Blockchain Technology in the Energy Sector Market Size, Share, Trends, Industry Analysis Report: By Technology, Application, End Users (Utilities, Government & Regulatory Bodies, Commercial & Industrial, and Residential), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 128

- Format: PDF

- Report ID: PM1466

- Base Year: 2024

- Historical Data: 2020-2023

Blockchain Technology in the Energy Sector Market Overview

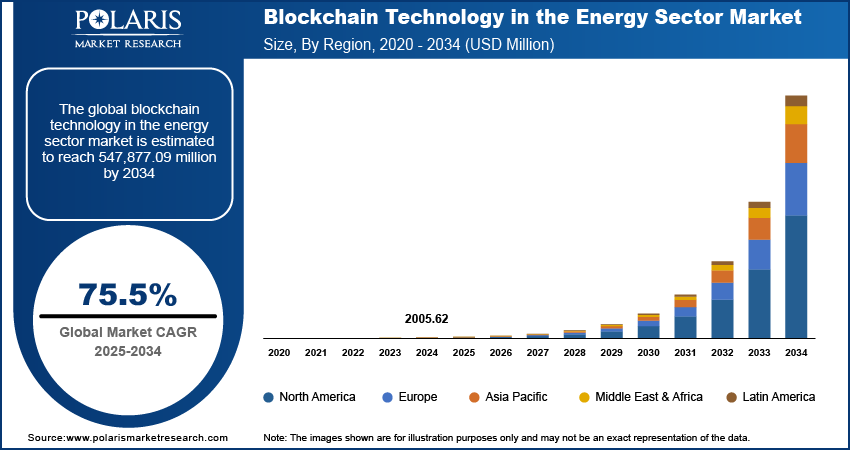

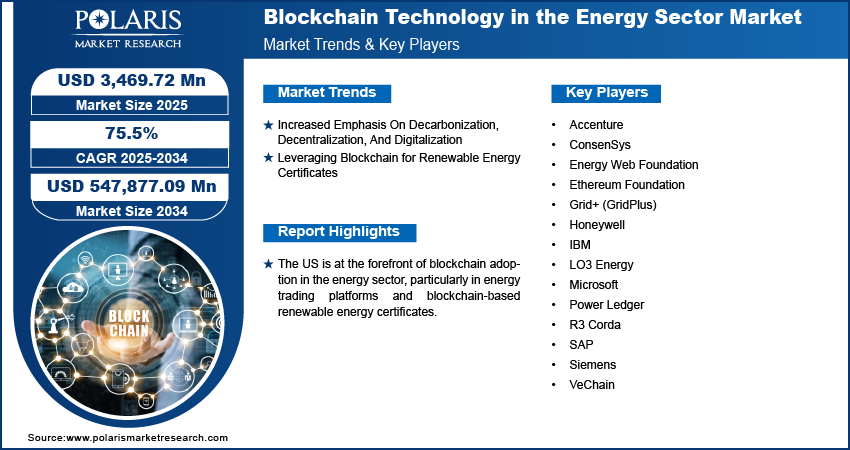

The global blockchain technology in the energy sector market size was valued at USD 2,005.62 million in 2024. The market is projected to grow from USD 3,469.72 million in 2025 to USD 547,877.09 million by 2034, exhibiting a CAGR of 75.5% from 2025 to 2034.

Blockchain technology in the energy sector is revolutionizing how energy is produced, distributed, and consumed by introducing enhanced transparency, efficiency, and security into energy transactions. Blockchain, a decentralized digital ledger, enables peer-to-peer energy trading, real-time monitoring, and seamless integration of renewable energy sources, significantly transforming the traditional energy value chain.

Blockchain technology addresses many challenges faced by the energy industry, such as inefficiencies in energy trading, grid management, and the integration of distributed energy resources (DERs) like solar panels and wind turbines. Blockchain facilitates direct transactions between energy producers and consumers, eliminating intermediaries and reducing costs by creating a decentralized network. This enhances operational efficiency and also empowers prosumers (individuals or entities who both produce and consume energy) to participate actively in energy markets.

