Bioprocess Validation Market Size, Share, Trends, Industry Analysis Report

: By Test Type (Extractables/Leachables Testing Services, Microbiological Testing Services, Physiochemical Testing Services, Integrity Testing Services, Compatibility Testing Services, and Others), Process Component, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 116

- Format: pdf

- Report ID: PM3013

- Base Year: 2024

- Historical Data: 2020-2023

Bioprocess Validation Market Overview

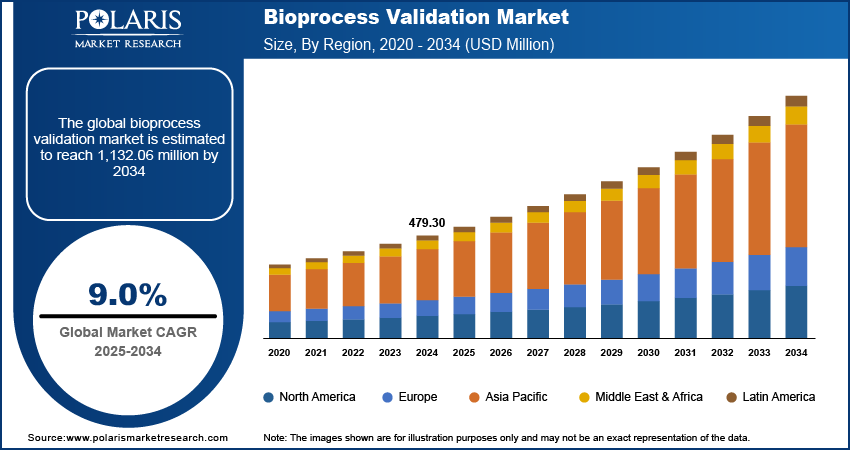

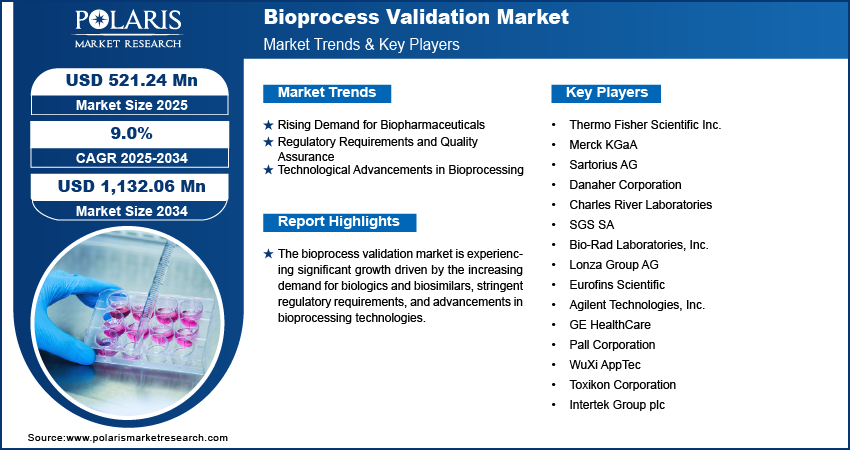

The bioprocess validation market size was valued at USD 479.30 million in 2024. The market is projected to grow from USD 521.24 million in 2025 to USD 1,132.06 million by 2034, exhibiting a CAGR of 9.0% during 2025–2034.

The bioprocess validation market refers to the industry focused on ensuring that biopharmaceutical manufacturing processes consistently produce products meeting predefined quality standards. This market is driven by the increasing demand for biopharmaceuticals, including vaccines and monoclonal antibodies, which require stringent validation processes to comply with regulatory requirements. Key drivers include advancements in bioprocessing technologies, regulatory mandates for quality assurance, and the growth of the biologics sector. Notable bioprocess validation market trends include the adoption of single-use technologies, automation in validation processes, and the integration of advanced analytical tools to enhance process efficiency and compliance.

