Blowing Agent Market Share, Size, Trends, Industry Analysis Report, By Type (Hydrochlorofluorocarbons (HCFC), Hydrofluorocarbons (HFC), Hydrofluoroolefin (HFO), Hydrocarbons (HC), Others); By Foam; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 116

- Format: PDF

- Report ID: PM4964

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

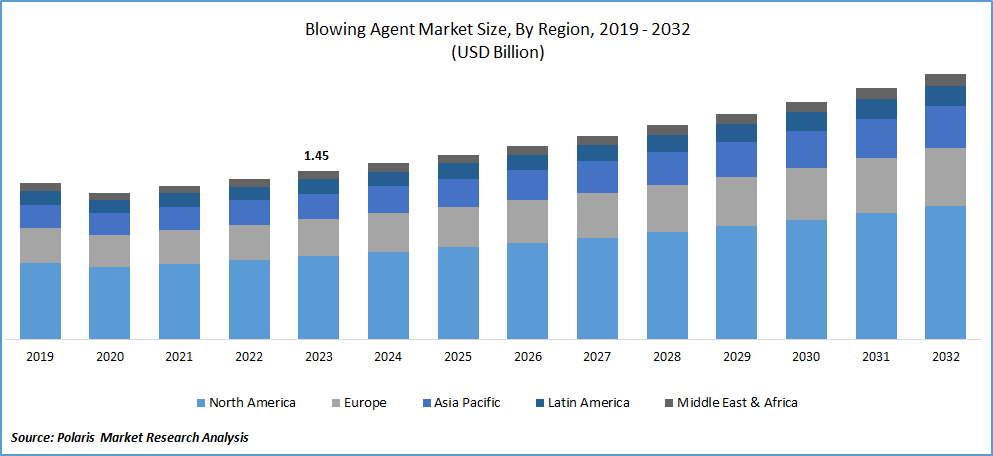

Blowing Agent Market size was valued at USD 1.45 billion in 2023. The market is anticipated to grow from USD 1.52 billion in 2024 to USD 2.29 billion by 2032, exhibiting the CAGR of 5.2% during the forecast period.

Blowing Agent Market Market Overview

The global blowing agents market is experience a significant growth driven by several factors including rising demand for blowing agents in various industries such as automotive, construction and aerospace. Many companies operating in the market are actively innovation to meet stringent regulations and evolving consumer preferences by developing eco-friendly blowing agents.

To Understand More About this Research:Request a Free Sample Report

For instance, Honeywell International Limited has introduced low global warming potential (GWP) hydro-fluoro-olefins (HFOs) for polyurethane foam applications.

Additionally, blowing agents are gaining more traction in various new applications such as in healthcare, focused on the FDA approval of a foaming agent for treating abdominal trauma. These involvement of blowing agents in other applications is gaining a surge in the demand in the market.

Blowing Agent Market Growth Drivers

Rapid Increase in Aircraft Production

Blowing agents play a vital role in the aerospace industry, particularly in protecting the integral aircraft components such as turbine housings and blades. These components entail multiple layers of polyurethane foam coatings to reduce abrasion and extend prolonged performance durability. The escalating demand for new aircraft, driven by increase in the passenger traffic, has resulted in a significant surge in aircraft deliveries. For instance, according to the General Aviation Manufacturers Association, total aircraft production & deliveries reached, nearly, 491 units in the 1st quarter of 2022, reflecting a 13.2% increase.

Rising Demand for Luxury Cars and Mid-Segment Cars

Changing lifestyles, swift urbanization and increasing disposable income among consumers globally are surging the demand for both luxury and mid-segment vehicles. This upstick in demand is propelling the requirement for blowing agents, extensively employed in the automotive sector for manufacturing various automotive components such as wiper cowls, side skirts and many more.

Blowing Agent Market Restraining Factors

Stringent Environmental Regulations

Governments present globally are imposing a number of regulations and policies mandating the adoption of eco-friendly blowing agents across various industries to reduce environmental impact. However, the constantly evolving nature of these regulations presents challenges for companies striving to find adaptable blowing agents, hampering the growth of the global blowing agents market.

