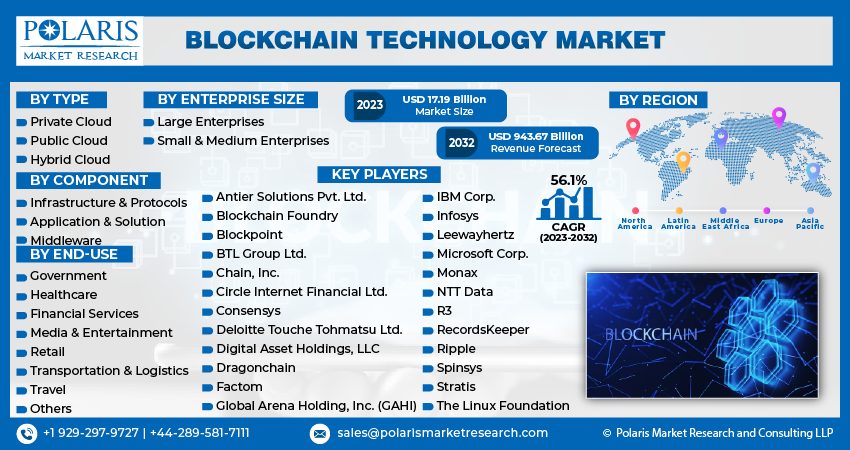

Blockchain Technology Market Share, Size, Trends, Industry Analysis Report, By Type (Private Cloud, Public Cloud, Hybrid Cloud); By Component; By Enterprise Size; By End-Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:Dec-2023

- Pages: 117

- Format: PDF

- Report ID: PM1017

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

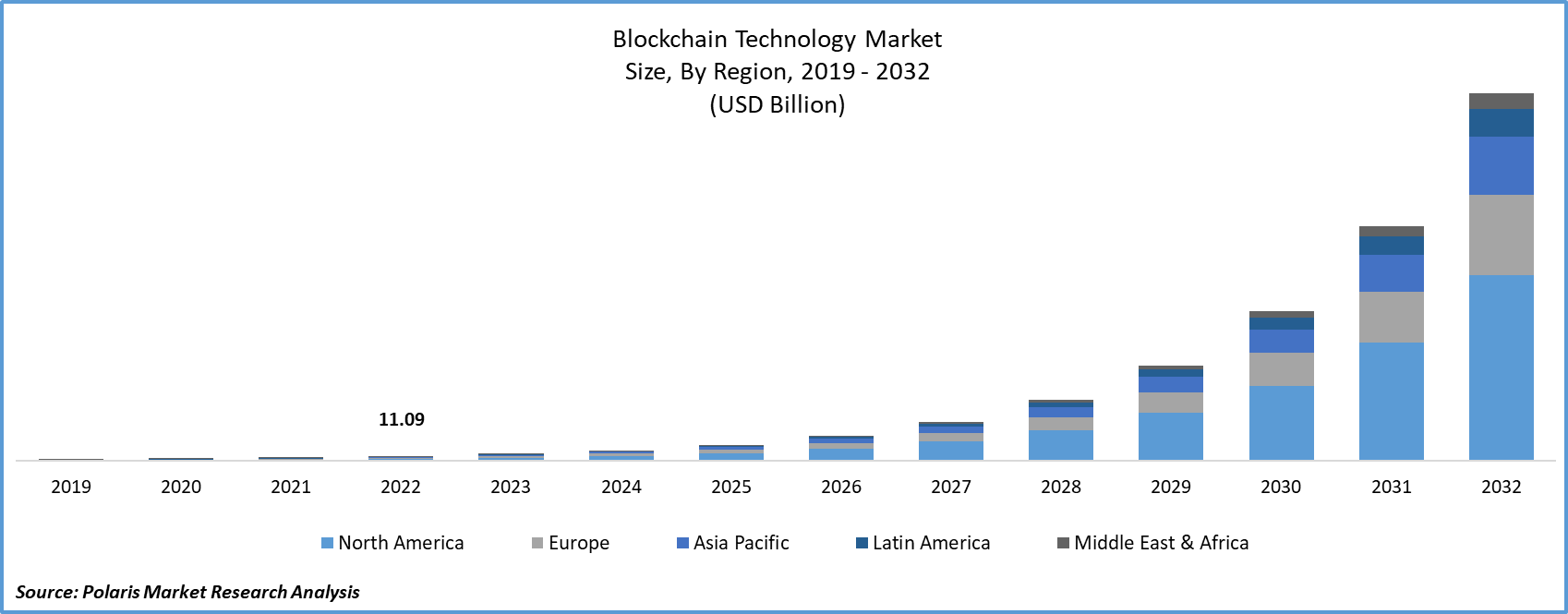

The global Blockchain Technology Market is projected to witness robust growth. It was valued at USD 11.09 billion in 2022 and is projected to grow to USD 943.67 Billion By 2032, exhibiting a CAGR of 56.1% over the forecast period, 2023 – 2032

Blockchain technology is a dispersed ledger that records and validates transactions over a network of computers, ensuring data exposure, immutability, and security. It is made up of a chain of blocks, each of which contains a batch of transactions and is maintained by a network of participants, which is known as nodes.