To Understand More About this Research: Request a Free Sample Report

Bioprocess Validation Market Dynamics

Rising Demand for Biopharmaceuticals

The growing demand for biopharmaceuticals, including monoclonal antibodies, vaccines, and recombinant proteins, is a significant bioprocess validation market driver. The biopharmaceutical industry is expanding rapidly due to the increasing prevalence of chronic diseases and the need for innovative therapeutic solutions. According to the World Health Organization (WHO), chronic diseases such as cancer and diabetes account for approximately 71% of all deaths globally, leading to increased investment in biopharmaceutical research and development. This surge in demand necessitates rigorous validation processes to ensure the safety, efficacy, and quality of biopharmaceutical products, thereby driving the market.

Regulatory Requirements and Quality Assurance

Stringent regulatory requirements imposed by agencies such as the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are driving the bioprocess validation market growth. Regulatory bodies mandate thorough validation of bioprocesses to ensure compliance with Good Manufacturing Practices (GMP). Failure to comply can result in product recalls, fines, and loss of market authorization. The FDA's emphasis on process validation, as outlined in its guidance document, underscores the importance of continuous monitoring and quality assurance throughout the product lifecycle. This regulatory landscape compels biopharmaceutical companies to invest in comprehensive validation processes, fueling market growth.

Technological Advancements in Bioprocessing

Advancements in bioprocessing technologies, such as single-use systems, automation, and advanced analytical tools, are significantly impacting the bioprocess validation market expansion. Single-use technologies reduce the risk of cross-contamination, improve process efficiency, and lower operational costs, making them increasingly popular in biopharmaceutical manufacturing. Automation and real-time monitoring tools enhance process control and data accuracy, facilitating more effective validation processes. The adoption of process analytical technology (PAT) frameworks, as encouraged by regulatory agencies, further supports this trend by promoting better process understanding and control. These technological advancements are driving the market by enabling more efficient and reliable bioprocess validation.

Bioprocess Validation Market Segment Insights

Bioprocess Validation Market Assessment by Test Type

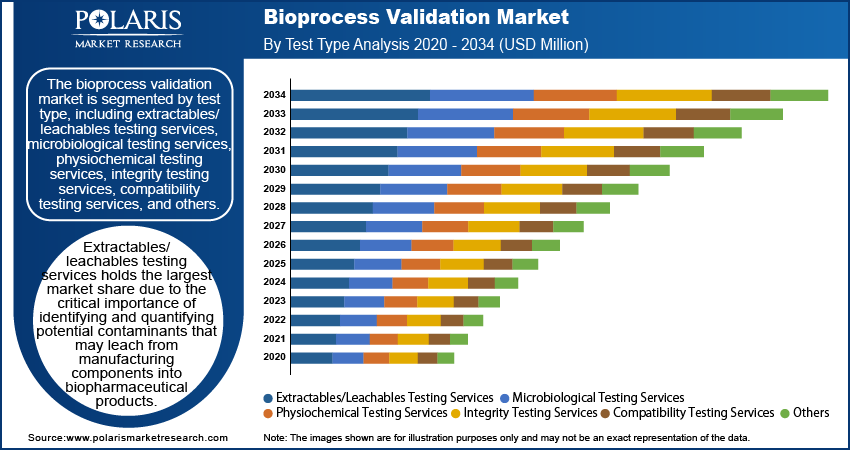

The bioprocess validation market is segmented by test type, including extractables/leachable testing services, microbiological testing services, physiochemical testing services, integrity testing services, compatibility testing services, and others. Among these, extractables/leachable testing services holds the largest market share due to the critical importance of identifying and quantifying potential contaminants that may leach from manufacturing components into biopharmaceutical products. This testing is essential for ensuring product safety and regulatory compliance, particularly in the production of complex biologics and parenteral products, which are highly sensitive to contamination.

