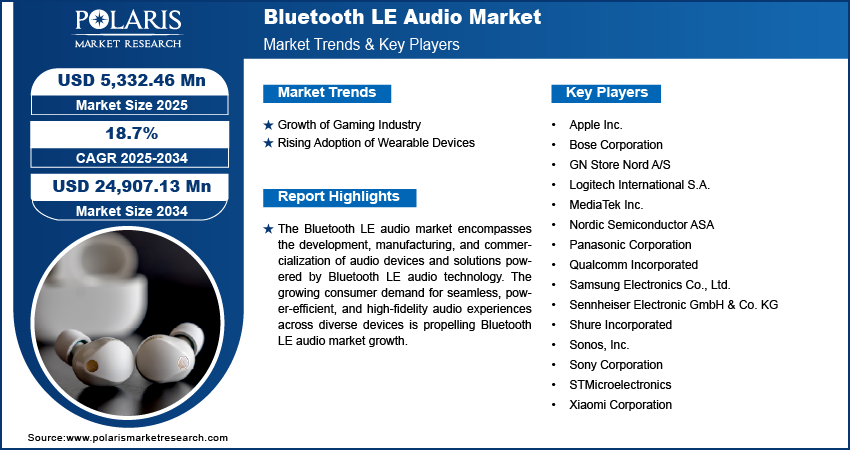

The global Bluetooth LE audio market size was valued at USD 4,500.72 million in 2024. The market is projected to grow from USD 5,332.46 million in 2025 to USD 24,907.13 million by 2034, exhibiting a CAGR of 18.7% during 2025–2034.

The Bluetooth LE audio market encompasses the development, manufacturing, and commercialization of audio devices and solutions powered by Bluetooth LE audio technology. Bluetooth LE audio is an advanced wireless audio transmission system introduced by the Bluetooth Special Interest Group (SIG) in 2020, designed to offer high-quality sound, ultra-low power consumption, multi-stream audio capabilities, and new features such as Auracast for audio sharing. It operates using the low complexity communication codec (LC3), which provides superior audio performance at lower bit rates compared to traditional Bluetooth classic audio standards.

The growing consumer demand for seamless, power-efficient, and high-fidelity audio experiences across diverse devices is propelling the Bluetooth LE audio market growth. Bluetooth LE audio technology is revolutionizing the way audio is transmitted across products such as wireless headphones, earbuds, speakers, hearing aids, gaming headsets, smart TVs, and automotive infotainment systems. This technology allows multiple audio streams to be transmitted simultaneously from a single device, facilitating public audio sharing in locations such as airports or stadiums and ensuring enhanced battery performance.

To Understand More About this Research: Request a Free Sample Report

The Bluetooth LE audio market demand is driven by the emerging trend of remote or digital jobs globally. According to the data published by the World Economic Forum, global digital jobs are estimated to grow by around 25% to over 90 million roles. Professionals working from home rely heavily on wireless headsets, earbuds, and speakers for video calls, virtual meetings, and content creation. These users demand audio devices that offer clear voice transmission, low latency, and long battery life, features that Bluetooth LE Audio delivers with greater efficiency than previous Bluetooth standards. Additionally, Bluetooth LE audio technology connects multiple devices simultaneously, such as a laptop, 5G smartphone, and tablet, without frequent re-pairing. This streamlines workflows for multitasking professionals, which encourages them to adopt devices powered by Bluetooth LE audio technology. Thus, the demand for Bluetooth LE audio devices is increasing with the rising number of professionals working in remote or digital environments globally.

Bluetooth LE Audio Market Dynamics

Growth of Gaming Industry

The gaming industry's exponential growth has amplified the need for advanced audio solutions, positioning Bluetooth LE audio as a crucial technology. Gamers demand low-latency, high-fidelity audio to ensure immersive experiences, particularly in competitive settings. Bluetooth LE Audio addresses these requirements by offering synchronized, multi-stream audio capabilities with minimal power consumption. According to data published by Forbes, in 2022, the global gaming industry generated an estimated $184.4 and is expected to grow in the coming years. This upward trend indicates a high demand for Bluetooth LE audio-enabled gaming devices, such as wireless headsets and controllers, which enhance gameplay through superior audio performance and extended battery life. Thus, the growing gaming industry drives the Bluetooth LE audio market development.

