Blood Glucose Monitoring Device Market Size, Share, Trends, Industry Analysis Report: By Product, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM1564

- Base Year: 2024

- Historical Data: 2020-2023

Blood Glucose Monitoring Devices Market Overview

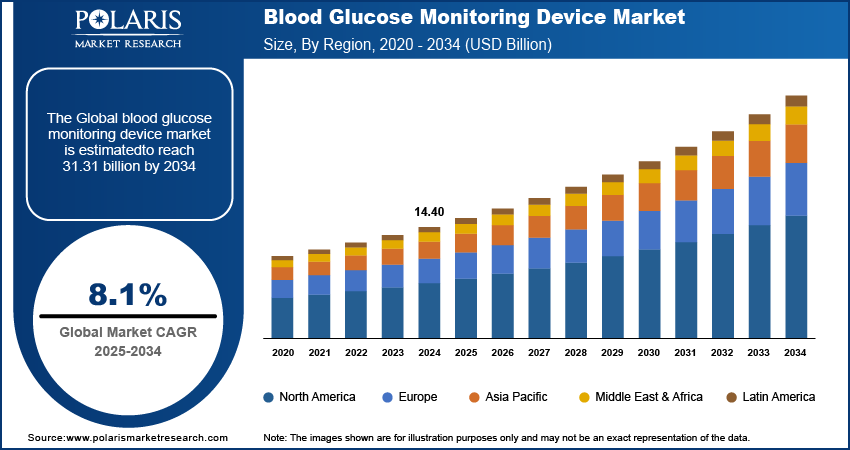

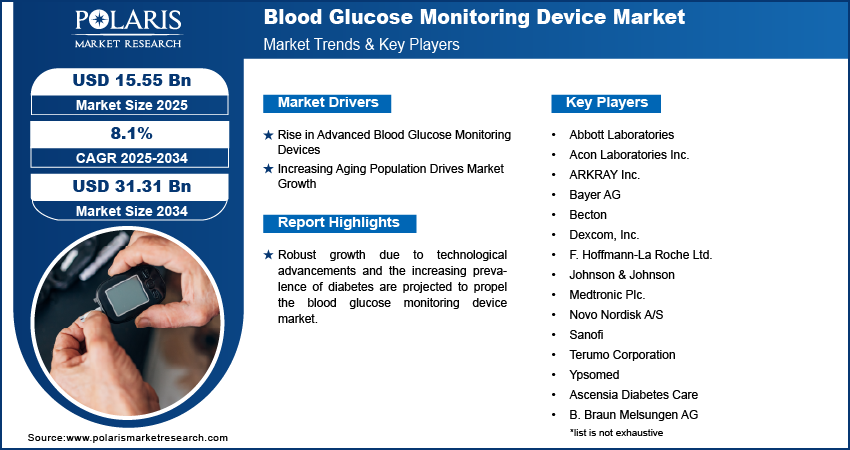

The blood glucose monitoring device market size was valued at USD 14.40 billion in 2024. The market is projected to grow from USD 15.55 billion in 2025 to USD 31.31 billion by 2034, exhibiting a CAGR of 8.1% from 2025 to 2034.

The blood glucose monitoring device market encompasses the production, distribution, and sales of devices used to measure blood glucose levels. These devices are primarily used by diabetic patients to manage their condition. The blood glucose monitoring device market is a dynamic and rapidly evolving sector within the healthcare industry, driven by the growing focus on personalized healthcare solutions.

The market for blood glucose monitoring is experiencing robust growth due to technological advancements that improve ease and accuracy, such as the integration of glucose monitoring with wearable technology and digital health platforms. For instance, in February 2024, DexCom, Inc. announced the launch of their latest CGM system, Dexcom ONE+. The Dexcom ONE+ utilizes an advanced sensor design and aims to provide wider accessibility to highly accurate real-time continuous glucose monitoring (CGM). Thus, technological advancements like these are expected to drive market growth.

To Understand More About this Research: Request a Free Sample Report

The increased prevalence of diabetes has become a significant driver of growth in healthcare practices and policies. As diabetes rates rise globally, there is a heightened focus on preventative measures, early detection, and comprehensive management strategies. This compels healthcare systems to invest in advanced diagnostic tools, such as the blood glucose monitoring device market. For instance, the WHO reported that 422 million individuals globally suffer from diabetes, with the majority living in low- and middle-income countries. The disease is directly responsible for 1.5 million deaths annually. There has been a steady rise in both the number of cases and the incidence of diabetes; as a result, the market is experiencing robust growth.

