Blue Hydrogen Market Share, Size, Trends, Industry Analysis Report: By Application, Transportation Mode, Technology (Steam Methane Reforming, Gas Partial Oxidation, Auto Thermal Reforming), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 119

- Format: PDF

- Report ID: PM2900

- Base Year: 2023

- Historical Data: 2019-2022

Blue Hydrogen Market Overview

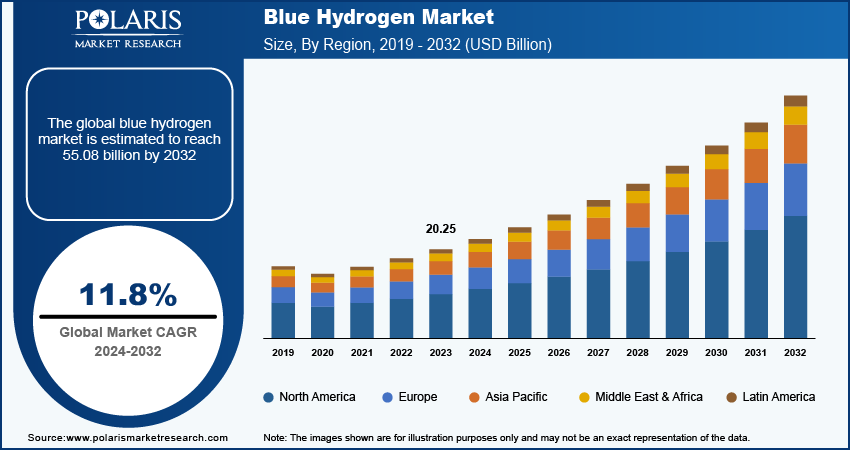

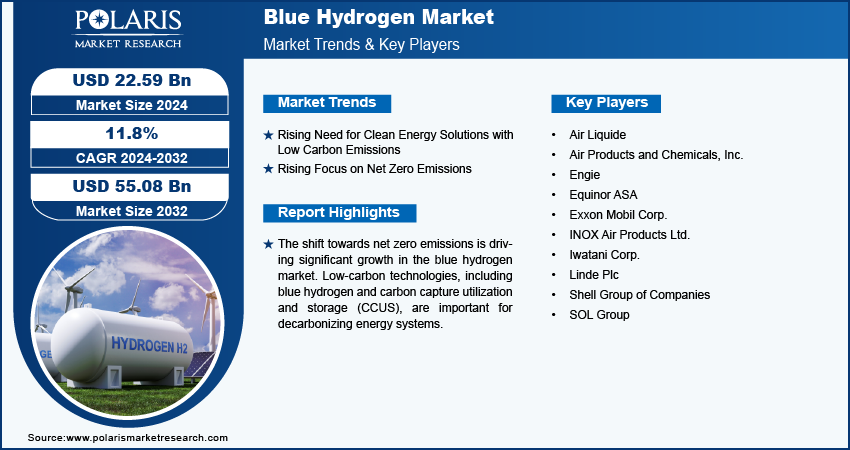

The global blue hydrogen market size was valued at USD 20.25 billion in 2023. The market is projected to grow from USD 22.59 billion in 2024 to USD 55.08 billion by 2032, exhibiting a CAGR of 11.8% during 2024–2032.

The blue hydrogen market is witnessing remarkable growth owing to the rising need for clean energy solutions and captive investments in the sector. Blue hydrogen provides a low-carbon alternative to conventional hydrogen production methods, which depend on fossil fuels and generate substantial greenhouse gas emissions. A significant factor driving the market growth is the increasing emphasis on cutting greenhouse gas emissions and advancing renewable energy sources. Governments worldwide are establishing ambitious emission reduction targets and investing in low-carbon technologies, including blue hydrogen. For instance, the European Union (EU) announced to reduce greenhouse gas emissions (GHGs) by nearly 55% by 2030. It is also making substantial investments in blue hydrogen as a crucial element of its energy transition strategy.

To Understand More About this Research: Request a Free Sample Report

Government initiatives and regulations play a crucial role in driving the global blue hydrogen market. To combat climate change and air pollution, governments worldwide are implementing policies that promote the use of low-carbon fuels, including hydrogen. Additionally, carbon pricing and taxes are being introduced to incentivize the shift toward low-carbon energy sources.