Microbiological testing services segment is also expected to register the fastest growth within the market. This growth is driven by the increasing demand for stringent microbial control in biopharmaceutical manufacturing processes to prevent contamination and ensure product sterility. With the rising production of biologics and the implementation of more rigorous regulatory standards, the need for comprehensive microbiological testing, including sterility, bioburden, and endotoxin testing, has significantly increased. The emphasis on maintaining high-quality standards in biomanufacturing processes continues to boost the demand for advanced microbiological testing services.

Bioprocess Validation Market Evaluation by Process Component

The bioprocess validation market segmentation, based on process components, includes filter elements, media containers & bags, freezing & thawing process bags, mixing systems, bioreactors, and others. Filter elements hold the largest market share, driven by their essential role in ensuring the purity and sterility of biopharmaceutical products. Filtration is a critical step in bioprocessing, utilized to remove impurities, particulates, and microbial contaminants. The growing production of biologics and the emphasis on contamination control have led to increased demand for high-performance filter elements, making this segment a dominant force in the market.

Bioreactors are also registering the fastest growth within the market, fueled by advancements in bioprocessing technologies and the rising adoption of single-use bioreactors. These systems offer significant advantages, including reduced risk of cross-contamination, scalability, and operational flexibility, making them increasingly popular in biopharmaceutical manufacturing. The growth of the biologics sector, coupled with the need for efficient and scalable production systems, is driving the demand for bioreactors. Additionally, ongoing innovations in bioreactor design and automation are further propelling the growth of this segment.

Bioprocess Validation Market Assessment by End User

The bioprocess validation market is segmented by end user into pharmaceutical companies, contract development & manufacturing organizations (CDMOs), biotechnology companies, and others. Pharmaceutical companies hold the largest bioprocess validation market share, primarily due to their extensive involvement in biopharmaceutical production and the necessity to comply with stringent regulatory standards. These companies invest heavily in bioprocess validation to ensure product quality, safety, and regulatory compliance. The growing pipeline of biologics and biosimilars further drives the demand for validation services within this segment.

Contract development & manufacturing organizations (CDMOs) are registering the fastest growth in the market. The increasing trend of outsourcing biopharmaceutical production to CDMOs for cost efficiency and scalability is a key factor contributing to this growth. CDMOs offer specialized expertise and infrastructure for bioprocess validation, catering to the needs of both large pharmaceutical firms and smaller biotech companies. The rising demand for flexible and efficient manufacturing solutions, coupled with the expansion of the biologics sector, is fueling the growth of the CDMO segment in the bioprocess validation market.

Bioprocess Validation Market Regional Insights

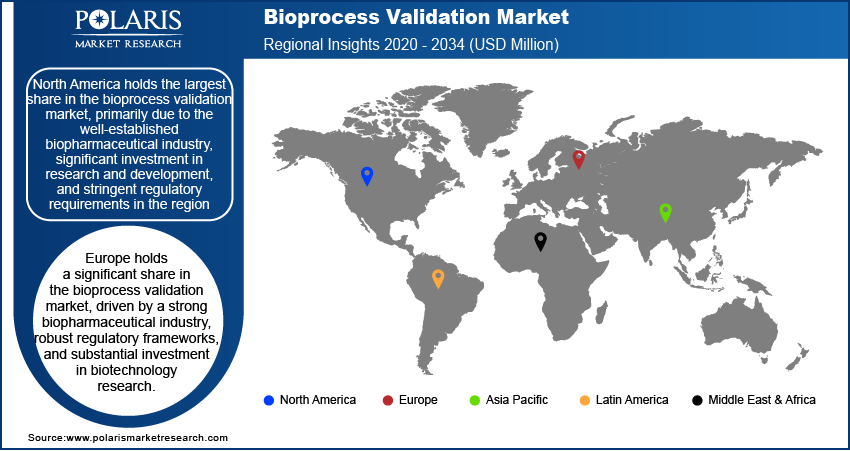

By region, the study provides bioprocess validation market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, primarily due to the well-established biopharmaceutical industry, significant investment in research and development, and stringent regulatory requirements in the region. The presence of major pharmaceutical and biotechnology companies, coupled with advanced healthcare infrastructure, drives the demand for comprehensive bioprocess validation services. Additionally, the increasing prevalence of chronic diseases and the growing production of biologics and biosimilars contribute to the market's dominance in North America. The region's focus on innovation and adherence to regulatory standards further solidifies its leading position in the global market.

