Biopolymer Packaging Market Size, Share, Trends, Industry Analysis Report: By Material [Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), Starch Blends, Polybutylene Succinate (PBS), and Others], End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 125

- Format: PDF

- Report ID: PM5500

- Base Year: 2024

- Historical Data: 2020-2023

Biopolymer Packaging Market Overview

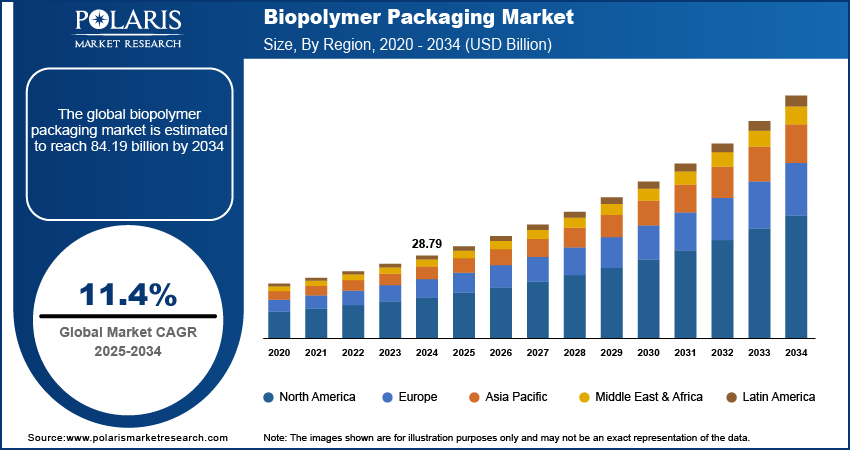

The global biopolymer packaging market size was valued at USD 28.79 billion in 2024. The market is projected to grow from USD 31.98 billion in 2025 to USD 84.19 billion by 2034, exhibiting a CAGR of 11.4% during 2025–2034.

Biopolymer packaging refers to packaging materials made from renewable biological resources, such as plant-based polymers or biodegradable substances. These eco-friendly alternatives are designed to reduce environmental impact by offering composability or recyclability, unlike traditional petroleum-based plastics.

Governments and regulatory bodies worldwide are enforcing stringent policies to reduce plastic waste and promote green packaging alternatives. Single-use plastic bags, extended producer responsibility (EPR) programs, and incentives for biodegradable materials are driving the adoption of biopolymer packaging. The European Union’s Single-Use Plastics Directive (SUPD) and similar regulations in major regions are compelling companies to shift to bio-based and compostable packaging. Additionally, consumers are also increasingly aware of plastic pollution, influencing businesses to adopt sustainable solutions. The demand for biopolymer packaging is growing as regulations are getting stricter, thereby driving the biopolymer packaging market demand.

To Understand More About this Research: Request a Free Sample Report

Advancements in biopolymer processing, blending techniques, and material properties are improving the usability and durability of bioplastics for packaging. Early-generation biopolymers had limitations such as poor mechanical strength, heat resistance, and limited barrier properties, restricting their use. However, innovations in PLA modifications, bio-based composites, and enzyme-assisted biodegradability have improved the performance of biopolymer packaging. Companies are investing in bio-nanocomposites, multilayer films, and hybrid biopolymers to improve packaging functionalities while maintaining composability. These technological advancements are broadening the scope of biopolymer packaging applications in food, medical, and industrial sectors, thereby fueling the biopolymer packaging market development.

