Blastic Plasmacytoid Dendritic Cell Neoplasm (BPDCN) Market Size, Share, Trends, Industry Analysis Report: By Treatment (Chemotherapy, Immunotherapy, and Stem Cell Transplantation), End Users (Hospitals, Specialty Clinics, and Others), and Region (North America, Europe, Asia Pacific, Latin America and the Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 118

- Format: PDF

- Report ID: PM5233

- Base Year: 2024

- Historical Data: 2020-2023

Blastic Plasmacytoid Dendritic Cell Neoplasm (BPDCN) Market Overview

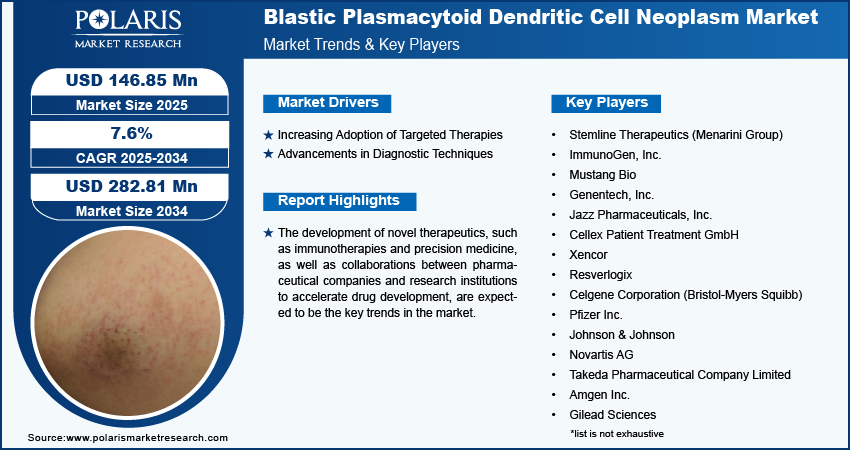

The blastic plasmacytoid dendritic cell neoplasm market size was valued at USD 136.72 million in 2024. The market is projected to grow from USD 146.85 million in 2025 to USD 282.81 million by 2034, exhibiting a CAGR of 7.6% from 2025 to 2034.

The BPDCN market focuses on the diagnosis, treatment, and management of BPDCN, a rare and aggressive hematologic malignancy. The market is driven by the increasing prevalence of BPDCN, advancements in diagnostic techniques, and the growing adoption of targeted therapies.

The development of novel therapeutics, such as immunotherapies and precision medicine, as well as collaborations between pharmaceutical companies and research institutions to accelerate drug development, are expected to be the key trends in the market. Regulatory approvals and the rising awareness of BPDCN among healthcare professionals also influence the market.

-market.webp)

To Understand More About this Research: Request a Free Sample Report

Blastic Plasmacytoid Dendritic Cell Neoplasm Market Trends and Drivers Analysis

Increasing Adoption of Targeted Therapies

The BPDCN market is witnessing a significant shift towards targeted therapies, driven by the need for more effective and less toxic treatment options. Traditional chemotherapy regimens have shown limited success, with high relapse rates and severe side effects. In contrast, targeted therapies such as tagraxofusp-erzs (SL-401), which received FDA approval in 2018, have demonstrated improved outcomes with a more favorable safety profile. According to a study published in Blood Journal, patients treated with tagraxofusp showed an overall response rate of 90% in treatment-naive BPDCN cases. This shift towards targeted treatments is expected to continue as research advances in understanding the molecular mechanisms of BPDCN.

Advancements in Diagnostic Techniques

The market is also benefiting from advancements in diagnostic techniques, which are crucial for the early detection and accurate characterization of BPDCN. Traditional methods often led to misdiagnosis due to the disease's rarity and overlapping features with other hematologic malignancies. However, recent innovations in immunophenotyping and molecular diagnostics have significantly improved diagnostic accuracy. For instance, the use of CD123 as a biomarker has become a standard in BPDCN diagnosis, allowing for more precise differentiation from other conditions. A study in the Journal of Clinical Oncology noted that improved diagnostic methods have led to earlier diagnosis in nearly 40% of cases, which is crucial for better patient outcomes.

