Bleaching Clay Market Share, Size, Trends, Industry Analysis Report, By Product (Natural Bleaching Clay, Activated Bleaching Clay); By Application; By Region; Segment Forecast, 2021 - 2028

- Published Date:Sep-2021

- Pages: 121

- Format: PDF

- Report ID: PM1964

- Base Year: 2020

- Historical Data: 2016-2019

Report Outlook

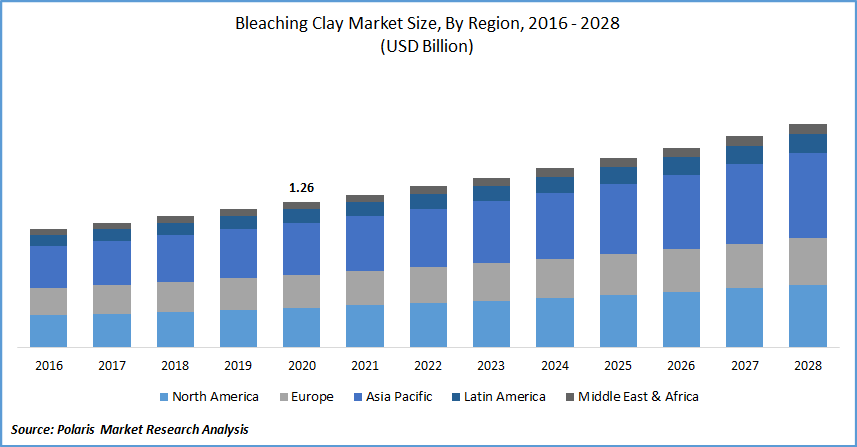

The global bleaching clay market was valued at USD 1.26 billion in 2020 and is expected to grow at a CAGR of 5.6% during the forecast period. The global demand will increase in the upcoming years due to the increasing usage of the product in processing and decolorizing edible oil, animal fats, margarine, and mineral oils.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The market demand could be driven by rising edible oil consumption. As a result, they are shifting lifestyles and increasing purchasing power parity. Global efforts to promote non-conventional fuels, combined with growing environmental issues, are likely to increase global acceptance and usage of biodiesel. Biodiesel is predicted to account for a sizable portion of the global bleaching clay demand in the coming years.

Also, bleaching clay is used to process numerous mineral oils, like lubricants and hydrocarbons. Due to its increasing uses in manufacturing several lubricants and grease, thermic fluid, food preparation, biomedicine, cosmetics, waxes, and health care products, the mineral oil industry is expected to see increased demand around the world. All these aspects are expected to boost the global bleaching clay market demand in the coming years.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The global bleaching clay market growth is mainly driven by factors such as increased use in refining and decolorizing edible oil, mineral oils, animal fats, and margarine. Bleaching clay is mainly used in food applications such as edible oil like soybean, sunflower, canola, and palm oil. It is used to remove the color and contaminants and thereby enhanced purification.

In 2020, vegetable oil production volume was estimated to be approximately 210 million metric tons and 19 million metric tons of sunflower oil consumed alone 2020. The changing economic condition and increased healthcare awareness have resulted in the consumer demand for high-quality edible oil, which will help in the growth of the global market for bleaching clay during the forecast period.

Contaminants in the mineral oil, such as sulfonic acid and sulfuric acid, can be effectively removed using bleaching clay. The demands for mineral oils such as rolling oil and lubricants have exponentially increased in the past few decades due to the automobile industry's huge boom worldwide.

The massive growth in the automobile industry will accelerate the growth of the global market for bleaching clay. COVID-19 is expected to slow down the development of the global market during the forecast period due to the problems in the supply chain in the transport of raw materials and the export of edible oil owing to strict lockdowns imposed in many countries across the globe.

Report Segments

The market is primarily segmented on the basis of product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Product

The natural bleaching clay segment is estimated to have the highest growth rate during the forecast period. It contains a variety of mineral clays, including bentonite, attapulgite, and sepiolite. It is mainly used to remove a variety of contaminants, including soluble organic and chemical substances. The feedstock's type and quality determine the selection and the refining process.