To Understand More About this Research: Request a Free Sample Report

Blockchain Technology in the Energy Sector Market Analysis

Increased Emphasis On Decarbonization, Decentralization, And Digitalization

Decarbonization efforts, fueled by global commitments to achieve net-zero emissions, have accelerated the adoption of blockchain-based solutions to enhance transparency in tracking carbon footprints and renewable energy usage. For instance, renewable energy sources are projected to contribute nearly 95% of the global increase in power capacity by 2026, with solar photovoltaic (PV) systems alone accounting for over 50% of this growth. Decentralization, a key trend in the energy sector, enables peer-to-peer energy trading through blockchain platforms, empowering consumers and producers to exchange surplus energy without intermediaries. Digitalization further complements these efforts by integrating blockchain with advanced technologies like IoT and AI, enabling real-time data exchange, efficient grid management, and enhanced operational efficiency. These combined forces make blockchain a pivotal enabler in the transition to a cleaner and more resilient energy ecosystem. Thus, the growing emphasis on decarbonization, decentralization, and digitalization drives the blockchain technology in the energy sector market revenue.

Leveraging Blockchain for Renewable Energy Certificates

Governments, private enterprises, and startups are actively leveraging blockchain to streamline and promote renewable energy certificates (RECs), thereby driving the blockchain technology in the energy sector market development. Blockchain ensures the secure, tamper-proof tracking of RECs, eliminating issues such as double counting and fraud that have plagued traditional systems. This technology facilitates seamless transactions, significantly reducing administrative costs and increasing market accessibility for small-scale renewable energy producers. As a result, several initiatives are emerging, including blockchain-enabled platforms for REC trading and pilot programs for energy attribute certifications, highlighting blockchain’s potential to democratize and optimize renewable energy markets worldwide.

Blockchain Technology in the Energy Sector Market Segment Insights

Blockchain Technology in the Energy Sector Market Assessment Based on Technology

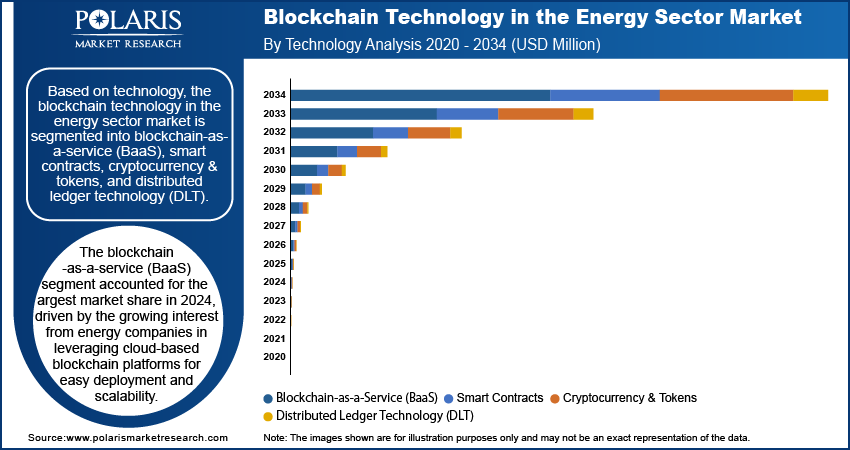

The blockchain technology in the energy sector market, based on technology, is segmented into blockchain-as-a-service (BaaS), smart contracts, cryptocurrency & tokens, and distributed ledger technology (DLT). The blockchain-as-a-service (BaaS) segment accounted for the largest market share in 2024, driven by the growing interest from energy companies in leveraging cloud-based blockchain platforms for easy deployment and scalability. BaaS allows utilities and other energy players to experiment with blockchain technology without significant upfront investment, fostering innovation and reducing entry barriers. Major companies like IBM and Microsoft are capitalizing on this segment, offering tailored BaaS solutions that enable seamless integration into existing energy infrastructures.

Blockchain Technology in the Energy Sector Market Evaluation Based on Application

The blockchain technology in the energy sector market, based on application, is segmented into energy trading, renewable energy certificate (REC) trading, peer-to-peer (P2P) energy trading, grid management, and carbon credit management. The energy trading segment dominated the market in 2024. Blockchain's ability to provide secure, transparent, and efficient transactions is particularly valuable in energy markets. The rise of decentralized energy systems and the growing complexity of energy trading, especially with renewable energy sources, has accelerated the adoption of blockchain to streamline transactions, reduce costs, and mitigate fraud. Peer-to-peer (P2P) energy trading platforms and smart grids are flourishing in regions like Europe and North America, where blockchain's capabilities in real-time monitoring and secure transactions are proving invaluable.

