Biotech Ingredients Market Size, Share, Trends, Industry Analysis Report: By Product (Flavors, Fragrances, and Active Cosmetic Ingredients), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5420

- Base Year: 2024

- Historical Data: 2020-2023

Biotech Ingredients Market Overview

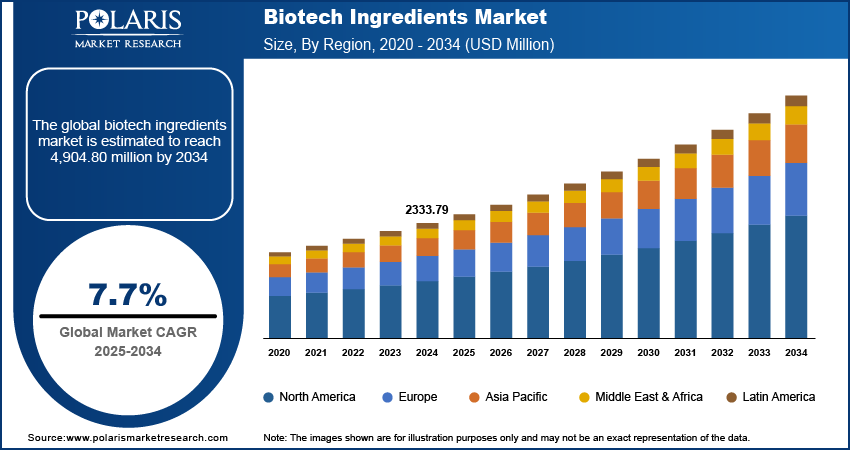

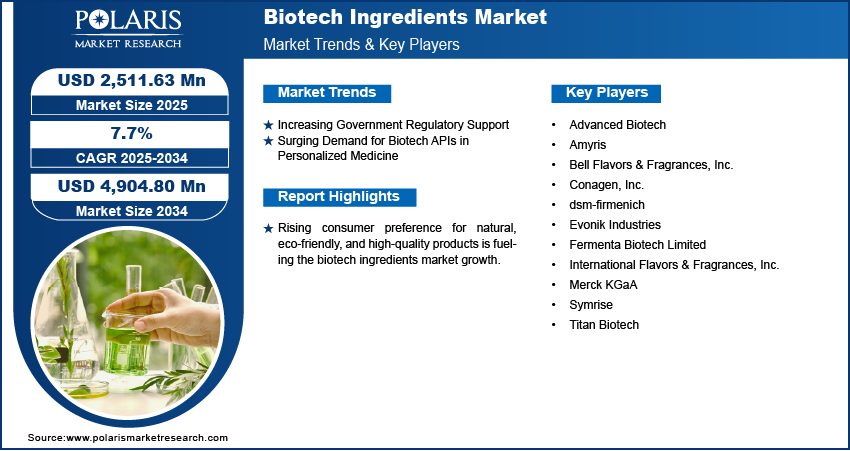

The global biotech ingredients market size was valued at USD 2,333.79 million in 2024 and is expected to reach USD 2,511.63 million by 2025 and USD 4,904.80 million by 2034, exhibiting a CAGR of 7.7% during 2025–2034.

The biotech ingredients market encompasses the production and utilization of biologically derived compounds, such as enzymes, peptides, and proteins, used in various industries, including pharmaceuticals, cosmetics, and food. These ingredients are manufactured through biotechnological processes, offering sustainable, high-quality, and innovative solutions that drive advancements in product formulations and applications.

To Understand More About this Research: Request a Free Sample Report

Rising demand for sustainable and bio-based ingredients across industries such as pharmaceuticals, cosmetics, and food is significantly propelling the biotech ingredients market development. Moreover, advancements in biotechnology, including fermentation and cell culture technologies, are driving cost-effective production, which is further driving the biotech ingredients market demand.

Rising consumer preference for natural, eco-friendly, and high-quality products is fueling the biotech ingredients market growth. Furthermore, the increasing shift from synthetic chemicals to biologically derived alternatives due to environmental concerns is propelling the market expansion.