Blood Glucose Monitoring Devices Market Trends and Drivers Analysis

Rise in Advanced Blood Glucose Monitoring Devices

The rise of advanced blood glucose monitoring devices is significantly driving growth in the diabetes management market. As technology continues to evolve, these devices have become increasingly sophisticated, offering features such as continuous glucose monitoring, real-time data analysis, and seamless integration with mobile apps. These advancements allow for more precise and convenient tracking of blood glucose levels, enabling patients to manage their condition with greater accuracy and less hassle.

The increasing use of high-tech solutions is enhancing patient outcomes by providing actionable insights and driving market expansion, as more individuals seek innovative tools to better manage their diabetes. For instance, in March 2023, Abbott announced that its two new continuous glucose monitoring (CGM) systems, Lingo and Libre Rio, received FDA approval in the United States. These systems are built on Abbott's industry-leading FreeStyle Libre technology. Abbott has made modifications to the sensors to enable integration with automated insulin delivery (AID) systems.

Increasing Aging Population

The global increase in the aging population is driving the blood glucose monitoring device market, primarily due to the rising prevalence of age-related diseases, such as diabetes. Older adults are at heightened risk for type 2 diabetes due to factors like reduced insulin sensitivity, slower metabolic rates, and the potential presence of comorbidities such as obesity and cardiovascular issues.

This demographic shift creates a growing need for reliable and user-friendly glucose monitoring devices specifically designed for older adults. The impact of the aging population on the blood glucose monitoring device market is substantial, fostering innovations and expanding the availability of advanced solutions aimed at improving diabetes management for this age group.

For instance, in June 2023, it was reported that diabetes affects more than one-third of individuals over 65 in the United States. Early research indicates that 61% of all diabetes-related costs in the US are incurred by individuals aged over 65, with more than half of these costs arising from managing complications related to the disease. Thus, the growing aging population further increases the prevalence of age-related diseases, significantly contributing to market growth.

Blood Glucose Monitoring Devices Market Segment Analysis

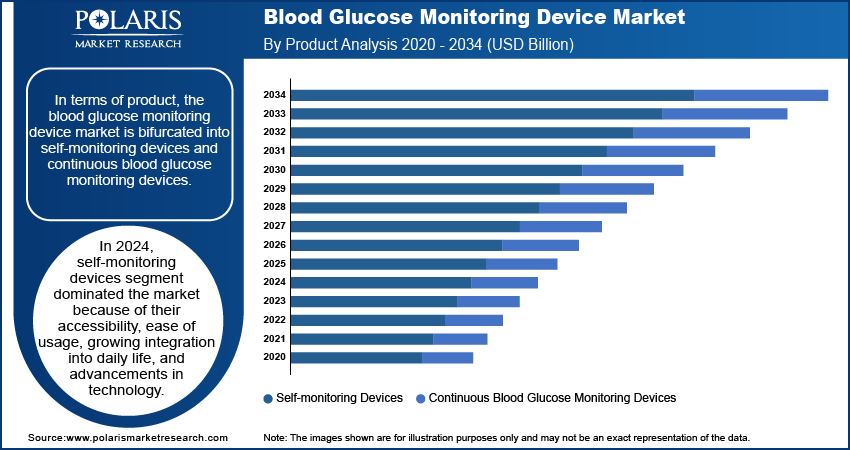

Blood Glucose Monitoring Device Market Assessment by Product

Based on product, the blood glucose monitoring device market is segmented into self-monitoring devices and continuous blood glucose monitoring devices. The self-monitoring devices segment dominated the market in 2024, owing to its accessibility, ease of usage, growing integration into daily life, and advancements in technology. Additionally, the increasing importance of preventive healthcare and the shift towards more personalized medicine has driven demand for such devices. Self-monitoring devices are expected to become even more sophisticated, offering greater accuracy and a broader range of health metrics as technology continues to advance. For instance, in June 2024, Prevounce Health announced the launch of the Pylo GL1-LTE blood glucose monitoring device. The Pylo GL1-LTE has been specifically developed for remote patient monitoring (RPM). This advanced self-monitoring device improves the range of remote care options and enhances Prevounce Health’s competitive position in the healthcare technology industry.

