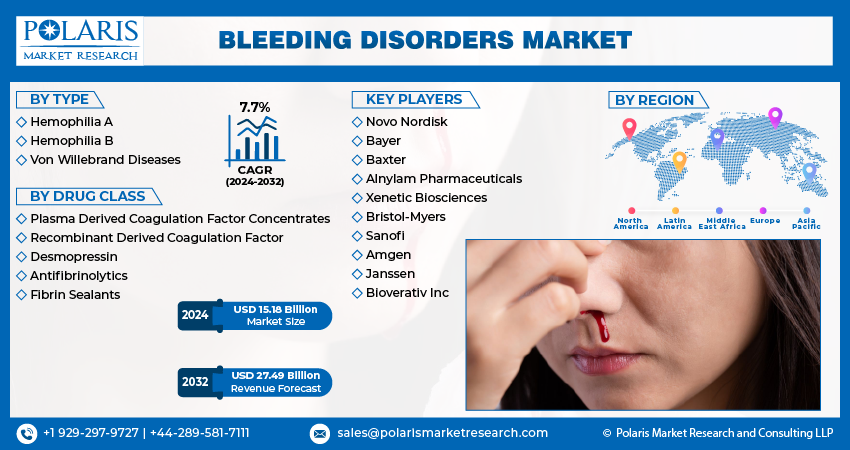

Bleeding Disorders Market Share, Size, Trends, Industry Analysis Report, By Type (Hemophilia A, Hemophilia B, Von Willebrand Diseases); By Drug Class; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM3351

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

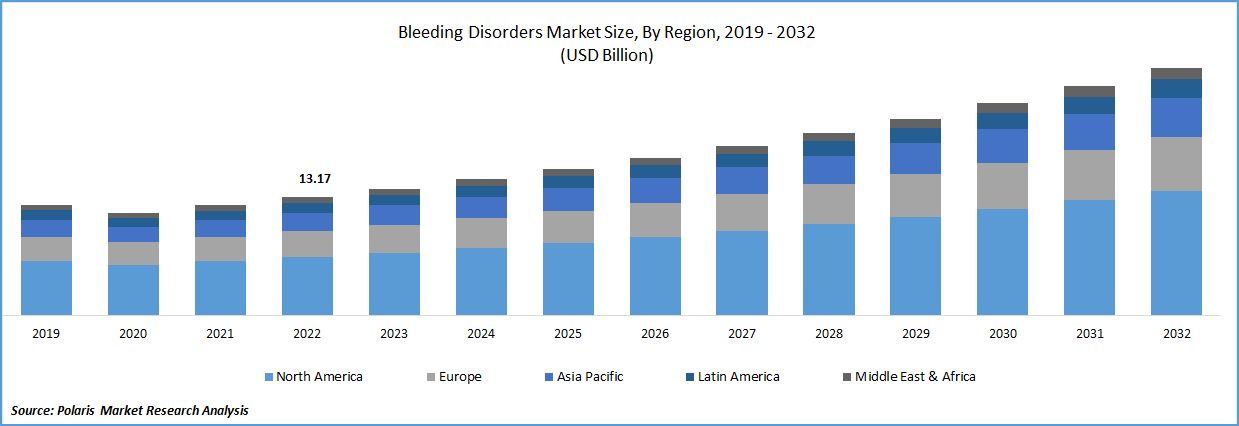

The global bleeding disorders market was valued at USD 14.14 billion in 2023 and is expected to grow at a CAGR of 7.7% during the forecast period. Blood donation plays a crucial role in the growth of the market, and ensuring a steady supply of donated blood and plasma is critical to meeting the needs of patients with bleeding disorders. The availability of donated blood and plasma is essential to produce these clotting factors. As the demand for clotting factor replacement therapy increases with the growing prevalence of bleeding disorders, the demand for blood donations also increases. As per the statistics published by the WHO, the number of voluntary, unpaid blood donations increased by 10.7 Mn from 2008 to 2018. Overall, 79 nations receive more than 90% of their blood supply from unpaid, voluntary donors; yet, 54 nations receive more than 50% of their blood supply from paid, family, or replacement donors.

To Understand More About this Research: Request a Free Sample Report

The increasing cases of HBV infections are contributing to the growth of the bleeding disorders market, as the demand for clotting factor replacement therapy increases among patients with HBV-related bleeding disorders. Infection with the hepatitis B virus (HBV) continues to be a serious issue for global health. The World Health Organization (WHO) has estimated that 2 billion individuals worldwide, or about one-third of the world's population, are infected. More than 350 million people worldwide (5–7% of the total population) have a chronic HBV infection.

Industry Dynamics

Growth Drivers

The prevalence of bleeding disorders such as hemophilia, von Willebrand disease, and other clotting factor deficiencies is on the rise. This is primarily due to factors such as genetic mutations, aging populations, and changing lifestyles. The development of advanced diagnostics and treatment options such as gene therapy and recombinant clotting factors has significantly improved patient outcomes and increased the demand for these products.