Blockchain Technology in the Energy Sector Market Outlook Based on End User

The blockchain technology in the energy sector market, based on end user, is segmented into utilities, government & regulatory bodies, commercial & industrial, and residential. The utilities segment led the market with the largest share in 2024. The key players in the energy value chain utilities are increasingly adopting blockchain for grid management, energy distribution, and energy trading optimization. The need to integrate decentralized energy sources, such as solar and wind, into the grid while maintaining reliability is a significant driver of blockchain adoption by utilities. By enabling automated grid management and improving operational efficiency, blockchain technology allows utilities to meet the growing demand for clean, distributed energy while reducing operational costs. The combination of regulatory pressure to adopt greener energy practices and the need for enhanced grid management solutions further position utilities as key adopters of blockchain technology.

Blockchain Technology in the Energy Sector Market Regional Analysis

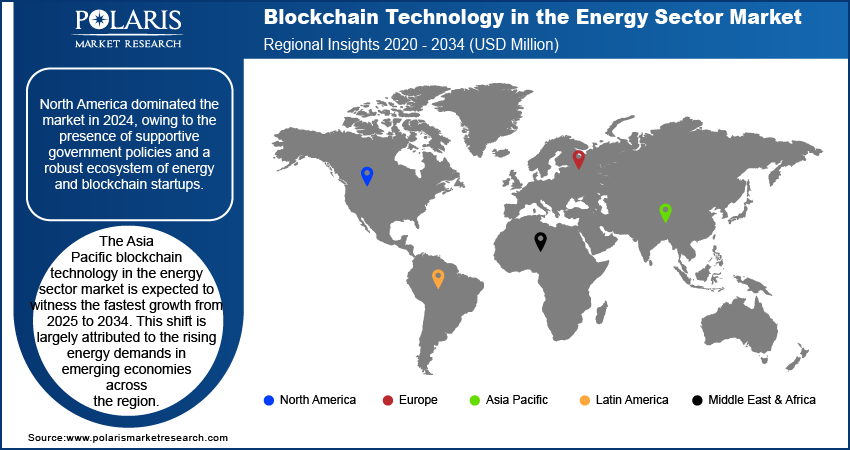

By region, the market report offers blockchain technology in the energy sector market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market in 2024, driven by advanced technological infrastructure, supportive government policies, and a robust ecosystem of energy and blockchain startups. The US is at the forefront of blockchain adoption in the energy sector, particularly in energy trading platforms and blockchain-based renewable energy certificates. This dominance is fueled by the country’s strong emphasis on sustainability, smart grid development, and decentralized energy solutions, with companies and utilities increasingly exploring blockchain for efficiency and security in energy transactions. For instance, in October 2024, The US Department of Energy's Grid Deployment Office awarded Arizona Public Service Company two grants totaling USD 70 million to enhance smart grid resilience, improve wildfire prevention, and address rising energy demands.

Notably, California, a key state within the US, is a pioneer in integrating blockchain into the energy sector, particularly for its initiatives around renewable energy trading and grid decentralization. California’s commitment to reducing carbon emissions, along with its support for clean energy initiatives, has made it a hub for blockchain-based energy solutions. With initiatives like the California Independent System Operator (CAISO) exploring blockchain for grid management and energy trading, the state’s leadership in technological adoption positions it as a key player in the future of blockchain technology in energy, offering a roadmap for other regions to follow.

The Asia Pacific blockchain technology in the energy sector market is expected to witness the fastest growth from 2025 to 2034. This shift is largely attributed to the rising energy demands in emerging economies, such as India and China, along with the increasing adoption of renewable energy sources and government-backed initiatives promoting energy digitalization. The growing need for reliable, efficient, and cost-effective energy solutions in these regions, coupled with the rapid growth of decentralized energy systems, positions blockchain as a critical tool for overcoming energy challenges. Major nations in Asia Pacific are also investing in pilot projects and collaborative efforts to leverage blockchain in energy trading, grid management, and carbon credit systems, driving the regional market forward.

