Biometric System Market Size, Share, Trends, Industry Analysis Report: By Authentication Type, Offering, Mobility, Type, Deployment Mode, Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast (2024–2032)

- Published Date:Oct-2024

- Pages: 117

- Format: PDF

- Report ID: PM5115

- Base Year: 2023

- Historical Data: 2019-2022

Biometric System Market Overview

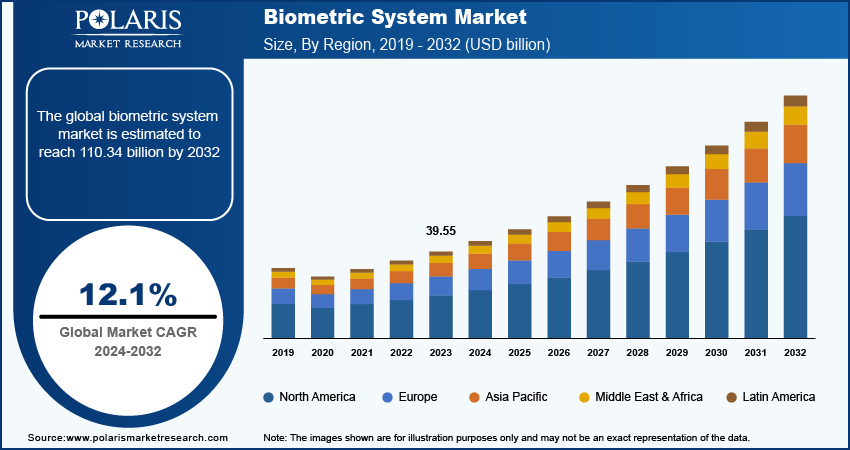

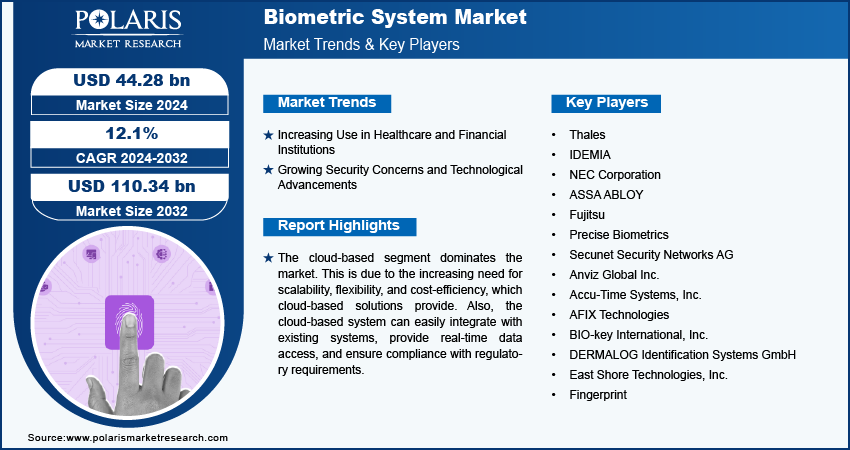

The global biometric system market size was valued at USD 39.55 billion in 2023. The market is projected to grow from USD 44.28 billion in 2024 to USD 110.34 billion by 2032, exhibiting a CAGR of 12.1% during 2024–2032.

Biometric systems are used to ensure secure verification of individuals by scanning their unique biometric characteristics such as fingerprint, face, iris, voice, and vein patterns. Biometric scan adds a layer of high security in the authentication of the system. Unique biological characteristics are used in the process of making the system or enterprise more secure.

The use of biometric systems in consumer electronics has grown due to the rising demand for security and user convenience. Nowadays, fingerprint sensors and facial recognition technologies are common in smartphones, laptops, and personal devices, driving the demand for biometric systems. The rise of Biometrics as a Service (BaaS) brings significant potential, particularly for small and medium-sized enterprises (SMEs), allowing them to adopt cost-effective solutions without large upfront investments.

The protection of sensitive biometric information and the technical challenges of dealing with complex systems are still significant barriers to mass adoption. Additionally, concerns about data security and privacy breaches continue to grow, making it critical to take strong security measures and privacy protection to build trust. All these factors drive the biometric system market growth.