Biopolymer Packaging Market Dynamics

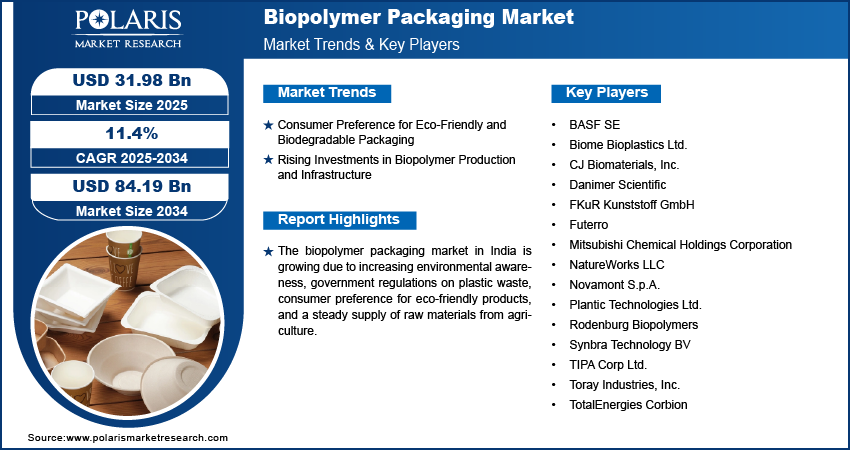

Consumer Preference for Eco-Friendly and Biodegradable Packaging

The consumer behavior is shifting toward biodegradable and eco-friendly packaging due to which the demand for the biopolymer packaging is growing. According to Trivium Packaging, 82% of consumers are willing to pay more for biodegradable packages, showcasing a shift in consumer behavior. Consumers are actively seeking products with eco-friendly packaging with increasing awareness of environmental pollution and the negative impact of conventional plastics. Brands operating in segments such as organic food, beverages, personal care, and healthcare are adopting biopolymers to meet this consumer behavior. Thus, rising consumer preference for eco-friendly and biodegradable packaging boosts the biopolymer packaging market demand.

Rising Investments in Biopolymer Production and Infrastructure

The growing demand for sustainable packaging has led to significant investments in biopolymer manufacturing facilities, research centers, and supply chain enhancements. Governments and private enterprises are funding projects aimed at scaling up the production of bio-based materials such as PLA, PHA, and starch-based polymers. For instance, in May 2024, Krungthai Bank provided financial assistance of USD 350 million to Natureworks to expand its Ingeo PLA manufacturing facility in Thailand. Additionally, investments in composting and recycling infrastructure are improving the end-of-life management of biopolymer packaging. These initiatives are making biopolymers more commercially viable, reducing production costs, and ensuring wider adoption across industries. Hence, rising investments in biopolymer production and infrastructure propel the biopolymer packaging market growth.

Biopolymer Packaging Market Segment Analysis

Biopolymer Packaging Market Assessment by Material Outlook

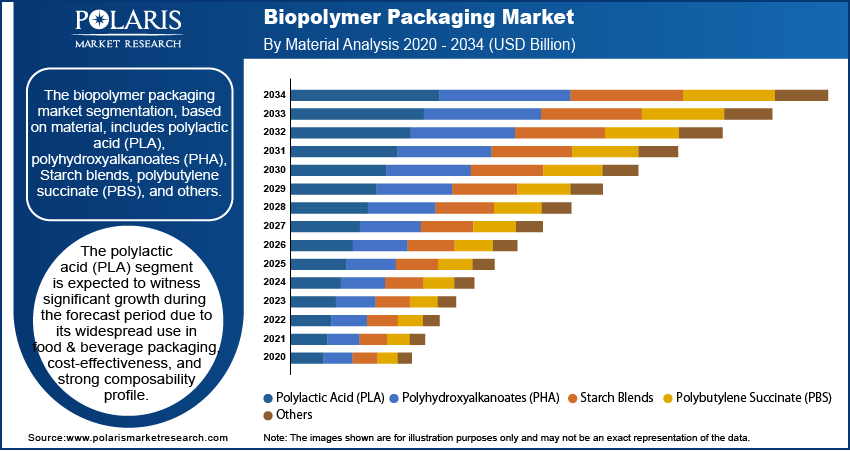

The biopolymer packaging market segmentation, based on material, includes polylactic acid (PLA), polyhydroxyalkanoates (PHA), starch blends, polybutylene succinate (PBS), and others. The polylactic acid (PLA) segment is expected to witness significant growth during the forecast period due to its widespread use in food & beverage packaging, cost-effectiveness, and strong composability profile. PLA is derived from renewable sources such as corn starch and sugarcane, making it a preferred choice for sustainable packaging. Its applications include biodegradable films, rigid packaging, and disposable containers. Rigid PLA packaging, such as bottles, thermoformed trays, and clamshells, dominates due to its transparency, strength, and suitability for food packaging. Leading brands in beverages and consumer goods increasingly prefer PLA-based rigid packaging as a sustainable alternative to PET and polystyrene, thereby driving the segmental growth.

