Blood Warmers Market Size, Share, Trends, Industry Analysis Report: By Product (Non-Portable Blood-IV Fluid Warmers, Portable Blood/IV Fluid), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 120

- Format: PDF

- Report ID: PM1884

- Base Year: 2024

- Historical Data: 2020-2023

Blood Warmers Market Overview

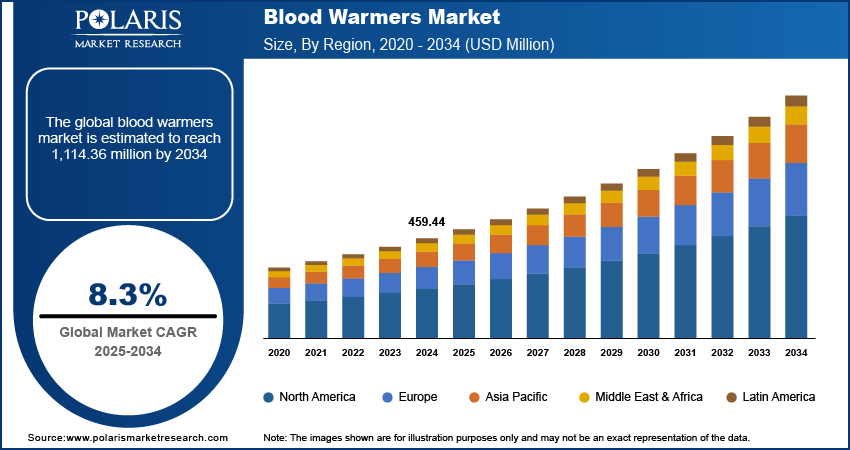

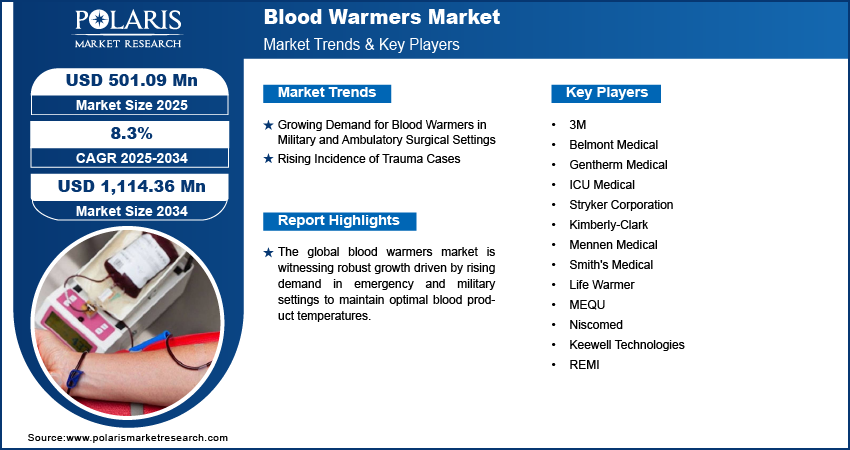

Global blood warmers market size was valued at USD 459.44 million in 2024. The market is projected to grow from USD 501.09 million in 2025 to USD 1,114.36 million by 2034, exhibiting a CAGR of 8.3% during the forecast period.

Blood warmer is a medical device used in healthcare facilities to warm fluids, crystalloids, colloids, or blood products before administering to patients at body temperature levels to prevent hypothermia.

The blood warmers market growth is driven by factors such as hypothermia prevention and a rising number of surgical interventions. The increasing number of surgical procedures worldwide has significantly heightened the demand for hypothermia prevention measures. Blood warmers play a crucial role in these interventions by ensuring that the fluids infused into patients are at body temperature, thereby maintaining normothermia. This is essential for both routine operations and emergency procedures, as it helps to reduce the risk of complications associated with cold blood transfusions. The ability of blood warmers to prevent hypothermia and improve patient safety and outcomes has driven their growing demand in medical settings, making them indispensable in modern surgical practices. This trend underscores the importance of advanced medical devices in enhancing patient care.

To Understand More About this Research: Request a Free Sample Report

The blood warmers market demand is being fueled by critical therapies such as continuous renal replacement and dialysis. These therapies are essential for patients with renal failure or undergoing organ transplantation, leading to a growing need for reliable blood warming solutions. Additionally, the increasing prevalence of kidney diseases and the demand for efficient treatment and blood warmers during dialysis procedures are contributing to this trend.

