Biorational Market Size, Share, Trends, Industry Analysis Report

: By Product Type, Source Type, Crop Type, End User (Foliar Spray, Soil Treatment, and Seed Treatment), Organization Size, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM2978

- Base Year: 2024

- Historical Data: 2020-2023

Biorational Market Overview

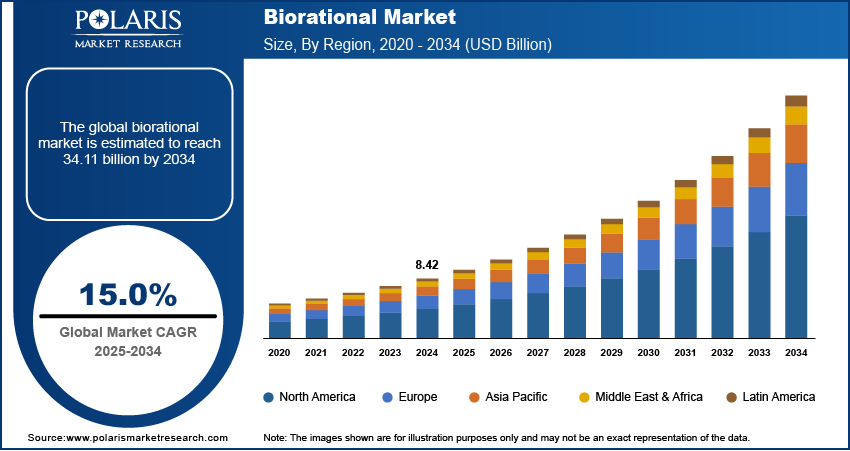

The global biorational market was valued at USD 8.42 billion in 2024. It is expected to grow from USD 9.66 billion in 2025 to USD 34.11 billion by 2034, at a CAGR of 15.0% from 2025 to 2034.

Biorationals are low-toxicity insecticides and pesticides created to disrupt the normal lifecycle of various insects and pests. They are used to break the cycle of infestation while keeping beneficial bacteria and insects in the soil and on plant leaves.

The global biorational market demand is rapidly growing within the agricultural sector, focusing on environmentally friendly and sustainable solutions for pest control and crop protection. Biorational products, including biopesticides, plant growth regulators, and beneficial insects, are designed to target specific pests or enhance crop resilience without causing harm to non-target species or the environment. These products are primarily derived from natural or biological sources, making them an essential component of integrated pest management (IPM) practices. This growth is actively supported by government initiatives. For instance, the European Parliament's November 2022 report highlighted that the EU aims for a 50% reduction in chemical pesticide use by 2030 through the Sustainable Use of Plant Protection Products Regulation, promoting biorational alternatives with financial incentives for farmers.

To Understand More About this Research: Request a Free Sample Report

The increasing emphasis on sustainable agricultural practices to fight the adverse effects of chemical pesticides on ecosystems is another key factor driving the biorational market growth. The adoption of biorational solutions has gained significant traction with rising consumer demand for organic food and stringent government regulations on synthetic pesticides. Furthermore, advancements in biotechnology and research into microbial formulations continue to support the development and commercialization of innovative biorational products.

Biorational Market Dynamics

Rising Organic Farming Practices

Farmers are adopting sustainable and environmentally safe crop protection methods with the increasing consumer preference for organic production. Biorational products, known for their low toxicity and minimal environmental impact, align well with organic farming requirements. The reduced environmental footprint of biorational products ensures compliance with strict regulations, such as the EU’s ban on several chemical pesticides. Additionally, their ability to improve soil health while targeting specific pests makes biorational indispensable in sustainable agriculture. Moreover, government initiatives to promote organic farming through subsidies and certification programs have boosted the demand for biorationals. For instance, a February 2022 report by India’s Ministry of Agriculture and Farmers Welfare noted that farmers now get support under Paramparagat Krishi Vikas Yojana (PKVY) and Mission Organic Value Chain Development for North Eastern Region (MOVCDNER) schemes, offering USD 360.84 and USD 378.30 per hectare for three years for organic inputs and FPO formation. Similarly, the Bhartiya Prakritik Krishi Paddhati (BPKP) scheme provides USD 41.22 per hectare for cluster formation and capacity building. Thus, the rise in organic farming practices globally has been a major driver of the biorational market development.

Integration of Biotechnology in Biorational Solutions

Advanced research has enabled the formulation of microbial-based biorational solutions, such as Bacillus thuringiensis (Bt)-based biopesticides, which offer high efficacy against pests while preserving beneficial organisms. Innovations in genetic engineering are also driving the creation of customized solutions tailored to regional pest challenges. Furthermore, precision agriculture technologies are leveraging data-driven insights to optimize biorational application, reducing wastage and maximizing efficiency. For instance, in July 2024, the Indian Ministry of Agriculture and Farmers Welfare promoted precision agriculture to boost crop yields. This method uses GPS technology, sensors, and drones to gather data on soil, moisture, and crop health, allowing for more efficient use of fertilizers and pesticides. The ministry also emphasized integrating biopesticides in pest management to reduce chemical pesticide reliance and support sustainable farming practices. These trends highlight a shift towards technology-driven solutions, ensuring a more sustainable and productive agricultural landscape while boosting the biorational market revenue.

