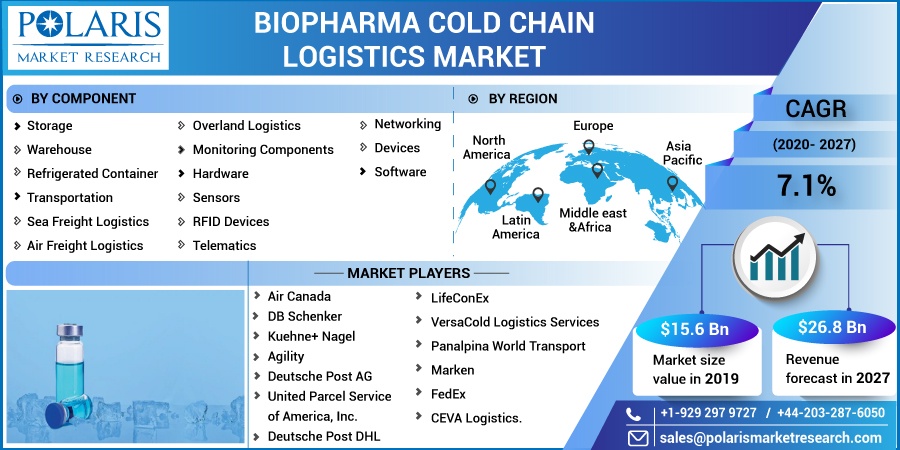

Biopharma Cold Chain Logistics Market Share, Size, Trends, Industry Analysis Report, By Component (Storage [Warehouse, Refrigerated Container], Transportation [Sea Freight Logistics, Air Freight Logistics, Overland Logistics], Monitoring Components); By Regions; Segment Forecast, 2020 - 2027

- Published Date:Dec-2020

- Pages: 118

- Format: PDF

- Report ID: PM1766

- Base Year: 2019

- Historical Data: 2016 - 2018

Report Outlook

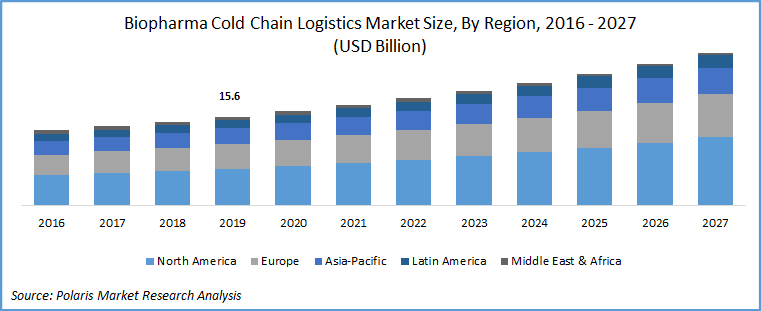

The global biopharma cold chain logistics market was valued at USD 15.6 billion in 2019 and is expected to grow at a CAGR of 7.1% during 2020 - 2027. The market growth is particularly driven by the huge demand of temperature-sensitive drugs and biopharmaceutical products such as life-saving vaccines and blood plasma in the developed economies. Amid COVID-19 pandemic, the trade of conventional and over the counter drugs has increased from country to country.

For instance, the U.S. Food & Drug Administration (FDA), recently, has approved emergency use authorization (EUA) for the drug hydroxyl-chloroquine, mostly manufactured in India, to be used as an antibiotic for the patients suffering with COVID-19 symptoms. The biopharma logistics companies are focused on developing their supply chain models robust, in line with this, they are keeping an eye on latest technologies real time supply chain visibility, warehouse robotics, digital twins, blockchain and analytics, and autonomous vehicles.

Know more about this report: request for sample pages

The other factors favoring the market growth include increase in demand for the over the counter (OTC) drugs, the rising importance of fast-track delivery of the product through technology, cost containment measures to maintain optimal distribution and packaging cost, and investments in the telematics and remote monitoring technologies to reduce cases of product adulteration during transport.

Industry Dynamics

Growth Drivers

Pharma logistics companies are using advanced technologies such as IoT, autonomous vehicles, and blockchain to enhance operational efficiency. Blockchain maintains digital ledger to maintain, record, and authenticate data, while IoT comprises of set of physical devices for communication over the internet. This technology enables biopharma companies to reduce operational transportation costs, lead time, and real time monitoring of cargo. It achieves cost savings by automating error free processes, by streamlining distribution operations. For instance, global logistics service providers such as DHL and Accenture have developed serialization prototype with blockchain technology to track shipment across six geographies.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Recently, in September 2020, DHL Global Forwarding, an entity of DHL group, announced technology enhancements to its life sciences services division, to meet the evolving pharma logistics needs, to counter the disruption caused due to COVID-19 pandemic. It launched “New LifeTrack User Interface”, a temperature-controlled shipment tracking portal, providing its customers with real-time analytics, digitalized standard operating procedures (SOP) information, and the lane risk assessment tool. This will enable the company’s LifeConEx and Thermonet clients with real time access to packaging time, lead time, and delivery of products to the target destination. Moreover, Maersk, Denmark based shipping container company, is using IoT enabled refrigerated containers to ensure the safety of the consignment from adulteration, misplacement, and theft. SkyCell offers IoT enabled refrigerated containers specially designed for pharmaceuticals products.

Biopharma Cold Chain Logistics Market Report Scope

The market is primarily segmented on the basis of component, and geographic region.

|

By Component |

By Region |

|

|

Know more about this report: request for sample pages

Insight by Component

Based on components, the global biopharma cold chain logistics market is categorized into storage, transport, and component. In 2019, the storage segment accounted for the largest revenue share. The factors responsible for its growth include the surge in demand for temperature-sensitive nutritional supplements and temperature-sensitive vaccines. The adoption of sea-based pharma logistics, as sea freight is capable of handling personalized medicines, is also driving the segment growth.

Geographic Overview

North America accounted for the largest revenue share in 2019. The growth in the regional market is attributed to the presence of major players operating in the concerned market. These players are involved in several strategic initiatives, which is taking the market forward. For instance, in August 2018, ICS, Texas-based pharma distribution services company, established its new third-party logistics and distribution center in Ohio. This 350,000 sq. ft. facility will strengthen the company’s robust distribution capabilities with embedded state of art technology.

Both the U.S. and Canada have a well-developed infrastructure of pharma logistics and distribution, and the players are focusing on newer technologies and investing in supply chain processes to minimize wastage and losses. According to the statistics published by the WHO and the Parenteral Drug Association (PDA), more than 25% of the transported vaccines incorrectly reach their target destination, 20% of the temperature-sensitive product were damaged due to temperature excursion, and the average cost for the root cause of damaged goods is USD 7 thousand.

Asia Pacific is projected to be the fastest-growing region, owing to the rapid economic strides made by these emerging economies. The pharmaceutical industry is undergoing a rapid change, owing to a surge in demand for drugs and vaccines from the huge population base. This is paving the way for a pharma logistics firm to take advantage of being India as being the world’s pharmaceutical hub and China being the largest producer of raw materials APIs used in the pharma industry for generics and OTC drugs. It is being estimated that more than 60% of the raw material being used is procured from China alone.

Competitive Insight

Key players operating in the global biopharma cold chain logistics market include Air Canada, DB Schenker, Kuehne+ Nagel, Agility, Deutsche Post AG, United Parcel Service of America, Inc., Deutsche Post DHL, LifeConEx, VersaCold Logistics Services, Panalpina World Transport, Marken, FedEx, and CEVA Logistics.