Rising Adoption of Wearable Devices

The increasing adoption of wearable devices drives consumers to look for devices that offer longer battery life and seamless audio connectivity. Bluetooth LE audio technology meets these expectations by reducing power consumption while maintaining high-quality sound in wearable devices such as smartwatches, fitness trackers, and wireless earbuds. It also enables features such as audio sharing and multi-stream capabilities, which enhance the functionality of wearables. Manufacturers are choosing Bluetooth LE Audio to improve user experience and extend device usability, making it a key technology in wearable devices. Thus, the rising adoption of wearable devices is propelling the Bluetooth LE Audio market expansion.

Bluetooth LE Audio Market Assessment by Segment

Bluetooth LE Audio Market Evaluation by Type

Based on type, the Bluetooth LE audio market is divided into Bluetooth LE audio SoC (System on Chip), Bluetooth LE audio modules, Bluetooth LE audio transceivers, Bluetooth LE audio headphones/earbuds, Bluetooth LE audio speakers, Bluetooth LE audio hearing aids, and others. The Bluetooth LE audio headphones/earbuds segment dominated the Bluetooth LE audio market share in 2024 due to upsurging consumer demand for wireless audio solutions that combine convenience, portability, and high-quality sound. Major tech brands integrated LE audio capabilities into their latest earbuds and headphones, allowing features such as multi-stream audio and longer battery life. Consumers increasingly favored these products for everyday activities such as commuting, working out, and remote work, where efficient power usage and stable connectivity matter most. The rise of hybrid work models and growing media consumption through mobile devices further propelled the adoption of these audio devices, contributing to their dominance in the market.

The Bluetooth LE audio SoC (System on Chip) segment is expected to grow in the coming years. SoCs enable compact design, reduce development time, and lower overall system costs, making them highly attractive for use in wearables, hearing aids, and smart home devices. The demand for SoCs embedded with LE Audio is projected to grow as more companies innovate around smaller, multifunctional devices with seamless connectivity and capabilities.

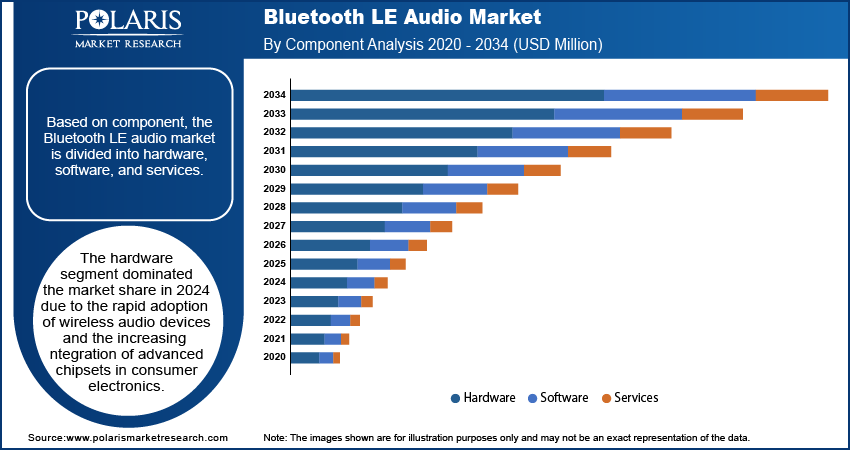

Bluetooth LE Audio Market Assessment by Component

Based on component, the Bluetooth LE audio market is divided into hardware, software, and services. The Bluetooth LE audio market statistics show that the hardware segment dominated the market share in 2024 due to the rapid adoption of wireless audio devices and the increasing integration of advanced chipsets in consumer electronics. Companies invested heavily in developing high-performance components such as SoCs, transceivers, and modules to support next-generation audio features such as low latency, improved sound quality, and energy efficiency. The proliferation of smart devices, including earbuds, headphones, and hearing aids, significantly boosted hardware demand, as manufacturers needed robust and scalable solutions to meet user expectations for seamless and reliable connectivity. The rising popularity of TWS (true wireless stereo) earbuds and the continued innovation in hearing assistance technology further strengthen the dominance of the hardware segment in the market.

The software segment is projected to grow at the fastest pace during the forecast period owing to the growing emphasis on audio customization, firmware updates, and the development of enhanced audio codecs. Manufacturers rely on sophisticated software to enable features such as adaptive noise cancellation, voice recognition, and spatial audio. The software also plays a crucial role in managing multi-device connectivity and ensuring interoperability across ecosystems. Software segment is estimated to gain a major share in the coming years with the increasing complexity of audio devices and the need for frequent updates to support new use cases.