Biotech Ingredients Market Dynamics

Increasing Government Regulatory Support

Governments worldwide are introducing regulations and incentives to encourage the adoption of bio-based products, recognizing their sustainability and reduced environmental impact. For instance, according to President Biden’s Executive Order 14081, “Advancing Biotechnology and Biomanufacturing Innovation for a Sustainable, Safe, and Secure American Bioeconomy,” the US EPA, FDA, and USDA are streamlining and updating their regulatory framework for biotechnological products to enhance clarity, efficiency, and safety in oversight. These policies encourage industries to shift from synthetic to biologically derived ingredients. Financial incentives, such as tax credits and grants, are accelerating research and development in biotechnology. Additionally, regulatory frameworks supporting bio-based production provide a favorable environment for biotech ingredients market growth, helping manufacturers meet environmental standards and meet the rising demand for eco-friendly products.

Surging Demand for Biotech APIs in Personalized Medicine

The rising focus on personalized medicine is driving demand for biotech-derived active pharmaceutical ingredients (APIs), as these tailored therapies often rely on biologically sourced compounds. Biotech APIs, such as peptides, proteins, and monoclonal antibodies, are integral to creating precision treatments that address specific patient needs. Advances in biotechnology are enabling scalable production of these APIs with high efficacy and safety profiles. This trend supports innovation in drug development and significantly contributes to the biotech ingredients market expansion.

Biotech Ingredients Market Segment Insights

Biotech Ingredients Market Assessment by Product Outlook

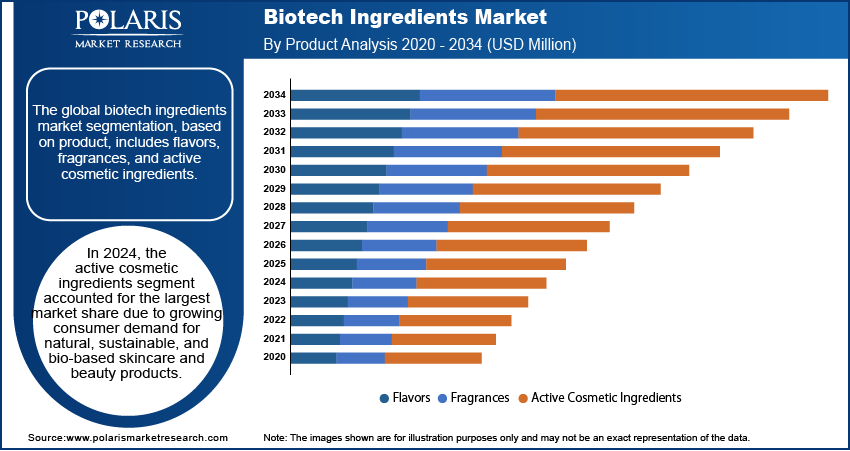

The global biotech ingredients market segmentation, based on product, includes flavors, fragrances, and active cosmetic ingredients. In 2024, the active cosmetic ingredients segment accounted for the largest share of the biotech ingredients market revenue due to growing consumer demand for natural, sustainable, and bio-based skincare and beauty products. Biotech-derived active ingredients, such as peptides, hyaluronic acid, and antioxidants, are favored for their efficacy and eco-friendliness, aligning with the trend toward clean beauty. Technological advancements in biotechnology have enabled the production of high-quality, customizable ingredients that meet the specific needs of cosmetic formulations. These factors boost the adoption of biotech ingredients in the cosmetics industry, fueling the active cosmetic ingredients segment growth.

Biotech Ingredients Market Evaluation by Application Outlook

The global biotech ingredients market segmentation, based on application, includes pharmaceuticals, food and beverages, cosmetics, and others. The pharmaceuticals segment is expected to witness significant growth during the forecast period due to increasing demand for biologically derived active pharmaceutical ingredients (APIs) used in advanced drug formulations. The rising prevalence of chronic diseases, coupled with the expansion of biopharmaceutical research, is driving the adoption of biotech ingredients in drug manufacturing. Additionally, advancements in biotechnology have enabled the production of high-purity, customizable APIs that provide precision medicine and targeted therapies, further boosting the biotech ingredients market demand in the pharmaceutical sector.