Blockchain Technology in the Energy Sector Market – Key Players and Competitive Landscape

The leading companies dominate the blockchain technology in the energy sector market through a combination of innovation, strategic partnerships, and large-scale investments in decentralized energy solutions. These companies include major players such as IBM, Microsoft, Power Ledger, Energy Web Foundation, and LO3 Energy. They have leveraged their technological expertise and industry experience to develop blockchain platforms for energy trading, grid management, and renewable energy integration. IBM, for example, is enhancing blockchain applications in energy with its Hyperledger technology, which facilitates secure and efficient energy transactions for utilities, consumers, and producers. Microsoft, with its Azure Blockchain Workbench, provides cloud-based solutions for energy companies to build decentralized applications, streamlining energy supply chains and improving transparency. Power Ledger, an Australia-based firm, is pioneering peer-to-peer energy trading, enabling individuals to trade excess solar power directly with others using blockchain. At the same time, the Energy Web Foundation focuses on developing open-source blockchain solutions for the global energy sector to improve grid efficiency and facilitate the integration of renewables. LO3 Energy has gained attention for its localized blockchain-enabled energy trading platforms, empowering communities to share energy and reduce dependency on centralized grids.

Major market participants lead by continuously innovating and offering tailored solutions to address the energy sector’s unique challenges. Furthermore, many of these players are involved in collaborations with utilities, governments, and other tech firms to test and scale blockchain projects, ensuring wide adoption and integration. On a competitive front, these companies benefit from their ability to establish regulatory frameworks, provide end-to-end blockchain solutions, and scale globally, positioning them as market leaders. Overall, their dominance comes from continuously enhancing blockchain infrastructure, ensuring scalability, reducing energy costs, and promoting sustainability, solidifying their leadership in the rapidly evolving market.

A few of the key players covered in the blockchain technology in the energy sector market report are IBM, Microsoft, Power Ledger, Energy Web Foundation, LO3 Energy, ConsenSys, VeChain, Accenture, SAP, Ethereum Foundation, Honeywell, R3 Corda, Siemens, and Grid+ (GridPlus).

List of Key Players in Blockchain Technology in the Energy Sector Market

- Accenture

- ConsenSys

- Energy Web Foundation

- Ethereum Foundation

- Grid+ (GridPlus)

- Honeywell

- IBM

- LO3 Energy

- Microsoft

- Power Ledger

- R3 Corda

- SAP

- Siemens

- VeChain

Blockchain Technology in the Energy Sector Industry Developments

In August 2023, Powerledger announced the launch of a public blockchain for the energy sector. According to Powerledger, the public blockchain seeks to address the challenges associated with the integration of renewable energies into the power grid.

In August 2023, Gitcoin announced its partnership with Shell to propel the adoption of renewable energy through the utilization of blockchain technology.

In January 2020, Powerledger announced its partnership with the Midwest Renewable Energy Tracking System (M-RETS) for the launch of a REC marketplace in the US.

Blockchain Technology in the Energy Sector Market Segmentation

By Technology Outlook (Revenue – USD Million, 2020–2034)

- Blockchain-as-a-Service (BaaS)

- Smart Contracts

- Cryptocurrency & Tokens

- Distributed Ledger Technology (DLT)

By Application Outlook (Revenue – USD Million, 2020–2034)

- Energy Trading

- Renewable Energy Certificate (REC) Trading

- Peer-to-Peer (P2P) Energy Trading

- Grid Management

- Carbon Credit Management

By End User Outlook (Revenue – USD Million, 2020–2034)

- Utilities

- Government & Regulatory Bodies

- Commercial & Industrial

- Residential

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Blockchain Technology in the Energy Sector Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,005.62 million |

|

Market Size Value in 2025 |

USD 3,469.72 million |

|

Revenue Forecast by 2034 |

USD 547,877.09 million |

|

CAGR |

75.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market was valued at USD 2,005.62 million in 2024 and is projected to grow to USD 547,877.09 million by 2034.

The global market is projected to register a CAGR of 75.5% from 2025 to 2034.

In 2024, North America accounted for the largest share of the market, driven by advanced technological infrastructure, supportive government policies, and a robust ecosystem of energy and blockchain startups.

A few of the key players in the market are IBM, Microsoft, Power Ledger, Energy Web Foundation, LO3 Energy, ConsenSys, VeChain, Accenture, SAP, Ethereum Foundation, Honeywell, R3 Corda, Siemens, Grid+ (GridPlus).

The blockchain-as-a-service (BaaS) segment held the largest market share in 2024, owing to the growing interest from energy companies in leveraging cloud-based blockchain platforms for easy deployment and scalability.

In 2024, the utilities segment accounted for the largest market share due to the increasing adoption of blockchain for grid management, energy distribution, and energy trading optimization.