Bluetooth LE Audio Market Outlook by Technology

Based on technology, the Bluetooth LE audio market is divided into LC3 codec, multi-stream audio, broadcast audio, audio sharing, isochronous channels, and auracast broadcast audio. The LC3 codec segment accounted for a major market share in 2024. LC3 delivered superior audio quality at lower bitrates, which helped reduce power consumption while maintaining an excellent listening experience. Device makers prefer this technology due to its ability to enhance battery life in wireless earbuds, hearing aids, and other low-power devices without compromising audio performance. The codec’s efficiency also allowed more stable connections and better performance in smaller devices, making it a top choice for both premium and mass-market audio products.

The auracast broadcast audio segment is projected to witness rapid growth during the forecast period owing to its transformative impact on how users share and access audio in public and private spaces. This technology enables one device to broadcast audio to an unlimited number of receivers, opening up new possibilities in venues such as airports, gyms, cinemas, and museums. It allows users to tune in directly using their earbuds or hearing aids, creating a personalized and accessible audio experience. The growing focus on inclusivity, particularly for individuals affected by hearing impairments, is expected to accelerate the adoption of auracast across industries.

Bluetooth LE Audio Market Regional Analysis

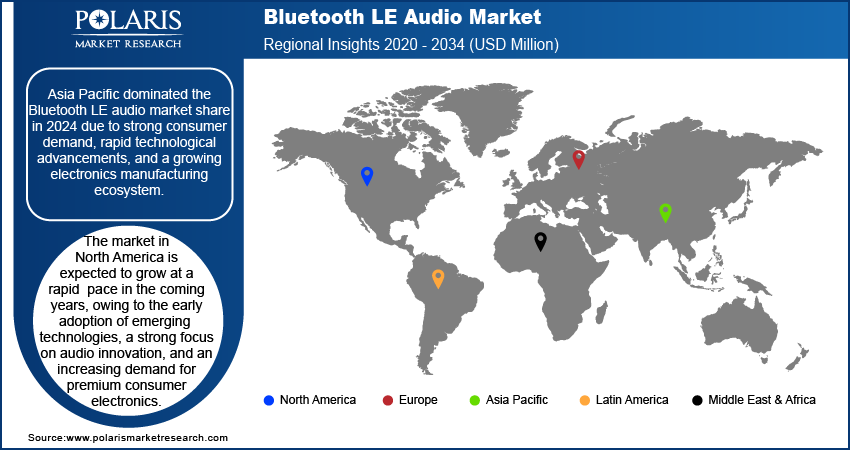

By region, the Bluetooth LE audio market report provides insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the Bluetooth LE audio market revenue share in 2024 due to strong consumer demand, rapid technological advancements, and a growing electronics manufacturing ecosystem. Countries such as China, Japan, and South Korea led the regional market in the production and adoption of wireless LE audio devices, benefiting from well-established supply chains and continuous innovation in chip and device design. China dominated the regional market due to its massive consumer base, aggressive investments in 5G and IoT technologies, and the presence of major consumer electronics brands. The region’s growing middle-class population and rising disposable income also fueled the demand for Bluetooth LE audio solutions across various price segments.

The Bluetooth LE audio market in North America is expected to grow at a rapid pace in the coming years, owing to the early adoption of emerging technologies, a strong focus on audio innovation, and an increasing demand for premium consumer electronics. The US is projected to lead the regional market due to the rising major tech companies and startups. Consumers in the US prioritize high-quality, seamless audio experiences for both entertainment and productivity, which motivates manufacturers to develop Bluetooth LE audio solutions. Additionally, favorable regulatory support for accessibility and hearing health, combined with the region’s high penetration of smart home and wearable devices, is estimated to boost the Bluetooth LE audio market expansion.

Bluetooth LE Audio Market – Key Players & Competitive Analysis Report

The Bluetooth LE audio market opportunity is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Major global companies dominate the market by leveraging extensive research and development and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product portfolio offerings and expand into new markets.

The Bluetooth LE audio market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are Apple Inc.; Bose Corporation; GN; Logitech International S.A.; MediaTek Inc.; Nordic Semiconductor ASA; Panasonic Corporation; Qualcomm Incorporated; Samsung Electronics Co., Ltd.; Sennheiser Electronic GmbH & Co. KG; Shure Incorporated; Sonos, Inc.; Sony Corporation; STMicroelectronics; and Xiaomi Corporation.

