Blockchain Security Market Size, Share, Trends, Industry Analysis Report: By Solution (Key Management, Smart Contract Security, Penetration Testing, IAM, and Audits), Services, Deployment Mode, Organization Size, Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 127

- Format: PDF

- Report ID: PM5239

- Base Year: 2024

- Historical Data: 2020-2023

Blockchain Security Market Overview

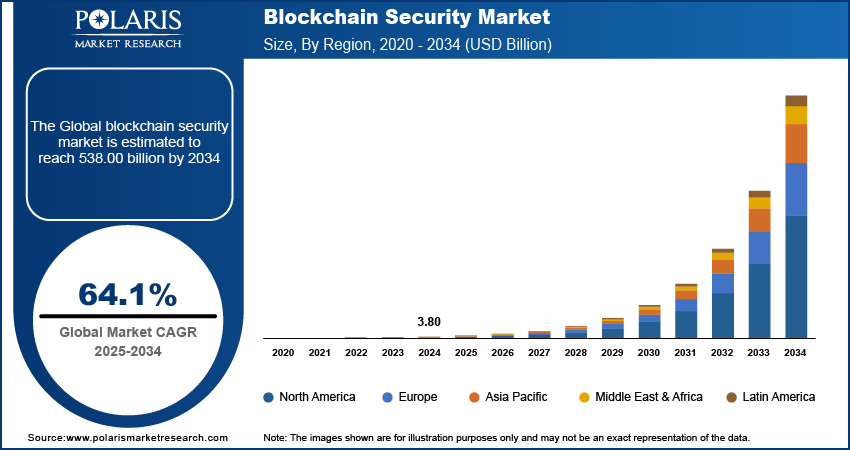

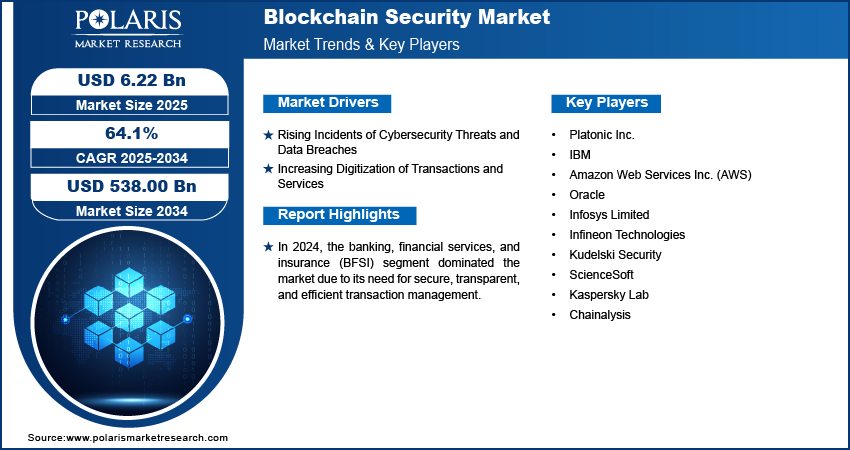

The blockchain security market size was valued at USD 3.80 billion in 2024. The market is projected to grow from USD 6.22 billion in 2025 to USD 538.00 billion by 2034, exhibiting a CAGR of 64.1% during 2025–2034.

The blockchain security market is evolving rapidly as businesses and governments are increasingly adopting blockchain to improve transparency and security in their operations. In addition, the applications of blockchain in sectors such as finance, healthcare, and supply chain are rising.

Blockchain's decentralized and unchangeable nature makes it a highly secure option for safeguarding digital transactions and data, driving its adoption. However, the rising number of cyberattacks, data breaches, and vulnerabilities in blockchain networks is pushing companies to seek advanced security solutions. As the blockchain ecosystem evolves, the development of industry standards associated with strategic partnerships and continuous technological innovation is expected to accelerate the growth of the blockchain security market.

In September 2024, MeitY launched the Vishvasya-Blockchain Technology Stack, offering Blockchain-as-a-Service. The stack supports permissioned blockchain applications and includes the NBFLite lightweight platform for startups and academia. MeitY also introduced the National Blockchain Framework (NBF), aimed at enhancing digital trust, transparency, and secure service delivery. The initiative seeks to address challenges such as skilled workforce shortages and security concerns, positioning India as a global leader in blockchain technology.