Report Segmentation

The Blowing Agent Market is primarily segmented based on type, foam, application, and region.

|

By Type |

By Foam |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Type Analysis

Hydrocarbon Segment is Dominate the Blowing Agents Market

The hydrocarbon segment dominates the blowing agents market and is expected to continue its dominance in the forecast period. The dominance is due to the rising usage of oxygenated hydrocarbons across various applications such as integral skin and polystyrene foams. For instance, Honeywell a key player in the blowing agents industry, has been expanding its portfolio for hydrocarbon blowing agents to meet the increasing demand for integral skin and polystyrene foams.

By Foam Analysis

Polyurethane Foams Segment Accounted for the Largest Market Share in 2023

Polyurethane foams segment held the largest market share in the global blowing agents market. These foams a wide application in thermal insulation for buildings, transportation systems and household appliances. Moreover, they are been used in bedding, seating, carpet backing, electronics, computers and many other applications. The consistent demand for polyurethane foams, across these industries is expected to drive market demand. For instance, in June 2023, Dow, a leading chemical company announced the expansion of its polyurethane foams production capacity to cater the rising demand from construction and automotive sectors.

By Application Analysis

Building And Construction Segment Garnered with the Significant Revenue Share in 2023

The building & construction segment is expected to dominate a significant revenue share in the coming years. This dominance is due to increasing population growth. The escalating demand for construction projects globally, propelled by rapid urbanization and increasing populations is a major driving factor. Blowing agents are an integral part for construction industry, utilized in diverse building components such as doors, roof insulations and many more. For instance, in September 2023, Huntsman Corporation introduced new blowing agents for construction applications specifically, aiming to address the growing demand for sustainable building materials.

Regional Insights

Asia Pacific Region Registered the Largest Share of the Global Market in 2023

Asia pacific region dominated the global market. Region’s dominance is propelled by the thriving automotive and building & construction sectors which are driving the demand for polyurethane and vinyl thermal insulating foam. For instance, in November 2023, BASF disclosed the expansion of its production facilities in China to address the increasing demand for blowing agents utilized in thermal insulation applications within the automotive and construction sectors in the region.

North America region expected to grow rapidly, primarily due to extensive utilization of blowing agents in the building & construction and automotive sectors. These agents are widely employed for building insulation and as sealants for windows and doors across the region. Moreover, there is a trend towards increased adoption of polyurethane foam for automobile interior components such as seats, door panels and others. Furthermore, the surge in customized packaging and the rising demand for microwave, snack and frozen foods are anticipated to fuel the demand for blowing agents in the food packaging industry. For instance, in October 2023, 3M company introduced a new line of blowing agents specifically for the North American market.

Key Market Players & Competitive Insights

Strategic Partnerships to Drive the Competition

The blowing agent is characterized by intense competition among number of international and local players. Competition stems from efforts in product diversification, revenue generation and seizing opportunities. Companies are focusing product approval, development, market expansion, and technological advancement to sustain their market position. For instance, in June 2019, Nouryon finalized a EUR 20 Mn project in Sundsvall, Sweden, substantially boosting production capacity for its Expancel expandable microspheres. These microspheres enhance product properties across a range of applications, from shoe soles and food packaging and wind turbines.

Some of the major players operating in the global market include:

- Arkema SA (France)

- Daikin Industries, Ltd. (Japan)

- Exxon Mobil Corporation (US)

- Foam Supplies, Inc. (US)

- Haltermann Carless (Germany)

- Harp International Ltd. (UK)

- Honeywell International Inc. (US)

- Linde plc (UK)

- Solvay SA (Belgium)

- The Chemours Company (US)

Blowing Agent Market Recent Developments in the Industry

- In June 2021, Arkema had announced for the expansion of its production capacity for the insulation foam-blowing agent Hydrofluoroolefin 1233zd (HFO-1233zd) in both China & the United States.

- In March 2021, Milliken acquired Zebra Chem, a German based manufacturer of blowing agents. This strategic move is expected to significantly enhance Milliken’s production capacity for blowing agents.

Blowing Agent Market Report Coverage

The blowing Agent market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, component, caliber, guidance mechanism, application, lethality, and their futuristic growth opportunities.

Blowing Agent Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.52 billion |

|

Revenue forecast in 2032 |

USD 2.29 billion |

|

CAGR |

5.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Blowing Agent Market report covering key segments are type, foam, application, and region.

Blowing Agent Market Size Worth $ 2.29 Billion By 2032

Blowing Agent Market exhibiting the CAGR of 5.2% during the forecast period.

Asia Pacific is leading the global market.

The key driving factors in Blowing Agent Market are Rapid Increase in Aircraft Production