For instance, according to the National Institute of Health, approximately 2 in 1,000 Americans have end-stage kidney disease (ESKD), which is treated through dialysis or transplants.

Blood Warmers Market Dynamics

Growing Demand for Blood Warmers in Military and Ambulatory Surgical Settings

The demand for blood warmers is increasing in both military and ambulatory surgical settings due to their critical role in providing rapid and efficient treatment. In military environments, where fast interventions are essential, blood warmers ensure blood products are available at optimal temperatures for transfusions, supporting life-saving measures in emergencies. Similarly, in ambulatory surgical centers, these devices enhance operational efficiency by reducing delays and facilitating smoother procedures. This growing adoption underscores the importance of blood warmers in improving patient outcomes in time-sensitive scenarios, driving significant growth in the market. Leading companies are innovating to meet the rising need, particularly in military ambulances for emergency cases.

For instance, in December 2020, Danish company MEQU introduced the Power Pack, a new battery for their M Warmer System. This compact system heats blood and IV fluids and is often used in emergency settings like ambulances and rescue helicopters. It’s used by military and special forces in the UK, US, Netherlands, Germany, France, Sweden, and Denmark to perform blood transfusions in remote or battlefield locations.

Rising Incidence of Trauma Cases

The number of trauma cases worldwide is increasing and is expected to continue rising in the future. This is significantly contributing to the blood warmers market trend, as trauma is a leading cause of death globally, especially among young adults. The need for efficient and rapid blood warming solutions in emergency and trauma care is driving the market expansion. Blood warmers are essential for preventing hypothermia and improving patient outcomes, making them vital in trauma treatment. The demand for advanced blood warming technologies is projected to grow accordingly as trauma cases increase.

For instance, according to the National Institute of Health in 2023, trauma is the leading cause of death worldwide. In the United States, trauma is the primary cause of death in young adults, accounting for ten percent of all male and female deaths.

Blood Warmers Market Segment Analysis

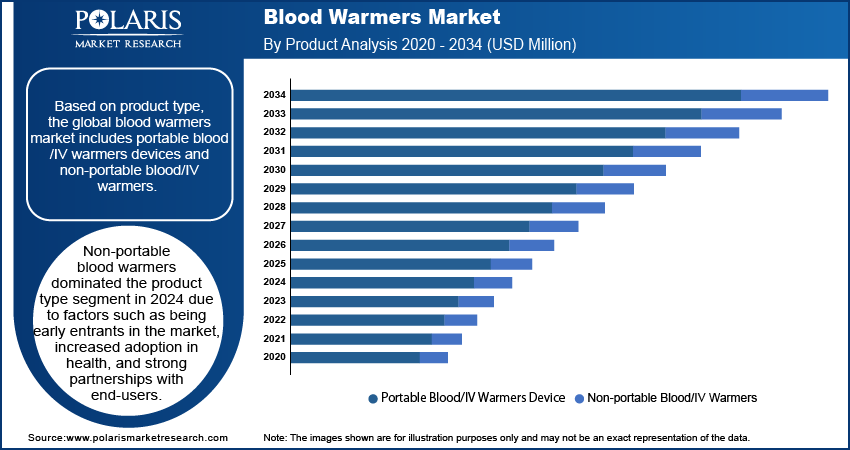

Blood Warmers Market Assessment by Product Insights

The global blood warmers market segmentation, based on product, includes portable blood/IV warmer device and non-portable blood/IV warmers. Non-portable blood warmers dominated the product type segment in 2024 due to factors such as being early entrants in the market, increased adoption in health, and strong partnerships with end-users.

The portable blood warmer segment is also expected to have the fastest market growth during the forecasted period due to the increased demand for these devices from defense, paramedic, ambulatory, and rescue services. Additionally, there is a growing need for healthcare in remote clinics and emergency units, which is likely to drive growth in this segment of the market. This portable device ensures rapid blood and IV fluid warming, which is crucial for improving outcomes in critical military operations worldwide. For instance, in April 2021, Belmont Medical Technologies secured a contract with the US Defense Logistics Agency to supply blood infusers and related products.