To Understand More About this Research: Request a Free Sample Report

Blockchain Security Market Driver Analysis

Rising Incidents of Cybersecurity Threats and Data Breaches

As businesses and governments digitize operations, the risk of cyberattacks targeting sensitive data and transactions increases. Traditional security measures often fall short, prompting a shift toward blockchain’s decentralized and inflexible technology, which ensures data integrity and enhances security. Industries such as finance, healthcare, and government are increasingly adopting blockchain to comply with regulations and protect against unauthorized access, leading to greater transparency and trust. As cyber threats evolve, the demand for blockchain security solutions continues to rise, further driving market growth. In July 2024, the Blockchain Security Standards Council (BSSC) was established to set and enforce security standards in the blockchain industry due to over 100 security breaches in the cryptocurrency sector that year. The BSSC aims to develop wide standards and audit frameworks to improve trust and security across the blockchain ecosystem. Therefore, the rising incidents of cybersecurity threats and data breaches are driving the blockchain security market growth.

Increasing Digitization of Transactions and Services

The need for secure systems to protect online activities increases as digital transactions and services grow. Blockchain security, known for its decentralized and unchangeable nature, offers a reliable solution to prevent fraud and data manipulation. Blockchain is especially important in industries such as finance, e-commerce, and healthcare, where sensitive data and financial transactions are common. By securely verifying digital exchanges, blockchain improves trust and protects the integrity of online transactions, providing data security and tamper-proof across these critical sectors. As more businesses embrace digital platforms, blockchain security is increasingly recognized as a key factor in ensuring secure and transparent digital services.

Blockchain Security Market Segment Analysis

Blockchain Security Market Assessment by Deployment Outlook

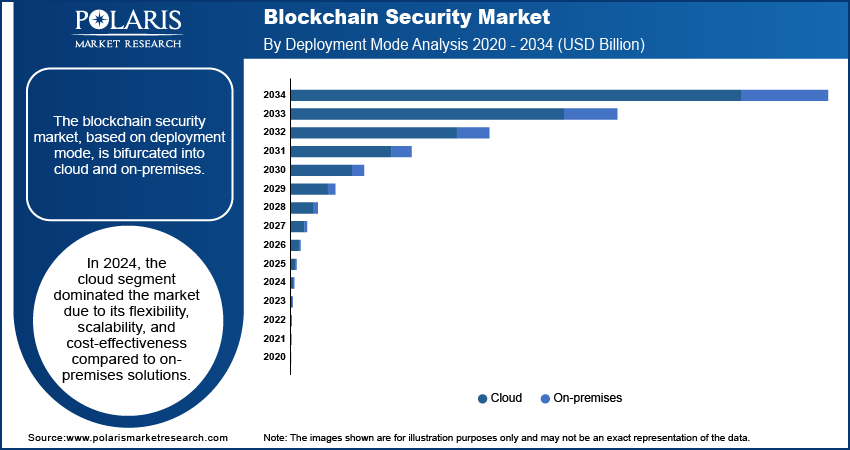

The blockchain security market, based on deployment, is bifurcated into cloud and on-premises. In 2024, the cloud segment dominated the market due to its flexibility, scalability, and cost-effectiveness compared to on-premises solutions. Cloud-based options enable businesses to manage blockchain security without extensive physical infrastructure, making it accessible to organizations of all sizes. The cloud model supports enhanced collaboration and secure data sharing across multiple locations and stakeholders. As more enterprises embrace digital transformation, the adoption of cloud-based blockchain security solutions is expected to grow in the coming years.

The blockchain security market for the on-premises segment is expected to record a significant CAGR during the forecast period, owing to its rising use in industries requiring stringent control over data privacy and compliance, such as banking, healthcare, and government. These industries prefer on-premises deployments for better customization, security, and regulatory alignment. Despite higher initial costs and maintenance demands, on-premises solutions offer enterprises full control over their infrastructure. They are preferred for sensitive data management, making them a crucial segment in the blockchain security market.

Blockchain Security Market Evaluation by Vertical Outlook

The blockchain security market segmentation, based on vertical, includes transportation and logistics; agriculture and food; manufacturing; energy and utilities; healthcare and life sciences; media, advertising, and entertainment; banking financial services and insurance; IT and telecom; retail and e-commerce; government: and others. In 2024, the banking, financial services, and insurance (BFSI) segment dominated the market due to its need for secure, transparent, and efficient transaction management. Financial institutions require robust security to protect sensitive data, comply with regulations, and combat cyber threats such as fraud. Blockchain's decentralized nature ensures secure transactions and streamlined processes. As digital technologies, such as cryptocurrencies and smart contracts, become more widespread, demand for blockchain security solutions rises in the BFSI sector. The adoption of blockchain is further driven by the need to improve operational efficiency, reduce costs, and enhance customer trust, making BFSI the leading market vertical.

