Bitterness Suppressors and Flavour Carriers Market Share, Size, Trends, Industry Analysis Report

By Category (Bitterness Suppressors and Flavor Carriers); By Form; By Flavor Type; By Application; By Region; Segment Forecast, 2023-2032

- Published Date:Jun-2023

- Pages: 118

- Format: PDF

- Report ID: PM3449

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

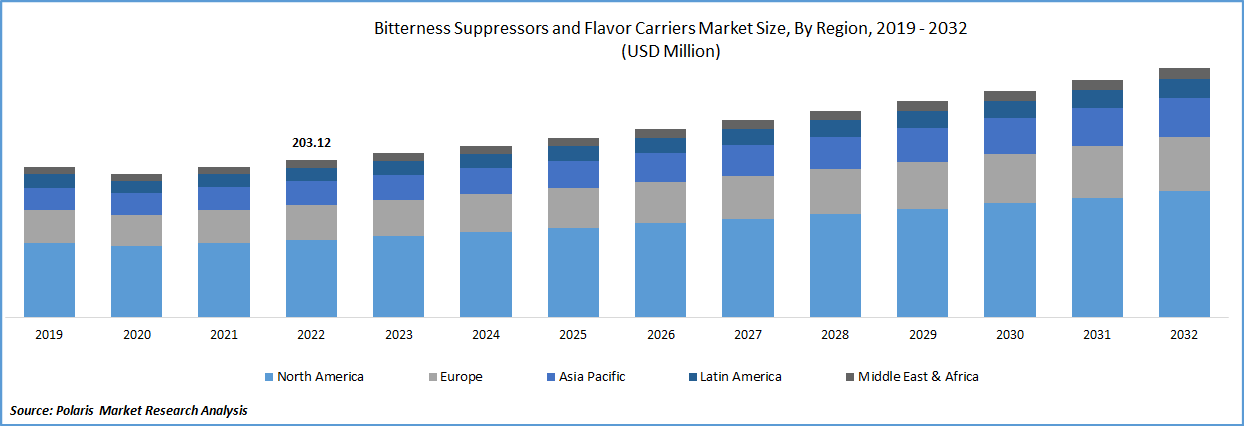

The global bitterness suppressors and flavour carriers’ market was valued at USD 203.12 million in 2022 and is expected to grow at a CAGR of 4.7% during the forecast period. The growing popularity of flavor carriers is enhancing the growth of the global market. Flavor carriers can also improve the bioavailability of certain ingredients, such as nutrients or drugs, by helping the body better absorb them. Several companies are contributing to innovations in the food flavor carrier market. For example, in January 2023, Walko Food Company established two new, unique flavors to its basket of delicious ice cream. Similarly, many other firms contribute to the market to improve their businesses. This has led to the development of new flavor carriers specifically designed to enhance the delivery of these ingredients. As a result, this factor is boosting the growth of the market.

To Understand More About this Research: Request a Free Sample Report

Bitterness suppressors and flavor carriers are crucial in the food and beverage industry. Bitterness suppressors mask the unpleasant and often overpowering bitterness that can be present in certain foods and beverages, such as coffee, tea, and some vegetables. This is important because bitterness can negatively impact the overall taste and enjoyment of the product. Using bitterness suppressors and flavor carriers can improve the quality and consistency of food and beverage products. By reducing bitterness and enhancing flavor, these ingredients can make products more appealing to consumers and increase their likelihood of repeat purchases.

The COVID-19 pandemic has had mixed impacts on the global market. COVID has disrupted the supply chain, causing delays and shortages in the production & delivery of ingredients. This has impacted the availability of products as well as their prices. COVID-19 has also led to changes in product demand, with some food and beverage categories experiencing a decline in sales while others have seen an increase. The pandemic has led to changes in consumer behavior, with more people cooking and eating at home. This has increased the demand for products with better flavor profiles and lower bitterness, leading to higher demand. COVID-19 has also affected research and development activities in the food and beverage industry, with some companies redirecting resources to address immediate challenges such as supply chain disruptions and changing consumer demand.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Surging demand for flavor carriers in the sports and nutrition industry is one of the prominent factors augmenting bitterness suppressors and flavour carriers’ market growth. To improve the taste and palatability of supplements and functional foods, flavor carriers are increasingly used in the sports industry. For instance, in October 2022, Warner Bros. Consumer Products and Vitamin Shoppe, an omnichannel specialty retailer of nutritional products, launched DC flavors by BodyTech, an exclusive range of protein, creatine, pre-workout, and other premium supplements. The use of flavor carriers can also enable innovation in the sports and nutrition industry, allowing manufacturers to develop new and unique products that appeal to consumers. Consequently, the escalating popularity of flavor carriers in the sports and nutrition industry will likely spur the global market.

The growing consumption of processed foods is another factor driving the growth of the global market. The growing global population has improved the demand for processed food. For example, approximately 70% of American diets involve processed foods. Fast food accounts for 10% of Americans' discretionary income. Whereas bitterness suppressors and flavor carriers are key ingredients in processed foods, helping to improve the taste and palatability of these products and meeting consumer demand for convenient, ready-to-eat foods. Therefore, this factor is fruitfully heightening market growth.