Blood Glucose Monitoring Devices Market Evaluation by End Use

The blood glucose monitoring device market segmentation, based on end use, includes hospitals & clinics, diagnostic centers, and home care settings. The hospital & clinic sector is anticipated to be the fastest-growing segment in the blood glucose monitoring device market due to the increasing prevalence of diabetes, advancements in technology, and heightened focus on patient outcomes. Hospitals are adopting advanced glucose monitoring systems to provide more accurate, real-time data, which is crucial for managing diabetes effectively and improving patient care. Additionally, the rise in hospital admissions for diabetes-related complications and the push towards personalized medicine drive hospitals to invest in sophisticated monitoring technologies such as blood glucose monitoring devices.

Blood Glucose Monitoring Devices Market Breakdown by Regional Insights

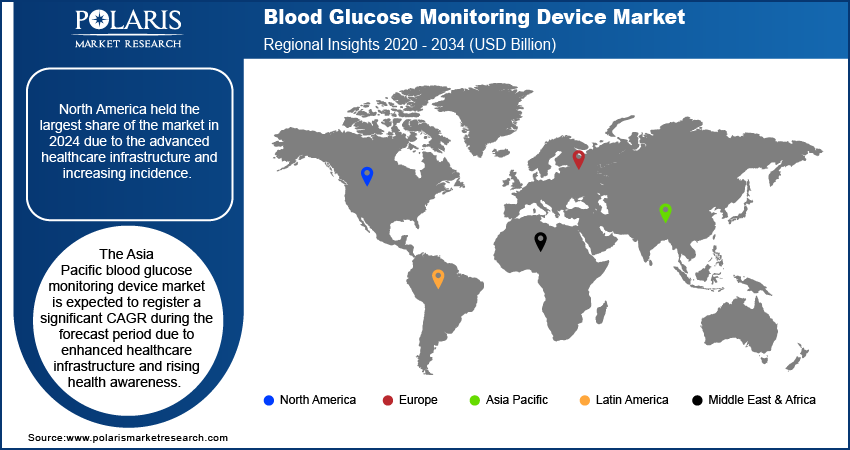

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the North America blood glucose monitoring device market dominated the global market due to factors such as the high prevalence of diabetes and the presence of advanced healthcare infrastructure in countries like the United States and Canada. According to the Centers for Disease Control and Prevention (CDC), over 37 million Americans have diabetes, and this number is expected to rise. The increasing incidence of both Type 1 and Type 2 diabetes drives demand for monitoring devices. The region benefits from a well-established network of healthcare providers, extensive insurance coverage, and high consumer awareness about diabetes management.

For instance, in January 2024, the prevalence of diabetes in the United States in 2021 was 38.4 million people, accounting for 11.6% of the population. Among them, 38.1 million were adults aged 18 years or older, and 352,000 were children and adolescents under the age of 20, including 304,000 with type 1 diabetes. The rising prevalence of diabetes propels the market growth in North America.

The Asia Pacific blood glucose monitoring device market is projected to witness the fastest CAGR from 2025 to 2034, driven by a large patient base in China and India, where urbanization and lifestyle changes are increasing diabetes rates. Notably, as of August 2021, China reported around 98 million Type 2 diabetes cases, while India had approximately 65 million. In addition, enhanced healthcare infrastructure, better access to advanced technologies, and rising health awareness are other key growth factors. Innovations in technology, such as continuous glucose monitoring (CGM) systems and smartphone integration, are making devices more user-friendly and appealing. Government initiatives and healthcare investments further support this expansion.

Blood Glucose Monitoring Device Market – Key Players & Competitive Analysis Report

The blood glucose monitoring devices market key players focus on innovation to expand their product lines. New entrants and established firms alike are focusing on technological advancements, including improved accuracy, user-friendly designs, and integration with digital health platforms. Competitive strategies often involve new product launches, contractual agreements, mergers and acquisitions, collaboration with other organizations, and investing in research and development to meet the evolving needs of diabetes patients. As the market continues to grow, these key players are expected to maintain a dynamic and competitive edge, driving progress in blood glucose monitoring technologies.

Manufacturing locally to reduce operating costs is one of the primary business strategies employed by manufacturers to assist customers and increase the market sector. To expand and survive in a more competitive and rising market environment, the blood glucose monitoring device market must offer cost-effective items. In recent years, the market has offered some technological advancements. Major players in the blood glucose monitoring device market, including Abbott Laboratories; Acon Laboratories, Inc.; ARKRAY Inc.; Bayer AG; Becton; Dexcom, Inc.; F. Hoffmann-La Roche Ltd.; Johnson & Johnson; Medtronic Plc.; Novo Nordisk A/S; Sanofi; Terumo Corporation; and Ypsomed.

