Blasting Automation Services Market Size, Share, Trends, Industry Analysis Report: By Process, Application (Metal Mining, Non-Metal Mining, and Coal Mining), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 125

- Format: PDF

- Report ID: PM5294

- Base Year: 2024

- Historical Data: 2020-2023

Blasting Automation Services Market Overview

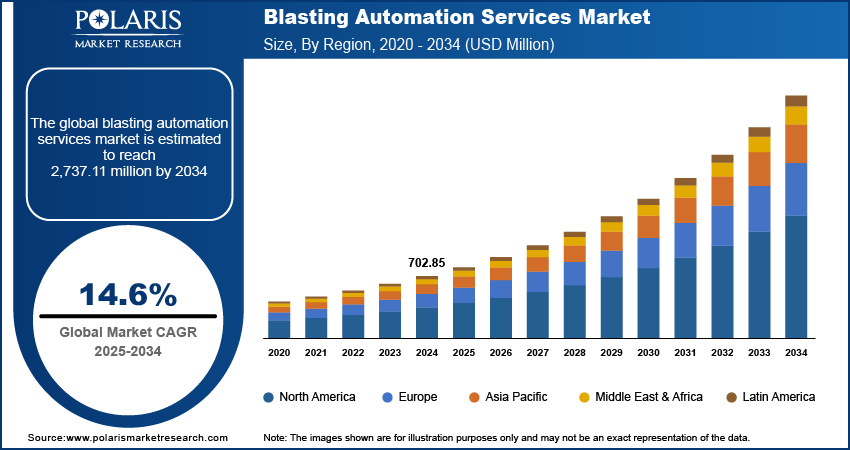

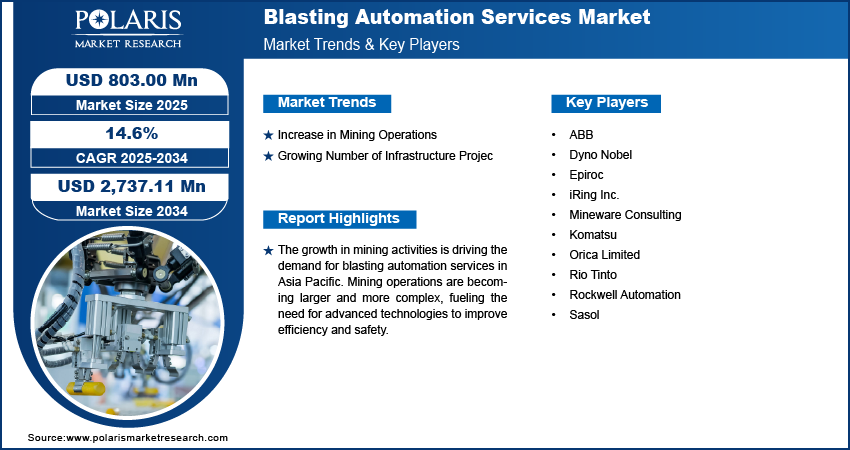

The blasting automation services market size was valued at USD 702.85 million in 2024. The market is projected to grow from USD 803.00 million in 2025 to USD 2,737.11 million by 2034, exhibiting a CAGR of 14.6% during 2025–2034.

Blasting automation services involve the use of advanced technology to automate the blasting process in industries such as mining and construction. These services improve efficiency, safety, and precision by controlling blast design, timing, and real-time monitoring while also minimizing human errors and environmental impact.

The growing emphasis on industrial automation is driving the blasting automation market growth. Companies are increasingly adopting automated systems to improve operational efficiency, reduce human error, and ensure safer blasting operations, propelling the demand for automation services. This trend is also pushing industries such as mining and construction to adopt smarter, more sustainable practices while meeting stricter safety and environmental standards. Thus, the growing emphasis on industrial automation is driving the blasting solution market growth.

To Understand More About this Research: Request a Free Sample Report

Technological advancements in blasting systems are helping the blasting automation market grow. New technologies now allow real-time monitoring and control of blasting operations, which improves accuracy, safety, and reduces costs. This is encouraging more companies to adopt blasting automation.

For example, Infosys launched a blast management solution that tracks real-time data and identifies important performance areas. This kind of automation helps lower costs by creating better blast designs and reducing waste. Because of these innovations, industries like mining and construction are increasingly using automation to make blasting processes safer, which is driving the growth of the blasting automation services market.

Blasting Automation Services Market Driver Analysis

Increase in Mining Operations

Mining companies are expanding their operations, due to which the demand for tools to manage blasting processes and handle larger volumes of material is rising. For instance, in 2023, the Indian Ministry of Mines reported that the country's mine production reached a value of USD 16.86 billion, reflecting the volume growth of the mining operations in India alone. Additionally, the growing demand for minerals and metals worldwide is pushing mining companies to adopt automation for more effective and scalable blasting techniques. Therefore, rising mining operations are driving the blasting automation market growth.