Biotech Ingredients Market Regional Analysis

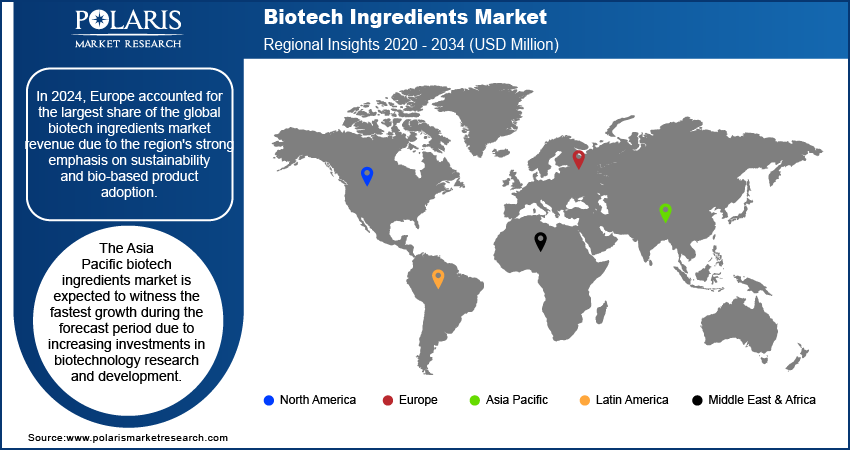

By region, the study provides biotech ingredients market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Europe dominated the global biotech ingredients market share due to the region's strong emphasis on sustainability and bio-based product adoption. Robust government support through incentives and stringent regulations promoting eco-friendly production accelerated the adoption of biotech ingredients across industries such as pharmaceuticals, cosmetics, and food. For instance, in March 2024, the European Commission proposed targeted measures to enhance biotechnology and biomanufacturing in the EU. The Communication titled “Building the Future with Nature” traces the existing challenges and obstacles, proposing targeted solutions in alignment with the overarching Communication regarding the long-term competitiveness of the EU. Additionally, the presence of advanced biotechnology research facilities and leading market players and increasing demand for natural and bio-derived ingredients contributed significantly to Europe’s market dominance.

The Asia Pacific biotech ingredients market is expected to witness the fastest growth during the forecast period due to increasing investments in biotechnology research and development; rising demand for bio-based products in pharmaceuticals, cosmetics, and food industries; and supportive government policies promoting sustainable production. In India, the Union Budget 2025–26 presents key growth opportunities for the biotechnology sector, highlighted by the Department of Biotechnology's initiatives. The Biotechnology Innovation Fund of Funds Accelerating Entrepreneurs (AcE) has attracted over USD 138.36 million in investments for biotech startups and SMEs. Moreover, to strengthen the "Make in India" initiative, a National Manufacturing Mission will be established, encompassing various industries. Additionally, the Union Cabinet has approved the BioE3 policy, which aims to enhance high-performance biomanufacturing and support R&D and entrepreneurship in the biotech field. The region’s expanding population, coupled with growing consumer awareness of natural and environmentally friendly products, further drives the biotech ingredients market demand in the region. Additionally, the presence of emerging economies, such as China and India, with strong industrial growth and innovation in biotechnology, contributes to the region's rapid market expansion.

Biotech Ingredients Market – Key Players & Competitive Analysis Report

The competitive landscape of the biotech ingredients market is highly dynamic, featuring a mix of established multinational companies and emerging startups. Key players are focusing on expanding their portfolios by introducing innovative and sustainable biotech-derived ingredients. Strategic collaborations, acquisitions, and investments in research and development are central to gaining a competitive edge. Companies also face increasing pressure to adhere to stringent regulatory requirements, prompting them to invest in compliance and product quality. The competition is intensifying as firms strive to meet the growing demand for natural and bio-based solutions across diverse industries. Moreover, in North America, established players focus on research and development, while in Europe, stringent regulations drive innovation in sustainable products. Asia Pacific, with its rapidly growing demand for natural products, promotes a competitive environment, particularly in emerging markets such as China and India. Companies in these regions are investing in local partnerships and enhancing their supply chains to strengthen market presence, focusing on the expansion of biotech applications in pharmaceuticals, food, and cosmetics.