Renewable energy policies such as renewable portfolio standards (RPS) and feed-in tariffs are fueling the expansion of renewable sources such as wind and solar power. Blue hydrogen is generated using these renewable energy sources, minimizing its carbon footprint. To promote the adoption of blue hydrogen, governments are providing several incentives.

Blue Hydrogen Market Trends

Rising Need for Clean Energy Solutions with Low Carbon Emissions

The blue hydrogen market is driven by the rising need for cleaner energy solutions and strong growth in fuel-cell electric vehicles. Fuel cell electric vehicles (FCEVs) are increasingly popular due to their low refueling and maintenance costs. Governments across the globe are promoting the adoption of such vehicles by offering favorable initiatives, such as tax rebates and subsidies. These efforts are designed to minimize carbon emissions and reduce reliance on fossil fuels, thereby contributing to the growth of the blue hydrogen market.

For instance, according to a report from vehicle technologies office, Hydrogen has the potential to deliver clean energy across various US economic sectors, including transportation, by significantly reducing greenhouse gas emissions from trucks, buses, planes, and ships. As a fuel and energy carrier, hydrogen powers vehicles through fuel cells without emitting harmful pollutants. It can play a vital role in lowering emissions from heavy-duty vehicles, which, though only 5% of vehicles on US roads, contribute over 20% of transportation-related emissions and are the largest source of mobile nitrogen-oxide emissions in the country.

Rising Focus on Net Zero Emissions

Under a net zero emissions scenario, hydrogen production undergoes a transformative shift. By 2030, global hydrogen output is expected to reach 200 million tonnes (Mt), with 70% generated through low-carbon technologies. By 2050, hydrogen production is anticipated to rise to 500 Mt, driven primarily by such methods. Achieving net zero emissions by 2050 will require extensive modifications to the energy system, utilizing a range of technologies. Moreover, blue hydrogen is expected to further play a crucial role in the decarbonization of the global energy system. The key pillars supporting this transition include renewable energy sources (solar, wind, and hydro) and carbon capture utilization and storage (CCUS). These elements collectively aim to reduce emissions and enhance energy sustainability by improving operational efficiency, transitioning to cleaner energy solutions, and leveraging advanced technologies like CCUS and blue hydrogen.

The International Renewable Energy Agency (IRENA) estimates that in a net zero emissions scenario, substantial growth in hydrogen demand, combined with cleaner production technologies, could avert up to 60 giga tonnes (Gt) of CO2 emissions from 2021 to 2050, contributing to around 6.5% of the total cumulative emissions reductions. Hydrogen fuel plays a crucial role in reducing greenhouse gas emissions in challenging-to-decarbonize sectors, such as heavy industry (especially steel and chemicals), heavy-duty transport, shipping, and aviation, where direct electrification faces significant limitations.

Blue Hydrogen Market Segment Insights

Blue Hydrogen Market Breakdown – Technology Insights

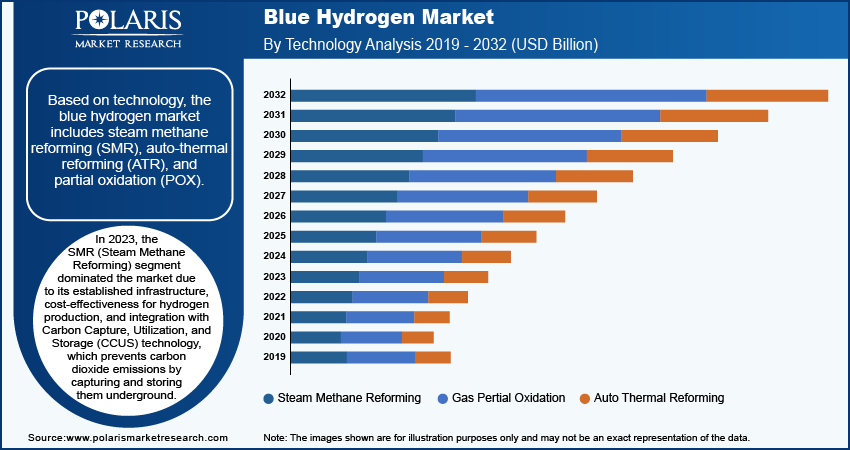

The global blue hydrogen market segmentation, based on technology, includes steam methane reforming (SMR), auto-thermal reforming (ATR), and gas partial oxidation (POX).