To Understand More About this Research: Request a Free Sample Report

Continuous technological advancements propel the development of more efficient and reliable security products. For example, voice biometric, contact-less biometric technology, etc. are contributing to the biometric system market growth. Additionally, the use of biometric payment cards by fin-tech companies is increasing as companies want to strengthen the security of card payments. Also, the increasing incidents of fraud and phishing drive the use of biometric technology in the retail and e-commerce sectors.

Biometric System Market Drivers

Growing Security Concerns and Technological Advancements Drive Market Growth

The increasing need to protect sensitive information and secure access facilities, particularly in government and military sectors, is driving the adoption of biometric systems. Innovations in artificial intelligence (AI) and machine learning (ML) have improved the accuracy and speed of biometric systems, making them more reliable and efficient for real-time applications. In September 2023, DoD implemented advanced biometric technologies through its Automated Biometric Identification System (ABIS). This system integrates fingerprint, facial, and iris recognition to identify and verify individuals, ensuring secure access to military facilities and classified information. It plays a crucial role in counter-terrorism efforts. In addition, it supports US military operations by providing a secure means to control access to sensitive locations and digital systems, reducing insider threats and unauthorized access.

Aadhaar program of India had registered over 1.3 billion individuals as of 2023. The system uses fingerprint and iris scans to provide secure access to various government services. The use of Aadhaar has significantly reduced fraud in public welfare distribution, with estimates of $7.6 billion saved annually by eliminating fake or duplicate beneficiaries. Thus, this illustrates how biometric systems are being used in critical sectors to secure sensitive information and protect national security.

Increasing Use in Healthcare and Financial Institutions Propels Market Growth

Biometric systems are increasingly utilized in healthcare organizations for patient identification, securing access to medical records, and ensuring privacy in telemedicine services. The growing prevalence of outpatient and home healthcare is a major driver of the biometric systems market expansion. The UK’s National Health Service (NHS) has implemented biometric authentication systems to secure access to patient records and reduce medical errors. In July 2021, NHS hospitals used fingerprint and facial recognition for staff to securely access medical systems and patient records, thereby protecting sensitive data.

The financial sector is rapidly embracing biometrics for fraud prevention, secure payments, and compliance with regulatory requirements such as Know Your Customer (KYC) and Anti-Money Laundering (AML) measures. For instance, in June 2024, MasterCard and Trulioo partnered to streamline digital onboarding. Specifically, Trulioo will utilize MasterCard’s identity solutions to power its person match and risk intelligence products. Therefore, the swift adoption of biometric systems in the financial sector addresses security concerns while enhancing regulatory compliance and improving the consumer experience.

Biometric Systems Market – Segment Insights

Biometric Systems Market Breakdown, By Authentication Type

The global biometric system market, based on authentication type, is bifurcated into single factor authentication and two-factor authentication. In 2023, the single factor authentication segment, particularly fingerprint recognition, dominates the market. The domination is driven by its widespread applications in smartphones, laptops, banking, and government services where it is used for secure access identity verification.

In November 2022, Emirates and the General Directorate of Residency and Foreigners Affairs in Dubai (GDRFA) announced that they are offering international travelers biometric recognition to identify travelers at multiple points in the airport. Travelers will be able to breeze through Dubai International Airport Terminal 3 Check-In, Lounges, Boarding, and Immigration at high-speed as the AI systems recognize their unique facial features and will link to their passport for instant identity verification. Owing to all these factors, the single factor authentication segment dominates the market.

Biometric Systems Market Breakdown, By Offering Outlook

The global biometric systems market, based on offering, is bifurcated into hardware and software. The hardware segment dominates the market. Hardware components such as fingerprint sensors, cameras, readers, and scanners form the backbone of biometric systems by capturing and processing biometric data for authentication and identification purposes.

Increased adoption of biometric devices, technological advancements, and cost-effectiveness of hardware propel the hardware segment growth. The HASH wallet, a hardware wallet designed to safeguard crypto-assets in the shape of a convenient smart card full of premium features from eSignus, reached a commercial launch featuring a biometric sensor from fingerprint cards, where they also released a beta version in November 2021 shortly after eSignus raised $500,000 funding. The hardware segment remains dominant, driven by government initiatives, rising security demands, and the rising use of biometric devices in commercial and consumer spaces.