Growing Number of Infrastructure Projects

The number of infrastructure projects, such as road construction, tunnels, and dams, is increasing worldwide, propelling the demand for safer, faster, and more cost-effective blasting solutions. According to the Indian Department of Economic Affairs, India recorded new infrastructure projects worth USD 818.67 billion by public–private partnerships. These projects require accurate and controlled blasting to clear large volumes of rock or soil. Thus, a growing number of infrastructure projects is fueling the blasting automation service market demand.

Blasting Automation Services Market Segment Analysis

Blasting Automation Services Market Assessment by Process Outlook

The blasting automation services market segmentation, based on process, includes batch machine and continuous machine. The batch machine segment is expected to experience significant CAGR in the global market during the forecast period due to rising demand for customized blasting solutions. The batch machine enables precise control over blasting operations for specific project needs. The ability to adjust the blasting parameters to suit different environments and requirements is driving its popularity.

Blasting Automation Services Market Evaluation by Application Outlook

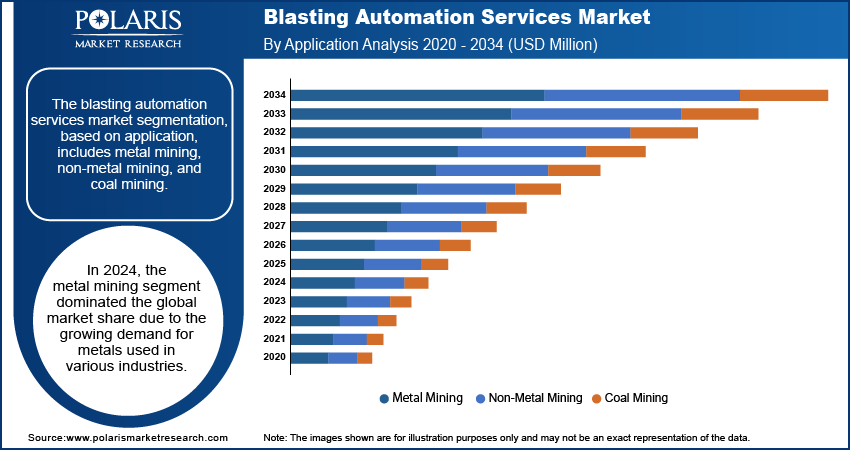

The blasting automation services market segmentation, based on application, includes metal mining, non-metal mining, and coal mining. The metal mining segment dominated the blasting automation services market share in 2024 due to the growing demand for base metals used in various industries. Increased global industrialization and the push for renewable energy are fueling the need for metals such as copper, gold, and lithium, which is driving the demand for blasting automation for precision in metal extraction. This demand for more efficient and controlled blasting processes is propelling the metal mining segment’s growth in the blasting automation service market.

Blasting Automation Services Market Regional Analysis

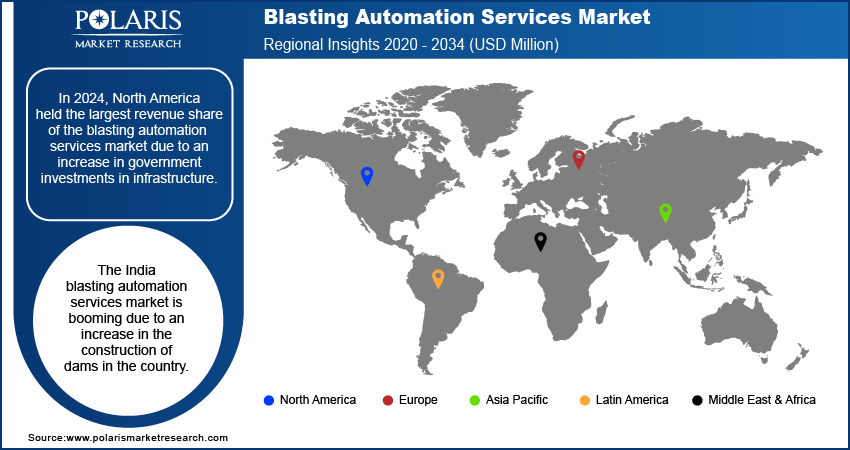

By region, the study provides the blasting automation services market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest revenue share of the blasting automation services market due to an increase in government investments in infrastructure. Increased funding for projects such as highways, bridges, and tunnels is driving the demand for precise blasting techniques. According to the US Department of the Treasury, the US funded USD 1.2 trillion for infrastructure development under the Bipartisan Infrastructure Law. This ongoing infrastructure investments in new projects is driving the demand for blasting automation solutions in North America.

The Asia Pacific blasting automation services market is experiencing significant growth due to growth in mining activities. Mining operations are becoming larger and more complex due to which the need for advanced technology to improve efficiency and safety is rising. For instance, according to the Australian Bureau of Statistics, Mining activities in Australia reached a value of USD 1,014.5 million in June 2022, showcasing growth in mining activities. This increase in mining activities is propelling the demand for blasting automation services, thereby driving the blasting automation market growth in the region.