Blood Warmers Market Evaluation by End Use Insights

The global blood warmers market segmentation, based on end use, includes hospitals/clinics, ambulatory services, defense forces, and rescue forces. Hospitals/clinics segment dominated the market in 2024 due to the rising global surgical rate, which boosts the demand for blood warmers. These warmers play a vital role in preventing hypothermia, and their effectiveness, affordability, and ease of maintenance make them indispensable in healthcare settings. For instance, QinFlow's partnership with Premier, Inc. provides blood warmers that are cost-effective and high-performance to hospitals and clinics. This agreement effectively enhances critical care by addressing supply gaps and ensuring efficient warming in emergency and intensive care settings.

The ambulatory services segment is also expected to experience significant growth during the forecast period due to the increased procurement of blood warmers by government agencies worldwide. This strategic investment aims to enhance emergency medical care capabilities, which will contribute to the overall growth of the ambulatory segment. For instance, in March 2021, the medical technology firm MEQU was granted a contract to supply portable blood warmers to Norway's National Air Ambulance Services. Given the critical nature of air ambulance operations, having solutions for pre-warming patients is essential. As a result, including blood warmers in ambulance equipment is becoming a standard practice. These initiatives are expected to lead to increased demand within the segment.

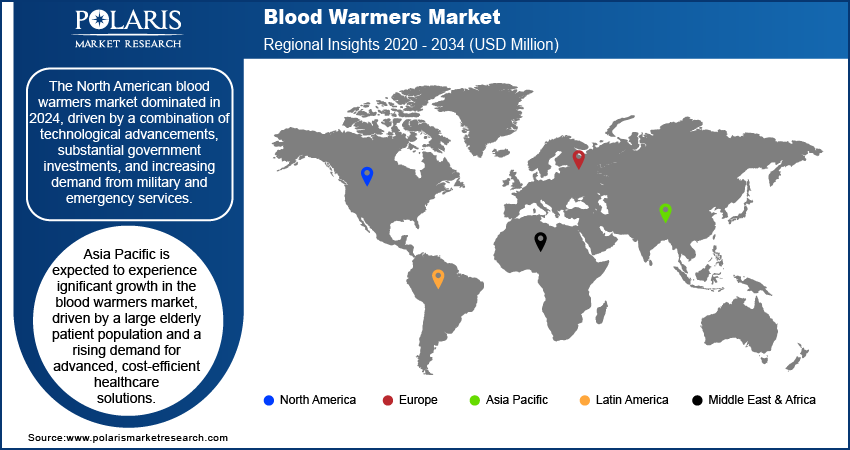

Blood Warmers Market Share Regional Insights

By region, the study provides blood warmers market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The market in North America was dominated in 2024, driven by a combination of technological advancements, substantial government investments, and increasing demand from military and emergency services. Government initiatives in the US and Canada have provided funding for the development of innovative medical technologies, including blood warmers, to improve patient care and emergency response. For instance, in 2020, the Combat Readiness Medical Research Program (CRRP), in collaboration with the US Army Institute of Surgical Research (USAISR) and MaxQ Research, LLC, developed the MaxExo blood warmer. This innovative device uses a chemical reaction to safely and rapidly warm reconstituted freeze-dried plasma at trauma sites. Designed to be smaller, easier to use, and more robust, the MaxExo blood warmer operates without electricity, making it highly suitable for use in emergency and battlefield settings.

Robust defense budgets and a focus on improving military and emergency healthcare systems in cold regions with harsh winter conditions have also boosted the demand for blood warmers. In these areas, maintaining blood products at optimal temperatures during transport and transfusion is crucial, as cold temperatures can affect blood viability. Consequently, blood warmers play a vital role in ensuring safe and effective transfusions in emergency medical situations.

Asia Pacific is expected to experience significant growth in the blood warmers market, driven by a large elderly patient population and a rising demand for advanced, cost-efficient healthcare solutions. For instance, according to WHO, in September 2023, the growing elderly population and high incidence of chronic diseases are primary factors, with non-communicable diseases responsible for 74% of all deaths in the region, highlighting the need for effective blood warming technologies in healthcare settings across the region. Furthermore, the growing incidence of surgeries and accidental injuries is anticipated to further accelerate blood warmers market expansion.