Biorational Market Segment Insights

Biorational Market Assessment by Source Type Outlook

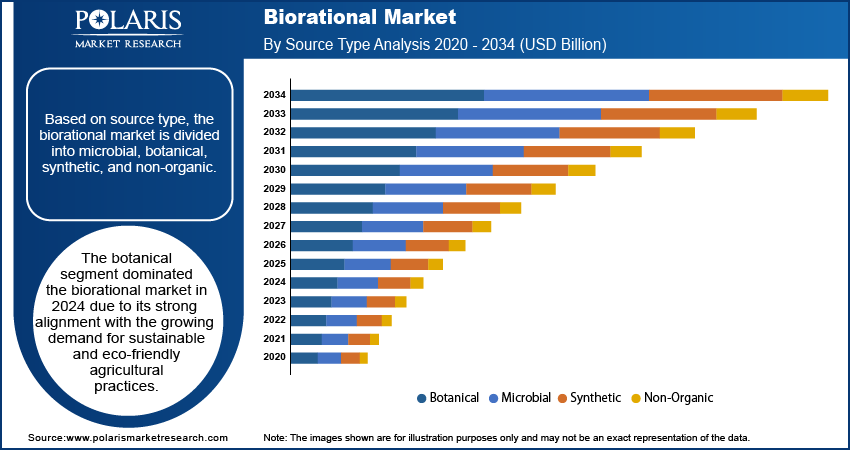

The global biorational market segmentation, based on source type, includes microbial, botanical, synthetic, and non-organic. The botanical segment dominated the market in 2024 due to its strong alignment with the growing demand for sustainable and eco-friendly agricultural practices. Botanical biorationals, derived from plant-based sources, offer natural pest control with minimal environmental impact, making them highly suitable for organic farming. Their biodegradability and ability to target specific pests while preserving beneficial organisms further enhance their appeal. Additionally, advancements in extraction and formulation technologies have improved the effectiveness and shelf life of botanical products, driving their adoption. Increasing regulatory restrictions on synthetic pesticides and the rising preference for residue-free produce have further solidified the segment's market leadership, particularly in regions emphasizing sustainable agriculture.

Biorational Market Evaluation by Crop Type Outlook

The global biorational market segmentation, based on crop type, includes fruits & vegetables, cereals & grains, oil seeds & pulses, and other crop types. The fruits & vegetables segment is expected to witness the fastest growth during the forecast period due to the high sensitivity of these crops to pest infestations and diseases. The demand for residue-free produce, driven by increasing consumer preference for organic and healthier food options, has encouraged the adoption of biorational solutions. Fruits and vegetables often require frequent pest control measures, making eco-friendly and targeted biorationals an ideal choice. Additionally, stringent regulations on pesticide residues in export markets have accelerated their use in this segment. This segment's growth is particularly prominent in regions with advanced agricultural practices.

Biorational Market Regional Analysis

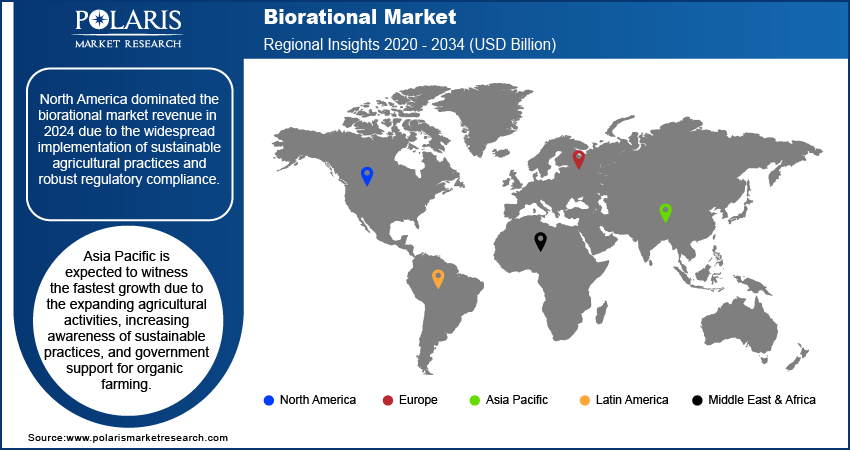

By region, the report provides biorational market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the biorational market revenue in 2024 due to the widespread implementation of sustainable agricultural practices and robust regulatory compliance. The US is at the forefront within this region, supported by refined agricultural infrastructure and investments in R&D. For instance, in September 2024, the US Department of Agriculture (USDA) announced an investment of nearly USD 121 million to advance research and extension activities aimed at addressing key challenges faced by specialty crop and organic agriculture producers. Government initiatives, particularly those from the USDA aimed at promoting environmentally friendly pesticide alternatives, alongside the presence of key industry stakeholders, have strengthened the region's preeminence in the biorational market landscape.