Growing Focus on Precision Medicine

Precision medicine is poised to emerge as a major trend in the BPDCN market, aligning with the broader healthcare industry’s move towards personalized treatment approaches. By tailoring therapies based on individual genetic profiles, precision medicine aims to enhance treatment efficacy while minimizing adverse effects. Current research efforts are focused on identifying genetic mutations and molecular pathways specific to BPDCN, which could lead to the development of highly targeted drugs. For example, recent studies have identified mutations in TET2 and ASXL1 genes in a significant portion of BPDCN patients, opening new avenues for targeted therapy development. The growing emphasis on precision medicine is expected to drive innovation in the BPDCN market, offering new hope for patients with this aggressive disease.

Blastic Plasmacytoid Dendritic Cell Neoplasm Market Segment Analysis

Blastic Plasmacytoid Dendritic Cell Neoplasm Market Assessment by Treatment

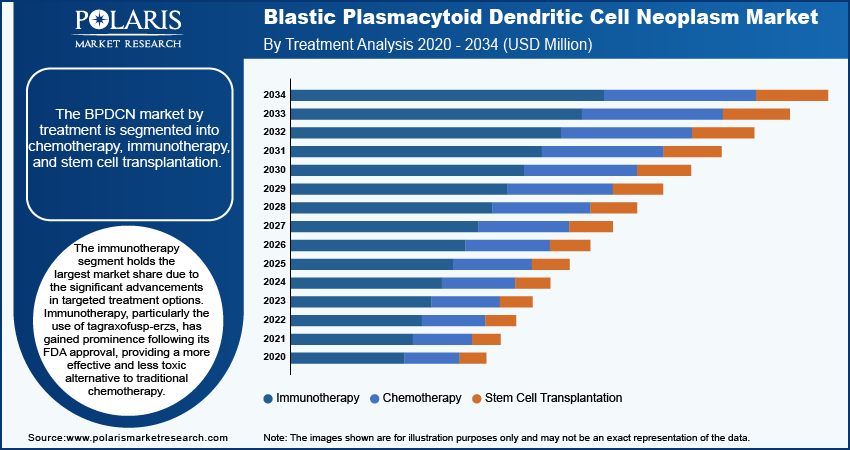

The BPDCN market by treatment is segmented into chemotherapy, immunotherapy, and stem cell transplantation. The immunotherapy segment holds the largest market share due to the significant advancements in targeted treatment options. Immunotherapy, particularly the use of tagraxofusp-erzs, has gained prominence following its FDA approval, providing a more effective and less toxic alternative to traditional chemotherapy. This segment is also witnessing the highest growth, driven by ongoing research and development efforts aimed at discovering new immunotherapeutic agents. The success of tagraxofusp has paved the way for further innovation, with numerous clinical trials underway exploring additional immunotherapy options for BPDCN treatment.

While immunotherapy leads the market, chemotherapy remains a widely used treatment, particularly in regions where newer therapies are not yet accessible or approved. Stem cell transplantation, although less frequently utilized, is considered a curative option, particularly in younger patients or those who achieve remission through initial treatments.

Blastic Plasmacytoid Dendritic Cell Neoplasm Market Evaluation by End Users Insights

The BPDCN market by end users is segmented into hospitals, specialty clinics, and others. Hospitals represent the largest segment of the market, holding the majority share due to their extensive resources, advanced medical infrastructure, and ability to offer comprehensive care. Hospitals are typically the first point of contact for BPDCN patients, offering a wide range of diagnostic and treatment options, including immunotherapy, chemotherapy, and stem cell transplantation. The availability of specialized oncology departments and multidisciplinary teams in hospitals contributes to their dominance in the market, ensuring that patients receive coordinated and effective care.