Abbott Laboratories is a global player in the blood glucose monitoring device market, renowned for its innovative and comprehensive range of products. It is headquartered in the northern suburbs of Chicago and serves a global clientele of over 160 countries. They specialize in providing advanced medical devices, diagnostics, nutrition products, and branded generic medicines. The company’s portfolio includes advanced glucose monitoring systems that cater to both personal and clinical use. Abbott's flagship product, the FreeStyle Libre system, is a notable breakthrough in continuous glucose monitoring, offering users a more convenient and accurate way to manage diabetes without the need for routine fingerstick testing.

F. Hoffmann-La Roche Ltd, a prominent Swiss multinational healthcare company headquartered in Basel, stands out as a major player in the blood glucose monitoring device market through its robust Diagnostics division. Roche has established itself as a key provider of advanced glucose monitoring solutions. The company’s devices are renowned for their precision, ease of use, and comprehensive data management features, catering to the diverse needs of diabetes management. Roche’s commitment to innovation, paired with its extensive global reach and dedication to improving patient outcomes, underscores its role in advancing diabetes care. Roche continues to drive progress with transformative solutions across major disease areas, reflecting its enduring commitment to patients, partners, and stakeholders alike.

List of Key Companies in Blood Glucose Monitoring Device Market

- Abbott Laboratories

- Acon Laboratories Inc.

- ARKRAY Inc.

- Bayer AG

- Becton

- Dexcom, Inc.

- F. Hoffmann-La Roche Ltd.

- Johnson & Johnson

- Medtronic Plc.

- Novo Nordisk A/S

- Sanofi

- Terumo Corporation

- Ypsomed

Blood Glucose Monitoring Device Market Developments

February 2024: DexCom, Inc., a leading provider of continuous glucose monitoring (CGM) systems for diabetes management, announced the launch of Dexcom ONE+, their most recent CGM device.

August 2023: ACON Laboratories, Inc. announced the launch of the On Call MultiPro System in physician clinics, offices, and hospitals for point-of-care testing.

July 2023: Dexcom, Inc. announced the launch of the next-generation Dexcom G7 Continuous Glucose Monitoring System, approved by Health Canada. This system is intended for individuals with all forms of diabetes who are two years of age or older.

April 2022: Abbott FreeStyle Libre 3 released CGM features, a smaller sensor that continuously monitors glucose levels and provides real-time data to users via a smartphone app.

January 2024: Medtronic obtained approval with a CE mark for the MiniMed 780G system with Simplera Sync sensor in an effort to expand its product line. a MiniMed 780G is a one-of-a-kind disposable, specialized continuous glucose monitor (CGM) that doesn't require fingersticks or overtape.

Blood Glucose Monitoring Device Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020-2034)

- Self-monitoring Devices

- Blood Glucose Meter

- Testing Strips

- Lancets

- Continuous Blood Glucose Monitoring Devices

- Sensors

- Transmitter & Receiver

- Insulin Pumps

By End Use Outlook (Revenue – USD Billion, 2020-2034)

- Hospitals & Clinics

- Diagnostic Centers

- Home Care Settings

By Regional Outlook (Revenue – USD Billion, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Blood Glucose Monitoring Device Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 14.40 billion |

|

Market Size Value in 2025 |

USD 15.55 billion |

|

Revenue Forecast in 2034 |

USD 31.31 billion |

|

CAGR |

8.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The blood glucose monitoring device market size was valued at USD 14.40 billion in 2024 and is projected to be valued at USD 31.31 billion in 2034.

The market is projected to grow at a CAGR of 8.1% from 2025 to 2034.

North America held the largest share of the market

The key players in the market are Abbott Laboratories; Terumo Corporation; ARKRAY Inc.; Medtronic Plc.; Acon Laboratories, Inc.; F. Hoffmann-La Roche Ltd.; Johnson & Johnson; Novo Nordisk A/S; Becton; Sanofi; Bayer AG; and Ypsomed.

The self-monitoring devices segment dominated the market in 2024.

The hospitals & clinics segment is expected to witness the fastest CAGR in the global market.