Biometric Systems Market Breakdown, By Mobility Outlook

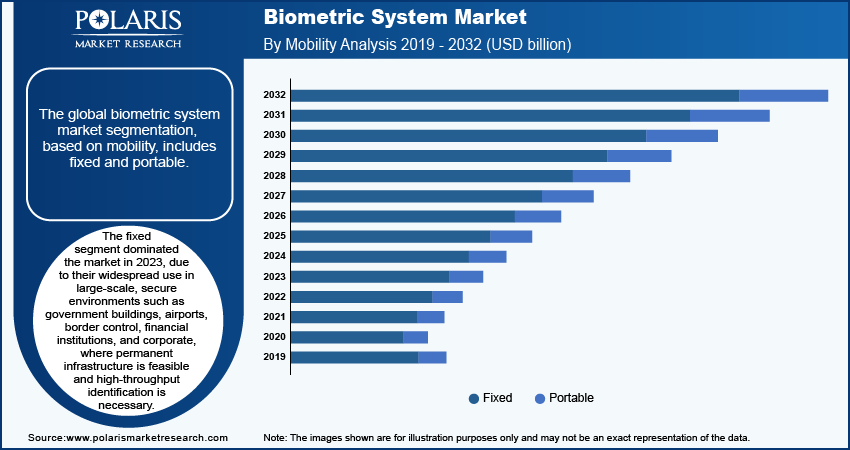

The global biometric system market segmentation, based on mobility, includes fixed and portable. The fixed segment dominated the market in 2023, due to their widespread use in large-scale, secure environments such as government buildings, airports, border control, financial institutions, and corporate, where permanent infrastructure is feasible and high-throughput identification is necessary. Fixed systems offer more robust, integrated solutions that can handle high-volume, continuous identification needs, making them preferable in these sectors.

Countries such as Ghana, Zimbabwe, and Somalia have expanded their use of fixed biometric systems for national digital ID projects, ensuring higher security and reliability in verifying individuals' identities. Additionally, Europe's digital border control initiatives, including the Schengen Information System, have employed fixed biometric solutions. The demand for fixed systems remains higher due to their permanent, infrastructure-integrated nature, and the need for robust security in highly regulated environments.

Portable biometric systems are experiencing rising demand, particularly in sectors such as law enforcement, healthcare, and elections. These systems are valued for their mobility and flexibility in remote or temporary settings, such as emergency services or in-field operations.

Biometric Systems Market, By Type Outlook

The global biometric system market is segmented into contact-based, contactless, and hybrid systems. In 2023, the contactless segment dominated the market. Contactless systems such as face recognition, iris scanning, and voice recognition are popular in sectors, including banking, healthcare, and public transportation. The market growth for this segment is driven by technological advancements, including the introduction of contactless finger biometrics and document liveness checks. Contactless biometric systems lead the market due to their noninvasive nature, addressing public health concerns and meeting increasing demand for secure authentication across various industries.

Accura Scan, a global provider of digital onboarding, KYC, and authentication solutions, introduced contactless finger biometrics and document liveness checks into its suite of digital ID products in December 2023. Additionally, hybrid biometric systems are gaining traction for their higher accuracy and flexibility in high-security environments.

Biometric Systems Market Breakdown, By Deployment Outlook

The global biometric system market segmentation, based on deployment, includes on-premises, cloud-based, and integrated deployment. The cloud-based segment dominates the market. This is due to the increasing need for scalability, flexibility, and cost-efficiency, which cloud-based solutions provide. Also, the cloud-based system can easily integrate with existing systems, provide real-time data access, and ensure compliance with regulatory requirements.

The COVID-19 pandemic has boosted the adoption of cloud-based biometric solutions as businesses and governments seek to enable secure remote authentication methods for employees and citizens. Thus, the cloud-based segment continues to lead the market due to its versatility and lower upfront costs. In comparison, on-premises deployment still holds significance in highly regulated sectors such as defense and government, where data privacy and security are top concerns.

Biometric System Marke Breakdown, By Vertical Outlook

The global biometric system market segmentation, based on vertical, includes government, defense, healthcare, BFSI, consumer electronic, travel & immigration, automotive, and security. The government segment, specifically the national/state ID and e-passport & e-visa, dominates the market. This dominance is primarily driven by large-scale biometric identification programs initiated by governments worldwide for national security, border control, and citizen identification purposes.