Specialty clinics, while smaller in scale, are registering the highest growth within the market. These clinics often focus on hematologic malignancies, providing specialized services that cater to the unique needs of BPDCN patients. Their growth is driven by the increasing demand for focused and personalized care, as well as the adoption of innovative treatments that may not yet be widely available in larger hospital settings. Additionally, specialty clinics are becoming preferred destinations for ongoing care and follow-up, especially for patients seeking tailored treatment regimens and closer monitoring of their condition.

Blastic Plasmacytoid Dendritic Cell Neoplasm Market Breakdown by Regional Insights

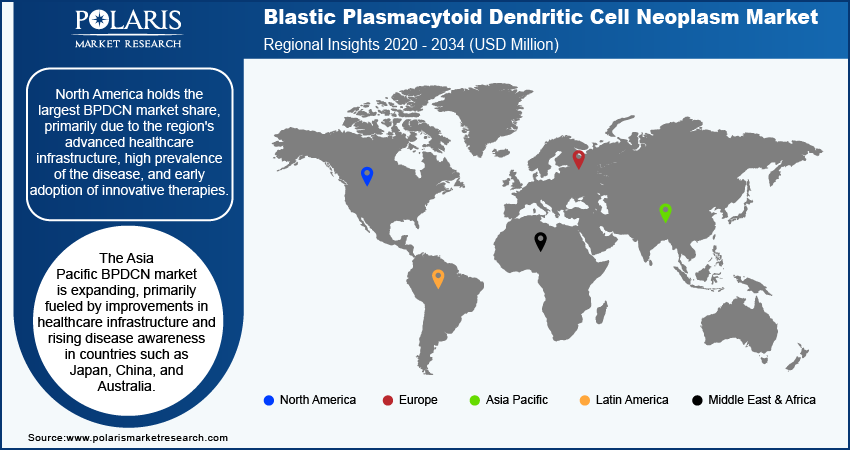

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest BPDCN market share, primarily due to the region's advanced healthcare infrastructure, high prevalence of the disease, and early adoption of innovative therapies. The United States, in particular, drives this dominance, benefiting from extensive research and development activities, as well as the availability of FDA-approved treatments like tagraxofusp-erzs. Additionally, strong awareness among healthcare professionals and patients, along with robust reimbursement policies, further solidifies the leading position of North America.

In Europe, the BPDCN market is growing steadily, supported by increasing awareness and the gradual adoption of advanced diagnostic and treatment options. Countries like Germany, the United Kingdom, and France are at the forefront, driven by strong healthcare systems and ongoing clinical research. The European Medicines Agency (EMA) has also been pivotal in facilitating the approval of new therapies, enhancing access to innovative treatments across the region..

The Asia Pacific BPDCN market is expanding, primarily fueled by improvements in healthcare infrastructure and rising disease awareness in countries such as Japan, China, and Australia. While the market is smaller compared to North America and Europe, it is poised for significant growth due to increasing investments in healthcare, the emergence of specialized cancer treatment centers, and the rising incidence of BPDCN in the region. Additionally, ongoing efforts to integrate advanced diagnostic techniques and targeted therapies into standard care practices are expected to boost market development.

Blastic Plasmacytoid Dendritic Cell Neoplasm Market – Key Players and Competitive Analysis Report

Key players actively participating in the BPDCN market include Stemline Therapeutics (now part of Menarini Group); Celgene Corporation (acquired by Bristol-Myers Squibb); Pfizer Inc., Johnson & Johnson; Novartis AG; Takeda Pharmaceutical Company Limited; Amgen Inc.; Gilead Sciences; F. Hoffmann-La Roche Ltd; Merck & Co., Inc.; AbbVie Inc.; AstraZeneca; Sanofi; Bayer AG; and Incyte Corporation. These companies are primarily involved in the development, production, and commercialization of treatments and diagnostics for BPDCN, with several focusing on innovative therapies like immunotherapy and targeted treatments.