The Asia Pacific biorational market is expected to witness the fastest growth during the forecast period due to the expanding agricultural activities, increasing awareness of sustainable practices, and government support for organic farming. For instance, a report by the Ministry of Agriculture and Farmers Welfare in January 2025 highlighted that USD 14.16 billion was allocated for various schemes and programs aimed at the welfare of farmers during 2024–2025. India, a leading country in the region, stands out due to its growing organic farming sector and significant investments in biotechnology for agriculture. The Indian government’s subsidies for eco-friendly pesticides and research programs underscore the region's potential for market expansion.

Biorational Market – Key Players and Competitive Insights

Major market players are investing heavily in research and development in order to expand their offerings, which will help the biorational market grow even more. The leading players dominate the market by leveraging their extensive product portfolios, strong distribution networks, and continuous investment in R&D. Companies such as Bayer AG and Syngenta AG excel through their global reach and innovative biopesticide solutions. Smaller players, such as Marrone Bio Innovations, focus on niche markets and advanced microbial formulations, ensuring competitiveness. Collaboration and partnerships among key players drive market consolidation and expansion. The intense focus on sustainable agriculture reinforces their position as industry leaders.

BASF SE is a global chemical corporation with seven distinct business segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. Advanced materials and their precursors for applications such as polyamides and isocyanates are available through the Materials section, inorganic basic products and specialties for the plastic and plastic processing industries. The industrial solutions sector deals with the development and sale of various ingredients and additives such as polymer dispersions, resins, electronic materials, pigments, light stabilizers, antioxidants, mineral processing, oilfield chemicals, and hydrometallurgical chemicals. On the other hand, Surface Technologies provides chemical solutions and automotive OEM services to the automotive and chemical sectors. This includes surface treatment, battery materials, refinishing coatings, catalysts, and base metal services. BASF SE offers biorational solutions, including biopesticides, biostimulants, and pheromones, enhancing crop protection and yield sustainability. Its innovations support integrated pest management, soil health, and environmentally friendly agricultural practices.

Bayer AG is a multinational conglomerate with core competencies in Life Sciences, encompassing healthcare and agriculture. The company has evolved into a global powerhouse with a diverse portfolio of products and solutions to improve lives and address some of the world's most pressing challenges. Bayer is advancing medical science and enhancing patient well-being in the healthcare sector. In September 2023, Bayer invested approximately USD 236 million to establish a new research and development facility in Germany aimed at advancing sustainable crop protection products and supporting regenerative agriculture efforts. Bayer AG provides biorational solutions, including biopesticides, biostimulants, and biological seed treatments, supporting sustainable agriculture with enhanced pest control, soil health, and crop resilience through environmentally friendly and innovative technologies.

List of Key Companies in Biorational Market

- Bayer AG

- Syngenta AG

- BASF SE

- Marrone Bio Innovations

- Valent BioSciences

- Koppert Biological Systems

- Certis USA

- Andermatt Biocontrol

- Isagro S.p.A.

- Stockton Group

- Gowan Company

- BioWorks, Inc.

- Sumitomo Chemical

- FMC Corporation

- Novozymes A/S

Biorational Industry Developments

April 2024: Bayer received a license from AlphaBio Control for a new biological insecticide for arable crops. The company stated that the new insecticide is set to launch in 2028.

October 2022: Valent BioSciences LLC, a global leader in biorational products for agriculture, public health, and forest health, announced that it had begun selling its biostimulant products directly to the US customer base.

July 2021: Sumitomo Chemical, a Japan-based chemical company, received US regulatory approval for the registration of its new plant growth regulator (PGR) Accede, which is a biorational product designed to improve fruit quality for peaches and apples.

Biorational Market Segmentation

By Product Type Outlook (Revenue – USD Billion, 2020–2034)

- Biopesticides

- Plant Growth Regulators

- Beneficial Insects

By Source Type Outlook (Revenue – USD Billion, 2020–2034)

- Microbial

- Botanical

- Synthetic

- Non-Organic

By Crop Type Outlook (Revenue – USD Billion, 2020–2034)

- Fruits & Vegetables

- Cereals & Grains

- Oil Seeds & Pulses

- Other Crop Types

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Foliar Spray

- Soil Treatment

- Seed Treatment

By Organization Size Outlook (Revenue – USD Billion, 2020–2034)

- Large Enterprise

- Small & Medium Enterprise

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Biorational Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 8.42 billion |

|

Market Size Value in 2025 |

USD 9.66 billion |

|

Revenue Forecast by 2034 |

USD 34.11 billion |

|

CAGR |

15.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global biorational market size was valued at USD 8.42 billion in 2024 and is projected to grow to USD 34.11 billion by 2034.

• The global market is projected to register a CAGR of 15.0% during the forecast period.

• North America dominated the biorational market revenue in 2024.

• Some of the key players in the market are Bayer AG; Syngenta AG; BASF SE; Marrone Bio Innovations; Valent BioSciences; Koppert Biological Systems; Certis USA; Andermatt Biocontrol; Isagro S.p.A.; and Stockton Group.

• The botanical segment dominated the market in 2024.