The law enforcement sector is significant within the government vertical due to the increasing use of biometrics in criminal identification and forensic investigations, further cementing the government sector's leading role in the biometric market. However, the sector remains the primary driver of biometric technology adoption, focusing on national security and improving public service delivery, making it the largest market shareholder in 2023.

Regional Insights

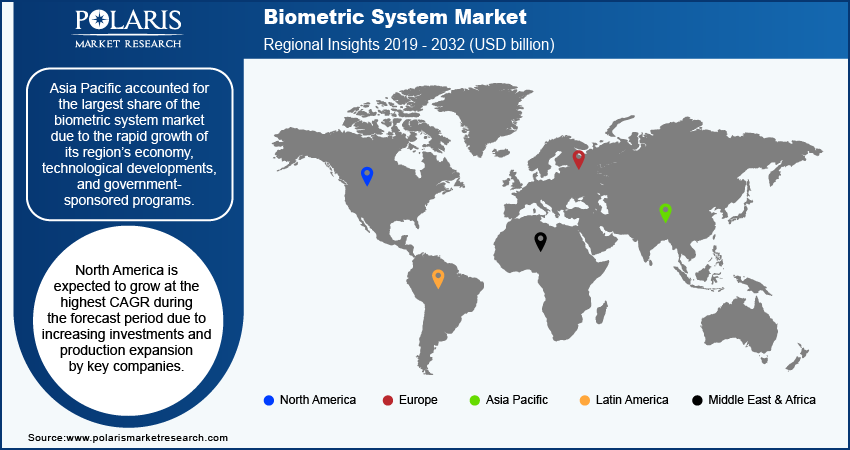

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for the largest market share in 2023 due to the region's rapid economic growth, technological developments, and government sponsored programs. Countries such as India and China top the board in the adoption of biometric systems with the introduction of national ID’s such as Aadhar and wide adoption in banking, healthcare and security sectors. One of the pioneering initiatives is the Indian government's Aadhaar program, launched in 2009, aiming to provide a unique 12-digit identification number to every Indian citizen based on their biometric and demographic data. With India's 1.4 billion population, Aadhaar is the world's largest biometric ID system. The strong presence of laptops and smartphones further drives demand for biometric technologies integrated into consumer electronics.

The biometric system market in North America is witnessing significant growth due to the increasing investments and production expansion by key companies. The US and Canada are major players in the biometric systems market in North America. High technology adoption rates, advanced infrastructure, and significant investments in the security and healthcare sectors drive this dominance. For instance, Intel unveiled RealSense ID, a face biometrics technology combining hardware and software. The company stated that facial authentication solution uses an active stereo-depth sensor and specialized neural network to authenticate the user on-device.

Biometric Systems Market – Key Players and Competitive Insights

The competitive landscape of the biometric system market is characterized by a diverse array of global and regional players striving to capture market share through innovation, strategic partnerships, and geographic expansion. The market is driven by significant investments in R&D, strategic global partnerships, adherence to regulatory standards, and a focus on security and privacy. Key players differentiate themselves through innovation, application diversification, and robust customer support. These companies focus on product innovation, including improvements in safety, functionality, and cost-efficiency, to meet the evolving needs of biometric systems. Major players are Thales; IDEMIA; NEC Corporation; ASSA ABLOY; Fujitsu; Precise Biometrics; Secunet Security Networks AG; Anviz Global Inc.; Accu-Time Systems, Inc.; AFIX Technologies; BIO-key International, Inc.; DERMALOG Identification Systems GmbH; East Shore Technologies, Inc.; and Fingerprint.

Fingerprint Cards is a Swedish biometric company that develops and produces biometric systems. Their products consist of fingerprint sensors, algorithms, packaging technologies, and software for biometric recognition. In December 2023, Fingerprint Cards announced the development of a new generation of Thales Gemalto biometric payment cards, which are ready for global deployment. The new Thales solution, which features a Fingerprints T-Shape sensor (T2) and biometric payment software platform, offers users advanced transaction speed, improved power efficiency, and enhanced security.

Precise Biometrics is a global identification software provider located in Sweden and offers products with various applications. The key segments include premium biometric authentication solutions for mobiles, laptops, security tokens, and smart looks, as well as automotive applications for in-car payments, driver authentication, and personalized settings and access. They also specialize in visitor management and physical biometric access control.