The media, advertising, and entertainment segment is expected to witness substantial growth during the forecast period, driven by the rising adoption of blockchain platforms such as Ethereum. These platforms offer benefits such as eliminating intermediaries, reducing IP violations, and enabling direct monetization through peer-to-peer micropayments and smart contracts. Blockchain also facilitates efficient micropayment systems and provides detailed records of media usage, enhancing transparency and revenue collection in the sector.

Blockchain Security Market Regional Outlook

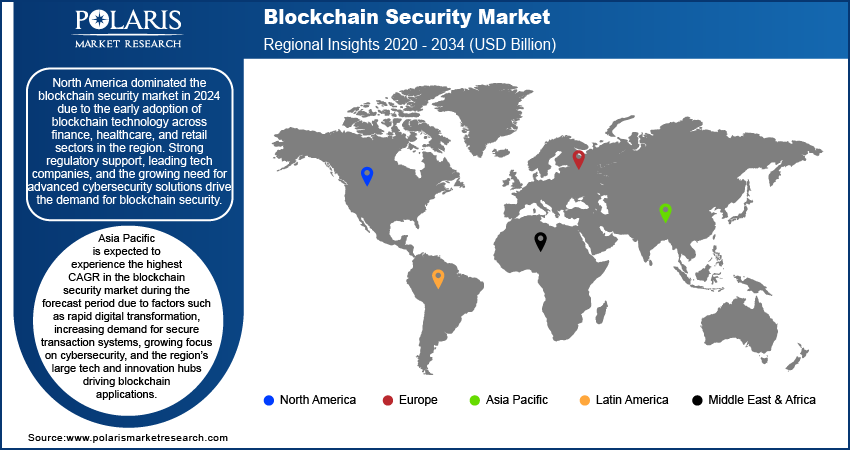

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the blockchain security market due to its early adoption of blockchain technology across multiple industries such as finance, healthcare, and retail. The region benefits from the presence of leading technology companies and a well-established regulatory environment that boosts blockchain innovation and development. Furthermore, as cyber threats continue to increase in sophistication, there is a growing requirement for robust blockchain security solutions to protect sensitive data and transactions. North America's advanced technological infrastructure, coupled with a rising focus on cybersecurity, positions it as the dominant region in the blockchain security market.

The Asia Pacific (APAC) blockchain security market is expected to register the highest CAGR during the forecast period due to factors such as rapid digital transformation, increasing demand for secure transaction systems, growing focus on cybersecurity, and the region’s large tech and innovation hubs driving more blockchain applications.

In January 2022, the Asian Development Bank (ADB) launched a project to improve cross-border securities transactions in the ASEAN+3 region using blockchain technology, aiming to reduce costs and risks by connecting central banks and securities depositories through a blockchain network. The initiative is part of ADB's Digital Innovation Sandbox program, promoting collaboration across public and private sectors.

Blockchain Security Market – Key Players and Competitive Analysis Report

The competitive landscape in the blockchain security market is marked by global and regional players aiming to capture market share through innovation, strategic collaborations, and regional expansion. Leading companies in the market focus on enhancing security protocols, ensuring data privacy, and improving scalability to meet the growing demand for secure digital transactions across industries such as finance, healthcare, and government. These companies leverage their strong research and development capabilities, along with global distribution networks, to offer advanced blockchain security solutions.

Smaller regional companies are emerging, offering specialized solutions tailored to local regulatory environments or specific industry requirements. Common competitive strategies in the blockchain security market are mergers and acquisitions, collaborations with industrial partners, and investments in emerging markets, all aimed at strengthening market presence and expanding product offerings. A few major players are IBM; Amazon Web Services, Inc. (AWS); Oracle; Infosys Limited; Infineon Technologies; Kudelski Security; ScienceSoft; Kaspersky Lab; Chainalysis; Consensys; Bitfury Group Limited; Fortanix; Hacken; Arridae Infosec; OVHcloud; and CryptoSec.