Merck KGaA, or the Merck Group, is a German multinational pharmaceutical, chemical, and life sciences company developing, manufacturing, and marketing biotech pharmaceutical, and specialty chemical products for global consumption. The company was founded in 1668 and is headquartered in Darmstadt, Germany. It is a global company operating across over 90 countries. Merck KGaA operates in three business segments: healthcare, life science, and performance materials. The life science segment provides products and services for the biopharmaceutical industry, including tools for genomic research, cell culture products, and bio-processing equipment. The performance materials segment offers specialty chemicals and materials used in various industries, such as electronics, coatings, and printing.

Evonik Industries specializes in the production of high-performance specialty chemicals across global regions, including Asia Pacific, Europe, the Middle East, Africa, Central and South America, and North America. The company's operations are segmented into five key areas—specialty additives, nutrition & care, smart materials, performance materials, and technology & infrastructure. The company was founded in 2007 and is headquartered in North Rhine-Westphalia, Germany. Evonik Industries is actively involved in the biotech ingredients market, focusing on the development and production of innovative, sustainable bio-based solutions. The company is also engaged in biotechnology and provides high-quality ingredients across various industries such as pharmaceuticals, food, and cosmetics, contributing to the growing demand for sustainable products.

List of Key Companies in Biotech Ingredients Market

- Advanced Biotech

- Amyris

- Bell Flavors & Fragrances, Inc.

- Conagen, Inc.

- dsm-firmenich

- Evonik Industries

- Fermenta Biotech Limited

- International Flavors & Fragrances, Inc.

- Merck KGaA

- Symrise

- Titan Biotech

Biotech Ingredients Industry Developments

In April 2024, Bloomage Biotech launched its second-generation ingredient, UltraHA J, an advanced sodium hyaluronate designed for joint repair. Clinical validation shows significant improvement in joint discomfort symptoms in healthy individuals.

In February 2024, Evonik partnered with Jland Biotech to commercialize a plant-based collagen solution for cosmetic formulations. This collaboration focuses on using innovative biotechnological processes to create sustainable vegan collagen that enhances skin health and appearance.

In January 2022, Conagen developed antioxidant kaempferol using advanced precision fermentation. This innovation allows brands in nutrition, beauty, and personal care to incorporate clean, sustainable kaempferol into their products, aligning with the growing demand for natural ingredients and sustainability in the market.

Biotech Ingredients Market Segmentation

By Product Outlook (Revenue USD Million 2020–2034)

- Flavors

- Fragrances

- Fine Fragrances

- Toiletries

- Active Cosmetic Ingredients

By Application Outlook (Revenue USD Million 2020–2034)

- Pharmaceuticals

- Food and Beverages

- Cosmetics

- Others

By Regional Outlook (Revenue USD Million 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Biotech Ingredients Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,333.79 million |

|

Market Size Value in 2025 |

USD 2,511.63 million |

|

Revenue Forecast by 2034 |

USD 4,904.80 million |

|

CAGR |

7.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global biotech ingredients market size was valued at USD 2,333.79 million in 2024 and is projected to grow to USD 4,904.80 million by 2034.

The global market is projected to register a CAGR of 7.7% during the forecast period.

In 2024, Europe accounted for the largest market share due to the region's strong emphasis on sustainability and bio-based product adoption.

A few of the key players in the market are Fermenta Biotech Limited; Titan Biotech; Conagen, Inc.; Advanced Biotech; Bell Flavors & Fragrances, Inc.; Merck KGaA; International Flavors & Fragrances, Inc.; Amyris; dsm-firmenich; Symrise; and Evonik Industries.

In 2024, the active cosmetic ingredients segment accounted for the largest market share due to growing consumer demand for natural, sustainable, and bio-based skincare and beauty products.

The pharmaceuticals segment is expected to witness significant growth during the forecast period due to increasing demand for biologically derived APIs used in advanced drug formulations.