In June 2024, Precise Biometric announced a strategic reallocation of its resources. The company is prioritizing the development and commercialization of ultrasonic fingerprint algorithms in response to the anticipated surge in demand for these products. This proactive decision underscores the company's commitment to meeting market needs. The company is strengthening its focus on developing ultrasonic fingerprint algorithms that can be integrated into mobile devices.

Key Companies in Biometric System Market

- Thales

- IDEMIA

- NEC Corporation

- ASSA ABLOY

- Fujitsu

- Precise Biometrics

- Secunet Security Networks AG

- Anviz Global Inc.

- Accu-Time Systems, Inc.

- AFIX Technologies

- BIO-key International, Inc.

- DERMALOG Identification Systems GmbH

- East Shore Technologies, Inc.

- Fingerprint

Biometric System Industry Developments

August 2024, MarterCard takes on UPI with a new biometric payment passkey in India. The new service will initially pilot in India with a few of the country’s largest payment players, including payment aggregators such as Juspay, Razor pay, and PayU, along with major online merchants such as BigBasket and leading banks, including Axis Bank.

July 2024, In Jakarta, Indonesia, the social security administrator for health launched a facial recognition system called FRISTA. The technology has the potential to prevent identity theft and protect user access to data. It can accurately recognize faces in photos, videos, and in person. Also, it enables the use of a single biometric identity number as an alternative to National Health Insurance (JKN) cards.

June 2024, Samsung brought full-screen fingerprint sensor to foldable phones. In contrast to the trend of placing fingerprint sensors at the bottom of the screen, Samsung’s foldable smartphones have retained the side button biometric scanner.

Biometric System Market Segmentation

By Authentication Type, Outlook (2019–2032, USD billion)

- Single Factor Authentication

- Fingerprint Recognition

- AFIS

- Non-AFIS

- Iris Recognition

- Palm Recognition

- Face Recognition

- Vein Recognition

- Signature Recognition

- Voice Recognition

- Other Single Factor Type

- Fingerprint Recognition

- Multi-Factor Authentication

- Two Factor Authentication

- Smart Card with Biometric Technology

- Biometric Technology with Pin

- Two-Factor Biometric Technology

- Three-Factor Authentication

- Smart Card with Pin and Biometric Technology

- Smart Card with Two-Factor and Biometric Technology

- Pin with Two-Factor Biometric Technology

- Three-Factor Biometric Technology

- Four-Factor Authentication

- Five-Factor Authentication

- Two Factor Authentication

By Offering Outlook (2019–2032, USD billion)

- Hardware

- Fingerprint Sensor

- Cameras

- Readers and Scanners

- Other Biometric Hardware

- Software

By Mobility Outlook (2019–2032, USD billion)

- Fixed

- Portable

By Type Outlook (2019–2032, USD billion)

- Contact Based

- Contact-less

- Hybrid

By Deployment Outlook (2019–2032, USD billion)

- On-Premises

- Cloud-Based

- Integrated Deployment

By Vertical Outlook (2019–2032, USD billion)

- Government

- National/State ID

- Law Enforcement

- e-Passport & e-Visa

- Others

- Defense

- Healthcare

- BFSI

- Consumer Electronic

- Travel & Immigration

- Automotive

- Security

- Home Security

- Commercial Security

By Region Outlook (2019–2032, USD billion)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Biometric System Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 39.55 billion |

|

Market Size Value in 2024 |

USD 44.28 billion |

|

Revenue Forecast in 2032 |

USD 110.34 billion |

|

CAGR |

12.1% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global Biometric System market size was valued at USD 39.55 billion in 2023 and is projected to grow to USD 110.34 billion by 2032.

The global market is projected to grow at a CAGR of 12.1% during the forecast period.

Asia Pacific accounted for the largest market share due to the region's well-established healthcare infrastructure.

A few key players in the market are Thales, IDEMIA, NEC Corporation, ASSA ABLOY, Fujitsu, Precise Biometrics, Secunet Security Networks AG, Anviz Global Inc., Accu-Time Systems, Inc., AFIX Technologies, BIO-key International, Inc., DERMALOG Identification Systems GmbH, East Shore Technologies, Inc., and Fingerprint.

The government vertical dominated the market in 2023 due to the large-scale biometric identification programs initiated by governments worldwide for national security, border control, and citizen identification purposes.

The Single Factor Authentication segment had the largest share due to its widespread applications in smartphones, laptops, banking, and government services where it is used for secure access identity verification.