The blasting automation services market in India is experiencing substantial growth due to the rise in dam construction in India. Numerous dam projects are being developed to support irrigation, water supply, and hydroelectric power, due to which there is a need for efficient excavation and rock-breaking techniques. For instance, according to the Indian Dam Rehabilitation and Improvement Projects, 143 large-size dams are under construction in the country. Additionally, increasing government investments in infrastructure development, such as water projects, are propelling the blasting automation market expansion in India.

Blasting Automation Services Market – Key Players and Competitive Analysis

The blasting automation services market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific sectors. This competitive environment is amplified by continuous progress in product offerings. A few major players in the blasting automation services market are ABB, Dyno Nobel, Epiroc, iRing Inc., Mineware Consulting, Komatsu, Orica Limited, Rio Tinto, Rockwell Automation, and Sasol.

ABB operates as a technology company worldwide. It was founded in 1988 and is headquartered in Zurich, Switzerland. The company operates through four segments: electrification, motion, process automation, and robotics & discrete automation. The electrification segment offers a product portfolio of switchgear under the distribution solution subsegment. The motion segment offers drive products, system drives, services, traction, IEC LV Motors, generators, and NEMA motors. Moreover, process automation and robotics & discrete automation cater to various energy and process industries and also offer measurement analytics, machine automation, and robotics. A few of the prominent end-markets catered by the company are renewables, automotive, food & beverage, distribution, oil & gas, chemicals, mining & metals, and buildings. The company’s prominent channel partners include distributors followed by direct sales; engineering, procurement, and construction (EPCs); original equipment manufacturers (OEMs); system integrators; and panel builders.

Rockwell Automation is a US-based company specializing in industrial automation. It offers a range of products that include Allen-Bradley brands, FactoryTalk software, and LifecycleIQ Services. Headquartered in Milwaukee, the company serves customers in over 100 countries globally. Rockwell Automation provides asset optimization and workforce station services such as equipment repair, remanufacturing, on-site field services, asset and equipment inventory management, applications remote support and monitoring, and training services. The company offers a diverse portfolio that encompasses hardware, software, design, analytics, and data solutions. This includes Manufacturing Execution Systems (MES), Human-Machine Interface (HMI), performance monitoring, maintenance, industrial communications, XR/augmented reality, industrial analytics, industrial automation control, industrial cybersecurity and networks, industrial solutions for digital transformation, motion and robotics, safety solutions, smart manufacturing, automotive and tire, process automation control, infrastructure, and more. Hardware includes condition monitoring, connection devices, circuit & load protection, distributed control systems, drives, energy monitoring, independent cart technology, industrial computers & monitors, industrial control products, input/output Modules, Human Machine Interface (HMI), and lighting control. Studio 5000, emulate3D digital twin, factoryTalk vault, arena simulation, factoryTalk logix echo, factoryTalk design studio, and factoryTalk twin studio are included in the design category. Analytics and data include factoryTalk historian, factoryTalk dataMosaix, factoryTalk energy manager, factoryTalk analytics, and thingworx IIoT. The company offers HMI products, which include factoryTalk View and factoryTalk Optix.

Key Companies in Blasting Automation Services Market

- ABB

- Dyno Nobel

- Epiroc

- iRing Inc.

- Mineware Consulting

- Komatsu

- Orica Limited

- Rio Tinto

- Rockwell Automation

- Sasol

Blasting Automation Services Market Developments

October 2023: The ABB Robot Charger technology for blasting automation was successfully tested in partnership with Boliden and LKAB. The robot automatically detected boreholes and charged explosives, eliminating the need for human presence and improving safety in underground mining operations.

October 2024, Dyno Nobel expanded its electronic detonator product line with the DigiShot XR range, designed to withstand extreme shock. The range includes DigiShot XR, DigiShot Plus XR, and DigiShot Plus XRS, offering improved shock resistance and longer programmable delays.

January 2024, Epiroc Canada and Vale Canada signed a non-binding Memorandum of Understanding to develop and test innovative mining equipment and techniques. The collaboration aims to enhance safety, productivity, and advanced solutions by integrating Epiroc’s automation, digitalization, and electrification technologies into underground mining operations.

Blasting Automation Services Market Segmentation

By Process Outlook (Revenue USD Million, 2020–2034)

- Batch Machine

- Continuous Machine

By Application Outlook (Revenue USD Million, 2020–2034)

- Metal Mining

- Non-Metal Mining

- Coal Mining

By Regional Outlook (Revenue USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Blasting Automation Services Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 702.85 million |

|

Market Size Value in 2025 |

USD 803.00 million |

|

Revenue Forecast in 2034 |

USD 2,737.11 million |

|

CAGR |

14.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 702.85 million in 2024 and is projected to grow to USD 2,737.11 million by 2034.

The global market is projected to grow at a CAGR of 14.6% during 2025–2034.

North America held the largest share of the global market in 2024.

A few key players in the market are ABB, Dyno Nobel, Epiroc, iRing Inc., Mineware Consulting, Komatsu, Orica Limited, Rio Tinto, Rockwell Automation, and Sasol.

The batch machine segment is expected to experience significant CAGR in the global market during the forecast period due to rising demand for customized blasting solutions.

The metal mining segment dominated the market share in 2024 due to the growing demand for metals used in various industries.