Europe holds a significant bioprocess validation market share, driven by a strong biopharmaceutical industry, robust regulatory frameworks, and substantial investment in biotechnology research. Countries such as Germany, the UK, and Switzerland are key contributors to the market, with well-established biomanufacturing capabilities and a focus on compliance with stringent European Medicines Agency (EMA) regulations. The region's emphasis on innovation and the growing production of biosimilars further boost the demand for bioprocess validation services.

The bioprocess validation market in Asia Pacific is experiencing the fastest growth, fueled by the rapid expansion of the biopharmaceutical industry, increasing investments in biotechnology, and supportive government initiatives. Countries including China, India, and South Korea are emerging as key players due to their growing manufacturing capabilities, lower production costs, and a rising number of contract manufacturing organizations (CMOs). The increasing prevalence of chronic diseases and a growing focus on regulatory compliance are also driving the demand for bioprocess validation services in this region.

Bioprocess Validation Market Key Players and Competitive Insights

Key players in the bioprocess validation market include major companies such as Thermo Fisher Scientific Inc., Merck KGaA, Sartorius AG, Danaher Corporation, and Charles River Laboratories. Other notable participants are SGS SA, Bio-Rad Laboratories, Inc.; Lonza Group AG; Eurofins Scientific; and Agilent Technologies, Inc. Additionally, companies such as GE HealthCare (formerly part of General Electric), Pall Corporation (a subsidiary of Danaher Corporation), WuXi AppTec, Toxikon Corporation, and Intertek Group plc are actively involved in providing bioprocess validation services.

The competitive landscape of the bioprocess validation industry is shaped by the diverse offerings and strategic focus of these companies. Many of these key players are investing in advanced technologies and expanding their service portfolios to cater to the growing demand for comprehensive validation solutions. The market is characterized by a mix of global conglomerates with extensive capabilities and specialized service providers offering niche solutions, which fosters a competitive environment.

Insights into the competitive dynamics reveal that companies are focusing on collaborations, acquisitions, and expanding their global footprint to strengthen their market position. Innovation in bioprocessing technologies, compliance with regulatory standards, and the ability to offer integrated validation services are crucial factors that differentiate key players in this market. The emphasis on quality assurance, coupled with the evolving regulatory landscape, continues to drive competition and advancements within the bioprocess validation market.

Thermo Fisher Scientific Inc. is a prominent company in the bioprocess validation market, known for its comprehensive portfolio of products and services catering to biopharmaceutical manufacturing. The company provides extensive validation services, including extractable and leachables testing, microbiological testing, and process validation support. Merck KGaA operates through its Life Science segment, offering a wide range of solutions for bioprocess validation, including filtration systems, process monitoring tools, and quality control services. The company is actively involved in advancing bioprocessing technologies to improve efficiency and compliance.

List of Key Companies in Bioprocess Validation Market

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Sartorius AG

- Danaher Corporation

- Charles River Laboratories

- SGS SA

- Bio-Rad Laboratories, Inc.

- Lonza Group AG

- Eurofins Scientific

- Agilent Technologies, Inc.

- GE HealthCare

- Pall Corporation (subsidiary of Danaher Corporation)

- WuXi AppTec

- Toxikon Corporation

- Intertek Group plc

Bioprocess Validation Market Developments

- November 2024: Merck KGaA announced the launch of a new advanced single-use bioreactor system designed to optimize biopharmaceutical production demonstrating its commitment to innovation in the bioprocessing field.

- September 2024: Thermo Fisher expanded its capabilities by opening a new bioprocessing facility in North Carolina. This move aimed at enhancing its production capacity and meeting the increasing demand for biologics.