The competitive landscape in the BPDCN market is characterized by intense research and development activities aimed at improving treatment outcomes and expanding therapeutic options. Companies like Stemline Therapeutics have pioneered the development of targeted therapies, such as tagraxofusp-erzs, which has become a critical treatment option. Meanwhile, major pharmaceutical firms like Pfizer, Johnson & Johnson, and Bristol-Myers Squibb continue to invest in novel therapeutic approaches and expand their oncology portfolios through strategic acquisitions and partnerships.

The competition is further intensified by the entry of emerging biopharmaceutical companies, which are driving innovation with new drug candidates and personalized treatment approaches. Established players are focusing on maintaining their market position by expanding their product pipelines, obtaining regulatory approvals in various regions, and enhancing patient access to advanced therapies. This competitive environment fosters continuous innovation, with companies vying to address the unmet medical needs in BPDCN treatment.

Stemline Therapeutics, now part of the Menarini Group, is a significant player in the BPDCN market, primarily known for developing tagraxofusp-erzs, the first FDA-approved treatment for BPDCN. Stemline's focus has been on developing targeted therapies for rare cancers, and its acquisition by Menarini in June 2020 has enhanced its capabilities in research and development.

Celgene Corporation, now under Bristol-Myers Squibb following its acquisition in November 2019, has been a key player in the oncology market, including BPDCN. The company has a strong portfolio of cancer therapies, and its integration into Bristol-Myers Squibb has allowed for broader research and development capabilities.

List of Key Companies in the Blastic Plasmacytoid Dendritic Cell Neoplasm Market

- Stemline Therapeutics (Menarini Group)

- ImmunoGen, Inc.

- Mustang Bio

- Genentech, Inc.

- Jazz Pharmaceuticals, Inc.

- Cellex Patient Treatment GmbH

- Xencor

- Resverlogix

- Celgene Corporation (Bristol-Myers Squibb)

- Pfizer Inc.

- Johnson & Johnson

- Novartis AG

- Takeda Pharmaceutical Company Limited

- Amgen Inc.

- Gilead Sciences

- F. Hoffmann-La Roche Ltd

- Merck & Co., Inc.

- AbbVie Inc.

- AstraZeneca

- Sanofi

- Bayer AG

- Incyte Corporation

BPDCN Industry Developments

- In July 2023, Menarini announced the expansion of clinical trials for tagraxofusp in combination with other therapies, aiming to enhance treatment outcomes for BPDCN patients.

- In June 2023, Bristol-Myers Squibb highlighted advancements in their hematology pipeline, including ongoing research into new treatments for BPDCN, reflecting their continued commitment to addressing this rare and challenging disease.

Blastic Plasmacytoid Dendritic Cell Neoplasm Market Segmentation

By Treatment Outlook

- Chemotherapy

- Immunotherapy

- Stem Cell Transplantation

By End Users Outlook

- Hospitals

- Specialty Clinics

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Blastic Plasmacytoid Dendritic Cell Neoplasm (BPDCN) Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 136.72 million |

|

Market Size Value in 2025 |

USD 146.85 million |

|

Revenue Forecast in 2034 |

USD 282.81 million |

|

CAGR |

7.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The blastic plasmacytoid dendritic cell neoplasm market size was valued at USD 136.72 million in 2024 and is projected to grow to USD 282.81 million by 2034.

The market is projected to register a CAGR of 7.6% from 2025 to 2034.

North America holds the largest share of the global market.

Key players actively participating in the BPDCN market include Stemline Therapeutics (now part of Menarini Group); Celgene Corporation (acquired by Bristol-Myers Squibb); Pfizer Inc.; Johnson & Johnson; Novartis AG; Takeda Pharmaceutical Company Limited; Amgen Inc.; Gilead Sciences; F. Hoffmann-La Roche Ltd; Merck & Co., Inc.; AbbVie Inc.; AstraZeneca; Sanofi; Bayer AG; and Incyte Corporation.

The immunotherapy segment accounts for the largest share of the BPDCN market.

The hospitals segment holds the largest share of the global market.