Blood Warmers Market- Key Market Players & Competitive Analysis Report

The competitive landscape of the blood warmers industry features global leaders and regional players striving to gain market share through innovation, strategic partnerships, and regional expansion. Major companies such as Smiths Medical, 3M, GE Healthcare, and Stryker leverage their strong R&D capabilities and broad distribution networks to offer advanced blood warming technologies for use in military, emergency, and clinical settings. Market trends indicate a rising demand for portable and energy-efficient devices, with innovations such as battery-operated or chemically activated blood warmers gaining traction for use in remote and battlefield environments. The market statistics show that the blood warmers market is poised for growth, driven by the increasing need for rapid and safe blood transfusions in trauma care and surgical procedures. Regional companies are focusing on localized demands, particularly in emerging economies, by providing cost-effective solutions tailored to unique operational challenges. Competitive strategies include collaborations with military organizations, the development of lightweight and portable technologies, and mergers and acquisitions to expand product portfolios, emphasizing the critical role of innovation and adaptability in this evolving market. A few major players in the blood warmers market include Stryker Corporation, Gentherm Medical, Belmont Medical, Kimberly-Clark, 3M, Mennen Medical, Smith’s Medical, ICU Medical, Vyaire Medical, Inc., The Surgical Company PTM, Life Warmer, MEQU

3M Company, originally founded in 1902 as Minnesota Mining and Manufacturing Company, is a diversified technology and science corporation headquartered in St. Paul, Minnesota. The company has operations in over 70 countries and sales in approximately 200 countries. 3M business operates in various industries, including industrial, safety, healthcare, and consumer markets. The company’s portfolio features more than 60,000 products categorized into key business segments. The Safety & Industrial segment offers personal protective equipment, adhesives, abrasives, and tapes for industries such as automotive and construction. In the transportation & electronics segment, 3M provides solutions for automotive OEMs and electronic components. The health care segment focuses on medical supplies, dental products, and health information systems for hospitals and clinics. Meanwhile, the consumer segment includes home improvement items, office supplies, and consumer health products. 3M operates manufacturing facilities across various regions, including North America, and significant operations in Asia Pacific, particularly in India and China. The company also maintains a robust presence throughout Europe.

Belmont Medical Technologies specializes in fluid and patient temperature management solutions. Known for devices such as the Belmont Rapid Infuser and Buddy Lite Warmer, Belmont serves critical care globally. Their dedication to innovation drives their mission of saving lives together. In April 2021, Belmont Medical Technologies secured a contract with the US Defense Logistics Agency to supply blood infusers and related products.

Key Companies in Blood Warmers Market

- 3M

- Belmont Medical

- Gentherm Medical

- ICU Medical

- Stryker Corporation

- Kimberly-Clark

- Mennen Medical

- Smith's Medical

- Life Warmer

- MEQU

- Niscomed

- Keewell Technologies

- REMI

Blood Warmers Market Developments

May 2022: Life Warmer introduced the Quantum Blood and Fluid Warming System, marking a significant advance in the blood warmer market. This innovative device has positioned Life Warmer as a strong competitor within the industry.

January 2022: ICU Medical Inc. announced the acquisition of Smiths Medical, Inc., expanding its range of products to include syringes, ambulatory infusion devices, vascular access solutions, and vital care equipment.

March 2023: Belmont Medical expanded its operations by establishing a direct presence in Germany. This move signifies their commitment to extending their global reach and making their technology more accessible.

January 2022: Qin Flow Inc. signed a group buy agreement with Premier, Inc. This agreement signifies a promising trend for the blood warmer market, granting healthcare facilities access to advanced blood-warming technology and fuelling market growth.

Blood Warmers Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Portable Blood/IV Warmer Device

- Non-portable Blood/IV Warmers

By Application Outlook (Revenue, USD Million, 2020–2034)

- Surgery

- Acute Care

- New Born Care

- Homecare

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals/Clinics

- Ambulatory Services

- Defense Forces

- Rescue Forces

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Blood Warmers Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 459.44 Million |

|

Market Size Value in 2025 |

USD 501.09 Million |

|

Revenue Forecast in 2034 |

USD 1,114.36 Million |

|

CAGR |

8.3% from 2025 – 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global blood warmers market size was valued at USD 459.44 million in 2024 and is projected to grow to USD 1,114.36 million by 2034.

The global market is projected to grow at a CAGR of 8.3% during the forecast period, 2025-2034.

North America had the largest share of the global market in 2024.

The key players in the market are Stryker Corporation, Gentherm Medical, Belmont Medical, Kimberly-Clark, 3M, Mennen Medical, Smith’s Medical, ICU Medical, Vyaire Medical, Inc., The Surgical Company PTM, Life Warmer, and MEQU

\Non-portable blood warmers dominated the product type segment in 2024.

The ambulatory segment is expected to experience significant growth during the forecast period.