Governments in several countries have introduced favorable policies to encourage the development of the healthcare sector, including the bleeding disorders market. For instance, in the United States, the Orphan Drug Act provides incentives for the development of treatments for rare diseases, including bleeding disorders. Such policies have encouraged investments in research and development activities, which has resulted in the development of new therapies for bleeding disorders. Growing awareness about bleeding disorders and patient education programs have helped in early diagnosis, better management, and improved outcomes for patients. This has led to an increase in demand for treatments, including clotting factor replacement therapy, which has contributed to the growth of the bleeding disorders market.

Governments and healthcare organizations across the world are increasing their healthcare expenditure, including investment in bleeding disorder treatments and research. Increasing awareness and education about bleeding disorders, especially in developing countries, has resulted in a higher diagnosis rate and improved access to treatment. Emerging markets such as China, India, and Brazil have a large population with a high incidence of bleeding disorders. This presents an opportunity for market players to expand their presence in these markets.

Report Segmentation

The market is primarily segmented based on type, drug class and region.

|

By Type |

By Drug Class |

By Region |

|

|

|

For Specific Research Requirements: Request for Customized Report

Hemophilia A Type is expected to witness fastest growth over the forecast period

Hemophilia A segment is projected to experience the fastest growth rate in coming years. The prevalence of hemophilia A is increasing globally, primarily due to genetic mutations and an aging population. The market for hemophilia A is seeing an increase in demand for cutting-edge treatments like gene therapy and recombinant clotting factors. Long-term advantages of these treatments include the chance of a disease cure. Recombinant clotting factors, for example, are a powerful therapy option that has dramatically improved patient outcomes and raised demand for these goods. An increase in education and awareness about hemophilia A, particularly in developing nations, has led to a higher diagnosis rate and easier access to treatment.

The Recombinant derived Coagulation Factor segment is expected to witness higher growth

The recombinant coagulation factor concentrates segment is estimated to have higher growth. The availability of recombinant coagulation factor concentrates has significantly improved patient outcomes and increased demand for these products. These treatments offer more consistent potency, longer shelf life, and fewer side effects compared to traditional plasma-derived products. Globally, the prevalence of bleeding diseases like hemophilia A and B is rising. The demand for recombinant coagulation factor concentrates is anticipated to increase over the next few years, particularly as a result of aging populations and genetic changes.

The demand in Asia Pacific is projected to witness higher growth rate

Asia Pacific is expected to have a higher growth rate in coming years. The development of advanced diagnostics and treatment options such as gene therapy and recombinant clotting factors has significantly improved patient outcomes and increased the demand for these products. Emerging markets such as China, India, and Indonesia have a large population with a high incidence of bleeding disorders. This presents an opportunity for market players to expand their presence in these markets. This has a large patient population with bleeding disorders, primarily due to the high prevalence of hepatitis and HIV infections, which are risk factors for bleeding disorders. The largest country in the area, India accounts for 10-15% of all HBV carriers worldwide and carries most of the HBV burden in South Asia due to its sheer population. This will propel the growth of the bleeding disorders market in coming years.

North America is projected to have a larger revenue share throughout the forecast period. The prevalence of bleeding disorders in North America is relatively high, particularly in the United States. The US Centers for Disease Control and Prevention (CDC) estimate that one in 5,617 live male births have hemophilia. In the US, there are 30,000 to 33,000 people who have hemophilia. The severe type of hemophilia A affects more than half of those who are affected. Four times as many people have hemophilia A than hemophilia B. All racial and ethnic groups are impacted by hemophilia. This has created a significant demand for bleeding disorder treatments and has driven the growth of the market in the region. North America has been at the forefront of developing and adopting advanced therapies such as gene therapy and recombinant clotting factors. This has driven the growth of the market in the region, with significant demand for these therapies.

Competitive Insight

Some of the major players operating in the global market include Novo Nordisk, Bayer, Baxter, Alnylam Pharmaceuticals, Xenetic Biosciences, Bristol-Myers, Sanofi, Amgen, Janssen, and Bioverativ Inc.

Recent Developments

- In February 2023, Bayer finalized the acquisition of Blackford Analysis, a developer of AI platforms and solutions for strategic imaging. Thus, Bayer now has a 100 percent stake in Blackford, a company with operations in the US & UK.

- In February 2023, Baxter International & Miromatrix Medical collaborated to offer additional therapeutic choices for people suffering from acute liver failure (ALF) who require organ support therapy.

Bleeding Disorders Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 15.18 billion |

|

Revenue forecast in 2032 |

USD 27.49 billion |

|

CAGR |

7.7% from 2024- 2032 |

|

Base year |

2023 |

|

Historical data |

2019- 2022 |

|

Forecast period |

2024- 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Drug Class, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Novo Nordisk, Bayer AG, Baxter International, Alnylam Pharmaceuticals, Pfizer, Xenetic Biosciences, Bristol-Myers Squibb Company, Sanofi, Amgen, Janssen Global Services, LLC and Bioverativ Inc. |

FAQ's

The bleeding disorders market report covering key segments are type, drug class and region.

Bleeding Disorders Market Size Worth $27.49 Billion By 2032.

The global bleeding disorders market expected to grow at a CAGR of 7.7% during the forecast period.

Asia Pacific is leading the global market.

key driving factors in bleeding disorders market are rise in awareness about bleeding disorders in developing countries.