To Understand More About this Research: Request a Free Sample Report

Several factors are driving the growth of the blockchain technology market. Decentralization, a core principle of blockchain, eliminates the need for intermediaries, facilitating a more transparent and resilient network. This has garnered attention across industries as it offers enhanced security, reduced dependency on central authorities, and increased efficiency. Trustless transactions, enabled by smart contracts, ensure that parties can engage in agreements without relying on a central authority or third party. This rising enthusiasm reflects a broader shift towards empowering individuals, enhancing privacy, and revolutionizing traditional models of trust and governance.

The beginning of Bitcoin marked the advent of a powerful surge in Blockchain technology, which has found extensive utility in transactions for numerous financial organizations. The adoption of blockchain technology solutions has witnessed widespread praise across diverse business sectors, encompassing applications like document management, exchanges, payments, smart contracts, and receipts. This surge has attracted numerous startups, actively contributing to the development of innovative blockchain solutions.

The COVID-19 pandemic has a significant impact on the blockchain technology market. On the one hand, the situation highlighted the exposure of traditional systems and highlighted the need for more resilient and transparent solutions. This increased awareness has fueled interest in blockchain technology as a tool for enhancing supply chain resilience, ensuring data integrity, and enabling secure and transparent transactions. However, on the other side, the economic uncertainties initiated by the pandemic have led to budget constraints for many businesses, potentially slowing down investments in blockchain initiatives. The general impact varies across industries, with sectors like healthcare and finance accelerating their adoption of blockchain for its ability to facilitate processes and enhance security. Despite short-term challenges, the long-term outlook for the blockchain technology market remains positive, driven by its potential to address critical issues exposed by the pandemic and contribute to a more robust and transparent global infrastructure.

For Specific Research Requirements: Request for Customized Report

Governments and regulatory authorities globally recognize the revolutionary capabilities of blockchain technology. They are proactively implementing favorable policies and regulations to promote its extensive adoption. This clear regulatory framework not only draws significant investments but also stimulates the creation of inventive blockchain solutions across various sectors. Furthermore, the growing involvement of major corporations and technology plays a substantial role in shaping the landscape of blockchain.

Industry Dynamics

Growth Drivers

Increasing Demand for E-Identity will Facilitate the Market Growth

The market growth of blockchain technology is primarily driven by the increasing demand for e-identity. Blockchain-powered platforms have diverse applications in areas with inadequate identification procedures and countries that need established regulatory frameworks. On a national level, several governments have adopted blockchain technology to create identity platforms in response to market demand. This deliberate integration is intended to bolster transaction security in both public and private sectors. In the recent past, numerous governments have incorporated blockchain into their e-citizenship initiatives, allowing them to organize identity-related processes and simplify bureaucratic protocols autonomously. As a result, these nations have effectively digitized a broad spectrum of public transactions, capitalizing on the secure digital identities facilitated by blockchain technology.

As traditional methods of identity verification face challenges such as fraud and data breaches, the adoption of blockchain-based e-identity solutions have gained momentum. These solutions leverage cryptographic techniques to ensure the integrity and privacy of user information, offering a more robust and transparent means of identity verification. In an era where online interactions and transactions are everywhere, the demand for secure and efficient e-identity solutions within the blockchain ecosystem is driven by the imperative to establish trust, enhance security, and streamline processes across various sectors, including finance, healthcare, and supply chain management.

Report Segmentation

The market is primarily segmented based on type, component, enterprise size, application, end-use, and region.

|

By Type |

By Component |

By Enterprise Size |

By End-Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The Public Cloud Segment Accounted for the Largest Revenue Share in 2022

The public cloud segment accounted for the largest revenue share in the blockchain technology market. Public cloud providers provide a flexible and economical foundation for implementing blockchain solutions. The ability to scale is crucial as blockchain networks expand, necessitating additional resources to handle growing transaction volumes. Additionally, these providers have made substantial investments in security and compliance measures, which play a key role in blockchain applications.

On the other hand, the private cloud segment is expected to witness substantial growth. Private cloud services provide dedicated infrastructure and resources tailored exclusively for corporate utilization. This specialized cloud environment enables businesses to engage in transactions at economically favorable rates, playing a significant role in the expansion of this sector. Additionally, the growing acceptance of private cloud solutions across both large enterprises and small to medium-sized businesses serves as a crucial factor propelling the growth of the market.