Biopolymer Packaging Market Evaluation by End Use Outlook

The biopolymer packaging market segmentation, based on end use, includes food & beverages, consumer goods, personal care & cosmetics, healthcare, agriculture, and others. The food & beverages segment dominated the biopolymer packaging market share in 2024, driven by increasing demand for eco-friendly packaging solutions. The rising ban on single-use plastics for food packaging, growing consumer preference for sustainable products, and stringent regulations are driving the demand for sustainable packaging. Fast-food chains, beverage brands, and organic food producers are adopting biodegradable cups, trays, and flexible films. Rising flexible biopolymer packaging use, such as PLA and starch-based films, pouches, and wrappers, in snack foods, bakery items, fresh produce, and dairy packaging to extend product shelf life is further fueling the segmental growth.

Biopolymer Packaging Market Regional Analysis

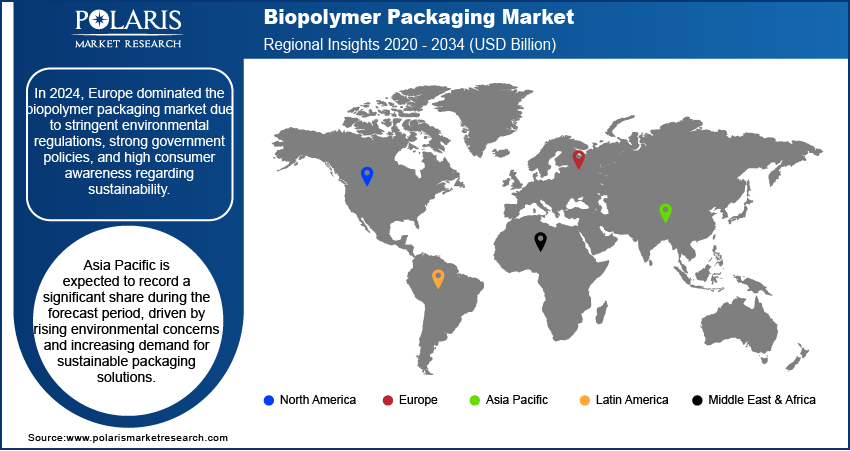

By region, the study provides the biopolymer packaging market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Europe dominated the market due to stringent environmental regulations, strong government policies, and high consumer awareness regarding sustainability. The European Union’s Circular Economy Action Plan and Single-Use Plastics Directive (SUPD) have accelerated the adoption of biodegradable and compostable packaging solutions. Businesses and retailers in countries such as Germany, France, and the UK are replacing traditional plastic packaging with biopolymers. Additionally, well-established composting infrastructure, government incentives for bio-based industries, and corporate sustainability commitments are further fueling the demand for biopolymer-based packaging across Europe.

According to the global biopolymer packaging market statistics, Asia Pacific is expected to record a significant share during the forecast period, driven by rising environmental concerns and increasing demand for sustainable packaging solutions. Governments in countries such as Japan, China, and South Korea are supporting reducing plastic waste. The increasing adoption of eco-friendly packaging in industries such as food, beverages, and consumer goods is driving the demand for sustainable packaging. Additionally, the region’s large population and expanding middle class are creating a rising demand for packaged goods, further boosting the Asia Pacific biopolymer packaging market opportunity.

The biopolymer packaging market in India is experiencing substantial growth. The Indian government has started implementing stricter regulations to reduce plastic waste, encouraging businesses to adopt more eco-friendly packaging solutions. Industries such as food and beverage, retail, and pharmaceuticals are actively seeking sustainable packaging alternatives. Additionally, rising consumer preference for environmentally conscious products and the expansion of eco-friendly initiatives are contributing to the biopolymer packaging market expansion in India.

Biopolymer Packaging Market Players & Competitive Analysis Report

The biopolymer packaging market ecosystem is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Major global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the biopolymer packaging industry by introducing innovative products to meet the demand of specific sectors. According to the biopolymer packaging market stats, this competitive trend is amplified by continuous progress in product offerings. A few major players in the market include BASF SE; Biome Bioplastics Ltd.; CJ Biomaterials, Inc.; Danimer Scientific; FKuR Kunststoff GmbH; Futerro; Mitsubishi Chemical Holdings Corporation; NatureWorks LLC; Novamont S.p.A.; Plantic Technologies Ltd.; Rodenburg Biopolymers; Synbra Technology BV; TIPA Corp Ltd.; Toray Industries, Inc.; and TotalEnergies Corbion.