In 2023, the SMR segment dominated the market. In SMR technology, the carbon dioxide produced is not released into the atmosphere but is captured and stored underground through the Carbon Capture, Utilization, and Storage (CCUS) process. This approach results in the production of blue hydrogen, free from greenhouse gas and carbon emissions. SMR is recognized for its cost-effectiveness and energy efficiency in producing high-purity hydrogen. The projected rise in SMR adoption is expected to fuel market growth during the forecast period.

Blue Hydrogen Market Breakdown – Application Insights

The global blue hydrogen market, based on application, is segmented into chemicals, refinery, power generation, and others.

The power generation segment held the largest revenue share in 2023. Approximately 96% of global hydrogen is produced from fossil fuels through a process known as reforming. In this process, the fuels are heated with steam to around 800°C. On the other hand, hydrogen fuel cells do not emit greenhouse gases during operation, which is anticipated to boost the demand for blue hydrogen in power generation and contribute to market revenue growth.

The refinery segment will register a substantial growth rate over the study period. To meet their sustainability objectives, key companies are implementing sustainable methods to manage the carbon dioxide produced during hydrogen generation. Petrochemical companies such as Exxon Mobil Corp. use steam methane reforming technology to produce hydrogen for their petroleum refineries. This shift allows them to transform grey hydrogen into blue hydrogen with zero carbon emissions.

Blue Hydrogen Market Regional Insights

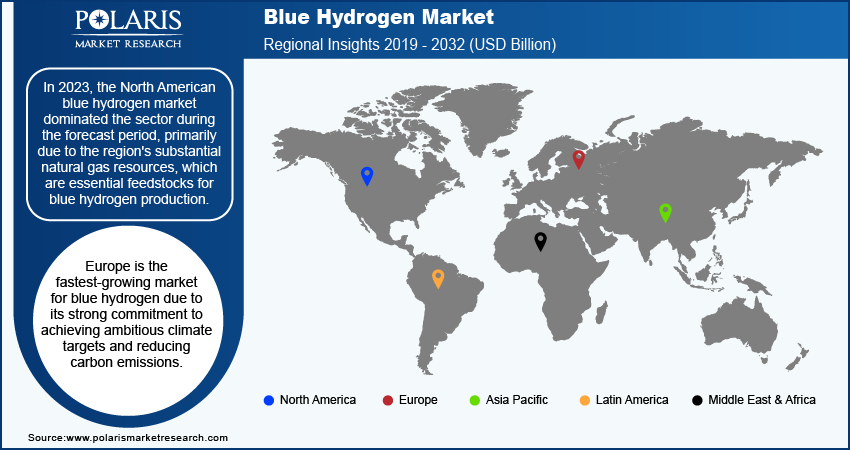

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

In 2023, the North American blue hydrogen market dominated the sector during the forecast period, primarily due to the region's substantial natural gas resources, which are essential feedstocks for blue hydrogen production. The United States, being the world’s largest natural gas producer as it provides a crucial feedstock for blue hydrogen production, allowing significant growth in low-carbon energy initiatives plays a pivotal role in this market. Additionally, the growing demand for low-carbon energy in North America is driven by climate targets and increasing environmental concerns. Furthermore, several U.S. states, such as California and New York, have set ambitious climate goals, while the Canadian government is committed to achieving net-zero emissions by 2050, further supporting the expansion of the blue hydrogen market in the region. For instance, in January 2023, the US government launched the Grannus Blue Ammonia and Hydrogen Project in Northern California. This initiative aims to produce 150,000 metric tons of blue ammonia and blue hydrogen annually.

Europe is the fastest-growing market for blue hydrogen due to its strong commitment to achieving ambitious climate targets and reducing carbon emissions. The region has implemented supportive policies and substantial funding for low-carbon technologies, including hydrogen production integrated with carbon capture, utilization, and storage (CCUS). Additionally, Europe's focus on energy security and reducing reliance on imported fossil fuels drives investments in blue hydrogen as a cleaner energy alternative. For instance, according to a report by CSIS, in August 2020, the Russian government announced a roadmap to produce blue hydrogen in the country. The roadmap includes plans to invest around $127 million in developing technologies for the production, transportation, and storage of blue hydrogen.