Platonic Inc. is a blockchain infrastructure company that focuses on tokenization within financial markets to empower global financial institutions by providing a platform that uses blockchain and smart contracts to increase operational efficiency, reduce risks, and replace outdated processes. On August 19, 2024, Platonic launched a decentralized tokenization platform aimed at enabling secure asset tokenization for financial institutions. The platform utilizes a patented Layer 1 blockchain, emphasizing security and client data protection. It integrates with legacy and modern financial infrastructures and incorporates AI-linked smart contracts to enhance automation and efficiency. The platform also offers access to public blockchains, which facilitates broader market reach and liquidity. The Platonic approach seeks to improve capital markets by providing a transparent, secure, and decentralized method for asset tokenization.

Kudelski Security, based in the US, is a provider of cybersecurity solutions to help enterprises and clients build, deploy, and manage effective security programs aligned to their business objectives. In January 2019, the company launched the Blockchain Security Center (BSC) to bring its cryptographic expertise to the blockchain development community. The aim was to integrate security into blockchain solutions across enterprises and public/private sectors. As blockchain applications grow, the technology is predicted to generate USD 3.1 trillion in business value by 2030, highlighting its potential for revolutionizing industries.

Key Companies in the Blockchain Security Market

- Platonic Inc.

- IBM

- Amazon Web Services Inc. (AWS)

- Oracle

- Infosys Limited

- Infineon Technologies

- Kudelski Security

- ScienceSoft

- Kaspersky Lab

- Chainalysis

Blockchain Security Industry Developments

In November 2022, Infosys introduced a VMware Blockchain solution for securely verifying vital records such as birth and marriage certificates. It ensures record immutability and transparency while maintaining privacy, with no sensitive data stored on the blockchain. The VMware blockchain system, which operates in a cloud-based multi-tenant environment, offers improved security, lower costs, and compatibility with decentralized apps.

In June 2023, Fujitsu launched "ConnectionChain" blockchain technology in collaboration with the Asian Development Bank, ConsenSys, R3, and SORAMITSU. The project aimed to improve and secure cross-border financial securities transactions by connecting multiple blockchains across regions such as ASEAN, Japan, China, and South Korea.

In April 2022, NSDL introduced a blockchain-based platform for monitoring corporate bond issuance, enhancing security, and providing timely updates to investors. This platform represents a pioneering use of blockchain technology in the corporate bond market.

Blockchain Security Market Segmentation

By Solution Outlook (Revenue, USD Billion, 2020–2034)

- Key Management

- Smart Contract Security

- Penetration Testing

- Identity and Access Management

- Audits

By Services Outlook (Revenue, USD Billion, 2020–2034)

- Development and Integration

- Support and Maintenance

- Technology Advisory and Consulting

- Incident and Response Services

By Deployment Mode Outlook (Revenue, USD Billion, 2020–2034)

- Cloud

- On-Premises

By Organization Size Outlook (Revenue, USD Billion, 2020–2034)

- SMEs

- Large Enterprises

By Vertical Outlook (Revenue, USD Billion, 2020–2034)

- Transportation and Logistics

- Agriculture and Food

- Manufacturing

- Energy and Utilities

- Healthcare and Life Sciences

- Media, Advertising, and Entertainment

- Banking Financial Services and Insurance

- IT and Telecom

- Retail and eCommerce

- Government

- Others

By Region Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Blockchain Security Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3.80 billion |

|

Market Size Value in 2025 |

USD 6.22 billion |

|

Revenue Forecast by 2034 |

USD 538.00 billion |

|

CAGR |

64.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global blockchain security market size was valued at USD 3.80 billion in 2024 and is projected to grow to USD 538.00 billion by 2034.

The global market is projected to record a CAGR of 64.1% during the forecast period.

North America dominated the market in 2024 due to the early adoption of blockchain technology across finance, healthcare, and retail. Strong regulatory support, leading tech companies, and the growing need for advanced cybersecurity solutions drive the demand for blockchain security across the region.

A few key players in the market are IBM; Amazon Web Services, Inc. (AWS); Oracle; Infosys Limited; Infineon Technologies; Kudelski Security; ScienceSoft; Kaspersky Lab; Chainalysis; Consensys; Bitfury Group Limited; Fortanix; Hacken; Arridae Infosec; OVHcloud; and CryptoSec.

The cloud segment dominated the market in 2024 due to its flexibility, scalability, and cost-effectiveness compared to on-premise solutions.

The banking, financial services, and insurance (BFSI) segment dominated the market in 2024 due to its need for secure, transparent, and efficient transaction management