By Component Analysis

The Infrastructure & Protocols Segment Accounted for the Highest Market Share During the Forecast Period

The infrastructure & protocols segment accounted for the highest market share during the forecast period. The increasing demand for standardized blockchain protocols such as Ethereum, Openchain, and Hyperledger is propelling the growth of this sector. Users seek these protocols to enable dependable and secure information sharing across cryptocurrency networks. As a result, the benefits offered by these infrastructures and protocols are propelling the expansion of this segment.

On the other hand, middleware segment is anticipated to experience significant growth throughout the forecast period. Middleware plays a crucial role in enhancing the efficiency of application development for developers. Specifically, within the healthcare sector, middleware tools are instrumental in automating the authentication process for clinical data. Anticipated increases in investments within the healthcare domain are poised to propel the growth of this segment. Further, middleware tools are adept at monitoring laboratory performance metrics, contributing to the expansion of this segment.

Regional Insights

Asia-Pacific Accounted for the Largest Market Share in 2022

Asia-Pacific accounted for the largest market share in the blockchain technology market. The widespread adoption of blockchain technology across various sectors, including financial services, supply chain management, and digital identity, has led to significant growth in the region. Substantial investments from both the public and commercial sectors are fueling the development of blockchain infrastructure. Key contributors to this growth include influential nations such as China, Singapore, and Japan. China, in particular, stands out as favorite in embracing blockchain technology, with significant investments from both public and commercial entities. Moreover, the surge in the popularity of cryptocurrencies and the growing need for secure and transparent payment systems have driven an increased demand for blockchain-based solutions in the financial services industry within the region.

North America is accounted for the fastest growth of blockchain technology in the forecast period. The presence of major corporations such as IBM, Microsoft, and Oracle in investing and advancing blockchain infrastructure has significantly boosted the widespread acceptance of blockchain technology in the region. Moreover, the financial services sector in the area has witnessed a surge in the integration of blockchain technology, with numerous banks and financial institutions incorporating it to establish secure and transparent payment systems. The regional market has experienced notable growth driven by the increasing demand for secure and transparent data management systems, leading to a substantial uptick in the adoption of blockchain solutions within the healthcare industry. Additionally, there has been a rise in the utilization of blockchain-based solutions in the supply chain management sector, driven by the growing need for efficient and transparent supply chain systems, thereby contributing to the expansion of the market.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Antier Solutions Pvt. Ltd.

- Blockchain Foundry

- Blockpoint

- BTL Group Ltd.

- Chain, Inc.

- Circle Internet Financial Ltd.

- Consensys

- Deloitte Touche Tohmatsu Ltd.

- Digital Asset Holdings, LLC

- Dragonchain

- Factom

- Global Arena Holding, Inc. (GAHI)

- IBM Corp.

- Infosys

- Leewayhertz

- Microsoft Corp.

- Monax

- NTT Data

- R3

- RecordsKeeper

- Ripple

- Spinsys

- Stratis

- The Linux Foundation

Recent Developments

- In April 2021, Oracle Corporation unveiled the launch of Enterprise Distributed Ledger Technology (DLT) aimed at combatting the COVID-19 pandemic across healthcare, financial services, supply chain, and other industries. The company implemented a range of solutions, including the establishment of trusted repositories and the anchoring of authoritative data, secure submission of tamper-proof test results, and the issuance of verifiable health credentials as part of its comprehensive strategy to address the challenges posed by COVID-19.

- In April 2021, R3, Trames, and IMDA entered into a Memorandum of Intent (MOI) aimed at accelerating the digitization of diverse supply chains and global trade operations. The MOI is anticipated to enhance the adoption of Trames' digital solution, leveraging IMDA's digital utility and R3's platform.

Blockchain Technology Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 17.19 billion |

|

Revenue forecast in 2032 |

USD 943.67 billion |

|

CAGR |

56.1% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Type, By Component, By Enterprise Size, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

We strive to offer our clients the finest in market research with the most reliable and accurate research findings. We use industry-standard methodologies to offer a comprehensive and authentic analysis of the Blockchain Technology Market. Besides, we have stringent data-quality checks in place to enable data-driven decision-making for you.

FAQ's

The blockchain technology market report covering key segments are type, component, enterprise size, application, end-use, and region.

Blockchain Technology Market Size Worth $943.67 Billion By 2032

The global blockchain technology market is expected to grow at a CAGR of 56.1% during the forecast period.

Asia-Pacific is leading the global market

key driving factors in blockchain technology market are Increasing demand for e-identity will facilitate the market growth