Blue Hydrogen Market – Key Players and Competitive Insights

Leading market players are engaged in mergers and acquisitions to expand their market share in specific regions. Additionally, they form technological collaborations and agreements to develop advanced products with enhanced performance characteristics, aiming to boost revenue. Market participants are undertaking several strategic activities to expand their footprint, with important market developments such as new product launches, contractual agreements, mergers & acquisitions, and collaboration.

Linde Plc; Shell Group; Air Liquide; Air Products and Chemicals.; Engie; Equinor; SOL Group; Iwatani Corp.; INOX Air Products; and Exxon Mobil are among the major players in the blue hydrogen market.

Linde, an industrial gas supplier, operates in over 100 countries. Its primary products include atmospheric gases such as oxygen, nitrogen, and argon, as well as process gases such as hydrogen, CO2, and helium. The company also provides equipment for industrial gas production. Linde serves diverse end markets, including chemicals, manufacturing, and steelmaking, and generated around USD 33 billion in revenue in 2023. In February 2023, Linde announced its plans to build a USD 1.8 billion blue hydrogen facility at Texas Gulf Coast to supply ammonia production. The company aims to commence production around 2025.

ExxonMobil is a global integrated oil and gas company involved in the exploration, production, and refining of oil. In 2023, it produced 2.4 million barrels of liquids and 7.7 billion cubic feet of natural gas/day. By the end of 2023, the company's reserves totaled 16.9 billion barrels of oil equivalent, with 66% being liquids. ExxonMobil is among the world's largest refiners, with a global refining capacity of 4.5 billion barrels of oil/day, and is also a manufacturer of commodity and specialty chemicals.

Key Companies in Blue Hydrogen Market

- Air Liquide

- Air Products and Chemicals, Inc.

- Engie

- Equinor ASA

- Exxon Mobil Corp.

- INOX Air Products Ltd.

- Iwatani Corp.

- Linde Plc

- Shell Group of Companies

- SOL Group

Blue Hydrogen Industry Developments

In January 2022: Linde plc and Yara collaborated to build and deliver a 24 MW hydrogen plant. This development highlights the increasing interest and investments in blue hydrogen technology. The new plant, set to begin operations in 2024, will produce low-carbon hydrogen via using natural gas combined with carbon capture and storage technology.

In March 2022: Air Products Inc. announced its plans to build and operate a new liquid hydrogen production plant in Casa Grande, Arizona. The facility will be capable of producing up to 30 tons of liquid hydrogen/day using Air Products' proprietary natural gas liquefaction technology.

In April 2021: TotalEnergies announced plans to establish a large-scale blue hydrogen production plant in France by 2023. The facility will have a capacity of 100 MW and will generate hydrogen from natural gas while capturing and storing the CO2 emissions.

Blue Hydrogen Market Segmentation

By Technology Outlook (Volume, Kilo Tons; Revenue, USD Billion, 2019–2032)

- Steam Methane Reforming

- Gas Partial Oxidation

- Auto Thermal Reforming

By Application Outlook (Volume, Kilo Tons; Revenue, USD Billion, 2019–2032)

- Chemicals

- Refinery

- Power Generation

- Others

By Transportation Mode Outlook (Volume, Kilo Tons; Revenue, USD Billion, 2019–2032)

- Pipeline

- Cryogenic Liquid Tankers

By Regional Outlook (Volume, Kilo Tons; Revenue, USD Billion, 2019–2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Blue Hydrogen Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 20.25 Billion |

|

Market Size Value in 2024 |

USD 22.59 Billion |

|

Revenue Forecast in 2032 |

USD 55.08 Billion |

|

CAGR |

11.8% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Volume, Kilo Tons; Revenue in USD Billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global blue hydrogen market size was valued at USD 20.25 billion in 2023 and is projected to grow to USD 55.08 billion by 2032.

The global market is projected to register a CAGR of 11.8 % during 2023–2032.

In 2023, the North American blue hydrogen market dominated the sector during the forecast period, primarily due to the region's substantial natural gas resources, which are essential feedstocks for blue hydrogen production.

Key players in the market are Linde Plc, Shell Group, Air Liquide, Air Products and Chemicals., Engie, Equinor, SOL Group, Iwatani Corp., INOX Air Products, and Exxon Mobil.

The steam methane reforming segment dominated the market in 2023.

In 2023, the power generation segment accounted for the largest share in the global market.