Bioprocess Validation Market Segmentation

By Test Type Outlook (Revenue-USD Million, 2020–2034)

- Extractables/Leachables Testing Services

- Microbiological Testing Services

- Physiochemical Testing Services

- Integrity Testing Services

- Compatibility Testing Services

- Others

By Process Component Outlook (Revenue-USD Million, 2020–2034)

- Filter Elements

- Media Containers and Bags

- Freezing & Thawing Process Bags

- Mixing Systems

- Bioreactors

- Others

By End User Outlook (Revenue-USD Million, 2020–2034)

- Pharmaceutical Companies

- Contract Development & Manufacturing Organizations (CDMOs)

- Biotechnology Companies

- Others

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Bioprocess Validation Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 479.30 million |

|

Market Size Value in 2025 |

USD 521.24 million |

|

Revenue Forecast by 2034 |

USD 1,132.06 million |

|

CAGR |

9.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The bioprocess validation market has been segmented into detailed segments of test type, process component, and end user. Moreover, the study provides the reader with a detailed understanding of the different segments at both the and regional levels.

Growth/Marketing Strategy

The growth strategy in the bioprocess validation market is driven by continuous innovation, expanding service offerings, and strategic partnerships. Key players are focusing on enhancing their technological capabilities through investments in automation, single-use systems, and real-time monitoring tools to improve process efficiency and reduce costs. Companies are also forming collaborations with biopharmaceutical manufacturers and contract development organizations to strengthen their service portfolios and expand market reach. Additionally, the growing demand for biologics and biosimilars is prompting companies to tailor their validation services to meet the specific needs of these products. A focus on geographical expansion, particularly in emerging markets, further supports market growth.

FAQ's

The bioprocess validation market size was valued at USD 479.30 million in 2024 and is projected to grow to USD 1,132.06 million by 2034.

The market is projected to register a CAGR of 9.0% during the forecast period, 2025-2034.

North America had the largest share of the market

Key players in the bioprocess validation market include major companies such as Thermo Fisher Scientific Inc.; Merck KgaA; Sartorius AG; Danaher Corporation; and Charles River Laboratories; SGS SA; Bio-Rad Laboratories, Inc.; Lonza Group AG; Eurofins Scientific; and Agilent Technologies, Inc.

The extractables/leachables testing services segment accounted for the larger share of the market in 2024.

The filter elements segment accounted for the larger share of the market in 2024.

Bioprocess validation is the process of ensuring that the manufacturing processes used in the production of biopharmaceuticals consistently produce products that meet predefined quality standards and regulatory requirements. This involves testing various aspects of the biomanufacturing process, such as raw materials, equipment, and methods, to confirm that they are capable of reliably producing safe, effective, and high-quality biopharmaceuticals. Bioprocess validation is crucial for ensuring the compliance of products with industry standards set by regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), and is typically required throughout the product's lifecycle, from development to commercial production.

A few key trends in the market are described below: Adoption of Single-Use Technologies: Increased use of single-use systems in biomanufacturing to reduce the risk of cross-contamination, improve flexibility, and lower operational costs. Automation and Digitalization: Integration of automation and real-time monitoring tools to enhance process control, efficiency, and data accuracy. Regulatory Emphasis on Quality and Compliance: Growing focus on meeting stringent regulatory requirements, driving demand for comprehensive validation services.

A new company entering the bioprocess validation market could focus on emerging trends such as automation and real-time process monitoring to offer more efficient and scalable solutions. Emphasizing single-use technologies and sustainability in biomanufacturing processes could help differentiate the company, as these areas are gaining traction for their cost-saving and environmental benefits. Additionally, offering specialized services for biologics production, particularly in the growing fields of gene and cell therapy, would cater to the increasing demand for advanced validation in complex biopharmaceuticals. Building strong partnerships with contract development organizations (CDMOs) and focusing on global expansion, especially in rapidly developing markets such as Asia Pacific, could further provide a competitive edge

Companies manufacturing, distributing, or purchasing bioprocess validation and related products, and other consulting firms must buy the report.