The product is commonly used in various industries, including mineral oils and lubricants, varnishes, paints, soaps, biofuel, and wastewater treatment. During the projected timeline, the market is anticipated to increase due to the rising need for refined and processed products from the end-use industries.

Insight by Application

The refining of vegetable oils and fats segment is anticipated to have a high growth rate during the projected timeframe. When processed, vegetable oils, such as palm, soybean, rapeseed, and soybean edible lard contain contaminants that must be eliminated to produce superior quality products.

Bleaching clay is being used to process edible oils and fats to eliminate pollutants that can influence the taste and color of these oils. Furthermore, it is critical in lowering pigments, phosphatides, residual soaps, trace metals, and oxidation products.

The growing demand from the food sector is one of the major factors leading to the higher utilization of vegetable oil. It is used as a component in non-dairy creamers, margarine, and ice cream preparations.

Furthermore, vegetable oil is used in various cosmetic formulations as a hair and skin conditioning agent. As a result, increasing demand for vegetable oil from various application industries such as food processing, cosmetics, and biofuel generation is expected to drive segment market growth.

In the waste oil regeneration method, lubricant refining is becoming more common. Contaminants in waste lubricant oil include polycyclic aromatic hydrocarbons, chlorinated hydrocarbons, and heavy metals, both of which are deemed toxic wastes that can damage the ecosystem. The adsorption method is used to eliminate these pollutants by using bleaching soil as a natural absorbent.

Geographic Overview

The Asia Pacific is expected to be the most significant region for the global market for bleaching clay due to increased market demand and increasing awareness for healthier food products such as low cholesterol edible oils in China and India.

The increased yields of oilseeds in emerging economies due to better agricultural practices will further drive the market in this region. In India alone, more than 30-million-ton oilseeds were produced in 2020, making it the world's biggest oilseed producer.

North America is expected to significantly contribute to the growth of the global market during the forecast period as the countries in these regions are some of the biggest exporters of crude and edible oils. The region also has a vibrant automotive industry, which will further help in the market growth for bleaching mud in the region.

The rising demand for refined edible and industrial oils is attributed to the growth of the market. Large-scale development of the raw resources, bentonite, and a significant presence of well-established international and domestic industry players in the region, is further anticipated to augment market growth for bleaching clay over the projected period.

Competitive Insight

The companies involved in the manufacturing of bleaching soil are launching new products in the market due to the increasing application in recent years. Companies are entering into acquisitions and partnerships to increase their foothold in the market for bleaching mud.

Some of the major players operating in the market for bleaching clay include Clariant, AMC (U.K.) Ltd., Indian Clay & Mineral Co., Taiko Group of Companies, MANEK ACTIVE CLAY PVT. LTD., Phoenix Chemicals (Pvt.) Ltd., Ashapura Perfoclay Limited (APL), Refoil Earth Pvt. Ltd., Korvi Activated Earth, Musim Mas Holdings Pte. Ltd., Oil-Dri Corporation of America, The W Clay Industries Sdn. Bhd.

Bleaching Clay Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 1.26 billion |

|

Revenue forecast in 2028 |

USD 1.94 billion |

|

CAGR |

5.6% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Product, By Application, By Region |

|

Regional scope |

North America Europe Asia Pacific Latin America, Middle East & Africa |

|

Key Companies |

Clariant, AMC (U.K.) Ltd., Indian Clay & Mineral Co., Taiko Group of Companies, MANEK ACTIVE CLAY PVT. LTD., Phoenix Chemicals (Pvt.) Ltd., Ashapura Perfoclay Limited (APL), Refoil Earth Pvt. Ltd., Korvi Activated Earth, Musim Mas Holdings Pte. Ltd., Oil-Dri Corporation of America, The W Clay Industries Sdn. Bhd. |