NatureWorks LLC is a producer of Ingeo, a PLA-based biopolymer derived from renewable plant sugars. The company plays a crucial role in transforming the packaging industry by offering high-performance bioplastics with reduced environmental impact. NatureWorks actively invests in R&D to improve PLA's mechanical properties, heat resistance, and end-of-life compostability. Ingeo is widely used in flexible and rigid packaging, offering a lower carbon footprint than petroleum-based plastics. The company focuses on enhancing PLA’s performance, making it suitable for food service, nonwovens, and 3D printing applications. Recently, NatureWorks expanded its Thailand facility to increase global PLA production and partnered with brand owners to introduce compostable coffee capsules and food packaging solutions.

BASF SE is a global manufacturer of chemicals and sustainable packaging solutions. The company is committed to reducing plastic waste by developing innovative biodegradable and compostable materials. BASF collaborates with industries to create eco-friendly packaging alternatives with a strong focus on circular economy initiatives. Its Ecovio and Ecoflex product lines are biodegradable polymers designed for packaging, agriculture, and food applications. Ecovio is partially bio-based, combining polylactic acid (PLA) with Ecoflex, making it compostable and durable. Recently, the company collaborated with packaging manufacturers to develop compostable film solutions for food packaging, supporting circular economy goals.

List of Key Companies in Biopolymer Packaging Market

- BASF SE

- Biome Bioplastics Ltd.

- CJ Biomaterials, Inc.

- Danimer Scientific

- FKuR Kunststoff GmbH

- Futerro

- Mitsubishi Chemical Holdings Corporation

- NatureWorks LLC

- Novamont S.p.A.

- Plantic Technologies Ltd.

- Rodenburg Biopolymers

- Synbra Technology BV

- TIPA Corp Ltd.

- Toray Industries, Inc.

- TotalEnergies Corbion

Biopolymer Packaging Industry Developments

In February 2024, Mondi announced the expansion of production for its EcoWicketBags, a paper-based packaging solution designed for the home and personal care industry. This initiative responds to increasing demand for sustainable packaging, particularly for products such as diapers and feminine hygiene items.

In February 2025, Tetra Pak introduced new carton packages in India that incorporate 5% certified recycled polymers. This move aligns with India's Plastic Waste Management regulations and underscores Tetra Pak's commitment to reducing plastic waste while transitioning toward renewable and recycled materials in its packaging solutions.

Biopolymer Packaging Market Segmentation

By Material Outlook (Revenue – USD Billion, 2020–2034)

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Starch Blends

- Polybutylene Succinate (PBS)

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Food & Beverages

- Consumer Goods

- Personal Care & Cosmetics

- Healthcare

- Agriculture

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Biopolymer Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 28.79 billion |

|

Market Size Value in 2025 |

USD 31.98 billion |

|

Revenue Forecast by 2034 |

USD 84.19 billion |

|

CAGR |

11.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 28.79 billion in 2024 and is projected to grow to USD 84.19 billion by 2034.

The global market is projected to register a CAGR of 11.4% during the forecast period.

Europe held the largest share of the global market in 2024.

A few key players in the market are BASF SE; Biome Bioplastics Ltd.; CJ Biomaterials, Inc.; Danimer Scientific; FKuR Kunststoff GmbH; Futerro; Mitsubishi Chemical Holdings Corporation; NatureWorks LLC; Novamont S.p.A.; Plantic Technologies Ltd.; Rodenburg Biopolymers; Synbra Technology BV; TIPA Corp Ltd.; Toray Industries, Inc.; and TotalEnergies Corbion.

The food and beverage segment dominated the market in 2024, driven by increasing demand for eco-friendly packaging solutions.

The polylactic acid (PLA) segment is expected to witness significant growth during the forecast period due to its widespread use in food & beverage packaging, cost-effectiveness, and strong composability profile.