Report Segmentation

The market is primarily segmented based on category, form, flavor type, application, and region.

|

By Category |

By Form |

By Flavor Type |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Flavour carriers segment dominated the global market in 2022

In fiscal year 2022, the flavor carriers segment dominates the market due to its remarkable benefits, such as versatility, cost-effectiveness, and many other aspects. These are highly appealing to consumers, as they help to improve the taste and overall palatability of food and beverage products. Manufacturers can increase their market share by creating more enjoyable products and building stronger brand loyalty among consumers. Also, flavor carriers are highly versatile and can be used in various food and beverage products. They can be used to create a variety of flavors, ranging from sweet to savory, and can be tailored to meet specific consumer preferences.

Liquid segment is growing with the fastest CAGR during the forecast period

Based on the form outlook, the liquid segment is projected to grow at the fastest CAGR during the forecast period. This is attributed to the better stability and improved functionality of the products. Liquid bitterness suppressors and flavor carriers are easier to use than their solid counterparts. They can be easily mixed into products and are more evenly distributed, ensuring a consistent flavor throughout the development. They can be used in a wider range of products, including those with high water content or low pH levels, and can often deliver a more intense flavor profile.

As a result, the popularity of liquid types is driven by their ease of use, stability, improved functionality, customizability, and convenience. As manufacturers look for ways to enhance the taste and quality of their products, liquid bitterness suppressors and flavor carriers offer an attractive solution.

Natural segment held the largest market share in 2022

In 2022, the natural flavor type segment held the largest market share, as natural ingredients have become increasingly popular in the food and beverage industry in recent years. Consumers are more aware of the potential health benefits and often seek more natural and sustainable options for their food choices. Natural flavor carriers, such as fruit juices and extracts, can provide a more authentic and nuanced flavor profile than synthetic alternatives. Businesses also focus on natural flavors to tap into many populations and maintain health. For example, in June 2021, the advent of BOMBAY BRAMBLE, by the BOMBAY SAPPHIRE, the world's premier premium gin brand, heralds the beginning of a new era in flavored gins. As a result, the demand for natural flavor types has been increasing, and this trend is expected to continue in the coming years.

Food and beverage segment dominated the market in 2022

The food and beverage segment dominates the global market as it is one of the largest consumers. These ingredients are commonly used in food and beverage products to enhance flavor profiles. Bitterness suppressors are often used in products such as coffee, tea, and beer to reduce the bitterness and astringency of these beverages, making them more palatable to consumers. Similarly, flavor carriers are commonly used in various food and beverage products to enhance their natural flavors, improve texture, and extend shelf life. Bitterness suppressors and flavor carriers can help companies create unique and innovative products that appeal to consumers and set them apart from their competitors.

North America is accounting the largest share in the global market during projected period

North America is expected to account for the largest share in the fiscal year 2022. This is primarily due to the region's well-established food & beverage industry. The region is home to several large food and beverage companies and a thriving craft beer and spirits industry. For example, U.S. beer sales were risen by around 1% in 2021, while craft beer sales increased by 8%, bringing the volume share of small & independent brewers to nearly 13.1%. The craft beer and spirits industries are major consumers of these ingredients. As a result, this factor bolsters the market's growth in this region.

Asia Pacific is the fastest-growing region with a significant CAGR. As incomes rise in the region, consumers are becoming more health-conscious and demanding healthier food and beverage options. With busy lifestyles, consumers in the Asia Pacific region are increasingly turning to processed foods, which are convenient and easy to prepare. For instance, nearly 107 million metric tonnes of packaged food could be consumed in China. This enhances the demand for bitterness suppressors and flavor carriers in this region and further boosts the market's sales.

Competitive Insight

The global market players include Cargill, Incorporated, Dohler, Givaudan, International Flavors & Fragrances, Sensient Colors, Symrise, Firmenich, Kerry Group, and Senomyx,

Recent Developments

- In March 2023, the creators of America's beloved Original Ranch, Hidden Valley Ranch, released the brand-new pickle-flavored Hidden Valley Ranch. The delicious new taste, which is available at Walmart locations across the nation, mixes the creaminess of the Hidden Valley Ranch with the fresh, & zesty twist.

Bitterness Suppressors and Flavour Carriers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 212.44 million |

|

Revenue forecast in 2032 |

USD 322.30 million |

|

CAGR |

4.7% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2023– 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Category, By Form, By Flavor Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Cargill, Incorporated, Dohler, E.I. du Pont de Nemours and Company, Givaudan, International Flavors & Fragrances, Inc., Sensient Colors LLC, Symrise AG, Firmenich SA, Kerry Group plc, Senomyx, Inc., and others |

FAQ's

The bitterness suppressors and flavour carriers market report covering key segments are category, form, flavor type, application, and region.

Bitterness Suppressors and Flavor Carriers Market Size Worth $322.30 Million By 2032.

The global bitterness suppressors and flavour carriers’ market is expected to grow at a CAGR of 4.7% during the forecast period.

North America is leading the global market.

key driving factors in bitterness suppressors and flavour carriers’ market are surging demand for flavor carriers in the sports and nutrition industry.