Apple Inc., headquartered in Cupertino, California, is one of the largest technology companies globally, founded in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne. The company has revolutionized the consumer electronics market with its ecosystem of devices such as the iPhone, iPad, Mac, Apple Watch, and AirPods. In the Bluetooth LE audio market, Apple has played a crucial role by setting new benchmarks through advanced features such as adaptive transparency, spatial audio, and seamless device switching across its ecosystem. The company's AirPods and AirPods Pro, integrated with LE Audio-enabled H1 and H2 chipsets, allow for superior sound quality, reduced latency, and extended battery life.

Bose Corporation, founded in 1964 by Dr. Amar G. Bose and headquartered in Framingham, Massachusetts, has built its legacy as a pioneer in premium audio technologies and noise-cancellation solutions. The company is globally renowned for its innovative approach to sound engineering, delivering immersive listening experiences across its product lines, including wireless headphones, portable speakers, home audio systems, and automotive sound systems. The company integrates Bluetooth LE audio technology into its latest products, allowing users to benefit from low-latency transmission, multi-stream audio, and enhanced battery performance. Bose has also expanded its presence in commercial audio applications, such as conference room solutions and aviation headsets, leveraging LE audio to deliver crystal-clear sound and wireless flexibility.

List of Key Companies in Bluetooth LE Audio Market

- Apple Inc.

- Bose Corporation

- GN

- Logitech International S.A.

- MediaTek Inc.

- Nordic Semiconductor ASA

- Panasonic Corporation

- Qualcomm Incorporated

- Samsung Electronics Co., Ltd.

- Sennheiser Electronic GmbH & Co. KG

- Shure Incorporated

- Sonos, Inc.

- Sony Corporation

- STMicroelectronics

- Xiaomi Corporation

Bluetooth LE Audio Industry Developments

February 2025: GN, the global company in hearing aid innovation, introduced the launch of ReSound Vivia, featuring Bluetooth LE Audio and Auracast broadcast audio.

October 2024: Sony announced the launch of the WF-L910 (LinkBuds Open) wireless earbuds. These earbuds bring together advanced technology and ergonomic design to offer an immersive audio experience.

Bluetooth LE Audio Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Bluetooth LE Audio SoC (System on Chip)

- Bluetooth LE Audio Modules

- Bluetooth LE Audio Transceivers

- Bluetooth LE Audio Headphones/Earbuds

- Bluetooth LE Audio Speakers

- Bluetooth LE Audio Hearing Aids

- Others

By Component Outlook (Revenue, USD Million, 2020–2034)

- Hardware

- Software

- Services

By Technology Outlook (Revenue, USD Million, 2020–2034)

- LC3 Codec

- Multi-Stream Audio

- Broadcast Audio

- Audio Sharing

- Isochronous Channels

- Auracast Broadcast Audio

By Application Outlook (Revenue, USD Million, 2020–2034)

- Personal Audio

- Hearing Accessibility

- Audio Sharing & Broadcasting

- Voice Communication

By End User Outlook (Revenue, USD Million, 2020–2034)

- Consumer Electronics

- Healthcare

- Automotive

- Enterprise & Commercial

- Industrial & IoT Devices

- Public Infrastructure

- Others

By Distribution Channel Outlook (Revenue, USD Million, 2020–2034)

- Online

- Offline

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Bluetooth LE Audio Market Report Scope

|

Report Attributes |

Details |

|

Market Value in 2024 |

USD 4,500.72 Million |

|

Market Forecast in 2025 |

USD 5,332.46 Million |

|

Revenue Forecast in 2034 |

USD 24,907.13 Million |

|

CAGR |

18.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global Bluetooth LE audio market size was valued at USD 4,500.72 million in 2024 and is projected to grow to USD 24,907.13 million by 2034.

The global market is projected to register a CAGR of 18.7% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

A few of the key players in the market are Apple Inc.; Bose Corporation; GN; Logitech International S.A.; MediaTek Inc.; Nordic Semiconductor ASA; Panasonic Corporation; Qualcomm Incorporated; Samsung Electronics Co., Ltd.; Sennheiser Electronic GmbH & Co. KG; Shure Incorporated; Sonos, Inc.; Sony Corporation; STMicroelectronics; and Xiaomi Corporation.

The hardware segment dominated the market share in 2024.

The Bluetooth LE audio SoC (System on Chip) segment is expected to grow at the fastest pace in the coming years.